Answered step by step

Verified Expert Solution

Question

1 Approved Answer

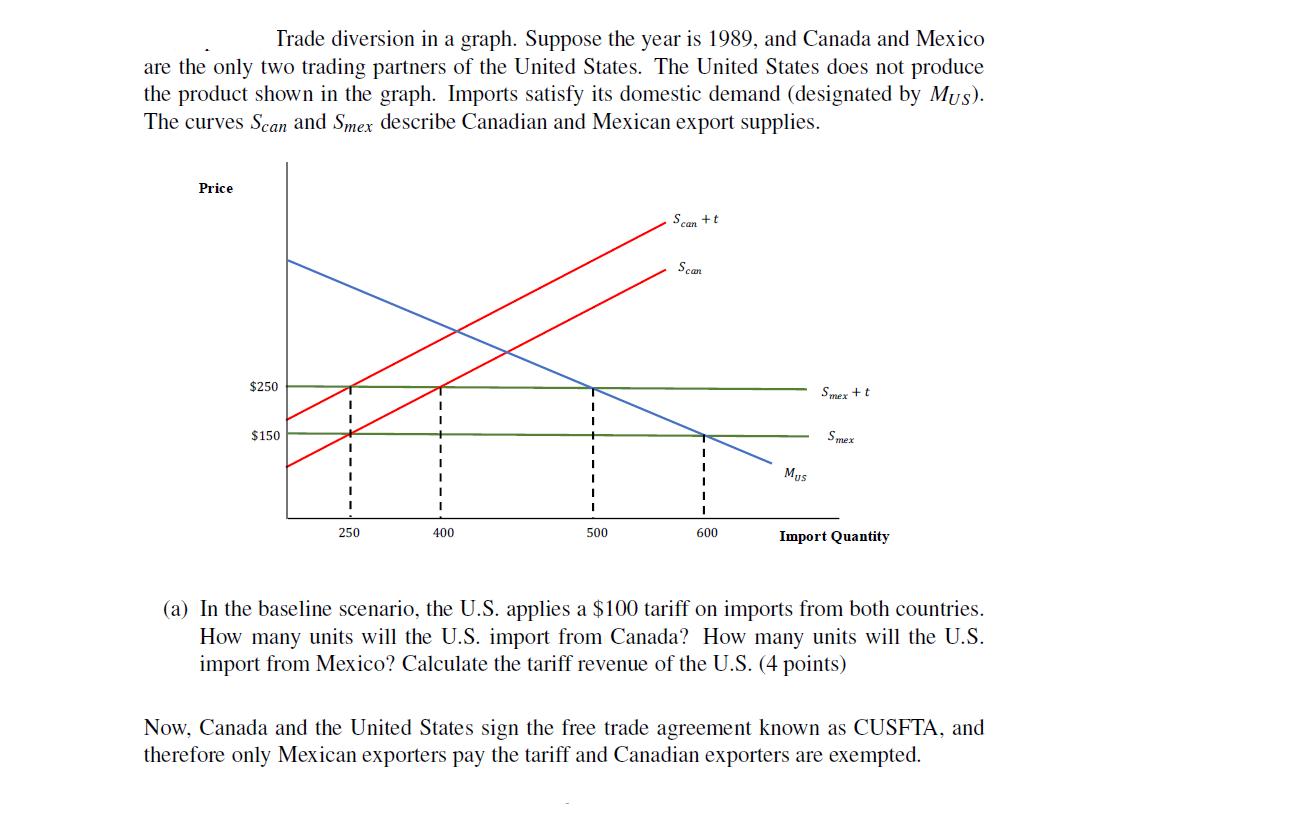

Trade diversion in a graph. Suppose the year is 1989, and Canada and Mexico are the only two trading partners of the United States.

Trade diversion in a graph. Suppose the year is 1989, and Canada and Mexico are the only two trading partners of the United States. The United States does not produce the product shown in the graph. Imports satisfy its domestic demand (designated by Mus). The curves Scan and Smex describe Canadian and Mexican export supplies. Price $250 $150 Scan +t Scan Mus Smex + t Smex 250 400 500 600 Import Quantity (a) In the baseline scenario, the U.S. applies a $100 tariff on imports from both countries. How many units will the U.S. import from Canada? How many units will the U.S. import from Mexico? Calculate the tariff revenue of the U.S. (4 points) Now, Canada and the United States sign the free trade agreement known as CUSFTA, and therefore only Mexican exporters pay the tariff and Canadian exporters are exempted. (b) After the CUSFTA, how many units will the U.S. import from Canada? How many units will the U.S. import from Mexico? Calculate the tariff revenue of the U.S. (4 points) (c) With respect to the baseline scenario, compute the net effect on US welfare of signing the CUSFTA. (6 points) (d) With respect to the baseline scenario, compute the net effect on Canadian welfare of signing the CUSFTA. (6 points) Instead of signing the CUSFTA, suppose that the three countries sign a free trade agreement known as NAFTA. Now both Canadian and Mexican exporters are exempted of paying the tariff. (e) After the NAFTA, how many units will the U.S. import from Canada? How many units will the U.S. import from Mexico? (4 points) (f) With respect to the baseline scenario, compute the net effect on US welfare of signing the NAFTA. (6 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started