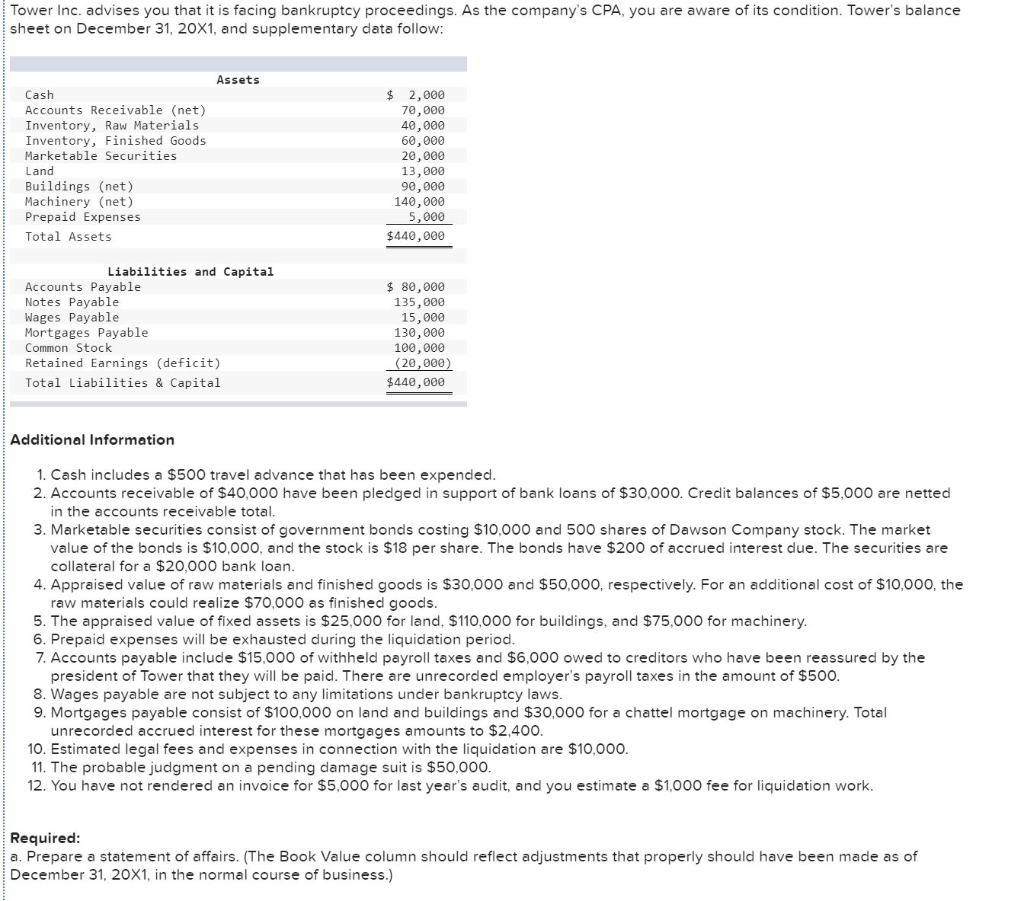

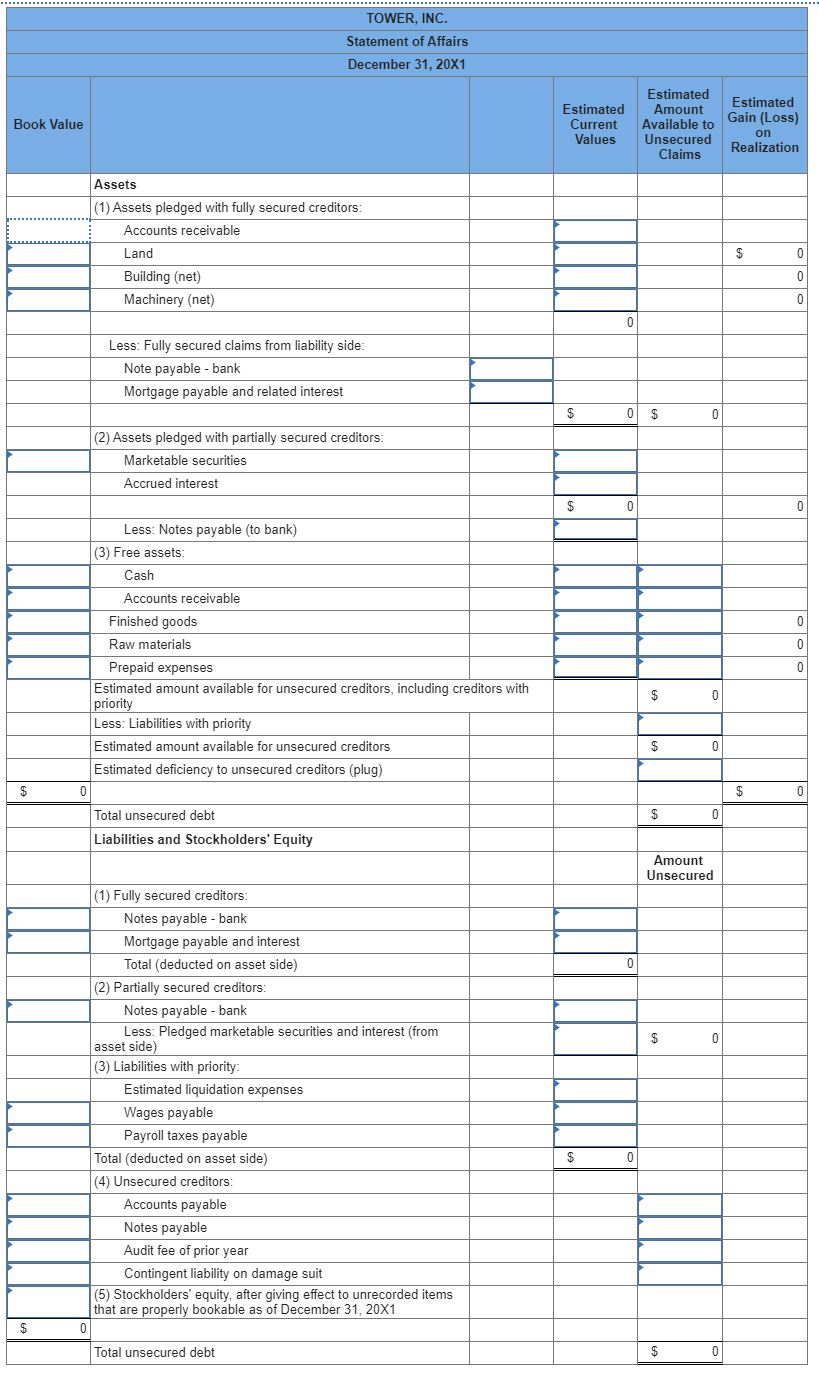

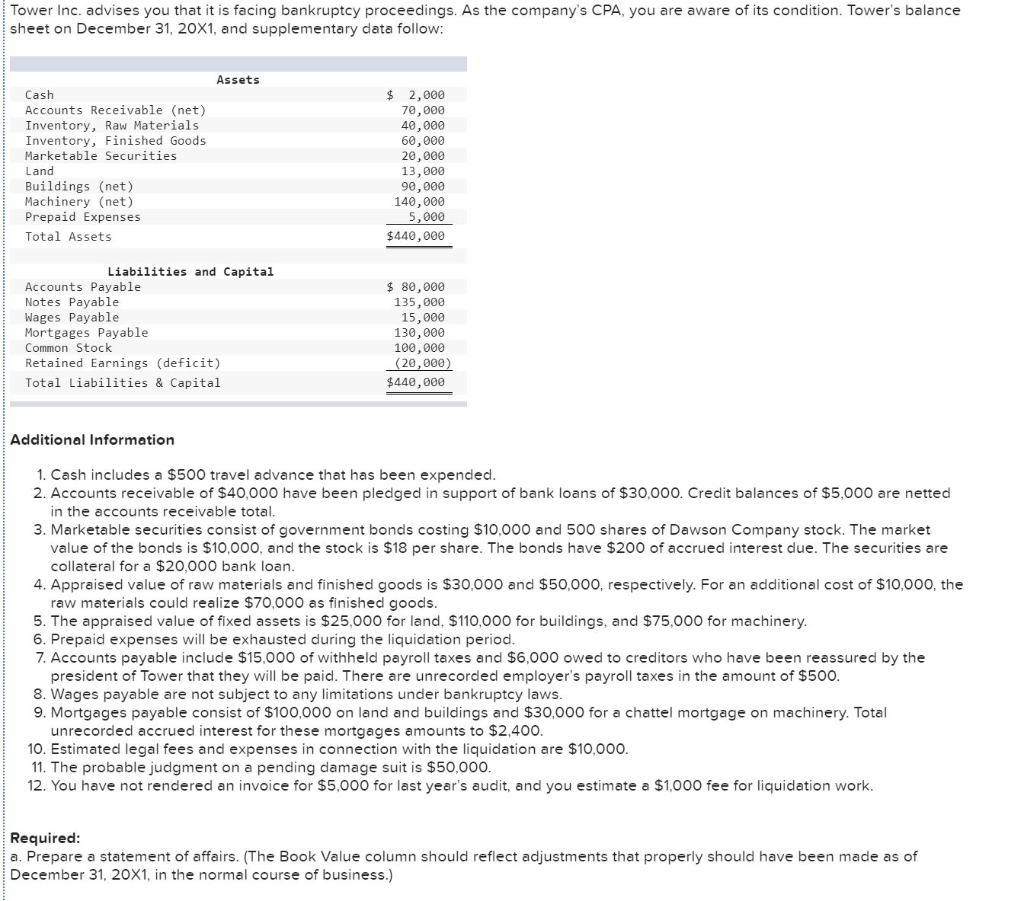

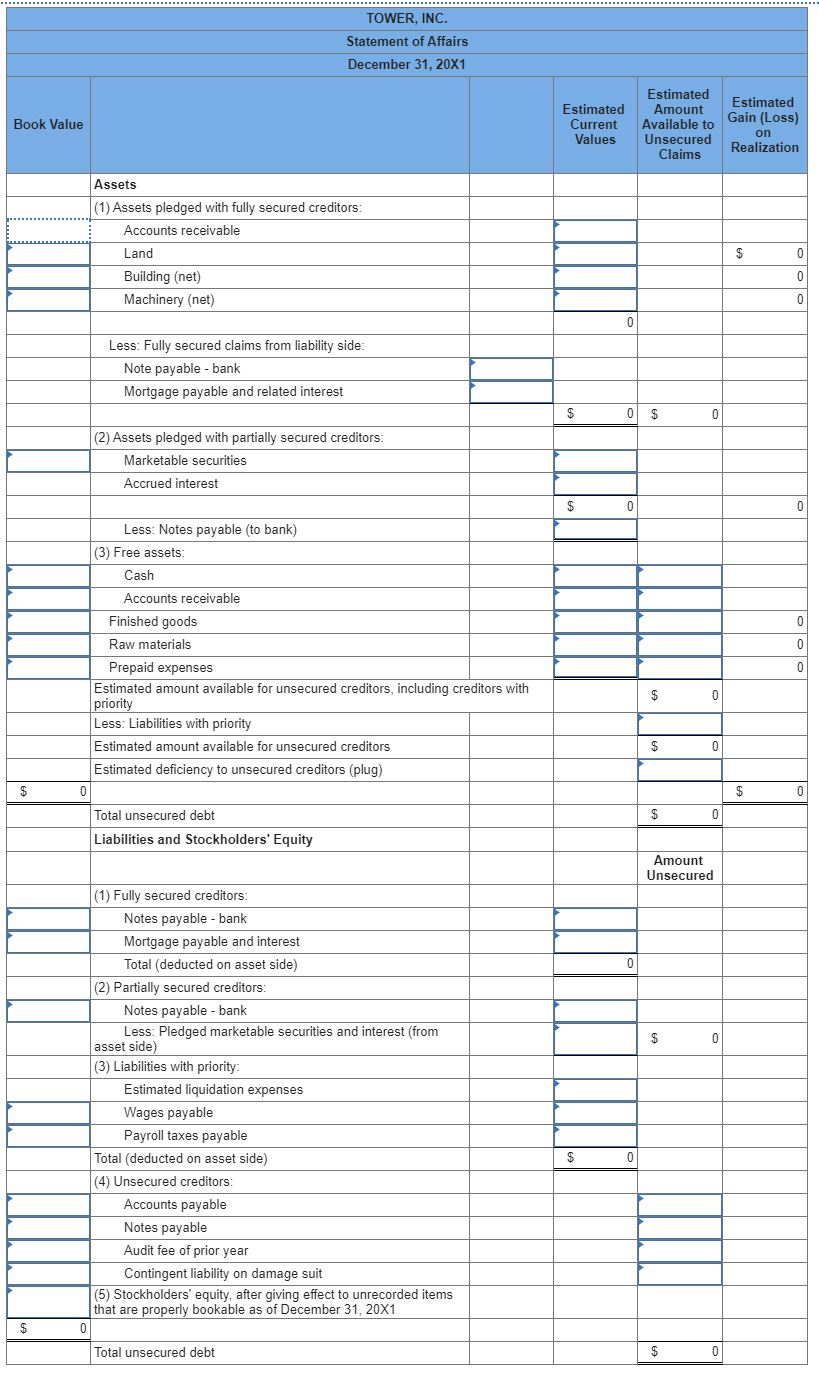

Tower Inc. advises you that it is facing bankruptcy proceedings. As the company's CPA, you are aware of its condition. Tower's balance sheet on December 31, 20X1, and supplementary data follow: Assets Cash Accounts Receivable (net) Inventory, Raw Materials Inventory, Finished Goods Marketable Securities Land Buildings (net) Machinery (net) Prepaid Expenses Total Assets $ 2,000 70,000 40,000 60,000 20,000 13,000 90,000 140,000 5,000 $440,000 Liabilities and Capital Accounts Payable Notes Payable Wages Payable Mortgages Payable Common Stock Retained Earnings (deficit) Total Liabilities & Capital $ 80,000 135,000 15,000 130,000 100,000 (20,000) $440,000 Additional Information 1. Cash includes a $500 travel advance that has been expended. 2. Accounts receivable of $40,000 have been pledged in support of bank loans of $30,000. Credit balances of $5,000 are netted in the accounts receivable total. 3. Marketable securities consist of government bonds costing $10,000 and 500 shares of Dawson Company stock. The market value of the bonds is $10,000, and the stock is $18 per share. The bonds have $200 of accrued interest due. The securities are collateral for a $20,000 bank loan. 4. Appraised value of raw materials and finished goods is $30,000 and $50,000, respectively. For an additional cost of $10,000, the raw materials could realize $70,000 as finished goods. 5. The appraised value of fixed assets is $25,000 for land, $110,000 for buildings, and $75,000 for machinery. 6. Prepaid expenses will be exhausted during the liquidation period. 7. Accounts payable include $15,000 of withheld payroll taxes and $6,000 owed to creditors who have been reassured by the president of Tower that they will be paid. There are unrecorded employer's payroll taxes in the amount of $500. 8. Wages payable are not subject to any limitations under bankruptcy laws. 9. Mortgages payable consist of $100,000 on land and buildings and $30,000 for a chattel mortgage on machinery. Total unrecorded accrued interest for these mortgages amounts to $2,400. 10. Estimated legal fees and expenses in connection with the liquidation are $10,000. 11. The probable judgment on a pending damage suit is $50,000. 12. You have not rendered an invoice for $5,000 for last year's audit, and you estimate a $1,000 fee for liquidation work. Required: I a. Prepare a statement of affairs. (The Book Value column should reflect adjustments that properly should have been made as of December 31, 20X1, in the normal course of business.) TOWER, INC. Statement of Affairs December 31, 20X1 Book Value Estimated Current Values Estimated Amount Available to Unsecured Claims Estimated Gain (Loss) on Realization Assets (1) Assets pledged with fully secured creditors: Accounts receivable Land Building (net) Machinery (net) Less: Fully secured claims from liability side: Note payable - bank Mortgage payable and related interest 0 $ (2) Assets pledged with partially secured creditors: Marketable securities Accrued interest Less: Notes payable (to bank) (3) Free assets: Cash Accounts receivable Finished goods Raw materials Prepaid expenses Estimated amount available for unsecured creditors, including creditors with priority Less: Liabilities with priority Estimated amount available for unsecured creditors Estimated deficiency to unsecured creditors (plug) 0 Total unsecured debt Liabilities and Stockholders' Equity Amount Unsecured (1) Fully secured creditors: Notes payable - bank Mortgage payable and interest Total (deducted on asset side) (2) Partially secured creditors: Notes payable - bank Less: Pledged marketable securities and interest (from asset side) (3) Liabilities with priority: Estimated liquidation expenses Wages payable Payroll taxes payable Total (deducted on asset side) (4) Unsecured creditors: Accounts payable Notes payable Audit fee of prior year Contingent liability on damage suit (5) Stockholders' equity, after giving effect to unrecorded items that are properly bookable as of December 31, 20X1 0 Total unsecured debt