Question

TPC 01-02 (Algo) [LO 1-7] KTR Company earns a $10 profit on each unit of manufactured goods, and it sells 20 million units each year.

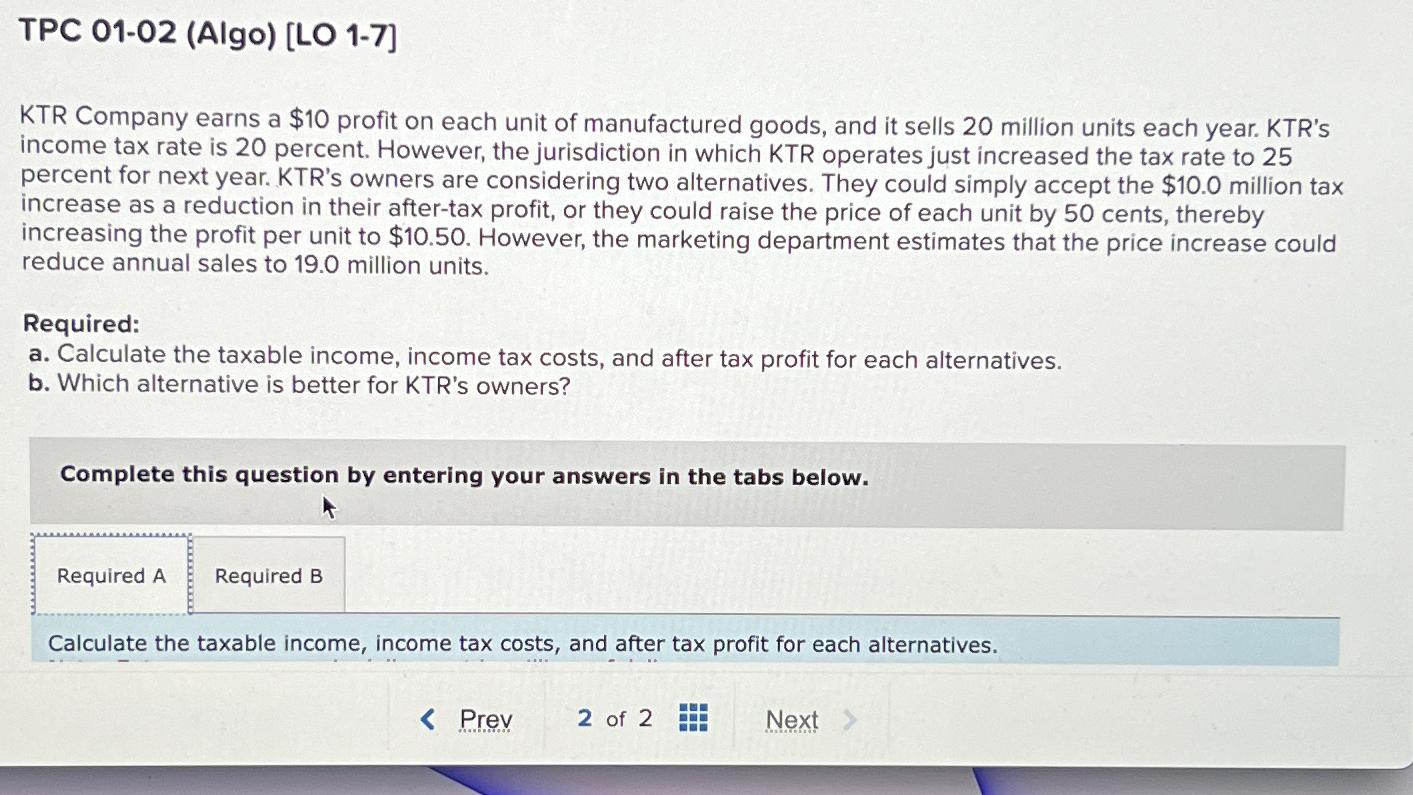

TPC 01-02 (Algo) [LO 1-7]\ KTR Company earns a

$10profit on each unit of manufactured goods, and it sells 20 million units each year. KTR's income tax rate is 20 percent. However, the jurisdiction in which KTR operates just increased the tax rate to 25 percent for next year. KTR's owners are considering two alternatives. They could simply accept the

$10.0million tax increase as a reduction in their after-tax profit, or they could raise the price of each unit by 50 cents, thereby increasing the profit per unit to

$10.50. However, the marketing department estimates that the price increase could reduce annual sales to 19.0 million units.\ Required:\ a. Calculate the taxable income, income tax costs, and after tax profit for each alternatives.\ b. Which alternative is better for KTR's owners?\ Complete this question by entering your answers in the tabs below.\ Required A\ Required B\ Calculate the taxable income, income tax costs, and after tax profit for each alternatives.\ Prev\ 2 of 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started