Answered step by step

Verified Expert Solution

Question

1 Approved Answer

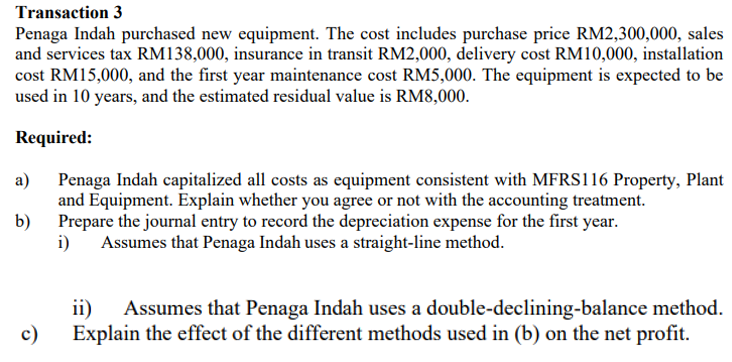

Transaction 3 Penaga Indah purchased new equipment. The cost includes purchase price RM 2 , 3 0 0 , 0 0 0 , sales and

Transaction

Penaga Indah purchased new equipment. The cost includes purchase price RM sales

and services tax RM insurance in transit RM delivery cost RM installation

cost RM and the first year maintenance cost RM The equipment is expected to be

used in years, and the estimated residual value is RM

Required:

a Penaga Indah capitalized all costs as equipment consistent with MFRS Property, Plant

and Equipment. Explain whether you agree or not with the accounting treatment.

b Prepare the journal entry to record the depreciation expense for the first year.

i Assumes that Penaga Indah uses a straightline method.

ii Assumes that Penaga Indah uses a doubledecliningbalance method.

c Explain the effect of the different methods used in b on the net profit.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started