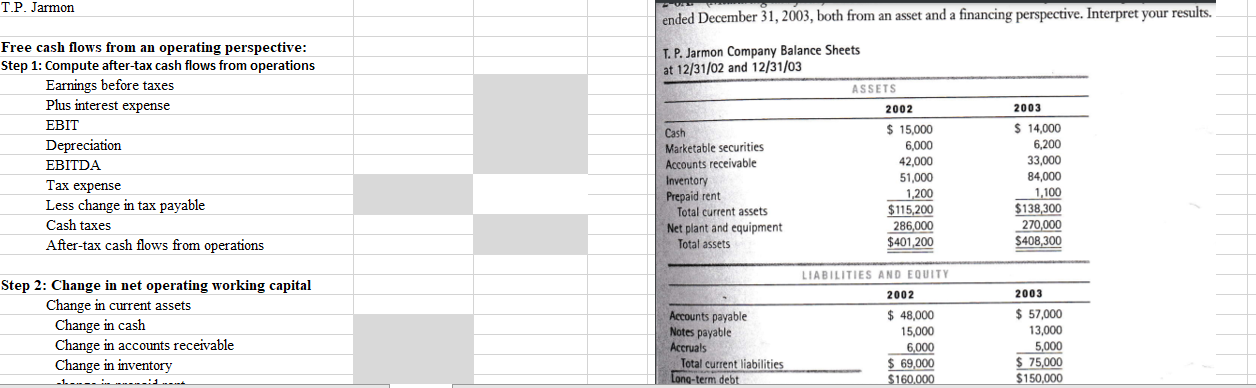

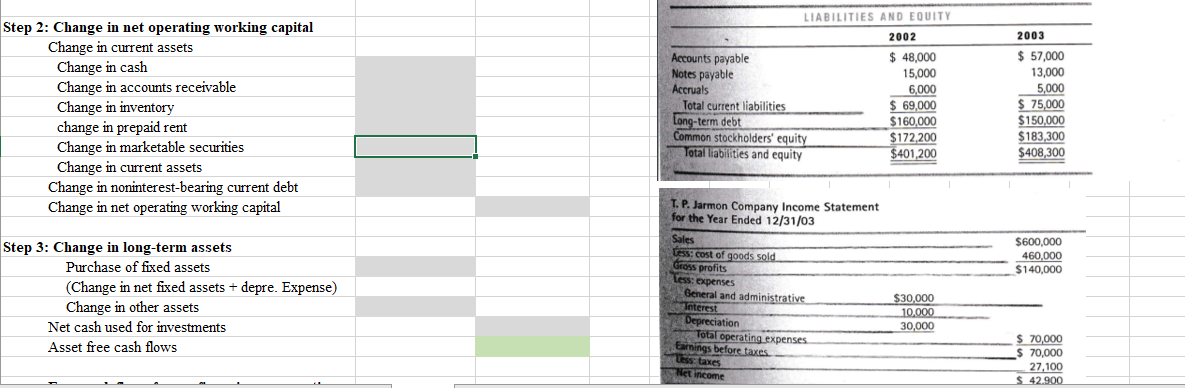

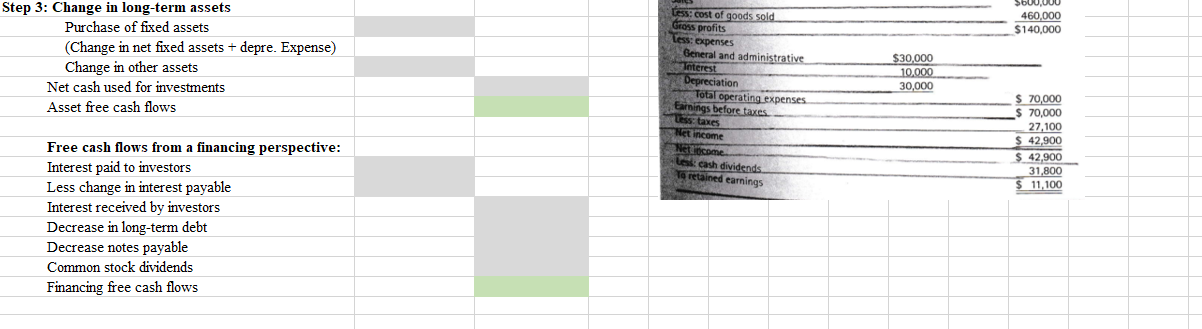

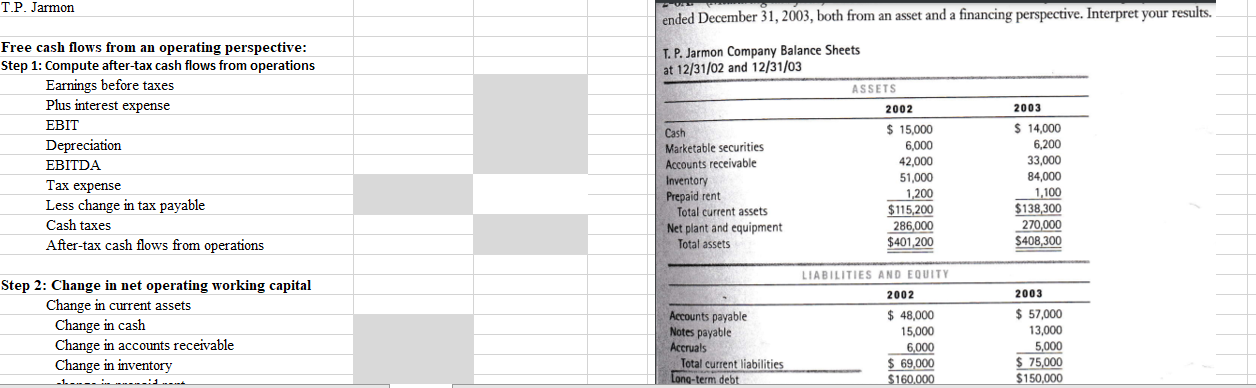

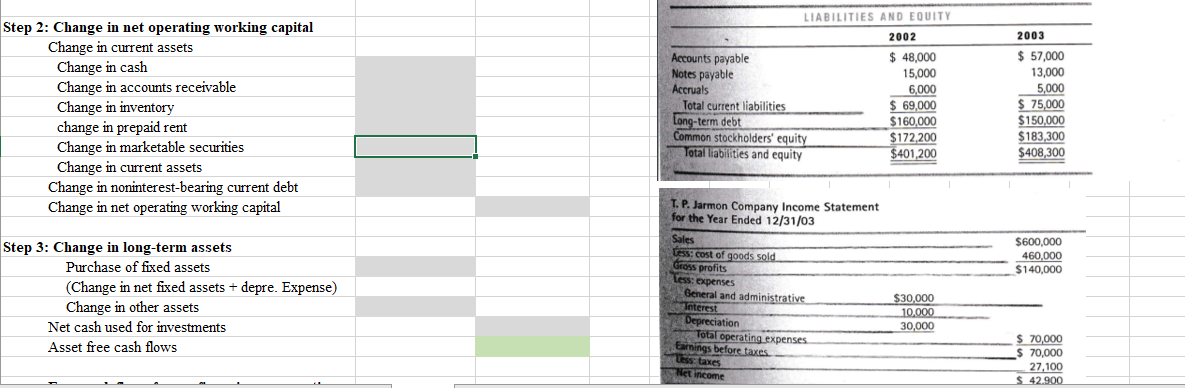

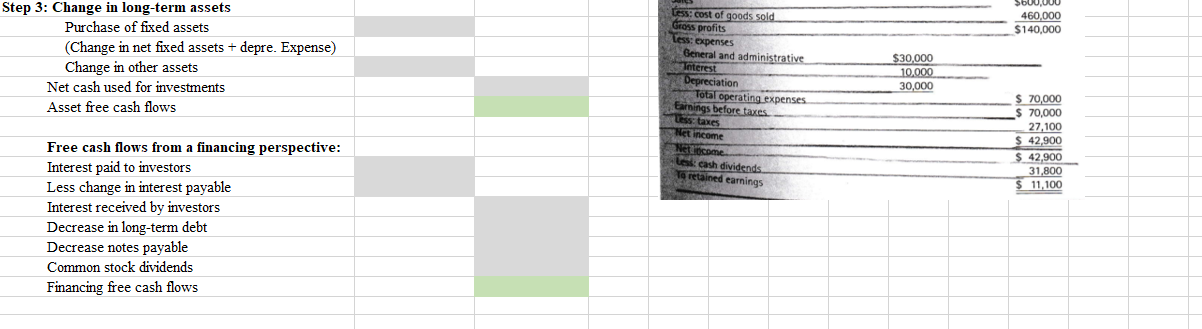

T.P. Jarmon ended December 31, 2003, both from an asset and a financing perspective. Interpret your results. Free cash flows from an operating perspective: Step 1: Compute after-tax cash flows from operations Earnings before taxes Plus interest expense EBIT Depreciation EBITDA Tax expense Less change in tax payable Cash taxes After-tax cash flows from operations T. P. Jarmon Company Balance Sheets at 12/31/02 and 12/31/03 ASSETS 2002 Cash $ 15,000 Marketable securities 6,000 Accounts receivable 42,000 Inventory Prepaid rent 1,200 Total current assets $115,200 Net plant and equipment Total assets 2003 $ 14,000 6,200 33,000 84,000 51,000 1,100 286,000 $401,200 $138,300 270,000 $408,300 LIABILITIES AND EQUITY 2002 2003 Step 2: Change in net operating working capital Change in current assets Change in cash Change in accounts receivable Change in inventory Accounts payable Notes payable Accruals Total current liabilities Long-term debt $ 48,000 15,000 6,000 $ 69,000 $160.000 $ 57,000 13,000 5,000 $ 75,000 $150,000 2003 $ 57,000 13,000 LIABILITIES AND EQUITY 2002 Accounts payable $ 48,000 Notes payable 15,000 Accruals 6,000 Total current liabilities Long-term debt Common stockholders' equity Total liabilities and equity Step 2: Change in net operating working capital Change in current assets Change in cash Change in accounts receivable Change in inventory change in prepaid rent Change in marketable securities Change in current assets Change in noninterest-bearing current debt Change in net operating working capital 5,000 $ 69,000 $160,000 $172 200 $401,200 $ 75,000 $150,000 $183,300 $408,300 $600,000 460,000 $140,000 Step 3: Change in long-term assets Purchase of fixed assets (Change in net fixed assets + depre. Expense) Change in other assets Net cash used for investments Asset free cash flows T. P. Jarmon Company Income Statement for the Year Ended 12/31/03 Sales ess: cost of goods sold Gross profits Tess: expenses General and administrative Teterest Depreciation Total operating expenses Samnings before taxes. 18 taxes Net income $30,000 10,000 30,000 $ 70,000 $ 70,000 27,100 $42.900 S600,000 460,000 $140,000 Step 3: Change in long-term assets Purchase of fixed assets (Change in net fixed assets + depre. Expense) Change in other assets Net cash used for investments Asset free cash flows $30,000 10,000 30,000 Less cost of goods sold Grons profits Tess: expenses General and administrative Tnterest Depreciation Total operating expenses Samnings before taxes Tess taxes Net income Netcome Less cash dividends To retained earnings $ 70,000 70,000 27,100 $ 42,900 $ 42,900 31,800 11,100 Free cash flows from a financing perspective: Interest paid to investors Less change in interest payable Interest received by investors Decrease in long-term debt Decrease notes payable Common stock dividends Financing free cash flows T.P. Jarmon ended December 31, 2003, both from an asset and a financing perspective. Interpret your results. Free cash flows from an operating perspective: Step 1: Compute after-tax cash flows from operations Earnings before taxes Plus interest expense EBIT Depreciation EBITDA Tax expense Less change in tax payable Cash taxes After-tax cash flows from operations T. P. Jarmon Company Balance Sheets at 12/31/02 and 12/31/03 ASSETS 2002 Cash $ 15,000 Marketable securities 6,000 Accounts receivable 42,000 Inventory Prepaid rent 1,200 Total current assets $115,200 Net plant and equipment Total assets 2003 $ 14,000 6,200 33,000 84,000 51,000 1,100 286,000 $401,200 $138,300 270,000 $408,300 LIABILITIES AND EQUITY 2002 2003 Step 2: Change in net operating working capital Change in current assets Change in cash Change in accounts receivable Change in inventory Accounts payable Notes payable Accruals Total current liabilities Long-term debt $ 48,000 15,000 6,000 $ 69,000 $160.000 $ 57,000 13,000 5,000 $ 75,000 $150,000 2003 $ 57,000 13,000 LIABILITIES AND EQUITY 2002 Accounts payable $ 48,000 Notes payable 15,000 Accruals 6,000 Total current liabilities Long-term debt Common stockholders' equity Total liabilities and equity Step 2: Change in net operating working capital Change in current assets Change in cash Change in accounts receivable Change in inventory change in prepaid rent Change in marketable securities Change in current assets Change in noninterest-bearing current debt Change in net operating working capital 5,000 $ 69,000 $160,000 $172 200 $401,200 $ 75,000 $150,000 $183,300 $408,300 $600,000 460,000 $140,000 Step 3: Change in long-term assets Purchase of fixed assets (Change in net fixed assets + depre. Expense) Change in other assets Net cash used for investments Asset free cash flows T. P. Jarmon Company Income Statement for the Year Ended 12/31/03 Sales ess: cost of goods sold Gross profits Tess: expenses General and administrative Teterest Depreciation Total operating expenses Samnings before taxes. 18 taxes Net income $30,000 10,000 30,000 $ 70,000 $ 70,000 27,100 $42.900 S600,000 460,000 $140,000 Step 3: Change in long-term assets Purchase of fixed assets (Change in net fixed assets + depre. Expense) Change in other assets Net cash used for investments Asset free cash flows $30,000 10,000 30,000 Less cost of goods sold Grons profits Tess: expenses General and administrative Tnterest Depreciation Total operating expenses Samnings before taxes Tess taxes Net income Netcome Less cash dividends To retained earnings $ 70,000 70,000 27,100 $ 42,900 $ 42,900 31,800 11,100 Free cash flows from a financing perspective: Interest paid to investors Less change in interest payable Interest received by investors Decrease in long-term debt Decrease notes payable Common stock dividends Financing free cash flows