Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Trader enters into a one-year short forward contract to sell an asset for $40 when the spot price is $38. The spot price in

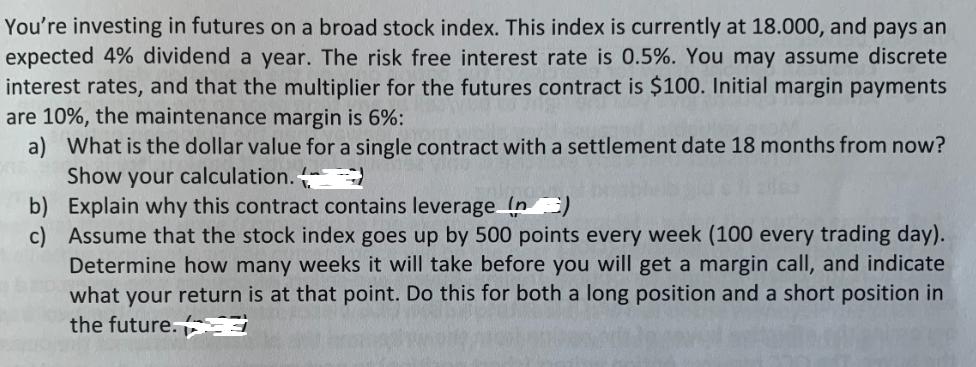

Trader enters into a one-year short forward contract to sell an asset for $40 when the spot price is $38. The spot price in one year proves to be $43. What is the trader's gain or loss? Show a dollar amount and indicate whether it is a gain or loss. You're investing in futures on a broad stock index. This index is currently at 18.000, and pays an expected 4% dividend a year. The risk free interest rate is 0.5%. You may assume discrete interest rates, and that the multiplier for the futures contract is $100. Initial margin payments are 10%, the maintenance margin is 6%: a) What is the dollar value for a single contract with a settlement date 18 months from now? Show your calculation. b) Explain why this contract contains leverage (n =) c) Assume that the stock index goes up by 500 points every week (100 every trading day). Determine how many weeks it will take before you will get a margin call, and indicate what your return is at that point. Do this for both a long position and a short position in the future.

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

i We must compare the assets agreedupon sale price 40 with the spot price at expiry 43 in order to determine the traders profit or loss The trader will experience a loss since the spot price is greate...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started