Question

Trading and Available-for-Sale Securities II Investment transactions: One company (Trading Co.) classifies the investments as trading securities, and the other (Available Co.) classifies the securities

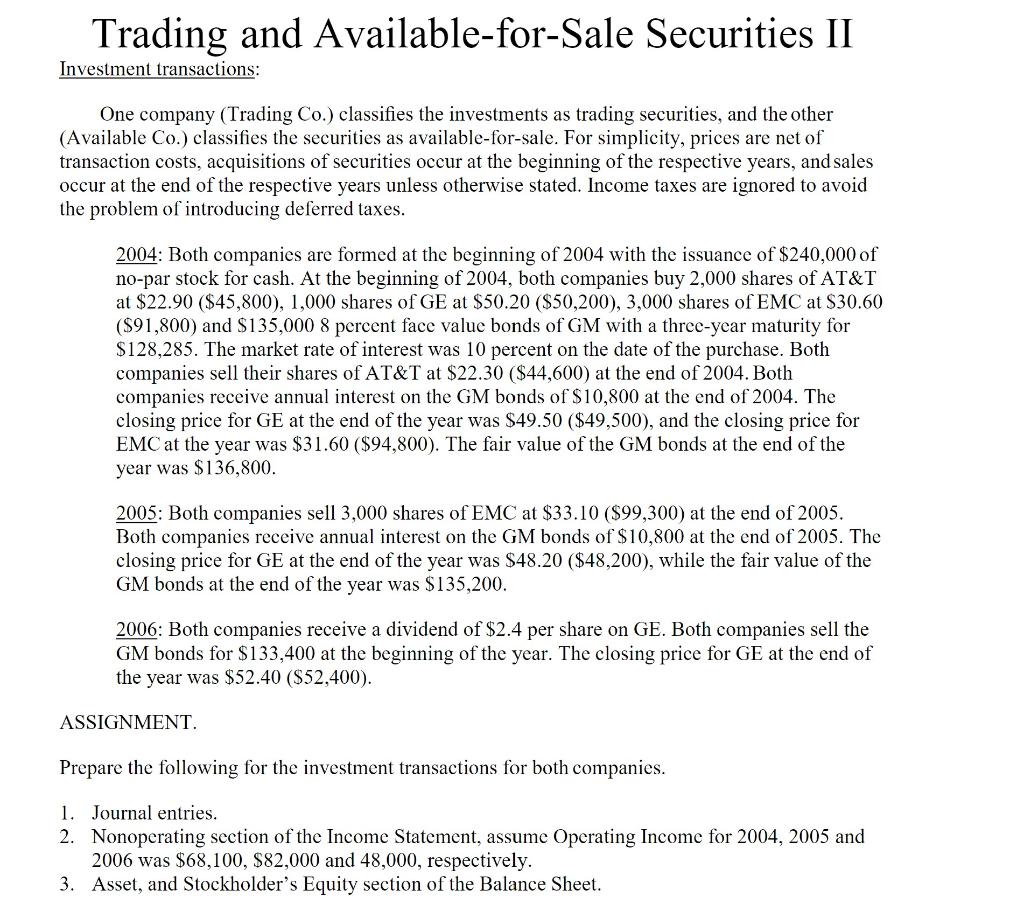

Trading and Available-for-Sale Securities II Investment transactions: One company (Trading Co.) classifies the investments as trading securities, and the other (Available Co.) classifies the securities as available-for-sale. For simplicity, prices are net of transaction costs, acquisitions of securities occur at the beginning of the respective years, and sales occur at the end of the respective years unless otherwise stated. Income taxes are ignored to avoid the problem of introducing deferred taxes.

2004: Both companies are formed at the beginning of 2004 with the issuance of $240,000 of no-par stock for cash. At the beginning of 2004, both companies buy 2,000 shares of AT&T at $22.90 ($45,800), 1,000 shares of GE at $50.20 ($50,200), 3,000 shares of EMC at $30.60 ($91,800) and $135,000 8 percent face value bonds of GM with a three-year maturity for $128,285. The market rate of interest was 10 percent on the date of the purchase. Both companies sell their shares of AT&T at $22.30 ($44,600) at the end of 2004. Both companies receive annual interest on the GM bonds of $10,800 at the end of 2004. The closing price for GE at the end of the year was $49.50 ($49,500), and the closing price for EMC at the year was $31.60 ($94,800). The fair value of the GM bonds at the end of the year was $136,800.

2005: Both companies sell 3,000 shares of EMC at $33.10 ($99,300) at the end of 2005. Both companies receive annual interest on the GM bonds of $10,800 at the end of 2005. The closing price for GE at the end of the year was $48.20 ($48,200), while the fair value of the GM bonds at the end of the year was $135,200.

2006: Both companies receive a dividend of $2.4 per share on GE. Both companies sell the GM bonds for $133,400 at the beginning of the year. The closing price for GE at the end of the year was $52.40 ($52,400). ASSIGNMENT. Prepare the following for the investment transactions for both companies. 1. Journal entries. 2. Nonoperating section of the Income Statement, assume Operating Income for 2004, 2005 and 2006 was $68,100, $82,000 and 48,000, respectively. 3. Asset, and Stockholders Equity section of the Balance Sheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started