Question

Transaction Analysis Mavtech: A Comprehensive Example Rachel started Mavtech Inc, a computer retail business on September 1, 2015. What follows is description of significant events

Transaction Analysis

Mavtech: A Comprehensive Example

Rachel started Mavtech Inc, a computer retail business on September 1, 2015. What follows is description of significant events that affected Mavtech Inc during September 2015.

On September 1, Mavtech issued 6000 shares at par to Rachel for cash. The par value of each share is $10.

On September 1, Mavtech borrowed $72,000 from a bank. The interest rate on the loan is 10% per annum. Interest is payable every year, the first interest payment being due for payment on September 1, 2016. The principal amount that was borrowed is due in one single repayment on September 1, 2019.

On September 1, Mavtech paid $6,000 toward rent on the store for the rest of 2015. The rent includes all utilities.

On September 1, Mavtech acquired furniture and fixtures for $14,000 and made a down payment of $3,000. The remaining payment will be made in October. The furniture and fixtures have an estimated useful life of 5 years, at the end of which they are expected to be sold for $2,000.

On September 1, Mavtech acquired 4 cash registers for $6,000 in cash.This equipment has a useful life of 3 years after which they are expected to be sold for $600.

On September 9, Mavtech paid $30,000 in advance to suppliers to buy 30 computers.

On September 10, Mavtech paid $450 and bought office supplies inventory.

The computers that were paid for on September 9th were delivered to Mavtech on September 14.

On September 17, a customer placed an order on Mavtech for 25 computers for a total price of $31,000.

On September 21, Mavtech hired an employee. The employee's wage was fixed at $2,400 per month. The employee will be paid every month on the 21st. The first payment will be made on October 21.

On September 22, Mavtech purchased an additional 40 computers for $40,000 on credit, due for payment on October 12.

Computers pertaining to the order placed on September 17, were delivered to the customer on September 27. The customer agreed to pay in five days.

On September 28, Mavtech purchased office supplies inventory for $350 by paying cash.

On September 29, Mavtech sold 15 computers at a total price of $20,700 for cash.

Miscellaneous expenses of $650 were incurred during September. These expenses were paid in cash.

On September 29th, Mavtech received $5,400 as payment in advance from a customer for 3 computers to be delivered on October 4.

On September 30, Rachel took $500 from Mavtech as dividends in cash.

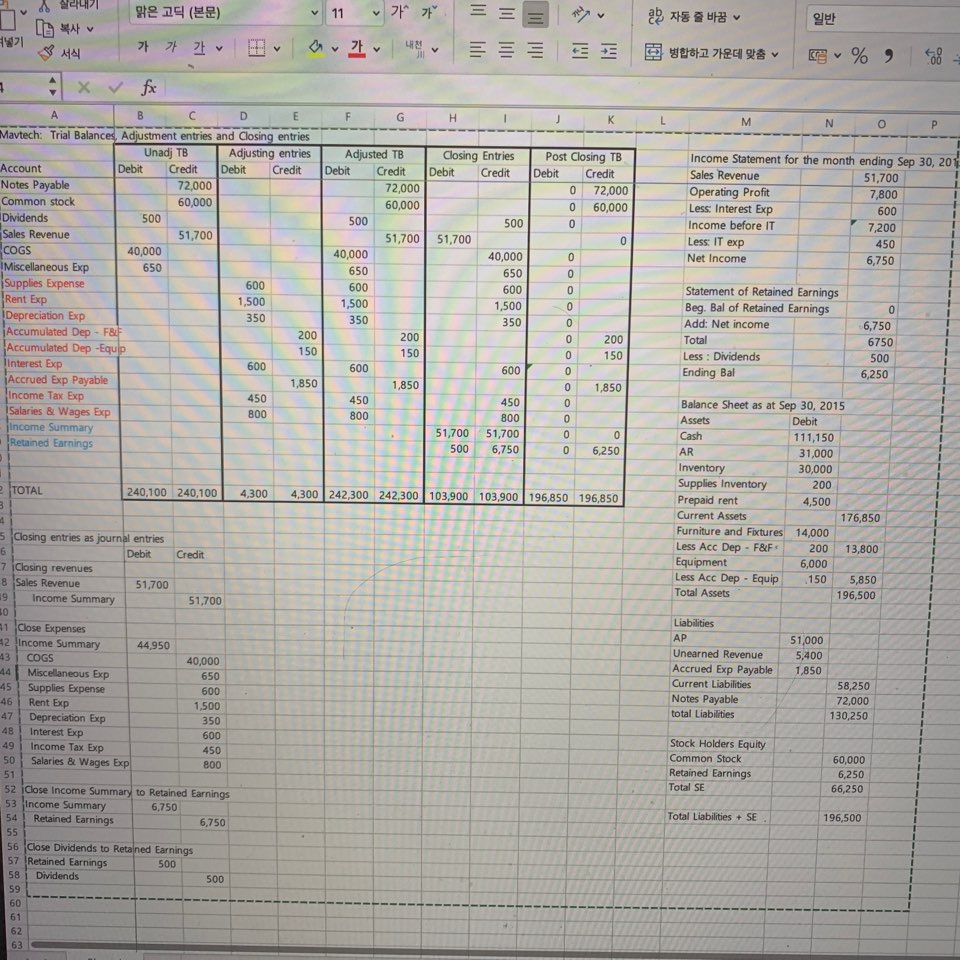

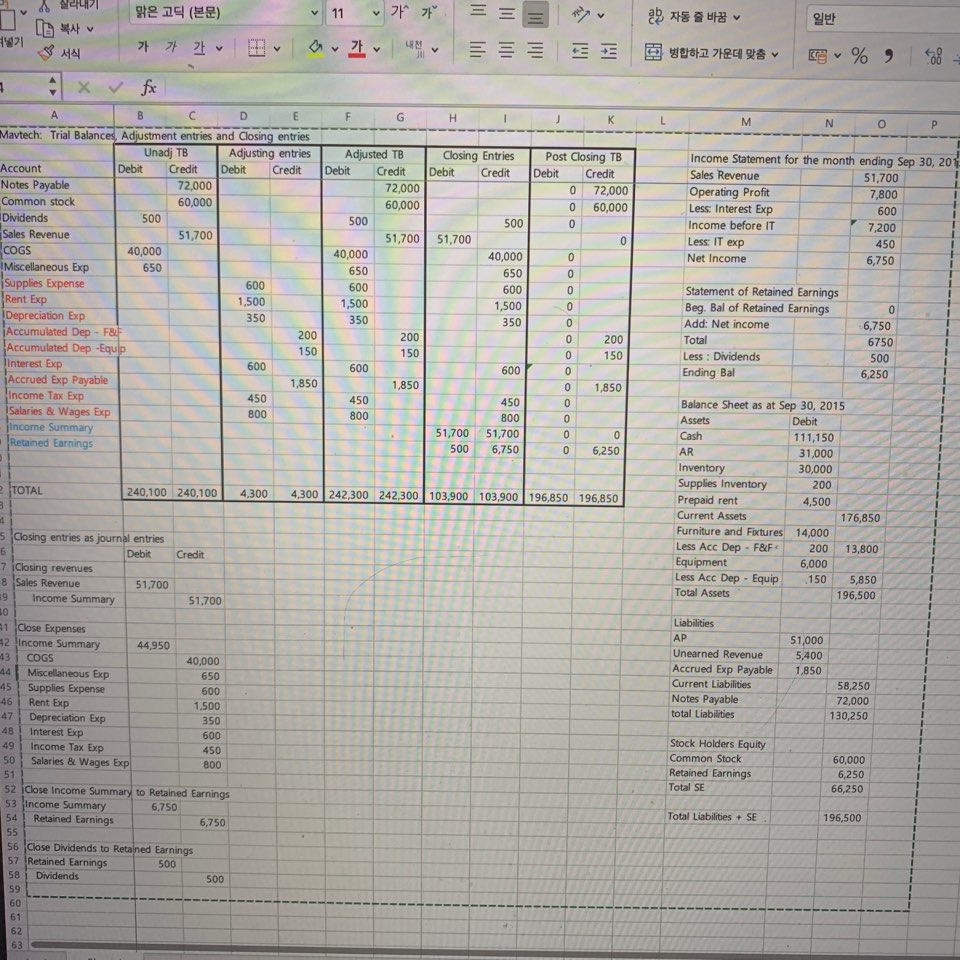

Required:

Prepare journal entries for all transactions listed above.

Post those entries to t-accounts and Need an unadjusted trial balance.

Prepare journal entries for any adjusting entries required.When doing so, consider the following additional information:

At the end of the day on September 30, Rachel counted the office supplies inventory and found that $200 worth of inventory was on hand.

Rachel figured that the income tax on the profits Mavtech Inc made during September would be $450. The tax will be paid to the IRS only in December 2015

Need an adjusted trial balance

Prepare the financial statements for the month.

Prepare closing journal entries and a post-closing trial balance.

Mavtech: October 2015 Transactions

The transactions below pertain to Mavtech's second month (October) of operations.

Paid $11,000 to the supplier to complete payment on the furniture and fixtures bought on September 1, 2015 (refer to transaction 4 of September).

Delivered the 3 computers to the customer for which advance payment of $5,400 was received in September.The full invoice value of the sale was received in advance.

Paid $40,000 to the supplier to complete payment of the 40 computers that were bought on September 22, 2015 (refer to transaction 11 of September).

The customer who owed $31,000 (refer to transaction 12 of September) paid the amount to Mavtech.

Purchased and received office supplies for $1,200 by paying cash in October.

Purchased 60 computers in October for $1,000 each, and paid $25,000 cash to the supplier, with the remaining amount to be paid in November.

Sold 50 computers in October for $1,400 each, received $20,000 cash, with the remaining amount to be collected in November.

Paid $2,400 to the employee on October 21st towards wages for the period September 21 to October 20th.

Rachel took $600 as dividends in cash from Mavtech.

On October 31st, Rachel realized that most of her business was commercial.She did not need as many cash registers.So, she sold three of the four cash registers for $4,000 cash.

Required:

Prepare journal entries for all transactions listed above.

Post those entries to t-accounts and need an unadjusted trial balance.

Prepare journal entries for any adjusting entries required.When doing so, consider the following additional information:

At the end of the day on October 31st, Rachel counted the office supplies inventory and found that $500 worth of inventory was on hand.

Rachel figured that the income tax on the profits Mavtech Inc made during October would be $500. The tax will be paid to the IRS only in December 2015

need an adjusted trial balance

Prepare the financial statements for the month.

Prepare closing journal entries and a post-closing trial balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started