Answered step by step

Verified Expert Solution

Question

1 Approved Answer

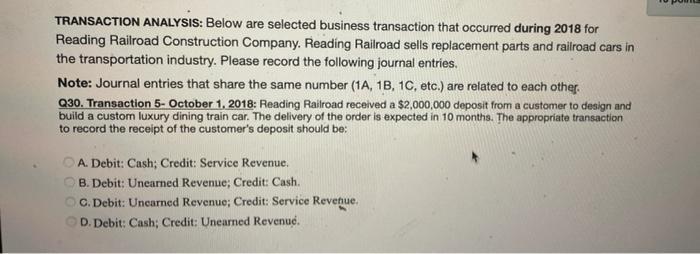

TRANSACTION ANALYSIS: Below are selected business transaction that occurred during 2018 for Reading Railroad Construction Company. Reading Railroad sells replacement parts and railroad cars

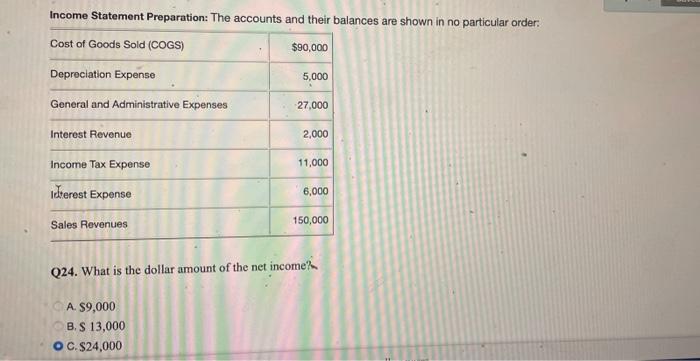

TRANSACTION ANALYSIS: Below are selected business transaction that occurred during 2018 for Reading Railroad Construction Company. Reading Railroad sells replacement parts and railroad cars in the transportation industry. Please record the following journal entries. Note: Journal entries that share the same number (1A, 1B, 1C, etc.) are related to each other. Q30. Transaction 5- October 1, 2018: Reading Railroad received a $2,000,000 deposit from a customer to design and build a custom luxury dining train car. The delivery of the order is expected in 10 months. The appropriate transaction to record the receipt of the customer's deposit should be: A. Debit: Cash; Credit: Service Revenue. B. Debit: Unearned Revenue; Credit: Cash. O C. Debit: Unearned Revenue; Credit: Service Revenue. D. Debit: Cash; Credit: Unearmed Revenu. Income Statement Preparation: The accounts and their balances are shown in no particular order: Cost of Goods Sold (COGS) $90,000 Depreciation Expense 5,000 General and Administrative Expenses 27,000 Interest Revenue 2,000 Income Tax Expense 11,000 Idrerest Expense 6,000 150,000 Sales Revenues Q24. What is the dollar amount of the net income A. $9,000 B.S 13,000 OC.$24,000

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Q 30 AnswerD Debit Cash Credit Uneraned Revenue Explanation Advance received for the services which ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started