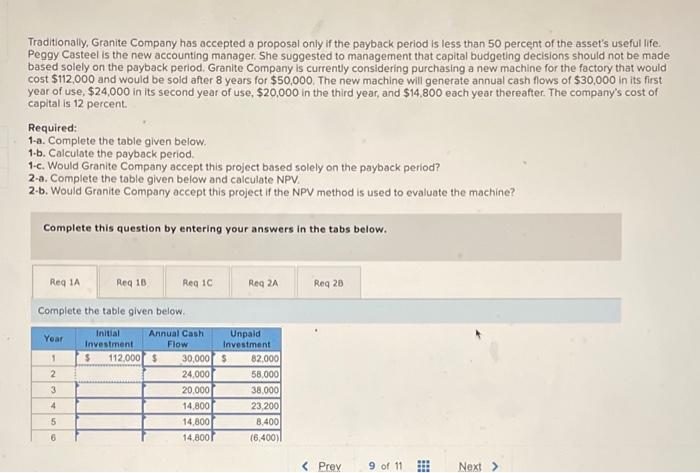

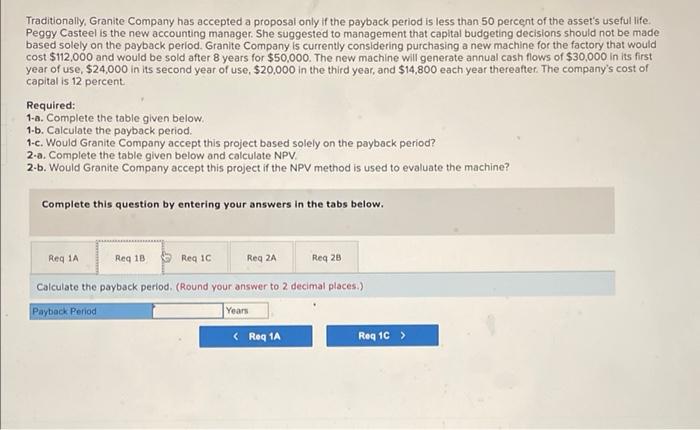

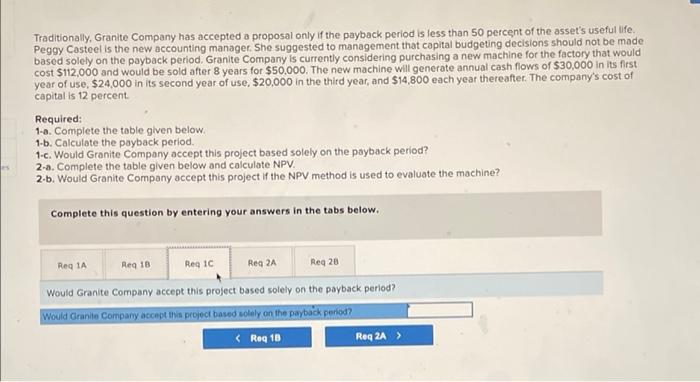

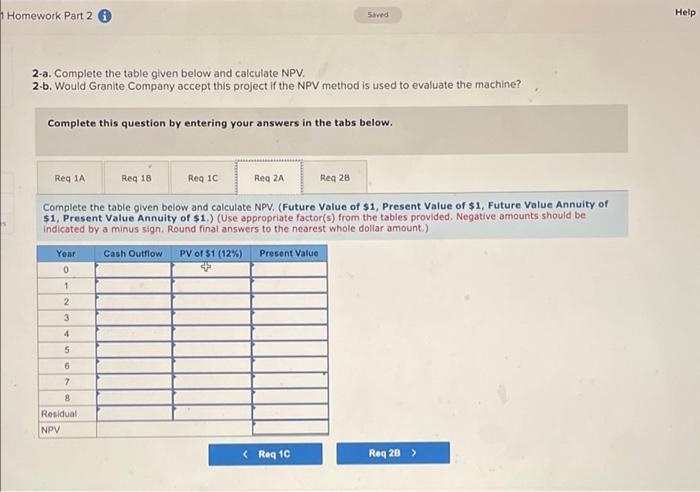

Traditionally, Granite Company has accepted a proposal only if the payback period is less than 50 percent of the asset's useful life, Peggy Casteel is the new accounting manager . She suggested to management that capital budgeting decisions should not be made based solely on the payback period. Granite Company is currently considering purchasing a new machine for the factory that would cost $112,000 and would be sold after 8 years for $50,000. The new machine will generate annual cash flows of $30,000 in its first year of use. $24,000 in its second year of use, $20,000 in the third year, and $14,800 each year thereafter. The company's cost of capital is 12 percent Required: 1-a. Complete the table given below. 1-b. Calculate the payback period. 1-c. Would Granite Company accept this project based solely on the payback period? 2-a. Complete the table given below and calculate NPV 2-b. Would Granite Company accept this project if the NPV method is used to evaluate the machine? Complete this question by entering your answers in the tabs below. Req 20 Req1A Req 18 Reg IC Reg 2A Complete the table given below. Initial Year Annual Cash Unpald Investment Flow Investment 1 $ 112,000 $ 30,000 s 82,000 2 24,000 58,000 3 20,000 38.000 4 14,800 23,200 5 14,800 8.400 14,8001 (6 400) Traditionally, Granite Company has accepted a proposal only if the payback period is less than 50 percent of the asset's useful life Peggy Casteel is the new accounting manager. She suggested to management that capital budgeting decisions should not be made based solely on the payback period. Granite Company is currently considering purchasing a new machine for the factory that would cost $112,000 and would be sold after 8 years for $50,000. The new machine will generate annual cash flows of $30,000 in its first year of use $24,000 in its second year of use, $20,000 in the third year, and $14,800 each year thereafter. The company's cost of capital is 12 percent Required: 1-a. Complete the table given below. 1-b. Calculate the payback period. 1-c. Would Granite Company accept this project based solely on the payback period? 2-a. Complete the table given below and calculate NPV. 2-b. Would Granite Company accept this project if the NPV method is used to evaluate the machine? Complete this question by entering your answers in the tabs below. Reg 1A Reg 13 Req 1C Reg 2A Reg 28 Calculate the payback period, (Round your answer to 2 decimal places.) Payback Period Years Reg 1A Reg 10 > Traditionally, Granite Company has accepted a proposal only if the payback period is less than 50 percent of the asset's useful life. Peggy Casteel is the new accounting manager. She suggested to management that capital budgeting decisions should not be made based solely on the payback period. Granite Company is currently considering purchasing a new machine for the factory that would cost $112,000 and would be sold after 8 years for $50,000. The new machine will generate annual cash flows of $30,000 in its first year of use. $24.000 in its second year of use, $20,000 in the third year, and $14,800 each year thereafter. The company's cost of capital is 12 percent Required: 1-a. Complete the table given below. 1-b. Calculate the payback period 1-c. Would Granite Company accept this project based solely on the payback period? 2-a. Complete the table given below and calculate NPV. 2-b. Would Granite Company accept this project if the NPV method is used to evaluate the machine? Complete this question by entering your answers in the tabs below. Reg 1A Reg 13 Reg 10 Reg 2A Reg 20 Would Granite Company accept this project based solely on the payback period? Would Granite Company accept a project based olely on the payback period? Homework Part 2 Saved Help 2-a. Complete the table given below and calculate NPV. 2-b. Would Granite Company accept this project if the NPV method is used to evaluate the machine? Complete this question by entering your answers in the tabs below. Req 1A Reg 18 Req1C Reg 2A Reg 28 Complete the table given below and calculate NPV. (Future Value of $1, Present Value of $1, Future Value Annuity of $1. Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Negative amounts should be Indicated by a minus sign. Round final answers to the nearest whole dollar amount.) Year Cash Outflow PV of $1 (12%) Present Value 0 1 2 3 4 5 6 7 8 Residual NPV