Question

Toyota company uses a job order costing system and uses a direct manufacturing labor costs as an allocation base in the allocating of manufacturing

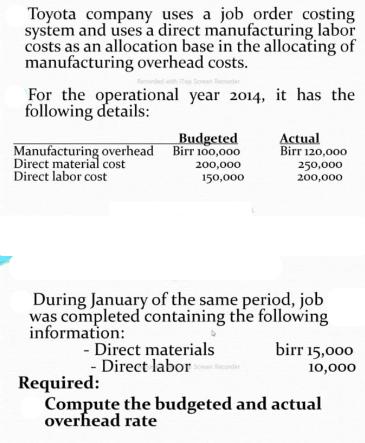

Toyota company uses a job order costing system and uses a direct manufacturing labor costs as an allocation base in the allocating of manufacturing overhead costs. For the operational year 2014, it has the following details: Manufacturing overhead Direct material cost Direct labor cost Budgeted Birr 100,000 200,000 150,000 Actual Birr 120,000 250,000 200,000 During January of the same period, job was completed containing the following information: - Direct materials - Direct labor birr 15,000 10,000 Required: Compute the budgeted and actual overhead rate

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To compute the budgeted and actual overhead rates for Toyotas job order costing system we can us...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting Tools for business decision making

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

6th Edition

978-0470477144, 1118096894, 9781118214657, 470477148, 111821465X, 978-1118096895

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App