Answered step by step

Verified Expert Solution

Question

1 Approved Answer

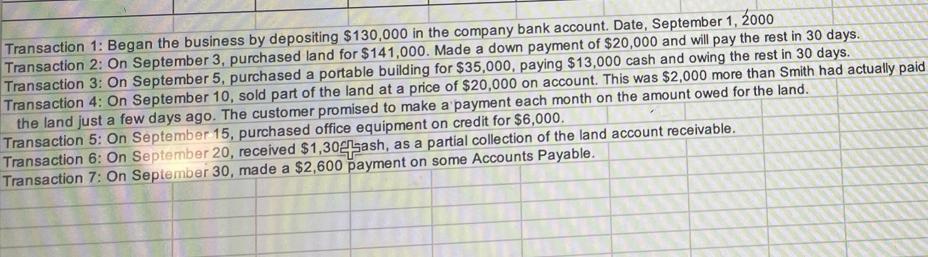

Transaction 1: Began the business by depositing $130,000 in the company bank account. Date, September 1, 2000 Transaction 2: On September 3, purchased land

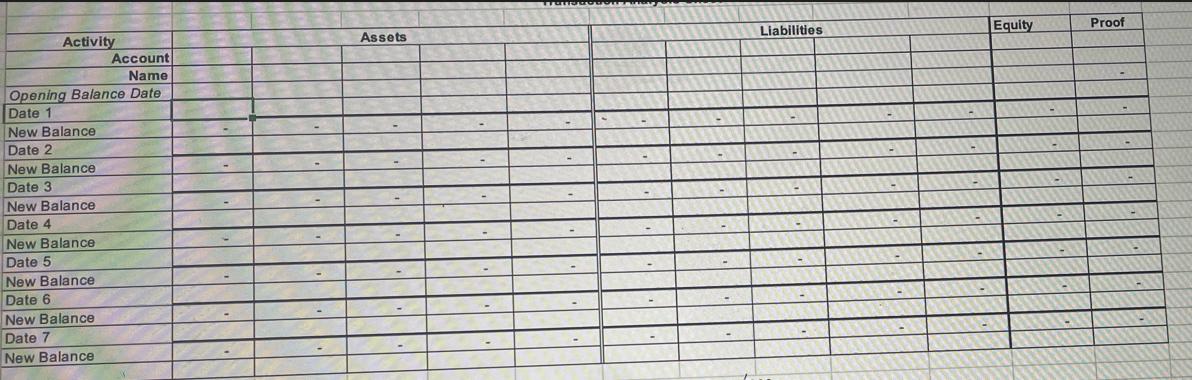

Transaction 1: Began the business by depositing $130,000 in the company bank account. Date, September 1, 2000 Transaction 2: On September 3, purchased land for $141,000. Made a down payment of $20,000 and will pay the rest in 30 days. Transaction 3: On September 5, purchased a portable building for $35,000, paying $13,000 cash and owing the rest in 30 days. Transaction 4: On September 10, sold part of the land at a price of $20,000 on account. This was $2,000 more than Smith had actually paid the land just a few days ago. The customer promised to make a payment each month on the amount owed for the land. Transaction 5: On September 15, purchased office equipment on credit for $6,000. Transaction 6: On September 20, received $1,30sash, as a partial collection of the land account receivable. Transaction 7: On September 30, made a $2,600 payment on some Accounts Payable. Activity Account Name Opening Balance Date Date 1 New Balance Date 2 New Balance Date 3 Date 4 Date 5 Date 6 Date 7 New Balance New Balance New Balance New Balance New Balance Assets Liabilities Equity Proof

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started