Question

Transaction 1: Large Mart has purchased a warehouse from Buy-More Ltd. The contract for the purchase was signed on the 1 April 201X and Large

Transaction 1:

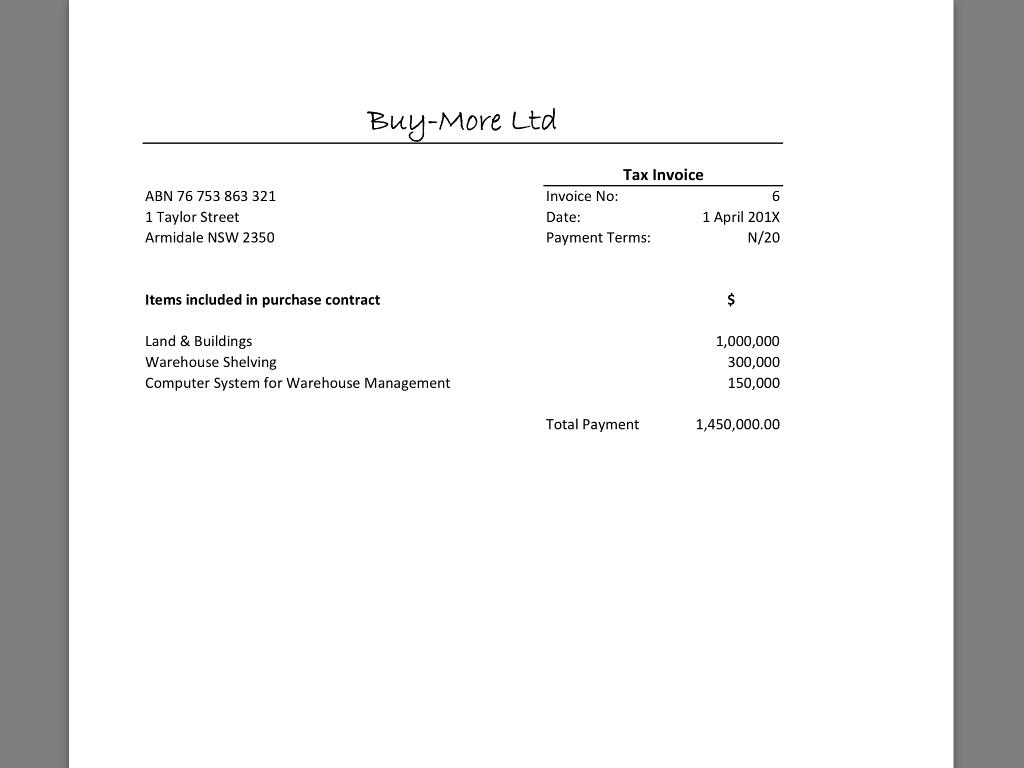

Large Mart has purchased a warehouse from Buy-More Ltd. The contract for the purchase was signed on the 1 April 201X and Large Mart took possession of the warehouse on that day. One important reason why this warehouse was purchased is that no changes to the property are required. As a result Large Mart starts to use the warehouse on the 1 April 201X. For detailed information about purchase contract (see invoice from Buy-More Ltd)

Additional information about the purchase of the warehouse:

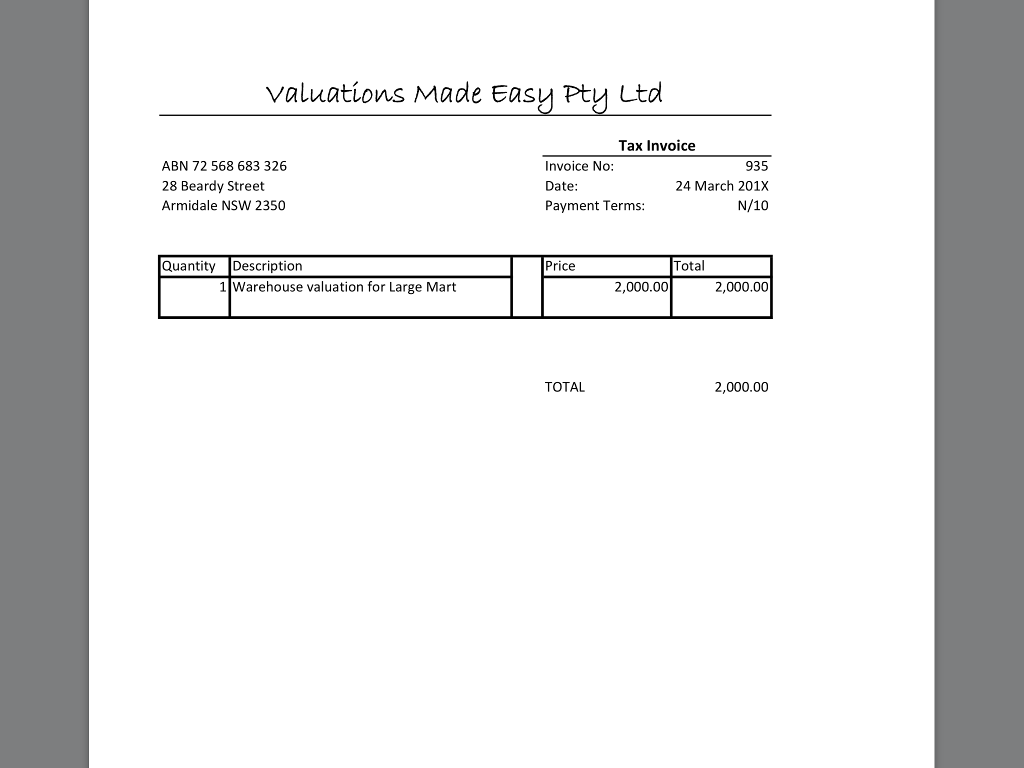

One week before the purchase was completed, Large Mart received a professional valuation for the land, the building, the shelving in the warehouse and the computer system used for the management of the warehouse. The valuation showed that the fair value of the land was equal to $600,000, that the fair value of the building was equal to $500,000, and that the shelving and the computer system had fair values equal to $300,000 and $150,000, respectively.

The company that conducted the valuations has sent invoice for its services (see invoice from Valuations Made Easy Pty Ltd).

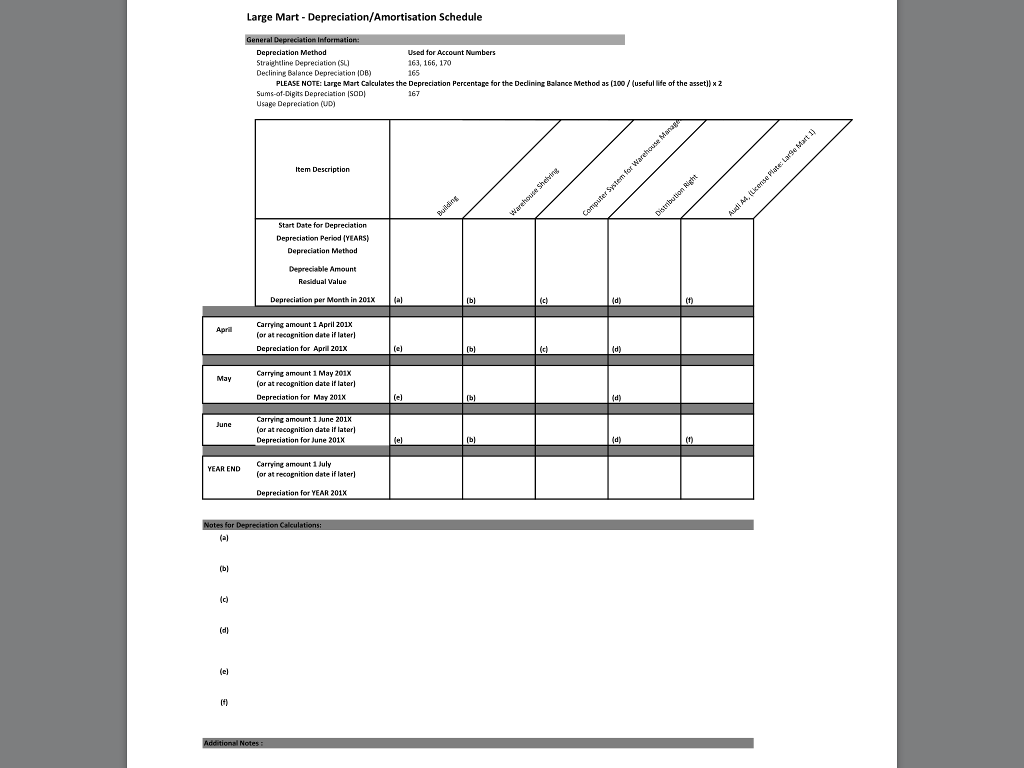

Large Mart estimates that the non-current assets that were purchased in the transaction outlined above have the following useful lives:

o Warehouse: 30 years

o Warehouse Shelving: 15 years

o Computer for Warehouse Management: 3 years

The Warehouse and the Computer System that were purchased in the outlined transaction are not expected to have any residual values at the end of their useful lives. However, the warehouse shelving is expected to have a residual value of $5,000 at the end of its useful life.

Required:

1. Provide all journal entries that are necessary to account for the purchase transaction described above, and remember to include the asset valuations costs in your calculations. When completing the journal entry ensure you account for the purchase (incl. Valuation) of the warehouse.

2. Prepare a depreciation schedule for all depreciable assets that were purchased in the outlined transaction (use the depreciation schedule provided in the supporting documents section to complete this task)

3. Provide all journal entries that are necessary to account for the depreciation of all depreciable assets that were purchased in the outlined transaction for the month ending 30 April 201X.

4. Provide all journal entries that are required to account for the payment of invoices that are associated with this transaction. a. The payment to Valuations Made Easy is made on the 3 April 201X b. The payment to Buy-More Ltd is made on the due date provided on the invoice (Ensure all entries are completed in the general ledger and the general journal).

Buy-More Ltd Tax Invoice ABN 76 753 863 321 1 Taylor Street Armidale NSW 2350 Invoice No: Date: Payment Terms: 6 1 April 201x N/20 Items included in purchase contract Land & Buildings Warehouse Shelving Computer System for Warehouse Management 1,000,000 300,000 150,000 Total Payment 1,450,000.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started