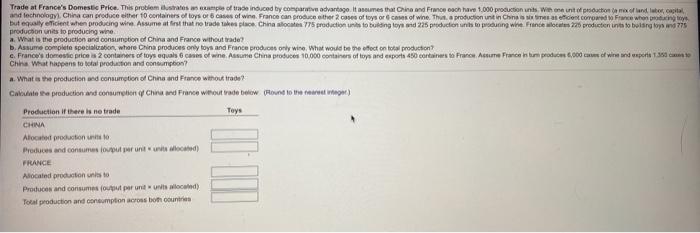

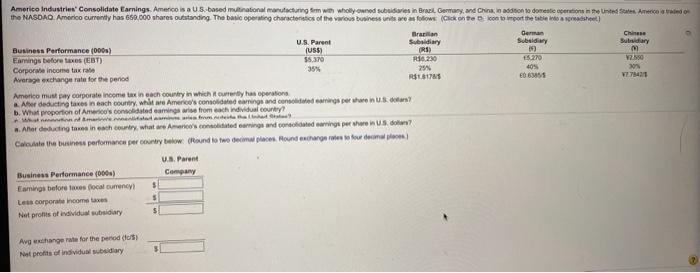

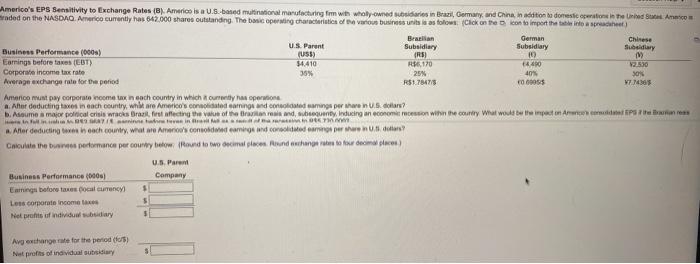

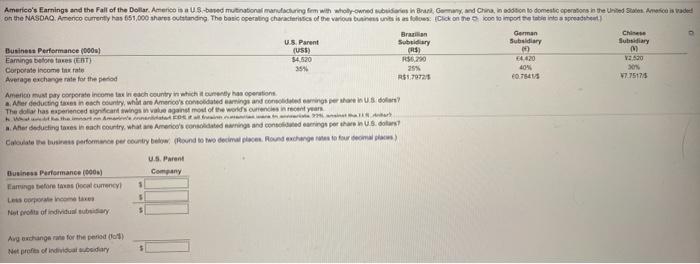

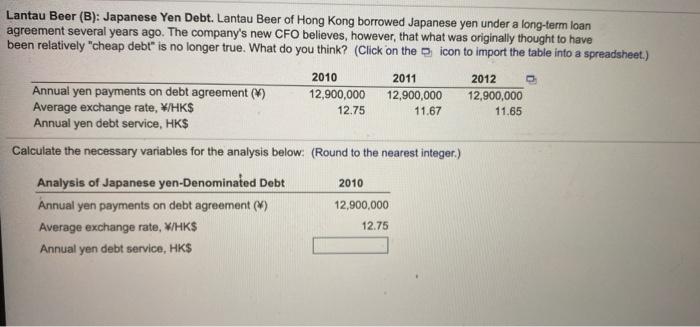

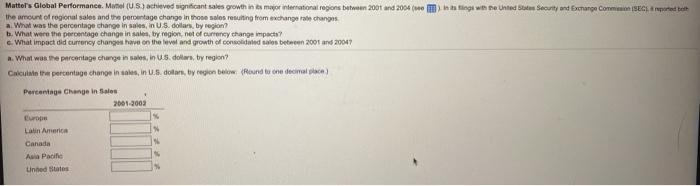

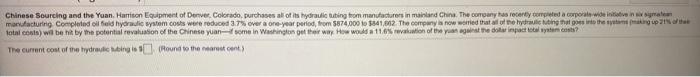

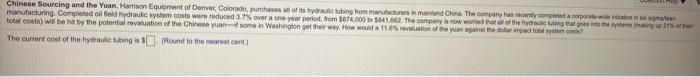

Trade at France's Domestie Price. This problem ilustrates of trade induced by compare advantage Itsumes that China and France each have 1.000 productions with a touton a mix of landlorcapital and technology, China dan produce the 10 containers of toys or care of wine, France can produce the core of toys or comes of wine. This production und in Chinese neden Corowad Freewher but gely eficient when producing wine. Assume at first that no trade the place China sociales 775 production is to buiding toys and 225 producen units to poung whe, France our producten into to bola to na 775 production is to producing wine a. What is the production and consumation of China and France without trade? b. Assume complete specialization, where China produces only toys and France products only wine What would be the effect on total production c. Frances domestic price a2 containers of toys equals 6 cases of wine. Assume China produces 10.000 containers of toys and exports 80 continues to France Assume France num produce .000 cod Wiederac Chhe What happens to total production and contempo? a. What is the production and consumtion of China and France without trade? Caterproduction and consumption of China and France without de bewone to the rear) Production if there is netrade Toys CHINA Alocated production to Producers and contumes loput perunt located) FRANCE Allocated production is to Produces and consumes out peruntunits located) Total production and consumption across bon countries America Industries Consolidate Earnings. Americo is a US-based multinational manufacturing with wholly-owned subsidiaries in BrasilGermany and China, in addition to deterions in the United Arad the NASDAD.Amenico currently has 650.000 shares outstanding. The basic operating characteristics of the vious business units are as foliowe (Click on the contemport the table to get Brian German Business Performance (000) U.S. Parent Subsidiary Subsidiary (US) Sundary (RS M Enrings before Sex (EBT) $5.370 ES 270 2.590 Corporate income tax rate 294 405 Average exchange rate for the period R$1.51725 EOS Americo must pay corporate income tax neach country in which it has operation er deducing taxes in each country white America's consolidated earnings and consolidated as per tre nu.8. b. What proportion of America's consolidated camins wise from each ndividual country Aer conducting taxes in each country, what are America's comited earning and cooled ning per here in ..? Call the business performare per country below. Round to two decimal places. Hound exchange for den om U.S. Parent Business Performance (000) Company Earnings before les local currency 5 Leis corporate income taxes $ Net profits of individual subsidiary Avg exchange rate for the period (5) Neprofits of individual subsidiary America's EPS Sensitivity to Exchange Rates (B). Americo is a 1.5. based multinational manufacturing firm with wholly-owned subsidiaries in Brazil, Germany and China. In addition to domestic to the United America aded on the NASDAQ. Americo currently has 642.000 shares outstanding. The basic operwing characteristics of business unit is as follows (Click on the conto import the two spre Bratlan German Chinese U.S. Parent Subsidiary Subsidiary ailery Business Performance (000) US) RS) M Earrings before taxes (ET) $4410 56,170 400 Corporate income tax rate 35% 25 40% 30% Average exchange rate for the period R$1.78478 000055 V7135 Americo must pay corporate income in each country in which only operation Ahor deducing tes in each country, what are America's conteaming and coming per have US dollars? Assume a major political crisis waoks Brasil, fireflecting the value of the trailers and beauty inducing an economie son when the country What would be the impact on Art Phones info.Tine even in the name Aer deducing teen each country, wiatre Asconde camins and condito caro per rende? Chout the performance per cowy below found to two decimalesund och from place) U.S. Parent Business Performance 000) Company Emring botor takes cal currency Los corporate Income Neprofits of individual wiary Argehange rate for the period (05) Net profits of individual subsidiary America's Earnings and the Fall of the Dollar. America US-based multinational manufacturing firm with wholly-owned bus in Brasil, Germany and China, iniin to domestic operations in the United States Americi del on the NASDAQ. Amenco currently has t51,000 shares outstanding. The basic operating characteristics of the various business unit is as follows: Click on the oto porttito spreadsheet Brain German Chinese U.S. Parent Subsidiary Subsidiary Sutisidiary Business Performance (000s) (US) (RS) Eaming before taxes (ET) 54 520 3620 EL 620 V2.600 Corporate income tax rate 35% 25% 404 Average exchange rate for the period R$170725 OU 17.75175 Americo y corporate income tax in each country in which the operations Ardeducting in each country, who are America's cordated caring and condited owner or do The dollar has experienced it wings in vegan most of the world are not Whethe.martrenni Ahar deducing toes in each country, what we America's coated caring and considering per anscors? Calculate the business performance per country w Rund to wo decimal pool Round exchanges to our complaces) U.S. Parent Business Performance (100) Comany Eng for a local currency 5 Lorem Most prot of individual diary $ Ang uchungerne for the period (1) Neprofit of individuary Lantau Beer (B): Japanese Yen Debt. Lantau Beer of Hong Kong borrowed Japanese yen under a long-term loan agreement several years ago. The company's new CFO believes, however, that what was originally thought to have been relatively "cheap debt" is no longer true. What do you think? (Click on the icon to import the table into a spreadsheet.) 2010 2011 2012 Annual yen payments on debt agreement (1) 12,900,000 12,900,000 12,900,000 Average exchange rate, W/HK$ 12.75 11.67 11.65 Annual yen debt service, HK$ Calculate the necessary variables for the analysis below: (Round to the nearest integer.) 2010 Analysis of Japanese yen-Denominated Debt Annual yen payments on debt agreement () Average exchange rate, W/HK$ Annual yen debt service, HK$ 12,900,000 12.75 In sing wis De Unted Security and Exchange Commi. ISEGI pored to Mattel's Global Performance Mine (US) achieved giant sales growth in tam international regions between 2007 and 2004 the amount of regional sales and the percentage change in the sales resulting from exchange rate changes a What was the percentage change in sales in US dollars by region t. What were the percentage change in sale by region, net of currency change impact? c. What impact did currency changes have on the level and growth of consolidated saben 2001 and 20047 What was the percentage change in sales, in US dollars by region? Calculate the percentage change in In US dollars, by region below found to che decima) Percentage Change in Sales 2001-2003 Cro Latin America Canada Asia Pacific Unded to Chinese Sourcing and the Yuan. Harrison Equipment of Denver, Colorado purchases all of its hydraulic thing from manufacturers in mainland China. The coroana centy towed a crate winters manufacturing Completed all field hyrwysem costs were reduced 37 over a one-year period from 5874.000 To $1,012. The company is now worried that of the hydraulichting that goes into the top total costs) will be by the potential evaluation of the Chinese yuan come in Washington other way How woud 116tion of the youngest palsts? The current cont of the hydraulic wings found to the nearest cont> Chinese Sourcing and the Yuan. Harrison Equipment of Denver, Colorado, purchases all of its hydrauling from main mand China. The company has anyoneda corporate ident manufacturing Completed oil field hydraulic system costs were reduced 37% ver a one-year period from $874.000 5841662. The company is now worried of the cating that goes into the map total costs) will bent by the potential evaluation of the Chinese yuan-some in Washington get their way. How would 11.6% revision of the year against the door allem The current cost of the hydraulic labing sound to the nearest cont) Trade at France's Domestie Price. This problem ilustrates of trade induced by compare advantage Itsumes that China and France each have 1.000 productions with a touton a mix of landlorcapital and technology, China dan produce the 10 containers of toys or care of wine, France can produce the core of toys or comes of wine. This production und in Chinese neden Corowad Freewher but gely eficient when producing wine. Assume at first that no trade the place China sociales 775 production is to buiding toys and 225 producen units to poung whe, France our producten into to bola to na 775 production is to producing wine a. What is the production and consumation of China and France without trade? b. Assume complete specialization, where China produces only toys and France products only wine What would be the effect on total production c. Frances domestic price a2 containers of toys equals 6 cases of wine. Assume China produces 10.000 containers of toys and exports 80 continues to France Assume France num produce .000 cod Wiederac Chhe What happens to total production and contempo? a. What is the production and consumtion of China and France without trade? Caterproduction and consumption of China and France without de bewone to the rear) Production if there is netrade Toys CHINA Alocated production to Producers and contumes loput perunt located) FRANCE Allocated production is to Produces and consumes out peruntunits located) Total production and consumption across bon countries America Industries Consolidate Earnings. Americo is a US-based multinational manufacturing with wholly-owned subsidiaries in BrasilGermany and China, in addition to deterions in the United Arad the NASDAD.Amenico currently has 650.000 shares outstanding. The basic operating characteristics of the vious business units are as foliowe (Click on the contemport the table to get Brian German Business Performance (000) U.S. Parent Subsidiary Subsidiary (US) Sundary (RS M Enrings before Sex (EBT) $5.370 ES 270 2.590 Corporate income tax rate 294 405 Average exchange rate for the period R$1.51725 EOS Americo must pay corporate income tax neach country in which it has operation er deducing taxes in each country white America's consolidated earnings and consolidated as per tre nu.8. b. What proportion of America's consolidated camins wise from each ndividual country Aer conducting taxes in each country, what are America's comited earning and cooled ning per here in ..? Call the business performare per country below. Round to two decimal places. Hound exchange for den om U.S. Parent Business Performance (000) Company Earnings before les local currency 5 Leis corporate income taxes $ Net profits of individual subsidiary Avg exchange rate for the period (5) Neprofits of individual subsidiary America's EPS Sensitivity to Exchange Rates (B). Americo is a 1.5. based multinational manufacturing firm with wholly-owned subsidiaries in Brazil, Germany and China. In addition to domestic to the United America aded on the NASDAQ. Americo currently has 642.000 shares outstanding. The basic operwing characteristics of business unit is as follows (Click on the conto import the two spre Bratlan German Chinese U.S. Parent Subsidiary Subsidiary ailery Business Performance (000) US) RS) M Earrings before taxes (ET) $4410 56,170 400 Corporate income tax rate 35% 25 40% 30% Average exchange rate for the period R$1.78478 000055 V7135 Americo must pay corporate income in each country in which only operation Ahor deducing tes in each country, what are America's conteaming and coming per have US dollars? Assume a major political crisis waoks Brasil, fireflecting the value of the trailers and beauty inducing an economie son when the country What would be the impact on Art Phones info.Tine even in the name Aer deducing teen each country, wiatre Asconde camins and condito caro per rende? Chout the performance per cowy below found to two decimalesund och from place) U.S. Parent Business Performance 000) Company Emring botor takes cal currency Los corporate Income Neprofits of individual wiary Argehange rate for the period (05) Net profits of individual subsidiary America's Earnings and the Fall of the Dollar. America US-based multinational manufacturing firm with wholly-owned bus in Brasil, Germany and China, iniin to domestic operations in the United States Americi del on the NASDAQ. Amenco currently has t51,000 shares outstanding. The basic operating characteristics of the various business unit is as follows: Click on the oto porttito spreadsheet Brain German Chinese U.S. Parent Subsidiary Subsidiary Sutisidiary Business Performance (000s) (US) (RS) Eaming before taxes (ET) 54 520 3620 EL 620 V2.600 Corporate income tax rate 35% 25% 404 Average exchange rate for the period R$170725 OU 17.75175 Americo y corporate income tax in each country in which the operations Ardeducting in each country, who are America's cordated caring and condited owner or do The dollar has experienced it wings in vegan most of the world are not Whethe.martrenni Ahar deducing toes in each country, what we America's coated caring and considering per anscors? Calculate the business performance per country w Rund to wo decimal pool Round exchanges to our complaces) U.S. Parent Business Performance (100) Comany Eng for a local currency 5 Lorem Most prot of individual diary $ Ang uchungerne for the period (1) Neprofit of individuary Lantau Beer (B): Japanese Yen Debt. Lantau Beer of Hong Kong borrowed Japanese yen under a long-term loan agreement several years ago. The company's new CFO believes, however, that what was originally thought to have been relatively "cheap debt" is no longer true. What do you think? (Click on the icon to import the table into a spreadsheet.) 2010 2011 2012 Annual yen payments on debt agreement (1) 12,900,000 12,900,000 12,900,000 Average exchange rate, W/HK$ 12.75 11.67 11.65 Annual yen debt service, HK$ Calculate the necessary variables for the analysis below: (Round to the nearest integer.) 2010 Analysis of Japanese yen-Denominated Debt Annual yen payments on debt agreement () Average exchange rate, W/HK$ Annual yen debt service, HK$ 12,900,000 12.75 In sing wis De Unted Security and Exchange Commi. ISEGI pored to Mattel's Global Performance Mine (US) achieved giant sales growth in tam international regions between 2007 and 2004 the amount of regional sales and the percentage change in the sales resulting from exchange rate changes a What was the percentage change in sales in US dollars by region t. What were the percentage change in sale by region, net of currency change impact? c. What impact did currency changes have on the level and growth of consolidated saben 2001 and 20047 What was the percentage change in sales, in US dollars by region? Calculate the percentage change in In US dollars, by region below found to che decima) Percentage Change in Sales 2001-2003 Cro Latin America Canada Asia Pacific Unded to Chinese Sourcing and the Yuan. Harrison Equipment of Denver, Colorado purchases all of its hydraulic thing from manufacturers in mainland China. The coroana centy towed a crate winters manufacturing Completed all field hyrwysem costs were reduced 37 over a one-year period from 5874.000 To $1,012. The company is now worried that of the hydraulichting that goes into the top total costs) will be by the potential evaluation of the Chinese yuan come in Washington other way How woud 116tion of the youngest palsts? The current cont of the hydraulic wings found to the nearest cont> Chinese Sourcing and the Yuan. Harrison Equipment of Denver, Colorado, purchases all of its hydrauling from main mand China. The company has anyoneda corporate ident manufacturing Completed oil field hydraulic system costs were reduced 37% ver a one-year period from $874.000 5841662. The company is now worried of the cating that goes into the map total costs) will bent by the potential evaluation of the Chinese yuan-some in Washington get their way. How would 11.6% revision of the year against the door allem The current cost of the hydraulic labing sound to the nearest cont)