Question

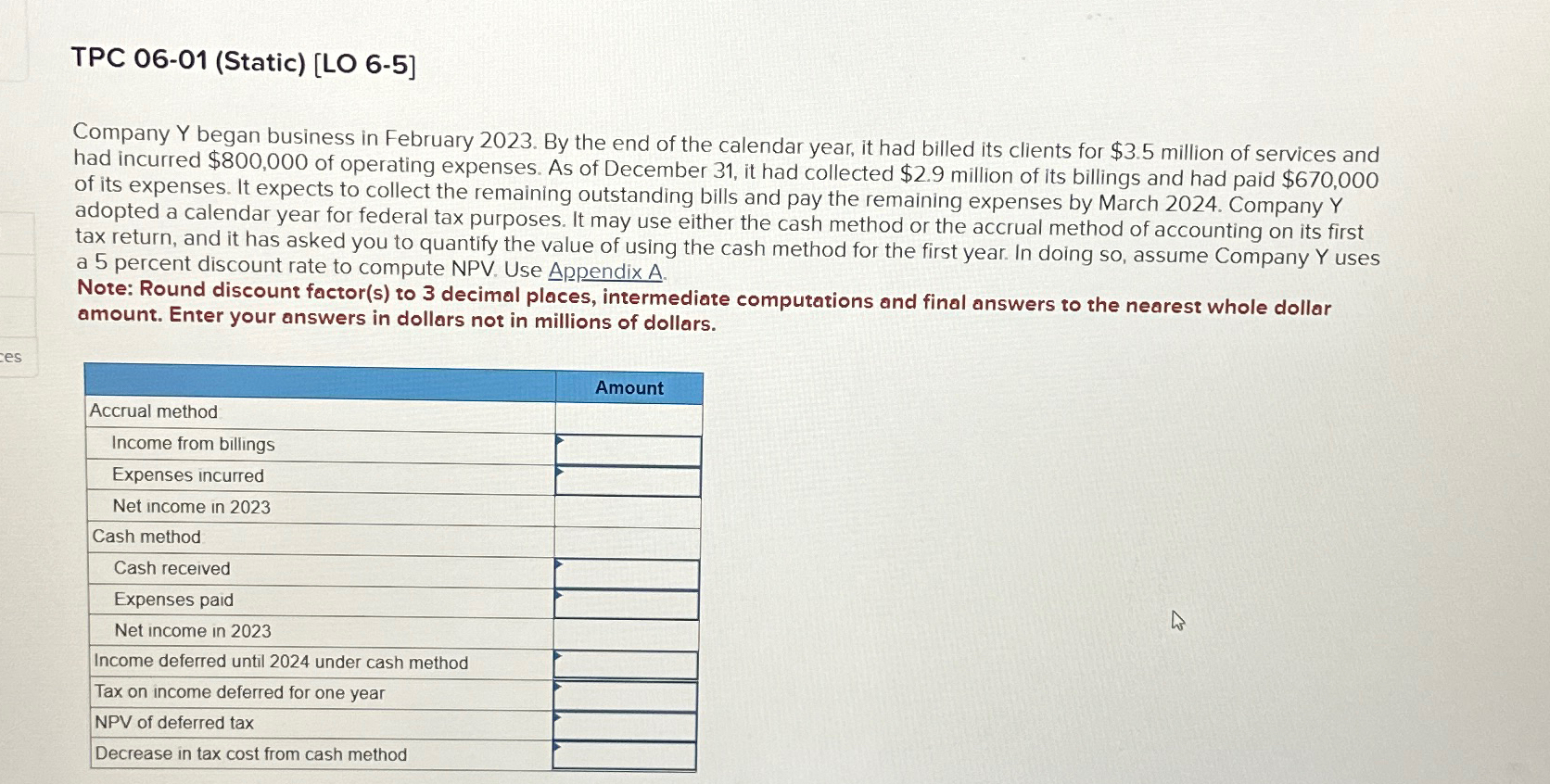

TPC 06-01 (Static) [LO 6-5] Company Y began business in February 2023. By the end of the calendar year, it had billed its clients for

TPC 06-01 (Static) [LO 6-5]\ Company

Ybegan business in February 2023. By the end of the calendar year, it had billed its clients for

$3.5million of services and had incurred

$800,000of operating expenses. As of December 31 , it had collected

$2.9million of its billings and had paid

$670,000of its expenses. It expects to collect the remaining outstanding bills and pay the remaining expenses by March 2024. Company

Yadopted a calendar year for federal tax purposes. It may use either the cash method or the accrual method of accounting on its first tax return, and it has asked you to quantify the value of using the cash method for the first year. In doing so, assume Company

Yuses a 5 percent discount rate to compute NPV. Use Appendix A.\ Note: Round discount factor(s) to 3 decimal places, intermediate computations and final answers to the nearest whole dollar amount. Enter your answers in dollars not in millions of dollars.\ \\\\table[[,],[Accrual method,Amount],[Income from billings,],[Expenses incurred,],[Net income in 2023,],[Cash method,],[Cash received,],[Expenses paid,],[Net income in 2023,],[Income deferred until 2024 under cash method,],[Tax on income deferred for one year,],[NPV of deferred tax,],[Decrease in tax cost from cash method,]]

ces TPC 06-01 (Static) [LO 6-5] Company Y began business in February 2023. By the end of the calendar year, it had billed its clients for $3.5 million of services and had incurred $800,000 of operating expenses. As of December 31, it had collected $2.9 million of its billings and had paid $670,000 of its expenses. It expects to collect the remaining outstanding bills and pay the remaining expenses by March 2024. Company Y adopted a calendar year for federal tax purposes. It may use either the cash method or the accrual method of accounting on its first tax return, and it has asked you to quantify the value of using the cash method for the first year. In doing so, assume Company Y uses a 5 percent discount rate to compute NPV. Use Appendix A. Note: Round discount factor(s) to 3 decimal places, intermediate computations and final answers to the nearest whole dollar amount. Enter your answers in dollars not in millions of dollars. Accrual method Income from billings Expenses incurred Net income in 2023 Cash method Cash received Expenses paid Net income in 2023 Income deferred until 2024 under cash method Tax on income deferred for one year NPV of deferred tax Decrease in tax cost from cash method Amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started