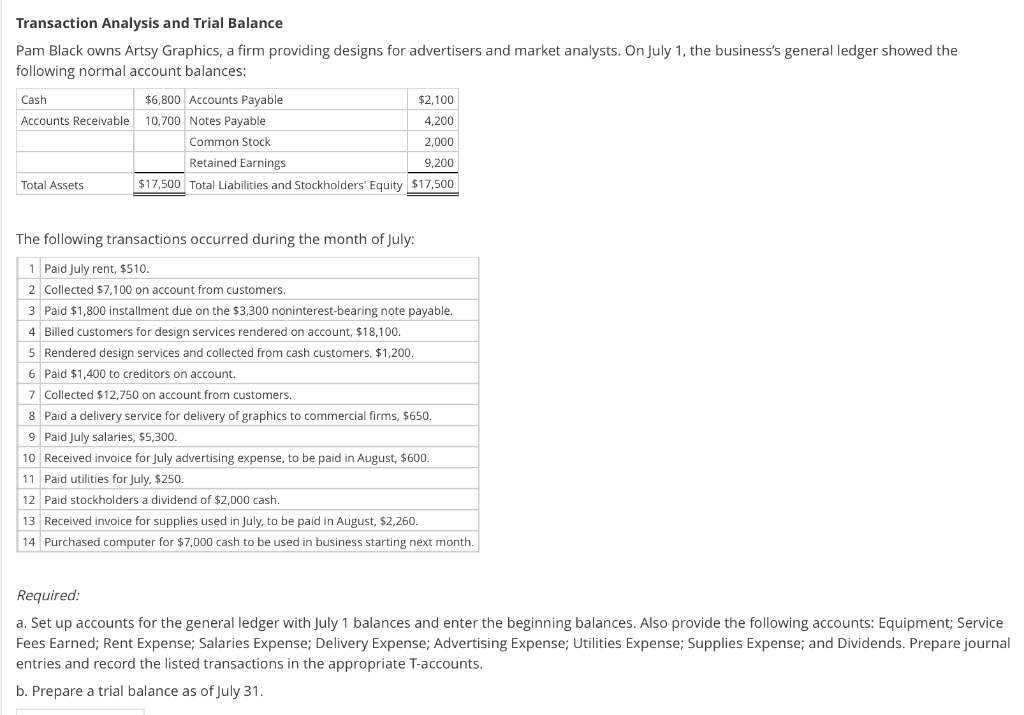

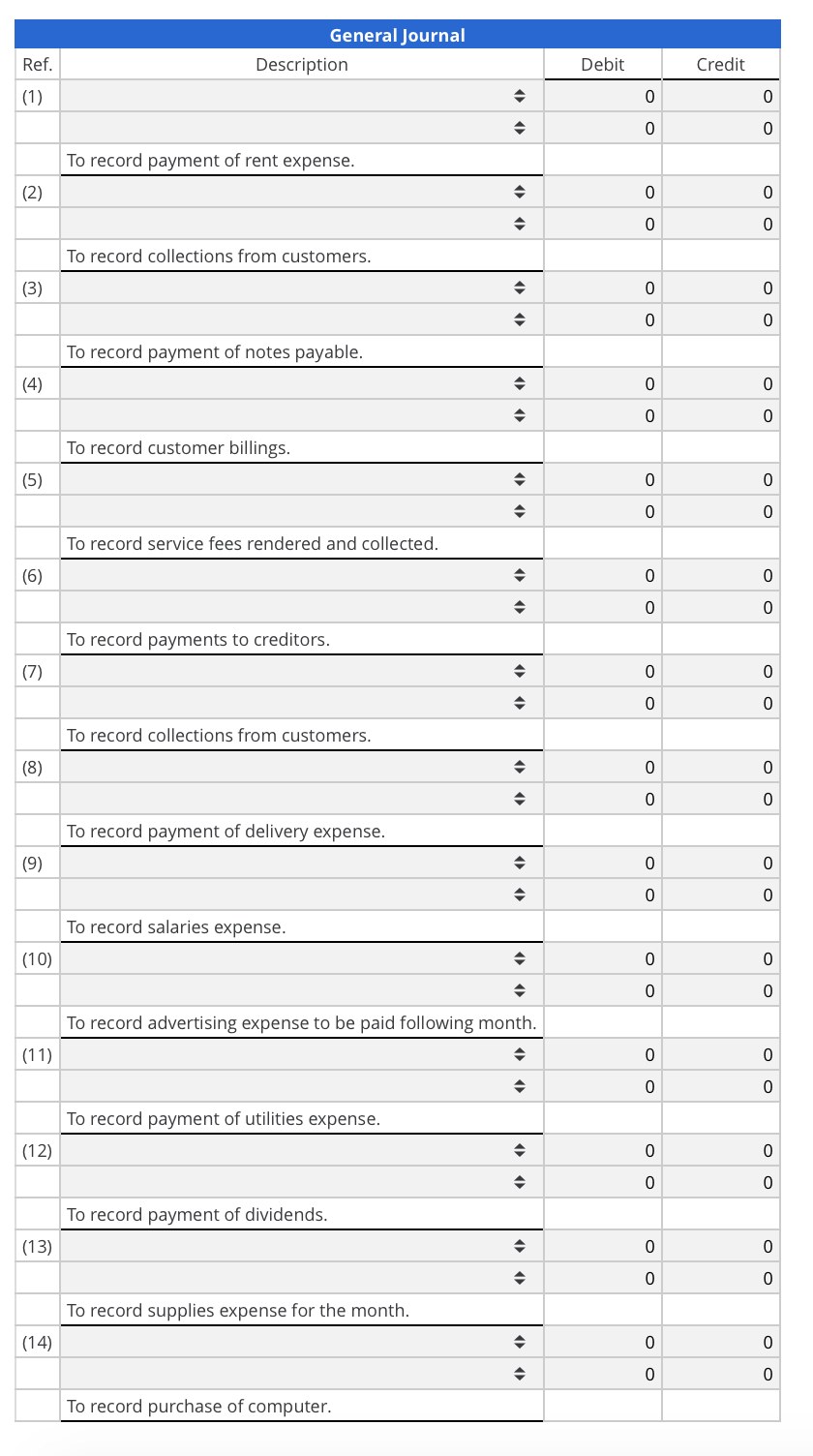

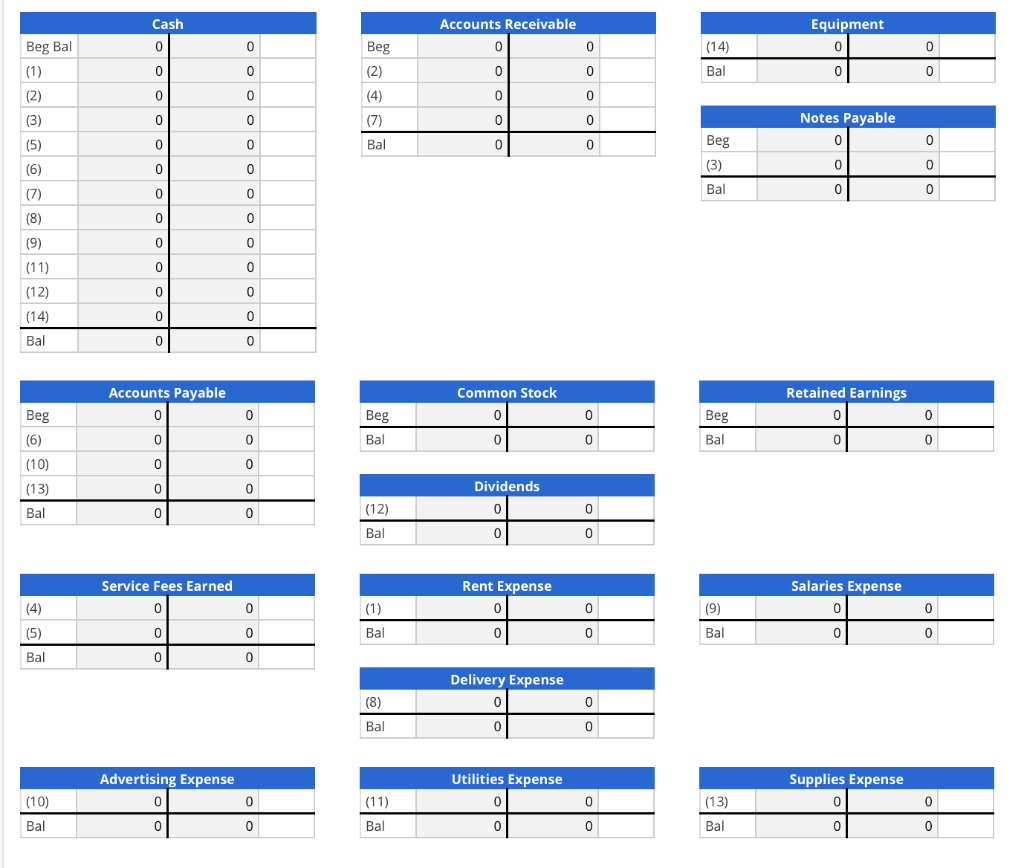

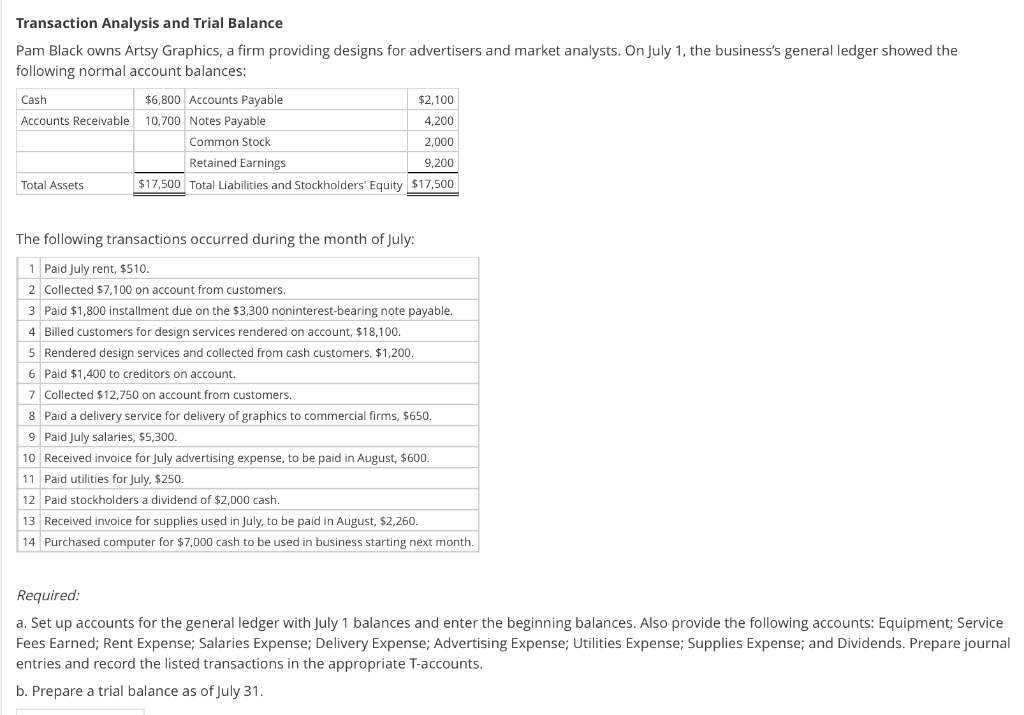

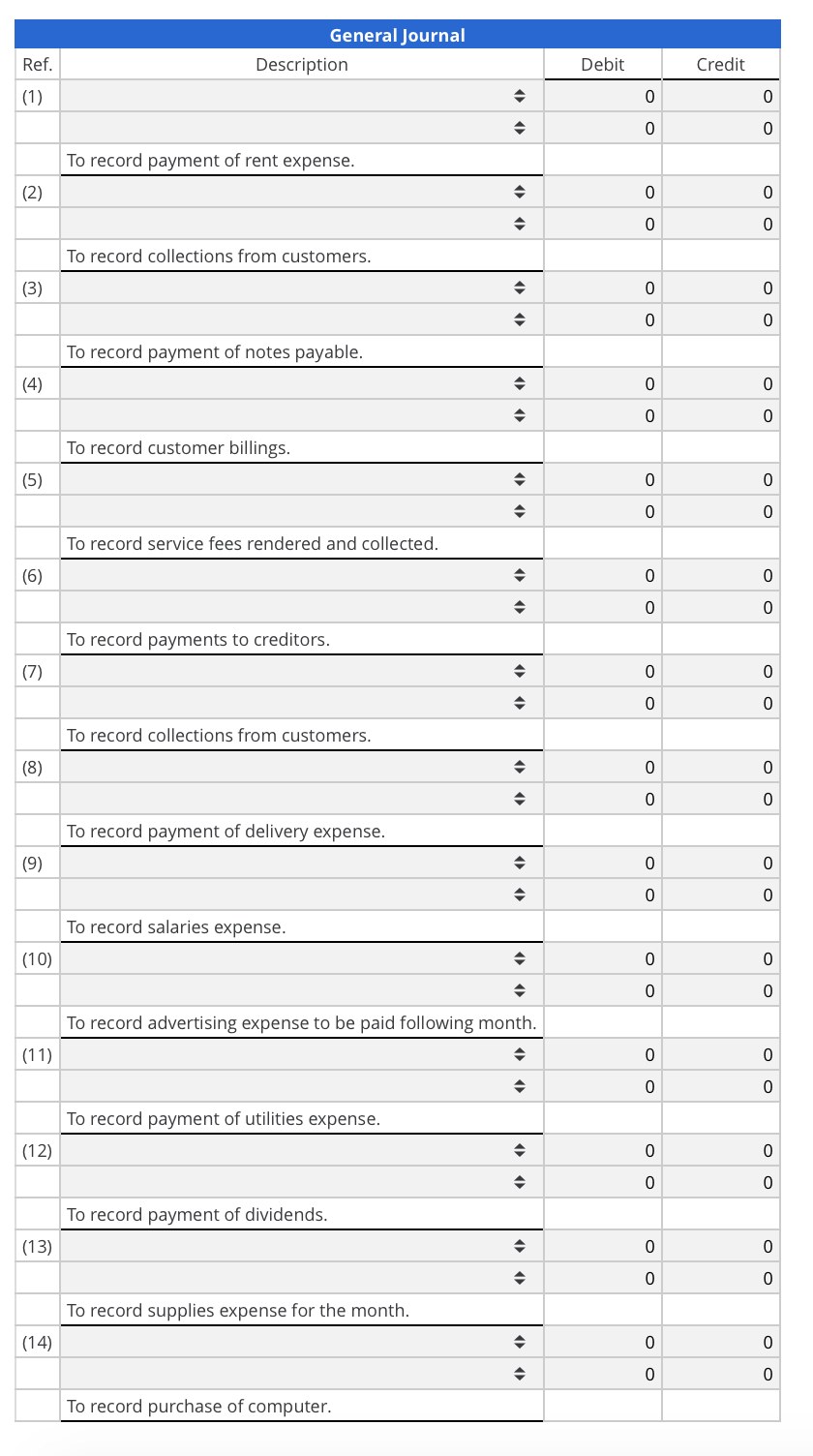

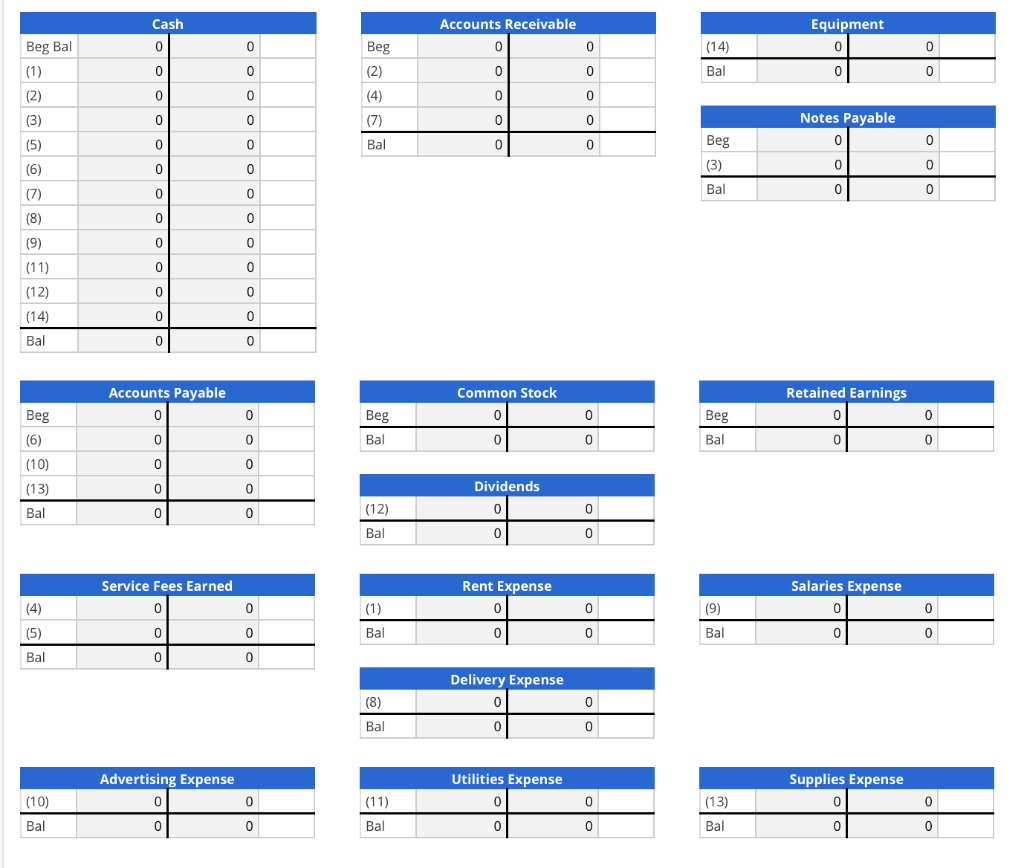

Transaction Analysis and Trial Balance Pam Black owns Artsy Graphics, a firm providing designs for advertisers and market analysts. On July 1, the business's general ledger showed the following normal account balances: Cash $6,800 Accounts Payable $2,100 Accounts Receivable 10,700 Notes Payable 4,200 Common Stock 2,000 Retained Earnings 9,200 Total Assets $17,500 Total Liabilities and Stockholders' Equity $17,500 The following transactions occurred during the month of July: 1 Paid July rent, $510. 2 Collected $7,100 on account from customers. 3 Paid $1,800 installment due on the $3,300 noninterest-bearing note payable. 4 Billed customers for design services rendered on account, $18,100. 5 Rendered design services and collected from cash customers, $1,200. 6 Paid $1,400 to creditors on account. 7 Collected $12,750 on account from customers. 8 Paid a delivery service for delivery of graphics to commercial firms, $650. 9 Paid July salaries, $5,300. 10 Received invoice for July advertising expense, to be paid in August, $600. 11 Paid utilities for July, $250. 12 Paid stockholders a dividend of $2,000 cash. 13 Received invoice for supplies used in July, to be paid in August, $2,260. 14 Purchased computer for $7,000 cash to be used in business starting next month. Required: a. Set up accounts for the general ledger with July 1 balances and enter the beginning balances. Also provide the following accounts: Equipment; Service Fees Earned; Rent Expense; Salaries Expense; Delivery Expense; Advertising Expense; Utilities Expense; Supplies Expense; and Dividends. Prepare journal entries and record the listed transactions in the appropriate T-accounts. b. Prepare a trial balance as of July 31. General Journal Description Ref. Debit Credit (1) 0 0 0 0 To record payment of rent expense. (2) 0 0 0 0 To record collections from customers. (3) o o To record payment of notes payable. (4) 0 0 0 0 To record customer billings. (5) 0 0 0 0 To record service fees rendered and collected. (6) 0 o o 0 To record payments to creditors. (7) o o o o To record collections from customers. (8) 0 o o 0 To record payment of delivery expense. (9) 0 0 0 0 To record salaries expense. (10) 0 o o 0 To record advertising expense to be paid following month. (11) o o To record payment of utilities expense. (12) 0 0 0 0 To record payment of dividends. (13) 0 0 0 0 To record supplies expense for the month. (14) 0 0 0 0 To record purchase of computer. Cash Accounts Receivable 0 Equipment 0 Beg Bal 0 0 Beg 0 (14) 0 0 0 0 0 Bal 0 0 0 0 0 0 (2) (4) (7) Bal 0 0 0 0 (1) (2) (3) (5) (6) (7) (8) Notes Payable 0 0 0 0 0 0 Beg 0 0 (3) 0 0 Bal 0 0 0 0 0 0 (9) 0 0 0 0 0 0 (11) (12) (14) Bal 0 0 0 0 0 Accounts Payable 0 Common Stock 0 Retained Earnings 0 0 0 0 Beg (6) (10) Beg Bal Beg Bal 0 0 0 0 0 0 0 0 0 (13) Ball Dividends 0 0 0 0 (12) Bal 0 0 Service Fees Earned 0 Rent Expense 0 Salaries Expense 0 (4) 0 0 0 (1) Bal (9) Bal (5) 0 0 0 0 0 0 Bal 0 0 Delivery Expense 0 0 (8) Bal 0 0 Utilities Expense Advertising Expense 0 Supplies Expense 0 (10) 0 (11) 0 0 (13) 0 Bal 0 0 Bal 0 0 Bal 0 0