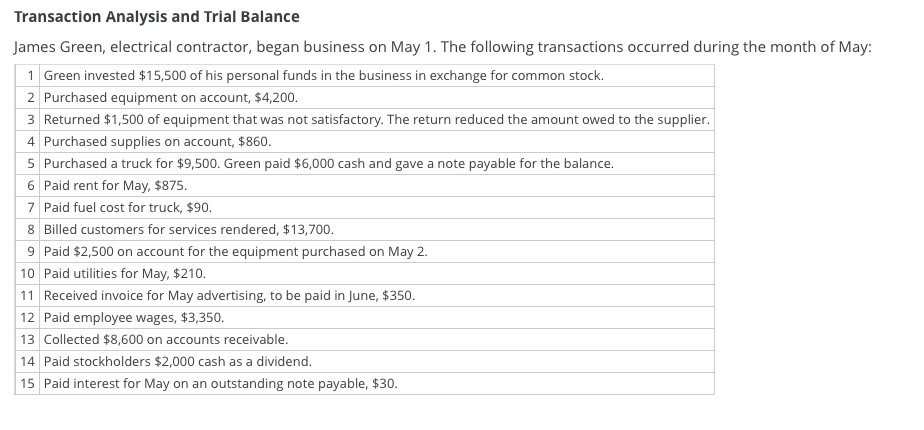

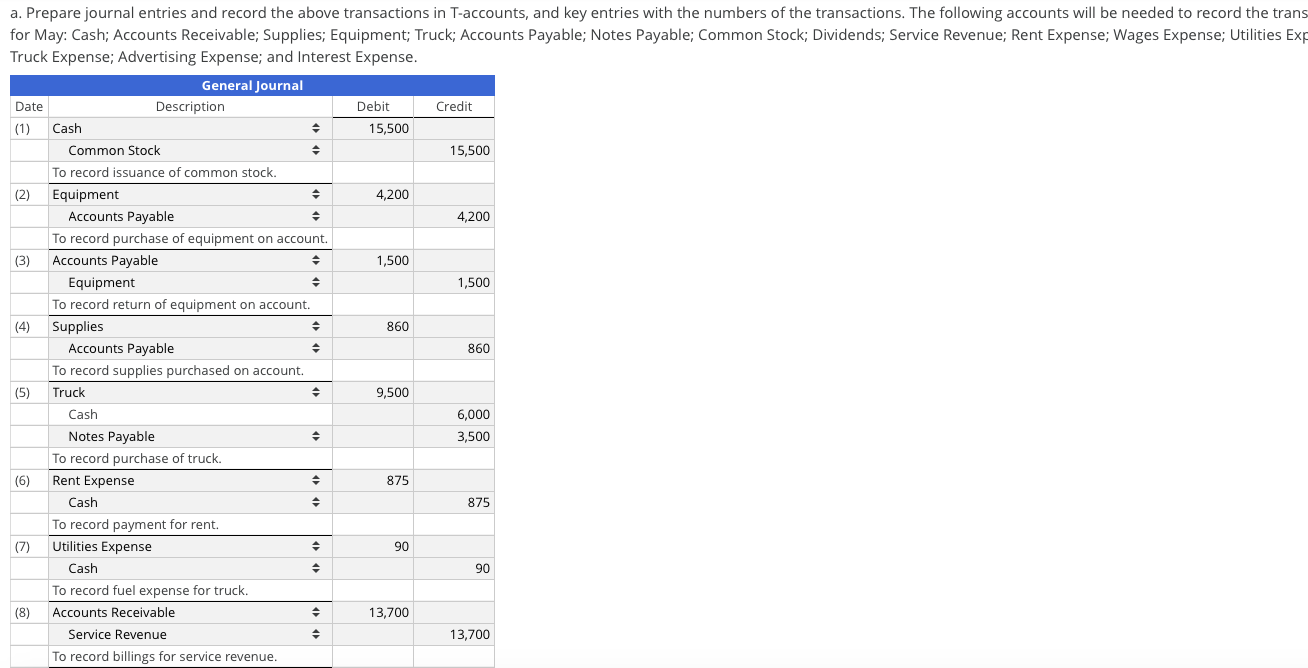

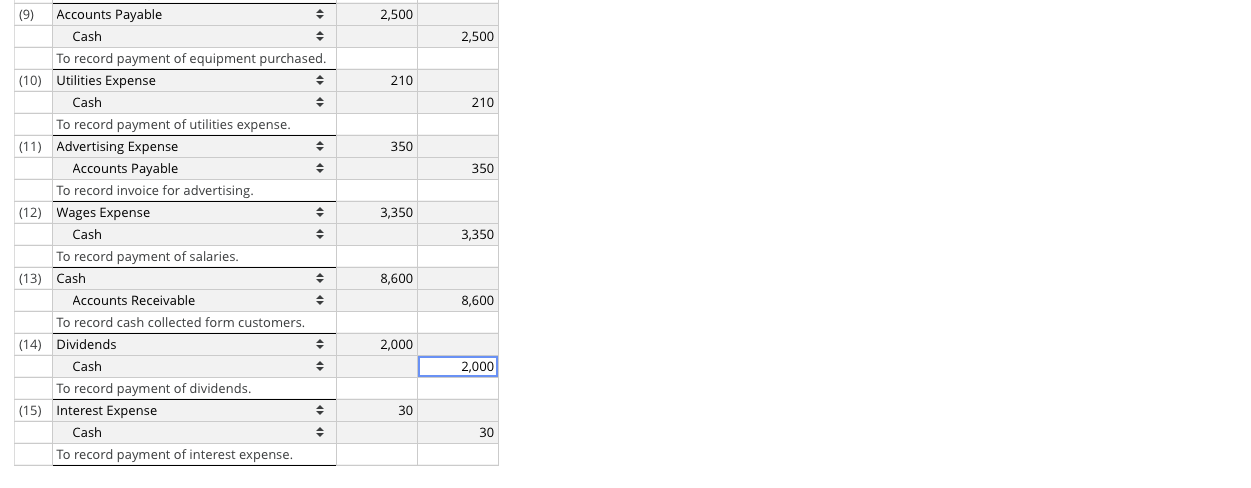

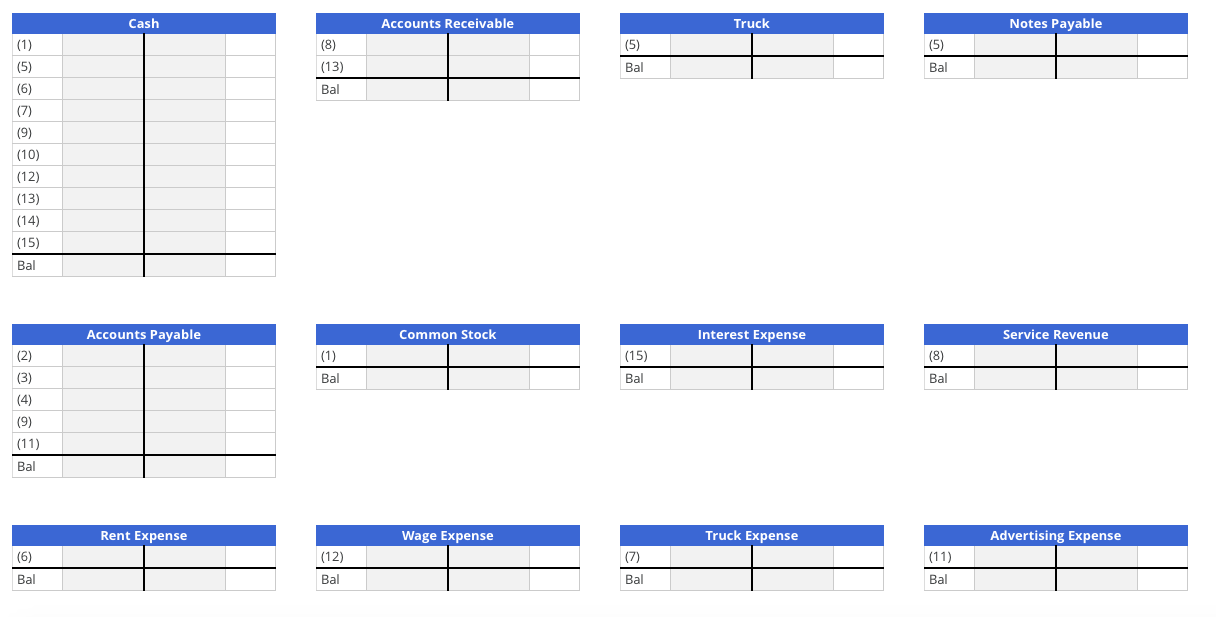

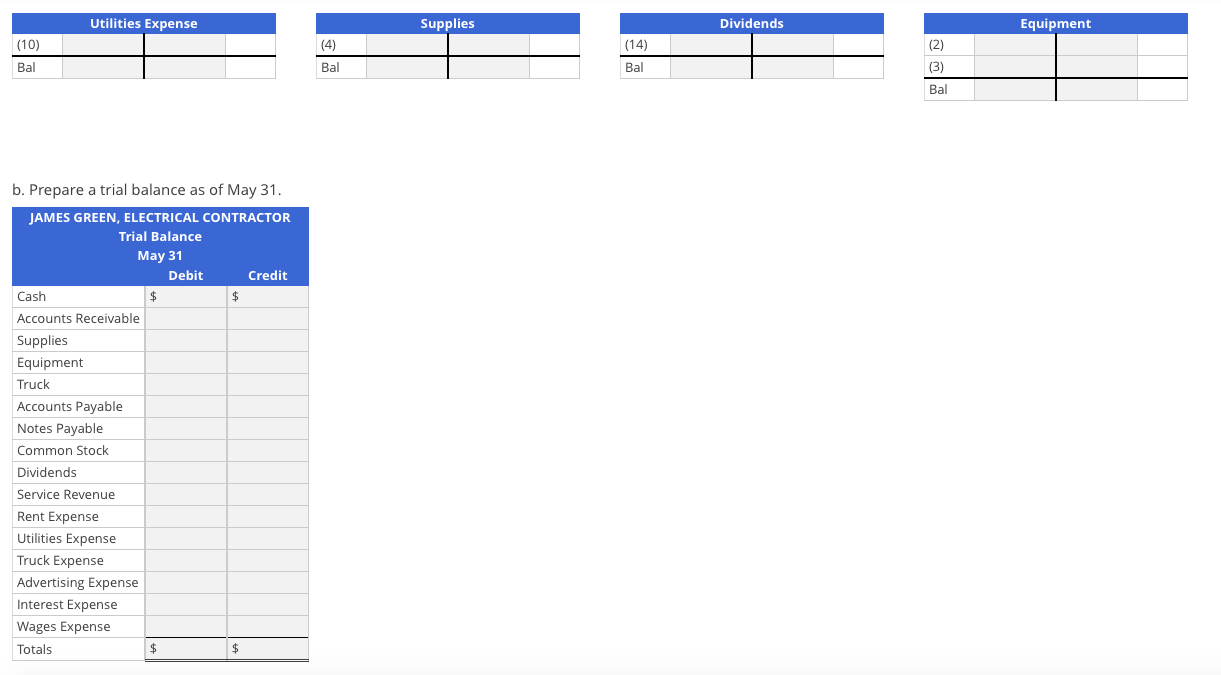

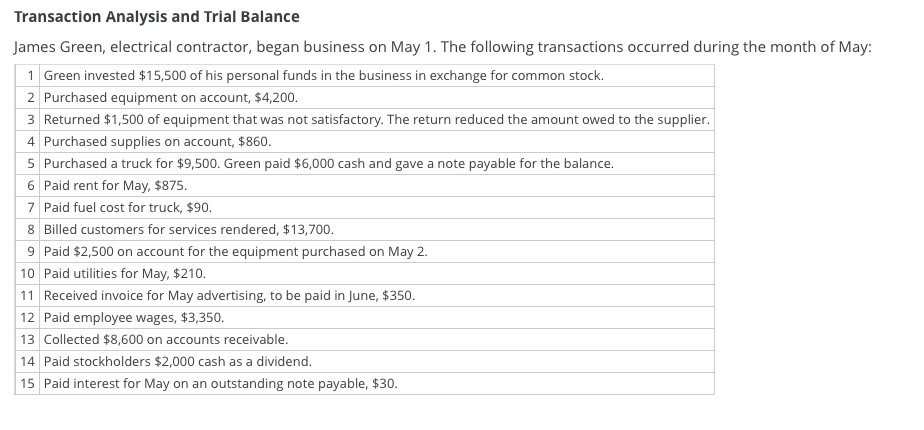

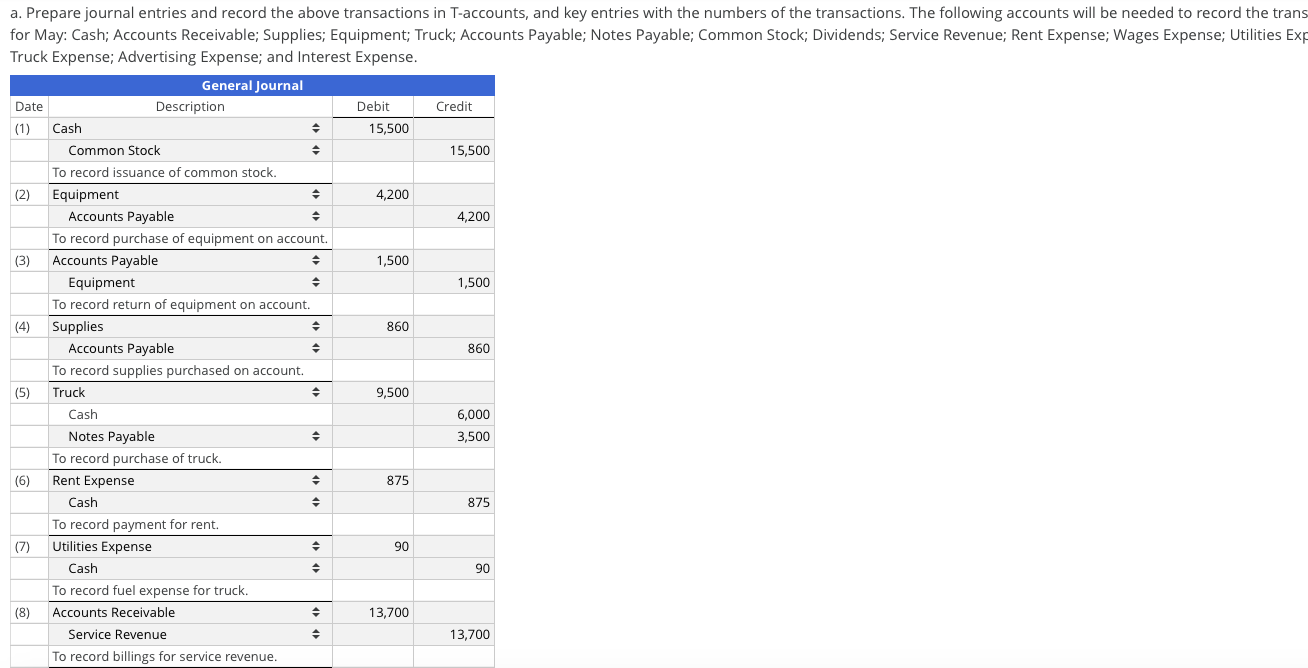

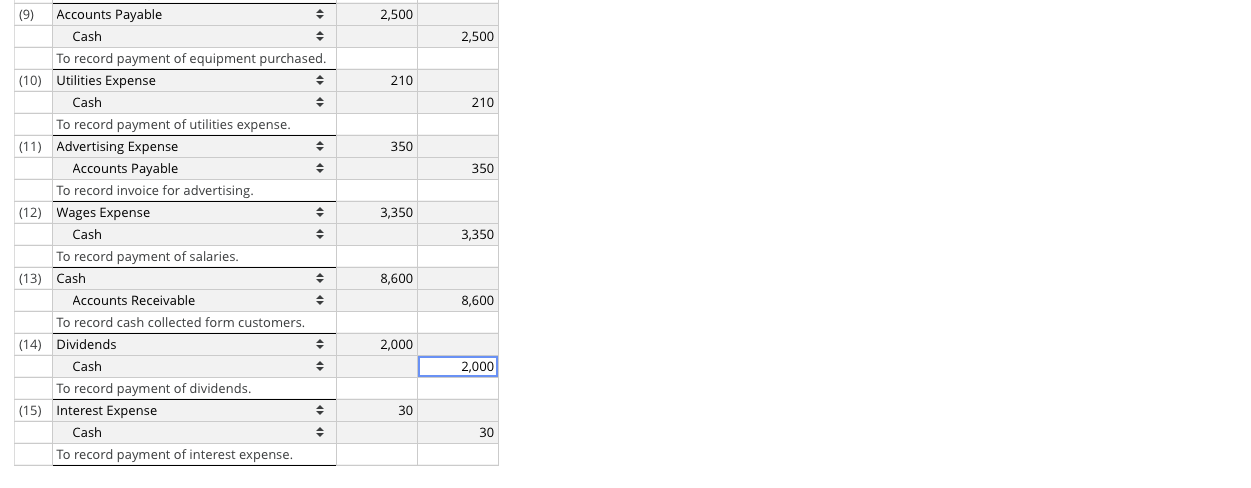

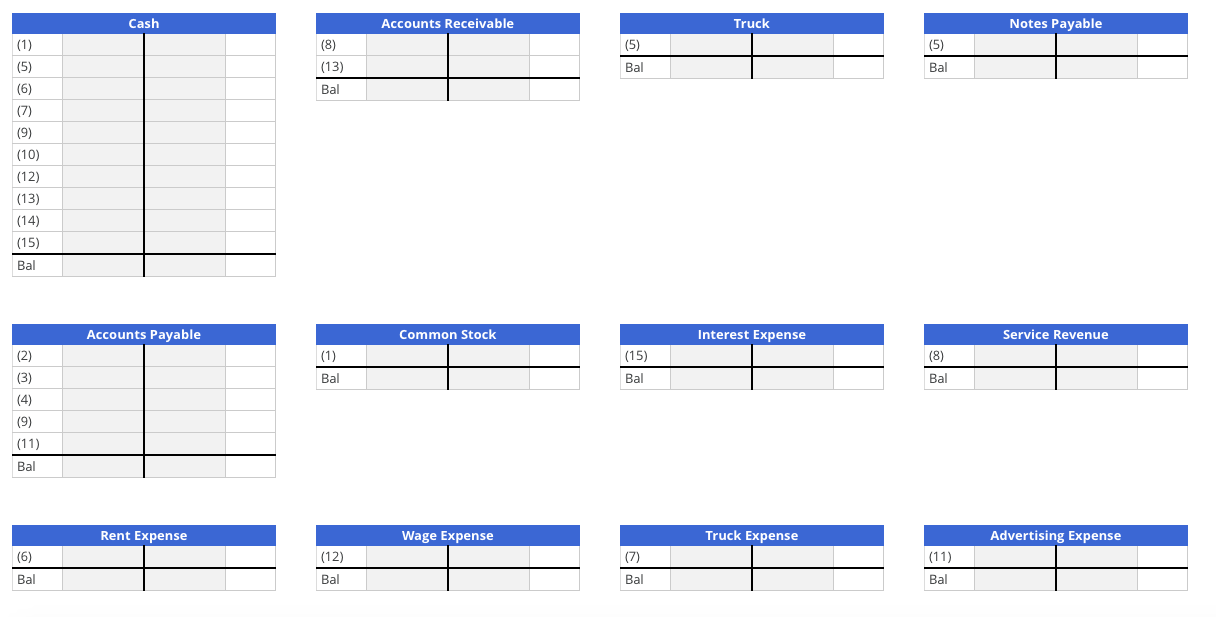

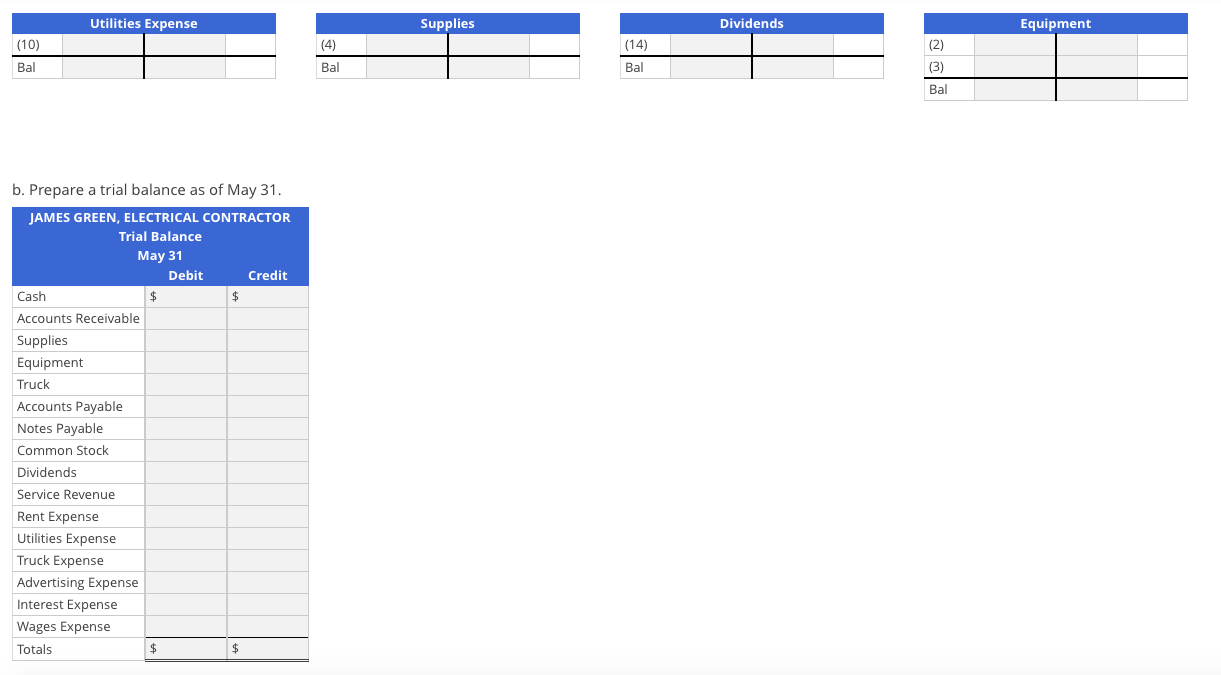

Transaction Analysis and Trial Balance James Green, electrical contractor, began business on May 1. The following transactions occurred during the month of May: 1 Green invested $15,500 of his personal funds in the business in exchange for common stock. 2 Purchased equipment on account, $4,200. 3 Returned $1,500 of equipment that was not satisfactory. The return reduced the amount owed to the supplier. 4 Purchased supplies on account, $860. 5 Purchased a truck for $9,500. Green paid $6,000 cash and gave a note payable for the balance. 6 Paid rent for May, $875. 7 Paid fuel cost for truck, $90. 8 Billed customers for services rendered, $13,700. 9 Paid $2,500 on account for the equipment purchased on May 2. 10 Paid utilities for May, $210. 11 Received invoice for May advertising, to be paid in June, $350. 12 Paid employee wages, $3,350. 13 Collected $8,600 on accounts receivable. 14 Paid stockholders $2,000 cash as a dividend. 15 Paid interest for May on an outstanding note payable, $30. (4) a. Prepare journal entries and record the above transactions in T-accounts, and key entries with the numbers of the transactions. The following accounts will be needed to record the trans for May: Cash; Accounts Receivable; Supplies; Equipment; Truck; Accounts Payable; Notes Payable; Common Stock; Dividends; Service Revenue; Rent Expense; Wages Expense; Utilities Exp Truck Expense; Advertising Expense; and Interest Expense. General Journal Date Description Debit Credit (1) Cash 15,500 Common Stock 15,500 To record issuance of common stock. (2) Equipment 4,200 Accounts Payable 4,200 To record purchase of equipment on account. (3) Accounts Payable 1,500 Equipment 1,500 To record return of equipment on account. 860 Accounts Payable 860 To record supplies purchased on account. (5) Truck 9,500 Cash 6,000 Notes Payable 3,500 To record purchase of truck. (6) Rent Expense 875 Cash 875 To record payment for rent. (7) Utilities Expense Cash To record fuel expense for truck. (8) Accounts Receivable 13,700 Service Revenue 13,700 To record billings for service revenue. Supplies 90 2,500 2,500 210 210 350 350 3,350 (9) Accounts Payable Cash To record payment of equipment purchased. (10) Utilities Expense Cash To record payment of utilities expense. (11) Advertising Expense Accounts Payable To record invoice for advertising. (12) Wages Expense Cash To record payment of salaries. (13) Cash Accounts Receivable To record cash collected form customers. (14) Dividends Cash To record payment of dividends. (15) Interest Expense Cash To record payment of interest expense. 3,350 8,600 8,600 2,000 2,000 30 30 Cash Accounts Receivable Truck Notes Payable (8) (5) (5) Bal Bal (13) Bal (10) (12) (13) (14) (15) Bal Accounts Payable Common Stock Interest Expense Service Revenue (1) Bal (15) Bal (8) Bal (11) Bal Rent Expense Wage Expense Truck Expense Advertising Expense (12) (11) Bal Bal Bal Bal Utilities Expense Supplies Dividends Equipment (10) (14) Bal Ral Bal b. Prepare a trial balance as of May 31. JAMES GREEN, ELECTRICAL CONTRACTOR Trial Balance May 31 Debit Credit Cash Accounts Receivable Supplies Equipment Truck Accounts Payable Notes Payable Common Stock Dividends Service Revenue Rent Expense Utilities Expense Truck Expense Advertising Expense Interest Expense Wages Expense Totals