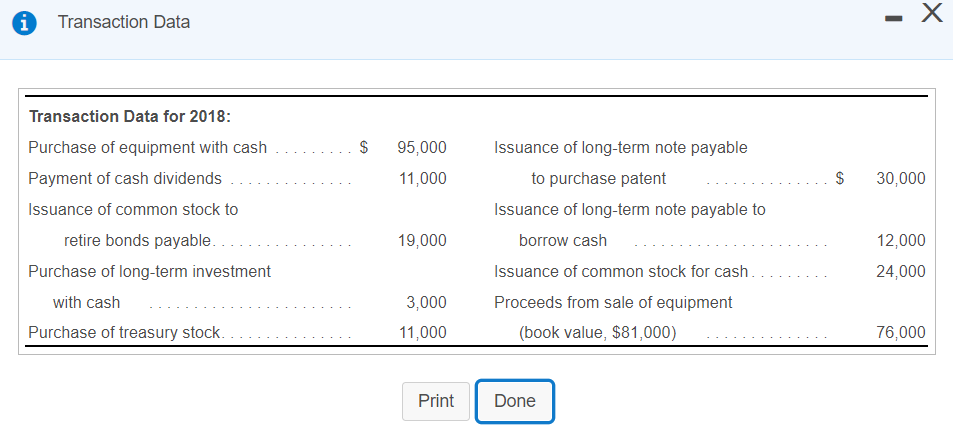

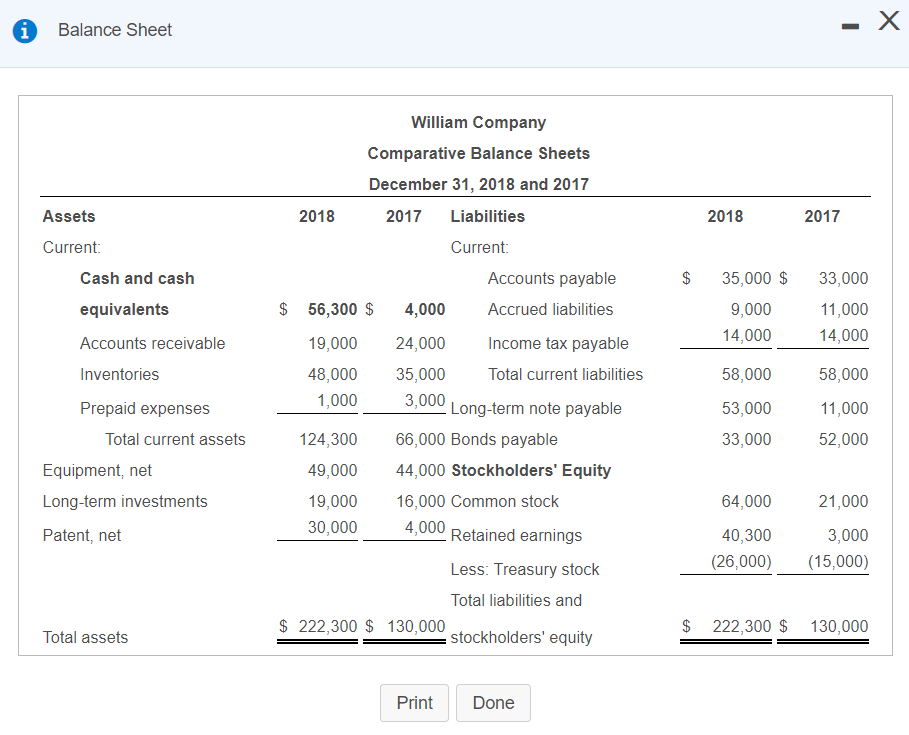

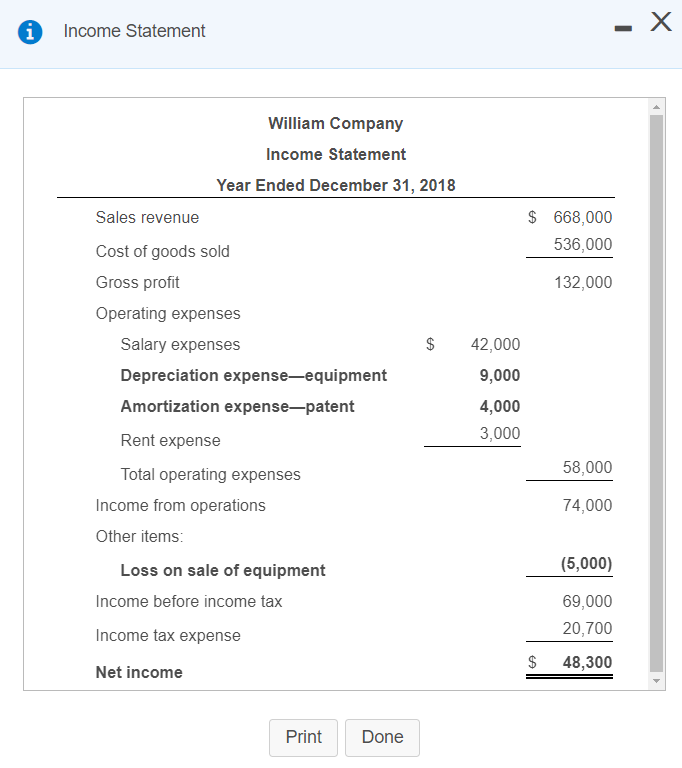

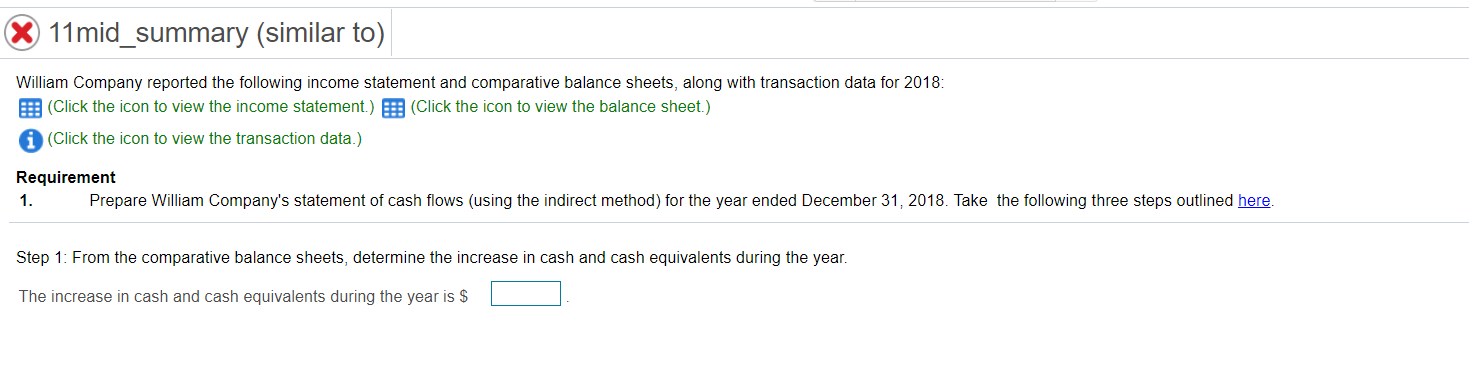

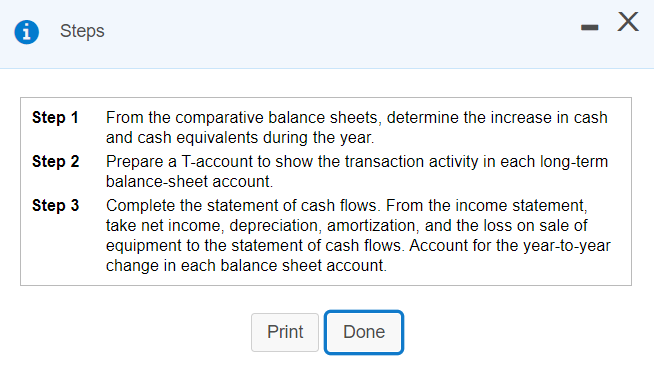

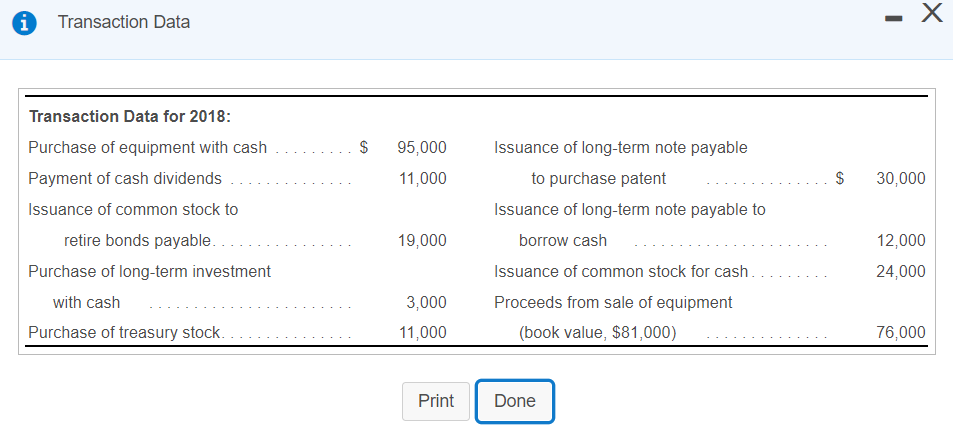

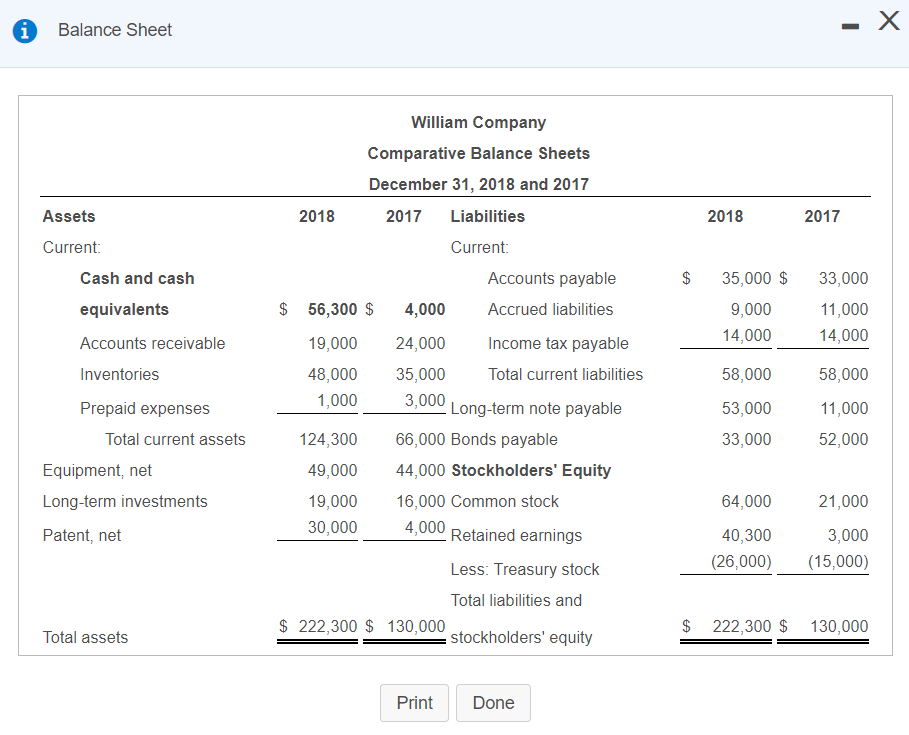

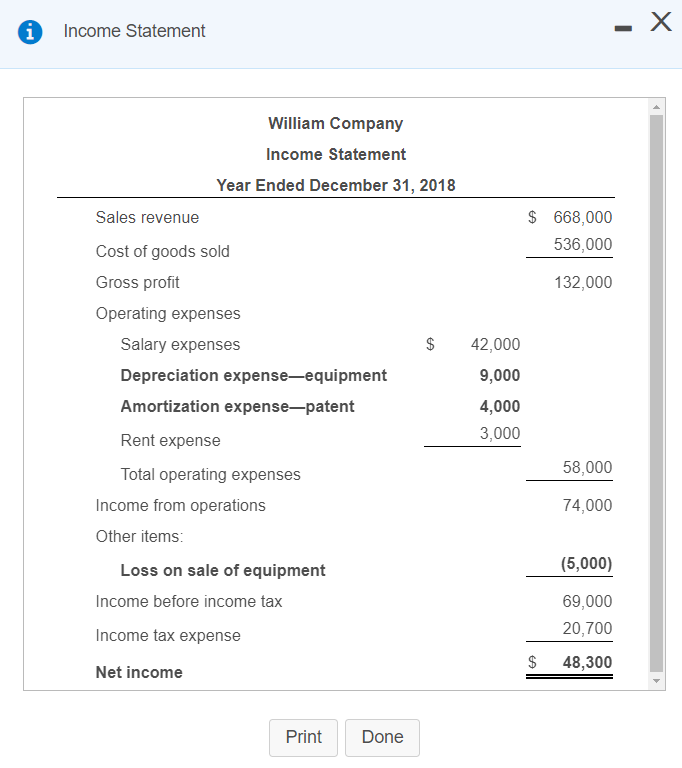

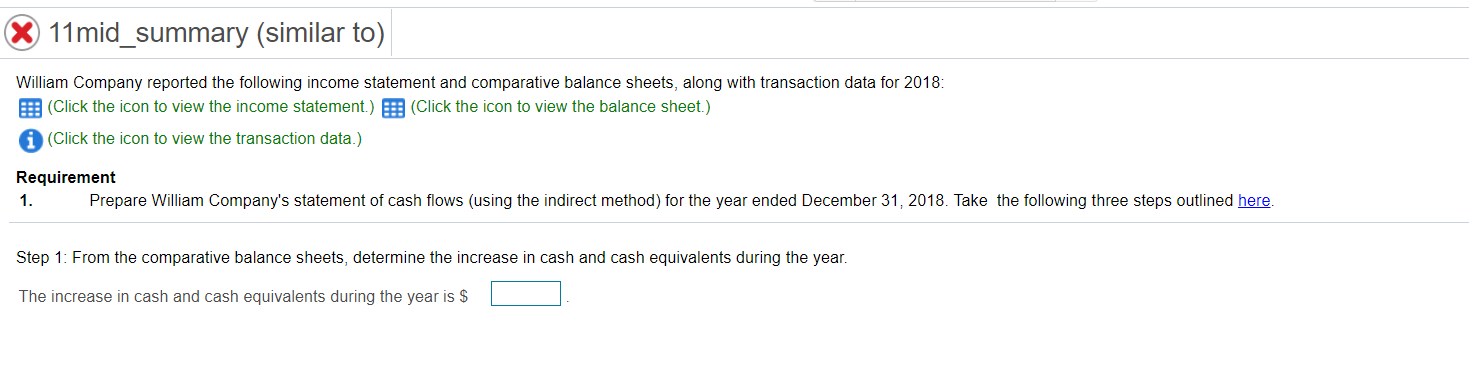

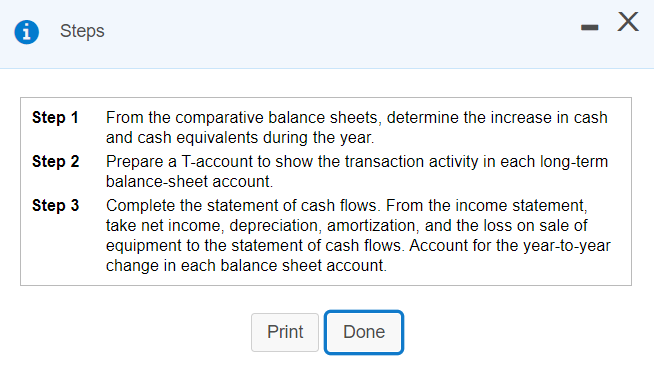

Transaction Data - $ 95,000 11,000 $ 30,000 Transaction Data for 2018: Purchase of equipment with cash Payment of cash dividends Issuance of common stock to retire bonds payable.. Purchase of long-term investment with cash Purchase of treasury stock. 19,000 Issuance of long-term note payable to purchase patent Issuance of long-term note payable to borrow cash Issuance of common stock for cash. Proceeds from sale of equipment (book value, $81,000) 12,000 24,000 3,000 11,000 76,000 Print Done i Balance Sheet - - X 2018 2017 $ 35,000 $ 9,000 14,000 33,000 11,000 14,000 Assets Current Cash and cash equivalents Accounts receivable Inventories Prepaid expenses Total current assets Equipment, net Long-term investments Patent, net William Company Comparative Balance Sheets December 31, 2018 and 2017 2018 2017 Liabilities Current Accounts payable $ 56,300 $ 4,000 Accrued liabilities 19,000 24,000 Income tax payable 48,000 35,000 Total current liabilities 1,000 3,000 Long-term note payable 124,300 66,000 Bonds payable 49,000 44,000 Stockholders' Equity 19,000 16,000 Common stock 30,000 4,000 Retained earnings Less: Treasury stock Total liabilities and $ 222,300 $ 130,000 stockholders' equity 58,000 58,000 53,000 11,000 52,000 33,000 64,000 21,000 40,300 (26,000) 3,000 (15,000) $ 222,300 $ 130,000 Total assets Print Done i Income Statement 1 > William Company Income Statement Year Ended December 31, 2018 Sales revenue $ 668,000 536,000 132,000 $ Cost of goods sold Gross profit Operating expenses Salary expenses Depreciation expenseequipment Amortization expensepatent Rent expense Total operating expenses Income from operations Other items: Loss on sale of equipment Income before income tax Income tax expense 42,000 9,000 4,000 3,000 58,000 74,000 (5,000) 69,000 20,700 Net income 48,300 Print Done 11mid_summary (similar to) William Company reported the following income statement and comparative balance sheets, along with transaction data for 2018: (Click the icon to view the income statement.) = (Click the icon to view the balance sheet.) A(Click the icon to view the transaction data.) Requirement 1. Prepare William Company's statement of cash flows (using the indirect method) for the year ended December 31, 2018. Take the following three steps outlined here. Step 1: From the comparative balance sheets, determine the increase in cash and cash equivalents during the year. The increase in cash and cash equivalents during the year is $ X i Steps Step 1 From the comparative balance sheets, determine the increase in cash and cash equivalents during the year. Step 2 Prepare a T-account to show the transaction activity in each long-term balance sheet account. Step 3 Complete the statement of cash flows. From the income statement, take net income, depreciation, amortization, and the loss on sale of equipment to the statement of cash flows. Account for the year-to-year change in each balance sheet account. Print Done Transaction Data - $ 95,000 11,000 $ 30,000 Transaction Data for 2018: Purchase of equipment with cash Payment of cash dividends Issuance of common stock to retire bonds payable.. Purchase of long-term investment with cash Purchase of treasury stock. 19,000 Issuance of long-term note payable to purchase patent Issuance of long-term note payable to borrow cash Issuance of common stock for cash. Proceeds from sale of equipment (book value, $81,000) 12,000 24,000 3,000 11,000 76,000 Print Done i Balance Sheet - - X 2018 2017 $ 35,000 $ 9,000 14,000 33,000 11,000 14,000 Assets Current Cash and cash equivalents Accounts receivable Inventories Prepaid expenses Total current assets Equipment, net Long-term investments Patent, net William Company Comparative Balance Sheets December 31, 2018 and 2017 2018 2017 Liabilities Current Accounts payable $ 56,300 $ 4,000 Accrued liabilities 19,000 24,000 Income tax payable 48,000 35,000 Total current liabilities 1,000 3,000 Long-term note payable 124,300 66,000 Bonds payable 49,000 44,000 Stockholders' Equity 19,000 16,000 Common stock 30,000 4,000 Retained earnings Less: Treasury stock Total liabilities and $ 222,300 $ 130,000 stockholders' equity 58,000 58,000 53,000 11,000 52,000 33,000 64,000 21,000 40,300 (26,000) 3,000 (15,000) $ 222,300 $ 130,000 Total assets Print Done i Income Statement 1 > William Company Income Statement Year Ended December 31, 2018 Sales revenue $ 668,000 536,000 132,000 $ Cost of goods sold Gross profit Operating expenses Salary expenses Depreciation expenseequipment Amortization expensepatent Rent expense Total operating expenses Income from operations Other items: Loss on sale of equipment Income before income tax Income tax expense 42,000 9,000 4,000 3,000 58,000 74,000 (5,000) 69,000 20,700 Net income 48,300 Print Done 11mid_summary (similar to) William Company reported the following income statement and comparative balance sheets, along with transaction data for 2018: (Click the icon to view the income statement.) = (Click the icon to view the balance sheet.) A(Click the icon to view the transaction data.) Requirement 1. Prepare William Company's statement of cash flows (using the indirect method) for the year ended December 31, 2018. Take the following three steps outlined here. Step 1: From the comparative balance sheets, determine the increase in cash and cash equivalents during the year. The increase in cash and cash equivalents during the year is $ X i Steps Step 1 From the comparative balance sheets, determine the increase in cash and cash equivalents during the year. Step 2 Prepare a T-account to show the transaction activity in each long-term balance sheet account. Step 3 Complete the statement of cash flows. From the income statement, take net income, depreciation, amortization, and the loss on sale of equipment to the statement of cash flows. Account for the year-to-year change in each balance sheet account. Print Done