Question

Transaction 1.) Frost Business started operations on December 1, 2018 with an initial issue of common stock of 64,770 after you record this transaction: The

Transaction 1.) Frost Business started operations on December 1, 2018 with an initial issue of common stock of 64,770 after you record this transaction: The check formula should return TRUE, show impact on cash flow if any, choose an account name if appropriate revenue, salary, rent.

Transaction 2.) Frost Business performed services for one month on account for 54,000. Even though no cash was received revenue must be recorded since the revenue recognition rules have been met (it has been earned and it's reasonable to expect payment. Check formula should return true, show impact on cash flow if any, choose account name if appropriate revenue, salary, rent.

Transaction 3.) Frost Business has received 25% of the amount recorded in transaction 2 as partial payments of the accounts receivable, after you record this transaction (check formula should return true, show impact on cash flow if any, choose an account name if appropriate revenue, salary, rent.

Transaction 4.) Frost Business paid 10% of the amount of the amount recorded in Transaction 2 as salary expense, after you record this transaction (check formula should return true, show impact on cash flow if any, choose an account name if appropriate revenue, salary, rent.

Transaction 5.) Frost Business paid 5% of the amount recorded in Transaction 2 as rent expense, after you record this transaction (check formula should return true, show impact on cash flow if any, choose an account name if appropriate revenue, salary, rent.

Transaction 6.) Record the payment of the cell phone bill. The amount is 1% of 54,000. Create a new expense name; after you record this transaction (check formula should return true, show impact on cash flow if any, choose an account name if appropriate revenue, salary, rent.

Transaction 7.) Record a cash prepayment from a second customer of 10,795. After you record this entry, a new row should be added for the transaction, the check formula should return true, show impact on cash flow if any, choose an account name if appropriate revenue, salary, rent.

Transaction 8.) Record an adjusting entry to recognize 25% of the prepayment from transaction 7 as revenue. After you record this transaction a new row should be added for the transaction, the check figure should return true, show impact on cash flow if any, choose an account name if appropriate revenue, salary, rent.

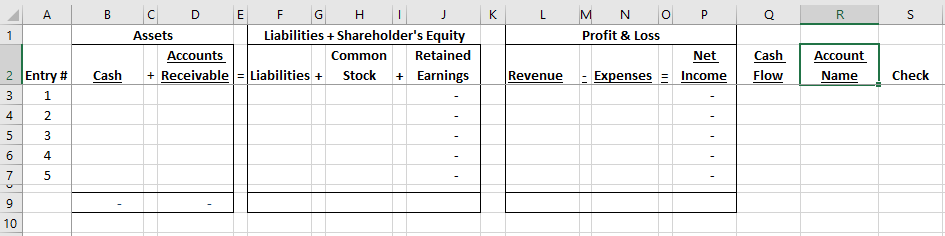

E F GH OP Assets Liabilities+Shareholder's Equi Profit & Loss Accounts Common Retained Net Cash Account 2|Entry # Cash + Receivable-Liabilities + stock + Earnings Revenue ExpensesIncomeFlovw Name e Check 4 4 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started