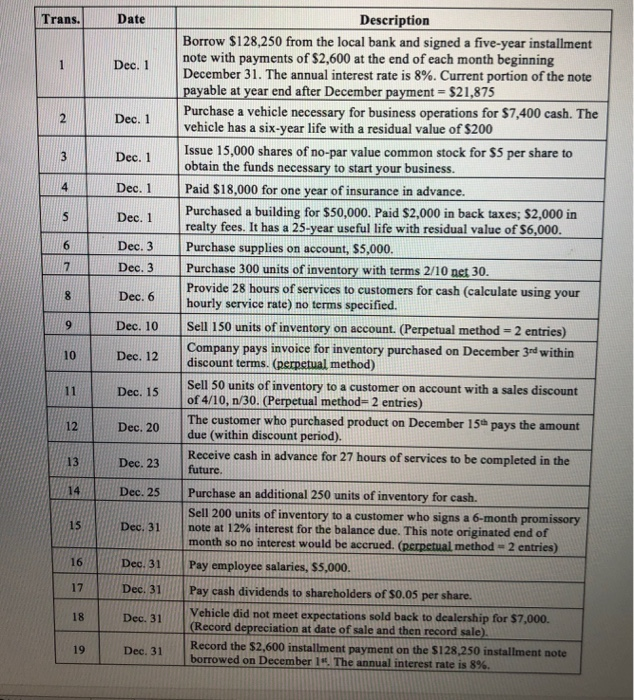

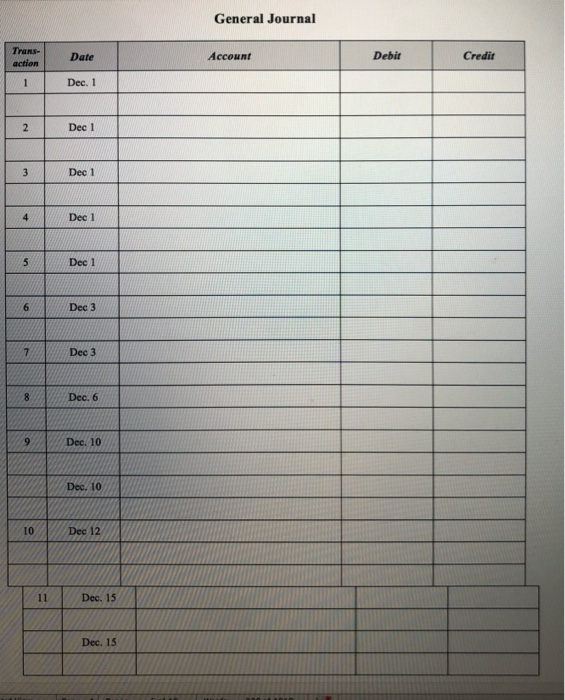

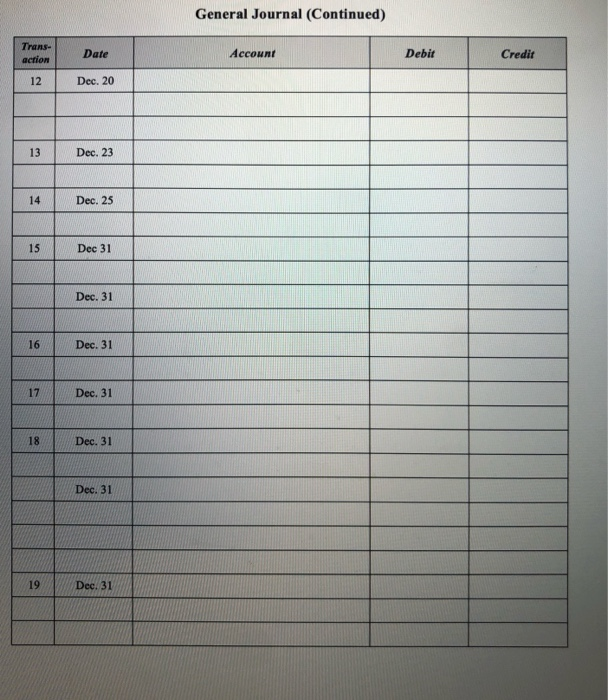

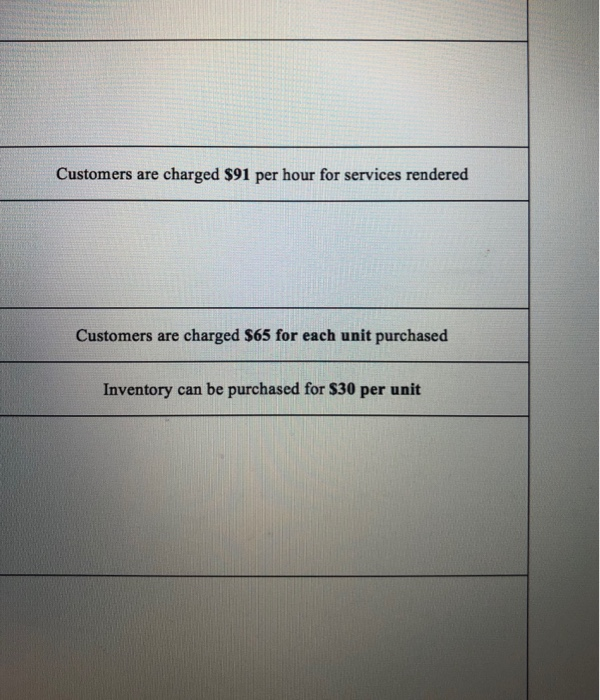

Trans. Date Dec. 1 Dec. 1 Dec. 1 Dec. 1 Dec. 1 Dec. 3 Dec. 3 Dec. 6 Description Borrow $128,250 from the local bank and signed a five-year installment note with payments of $2,600 at the end of each month beginning December 31. The annual interest rate is 8%. Current portion of the note payable at year end after December payment-$21,875 Purchase a vehicle necessary for business operations for $7,400 cash. The vehicle has a six-year life with a residual value of $200 Issue 15,000 shares of no-par value common stock for $5 per share to obtain the funds necessary to start your business. Paid $18,000 for one year of insurance in advance. Purchased a building for $50,000. Paid $2,000 in back taxes; $2,000 in realty fees. It has a 25-year useful life with residual value of $6,000. Purchase supplies on account, $5,000. Purchase 300 units of inventory with terms 2/10 net 30. Provide 28 hours of services to customers for cash (calculate using your hourly service rate) no terms specified. Sell 150 units of inventory on account. (Perpetual method - 2 entries) Company pays invoice for inventory purchased on December 3rd within discount terms. (perpetual method) Sell 50 units of inventory to a customer on account with a sales discount of 4/10, n/30. (Perpetual method -2 entries) The customer who purchased product on December 15 pays the amount due (within discount period). Receive cash in advance for 27 hours of services to be completed in the future Purchase an additional 250 units of inventory for cash. Sell 200 units of inventory to a customer who signs a 6-month promissory note at 12% interest for the balance due. This note originated end of month so no interest would be accrued. (perpetual method - 2 entries) Pay employee salaries, $5,000. Dec. 10 Dec. 12 11 Dec. 15 12 Dec. 20 Dec. 23 Dec. 25 15 Dec. 31 Dec. 31 Dec. 31 Dec. 31 Pay cash dividends to shareholders of $0.05 per share. Vehicle did not meet expectations sold back to dealership for $7,000. (Record depreciation at date of sale and then record sale). Record the $2,600 installment payment on the S128,250 installment note borrowed on December 1 The annual interest rate is 8% Dec. 31 General Journal Date Account Debit Credit Dec. 1 Dec 1 Dec 1 Dec 1 Deci Dec 1 Www Dec 3 Dec 3 Dec. 6 Dec. 10 Dec. 10 Dec. 15 Dec. 15 General Journal (Continued) Trans- action Date Account Debit Credit 12 Dec. 20 13 Dec. 23 Dec. 25 15 Dec 31 Dec. 31 16 Dec. 31 17 Dec. 31 18 Dec. 31 Dec. 31 19 Dec. 31 Customers are charged $91 per hour for services rendered Customers are charged $65 for each unit purchased Inventory can be purchased for $30 per unit