Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TPW, a calendar year taxpayer, sold land with a $535,000 tax basis for $750,000 in February. The purchaser paid $75,000 cash at closing and gave

TPW, a calendar year taxpayer, sold land with a $535,000 tax basis for $750,000 in February. The purchaser paid $75,000 cash at closing and gave TPW an interest-bearing note for the $675,000 remaining price. In August, TPW received a $55,950 payment from the purchaser consisting of a $33,750 principal payment and a $22,200 interest payment. In the first year after the year of sale, TPW received payments totaling $106,900 from the purchaser. The total consisted of $67,500 principal payments and $39,400 interest payments.

Required:

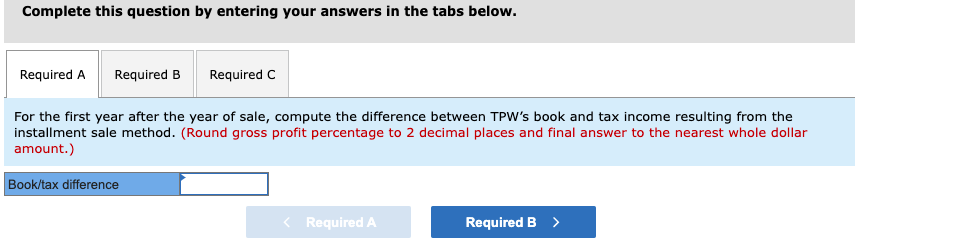

- For the first year after the year of the sale, compute the difference between TPWs book and tax income resulting from the installment sale method.

- Is this difference favorable or unfavorable?

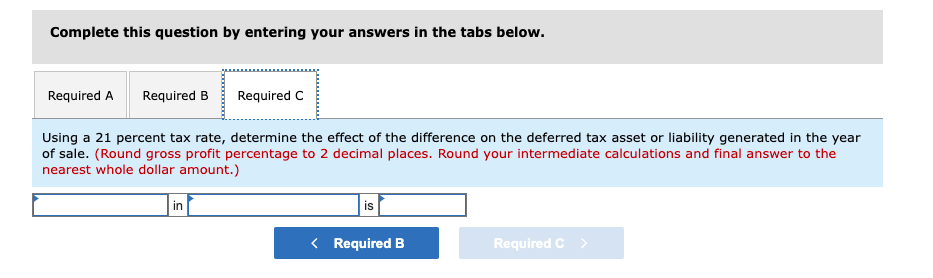

- Using a 21 percent tax rate, determine the effect of the difference on the deferred tax asset or liability generated in the year of sale.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started