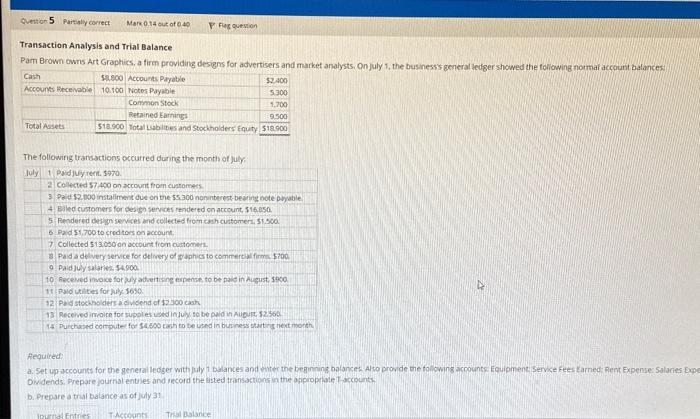

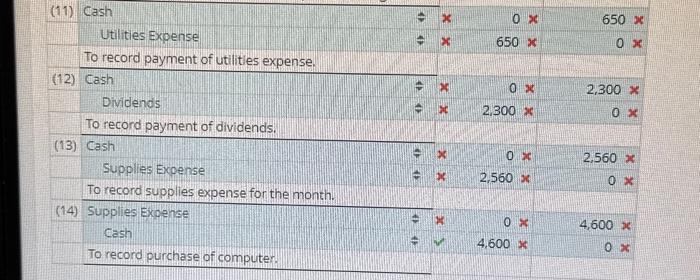

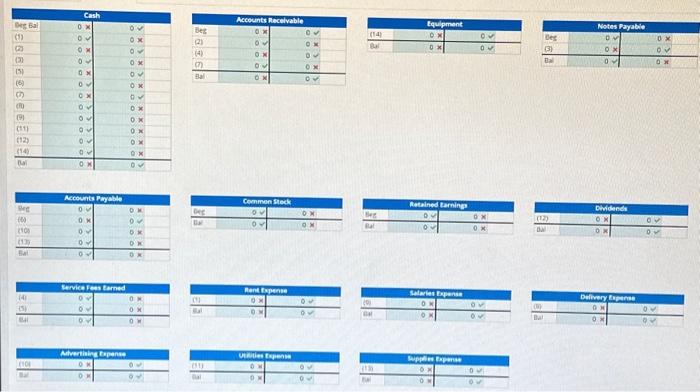

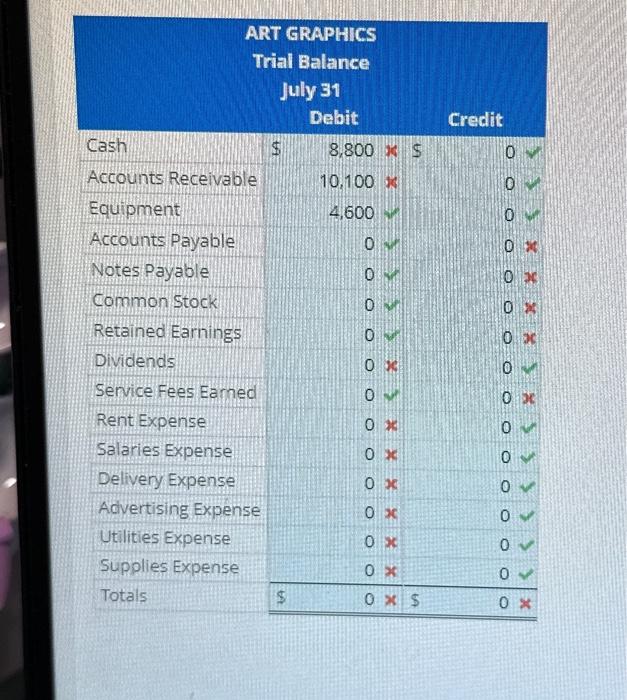

Transaction Analysis and Trial Balance Pam Brown owns Art Graphics, a firm providing designs for advertisers and market analysts, On july 1, the business's general fedger showed the foliowing normai account balances: Requited: b. Prepare a trisl balance as of july 3 ! Course content / Introduction / BEFORE CLASS HW 2 due 4 th oct 2023 11:59pm \begin{tabular}{|c|c|c|c|c|c|c|} \hline Ref. & Description & & & Debit & & credit \\ \hline \multirow[t]{3}{*}{ (1) } & Rent Expense & = & & 0 & & 970credit \\ \hline & Cash & = & & 970 & & 0x \\ \hline & To record payment of rent expense. & & & & & \\ \hline \multirow[t]{3}{*}{ (2) } & Service Fees Eamed & = & x & 0 & & 7,400 \\ \hline & Accounts Receivable & & & 7.400 & & 0 \\ \hline & To record collections from customers. & & & . & & \\ \hline \multirow[t]{3}{*}{ (3) } & Notes Payable & & & 0x & & 2.800 \\ \hline & Cash & = & & 2.800 & & 0x \\ \hline & To record payment of notes payable. & & & & & \\ \hline \multirow[t]{3}{*}{ (4) } & Retained Earnings & = & x & 0 & x & 16,850 \\ \hline & Accounts Recetvable & & x & 16.850 & x & 0 \\ \hline & To record customer billings, & & - & & & x= \\ \hline \multirow[t]{3}{*}{ (5) } & Service Fees Earned & & x & 0 & x & 1.500 \\ \hline & Cash & & x & 1.500 & & 0x \\ \hline & To record service fees rendered and col & & & + & & \\ \hline \multirow[t]{3}{*}{ (6) } & Salanes Expense & & x & 0 & & 1.700 \\ \hline & Accounts Payable & & x & 1.700 & x & 0x \\ \hline & To record payments to creditors. & & & & & \\ \hline \multirow[t]{3}{*}{ (7) } & Retained Earnings: & = & x & 0x & x & 13.050 \\ \hline & Accounts Rece vabis & = & & 13.050 & x & 0 \\ \hline & To record collections from customers. & & & & & \\ \hline \multirow[t]{3}{*}{ (8) } & Advertising Expense & & x & 0x & x & 700 \\ \hline & Cash & = & & 700 & & 0 \\ \hline & To record payment of delivery expense. & & & & & \\ \hline \multirow[t]{3}{*}{ (9) } & Cash & & x & & x & 4,900 \\ \hline & Salanes Expense & = & x & 4,900 & x & 0x \\ \hline & To record salanes expense. & & - & & & \\ \hline \multirow[t]{3}{*}{ (10) } & Advertising Expense & & & 0 & & 900 \\ \hline & Cash & = & x & 900 & x & 0 \\ \hline & To record advertising expense to be pa & onth. & & & & \\ \hline \multirow[t]{3}{*}{ (11) } & cosh & = & x & & x & 650 \\ \hline & Uelities Expense & & x & 650 & & 0 \\ \hline & To record payment of ut lities expense. & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline & RTrit & RAPHICSBalancely31Debit & & & Credit \\ \hline Cash & $ & 8,800 & x & $ & 0 \\ \hline Accounts Receivable & & 10,100 & x & & 0x \\ \hline Equipment: & & 4,600 & & & 04 \\ \hline Accounts Payable & & & r & & 0x \\ \hline Notes Payable & & & & & 0x \\ \hline Common Stock & & 0 & vi & & 0 \\ \hline Retained Earnings & & 0 & r & & 0x \\ \hline Dividends & & & x & & 0x \\ \hline Service Fees Earned & & & & & 0x \\ \hline Rent Expense & & & x & & 0r \\ \hline Salaries Expense & & 0 & x & & 0 \\ \hline Delivery Expense & & 0 & x & & 0 \\ \hline Advertising Expense & & 0 & x & & 0 \\ \hline Utilities Expense & & & x & & 0 \\ \hline Supplies Expense & & 0 & x & & 0 \\ \hline Totals & $ & 0 & x & $ & 0x \\ \hline \end{tabular} (11) Cash Utilities Expense To record payment of utilities expense. (12) Cash Dividends =650x0x To record payment of dividends. (13) Supplies Expense To record supplies expense for the month. (14) Supplies Expense Cash =x0x 2,300 =x2,300x 0 To record purchase of computer. x 0 =x2,560x 2,560x 0 =x 4,600x 0