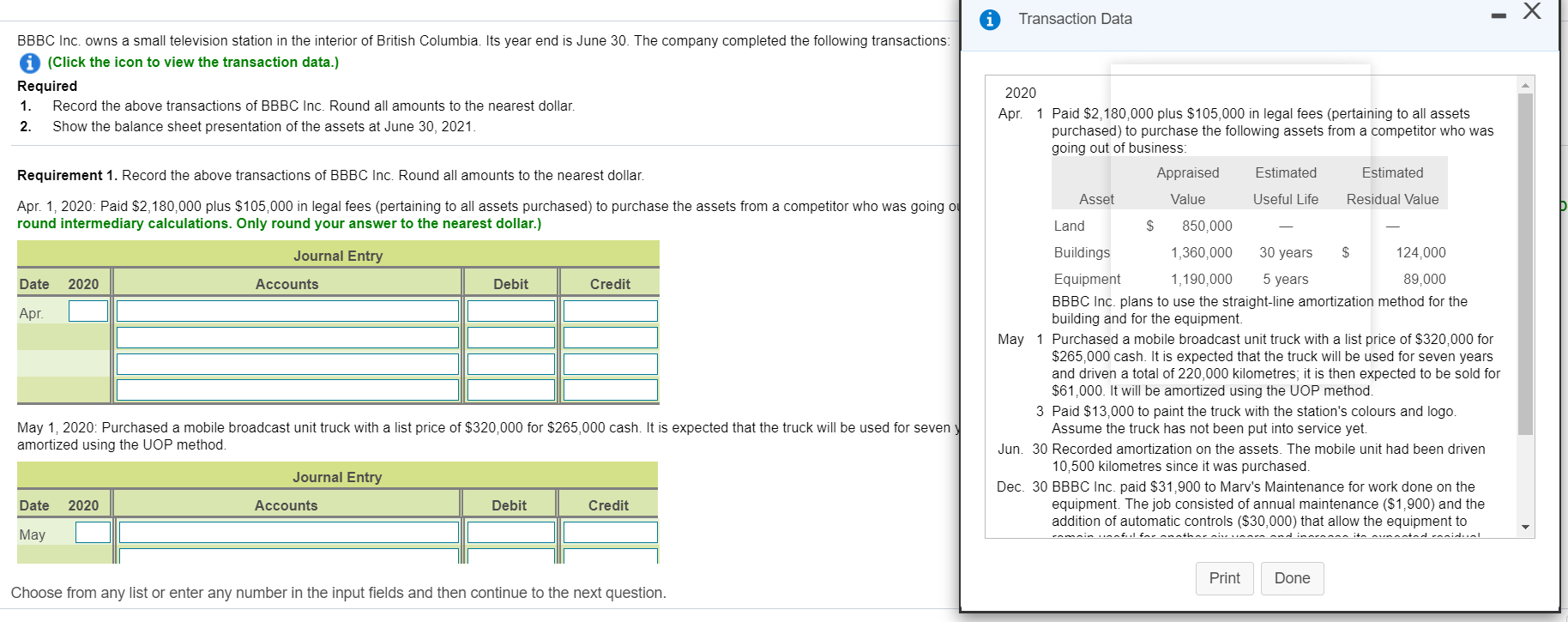

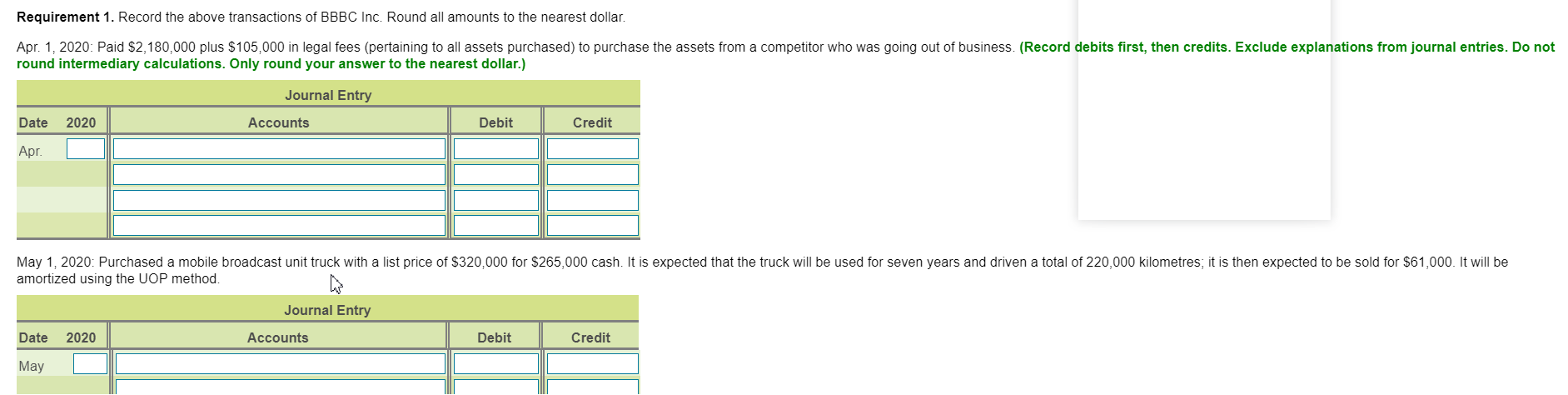

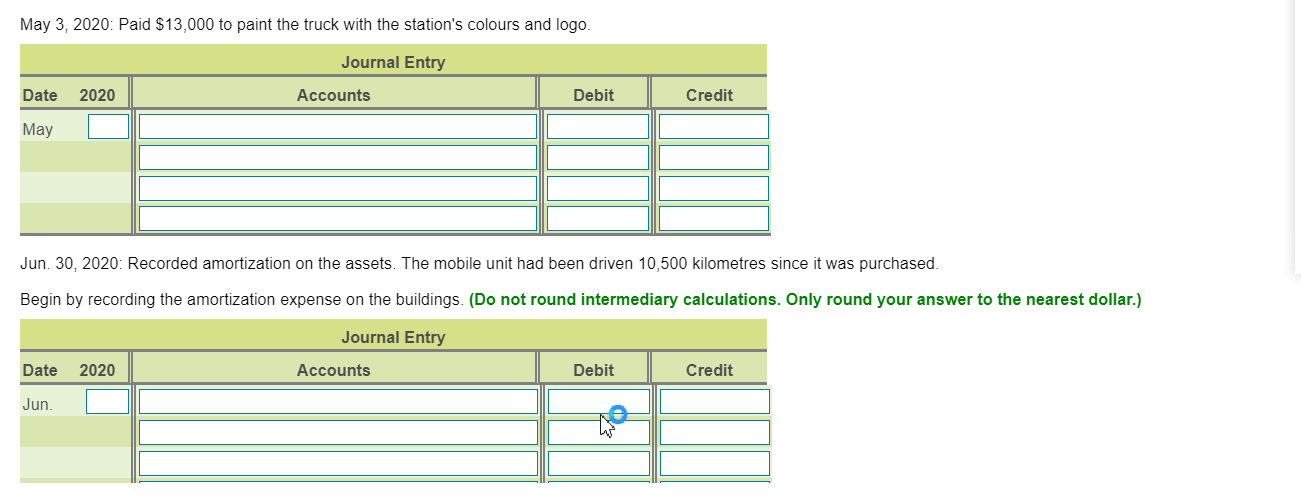

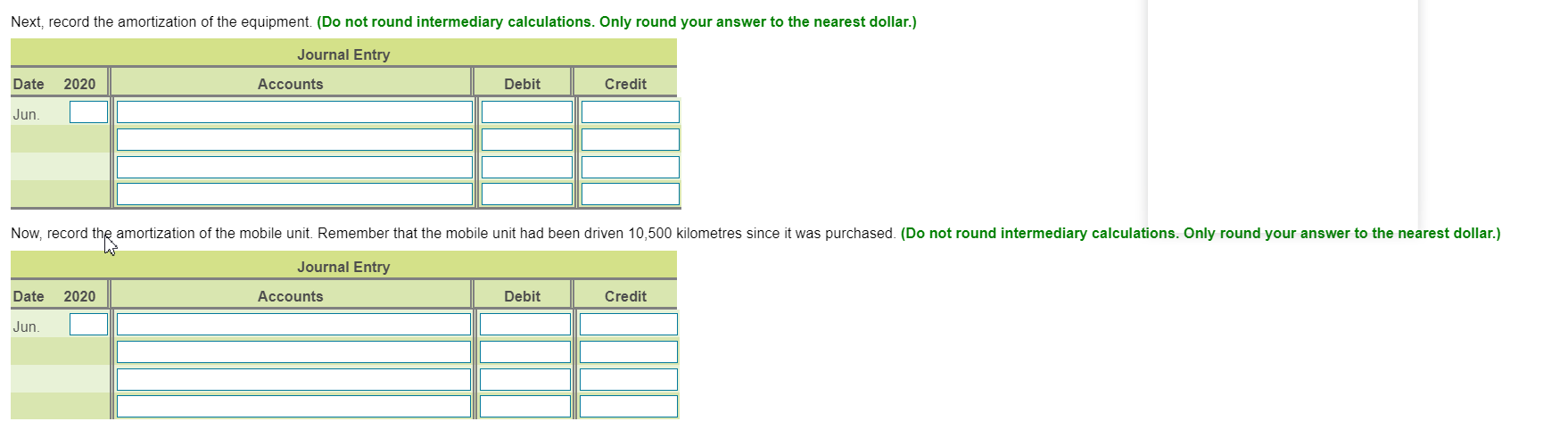

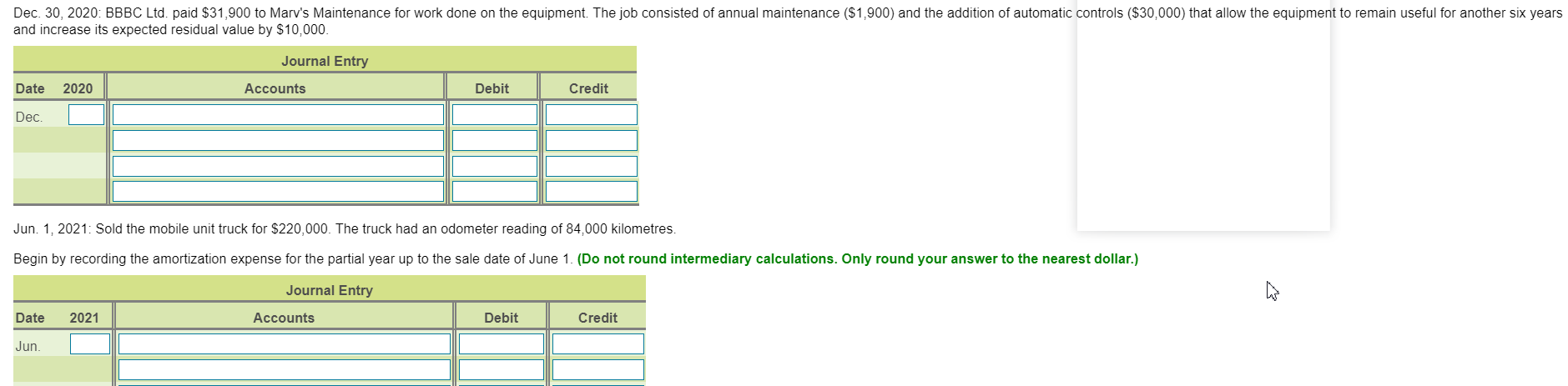

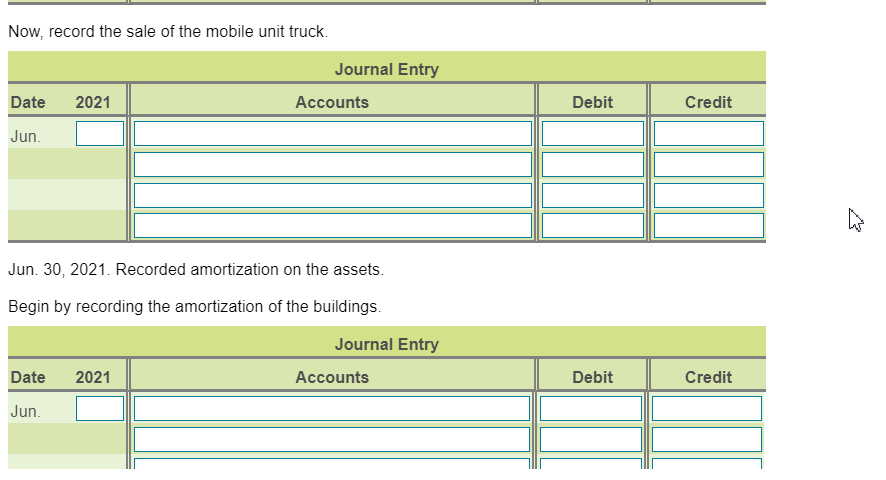

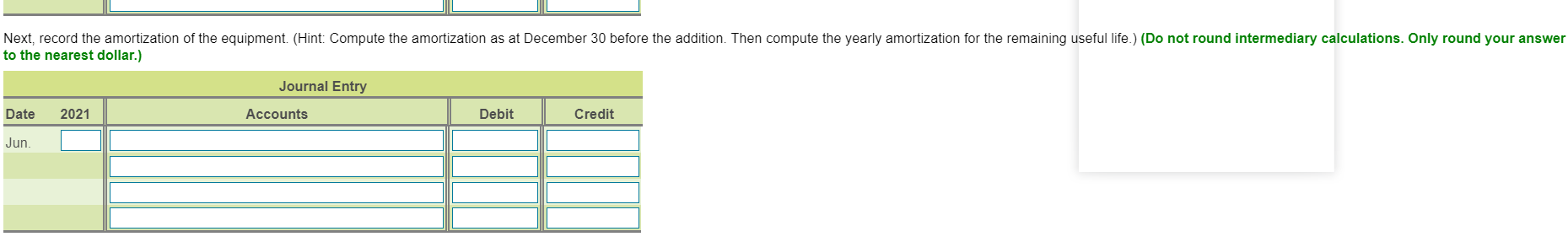

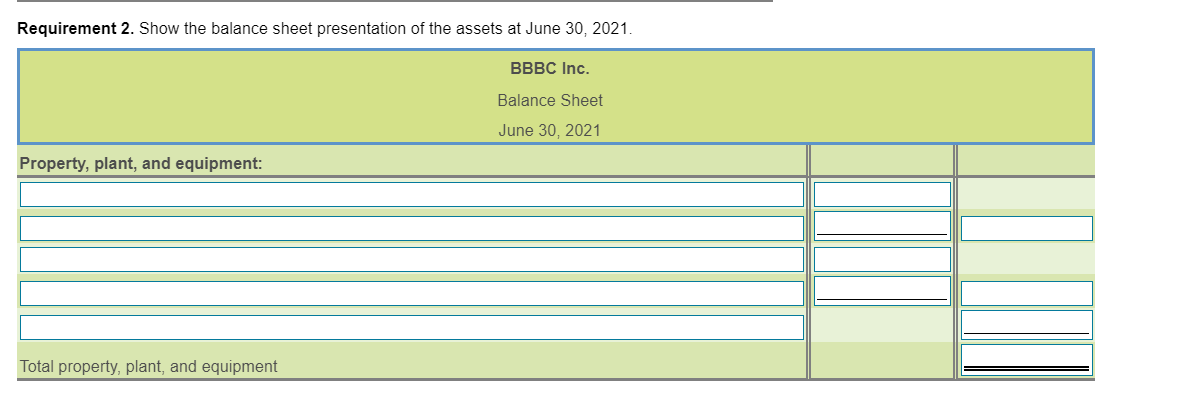

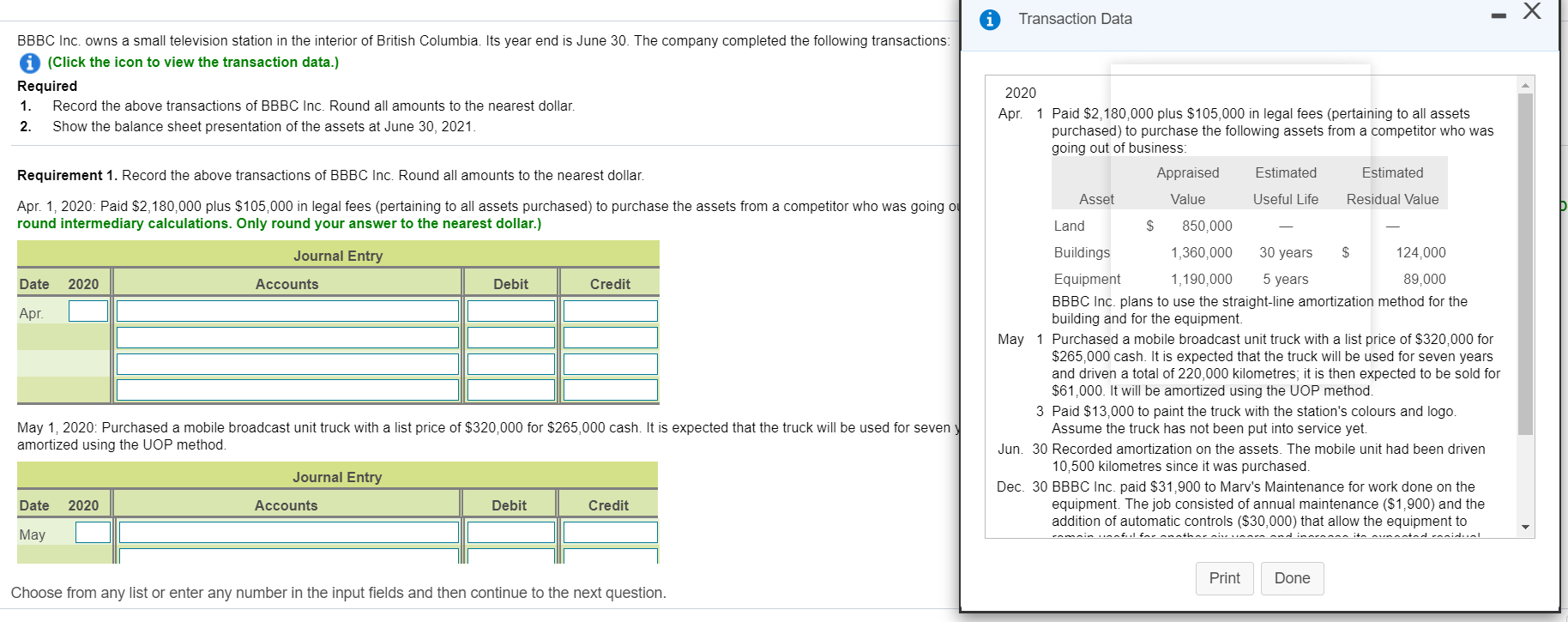

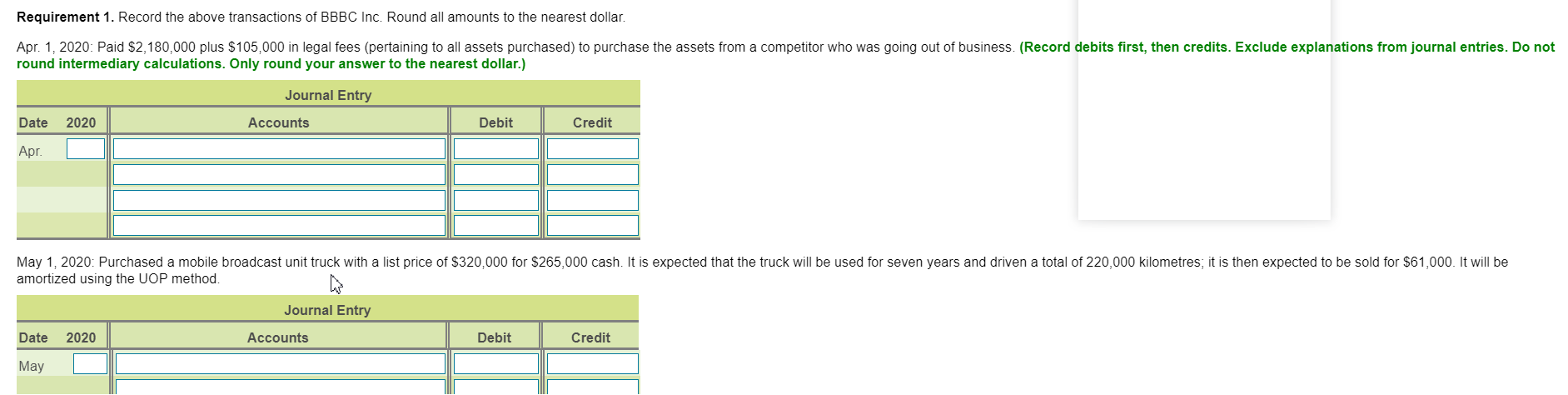

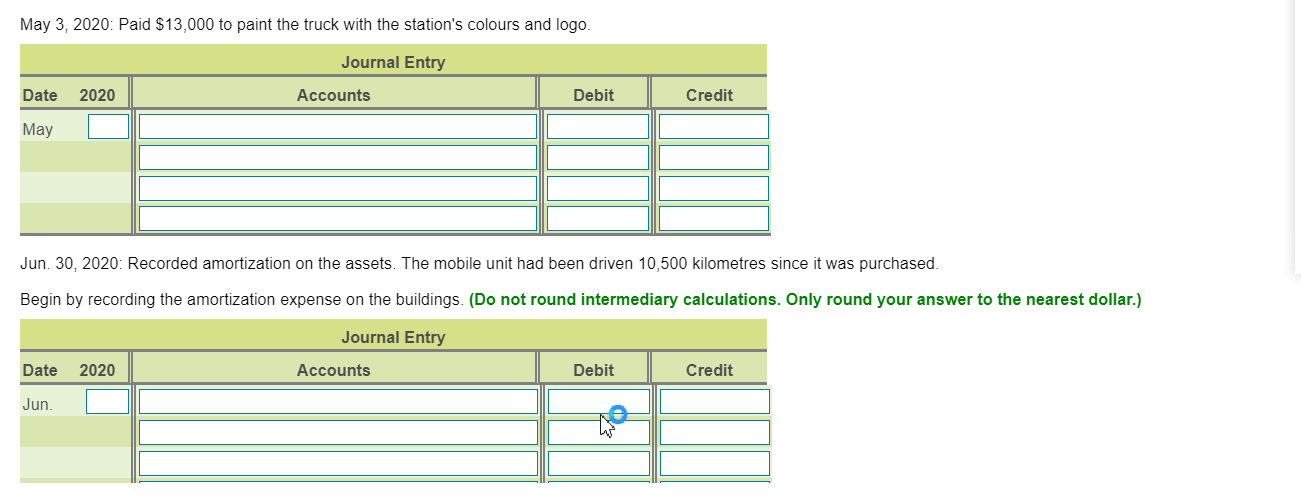

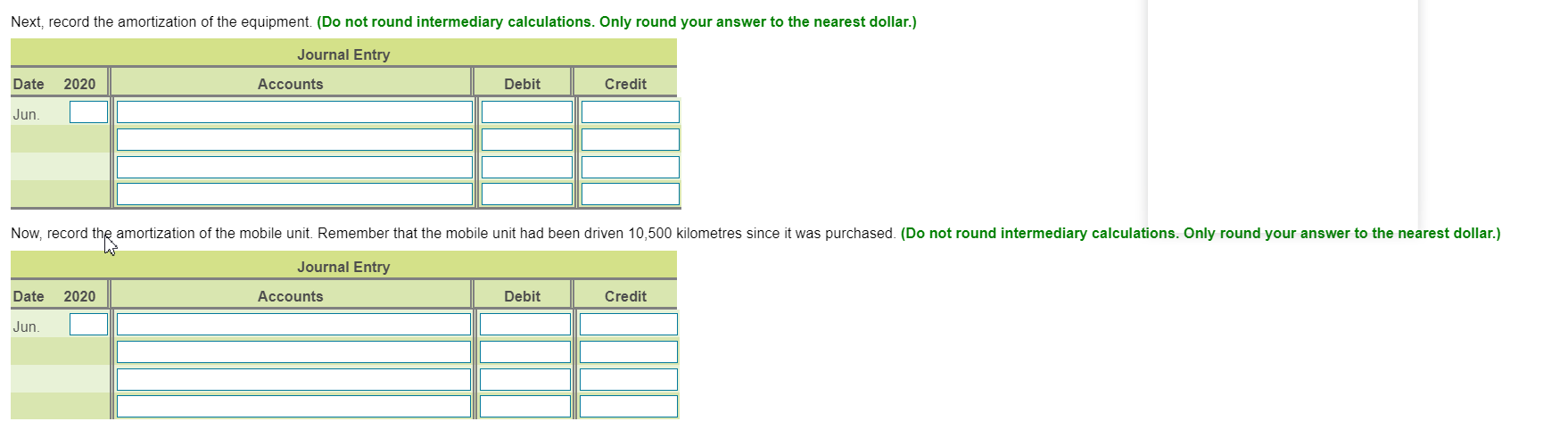

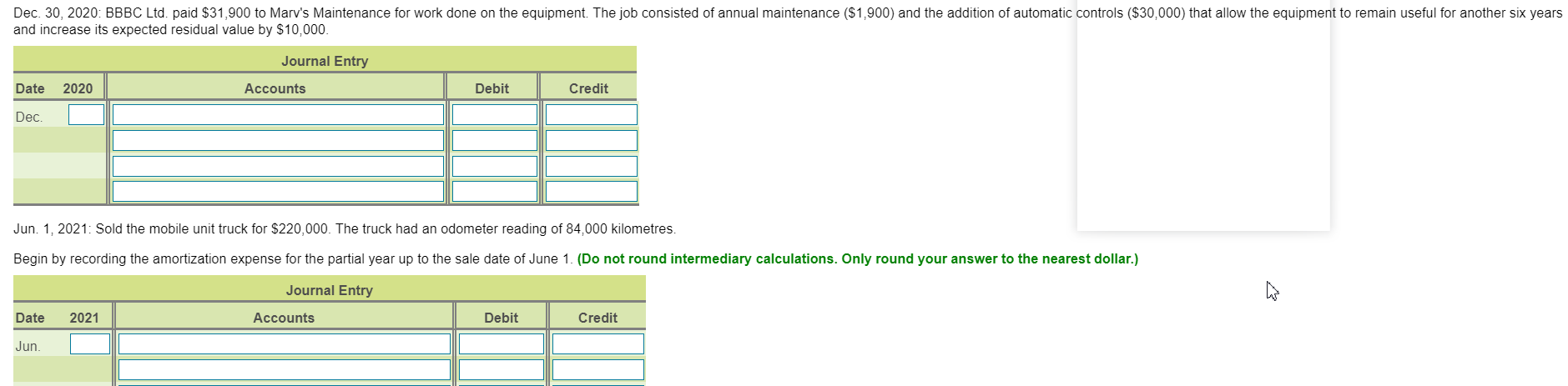

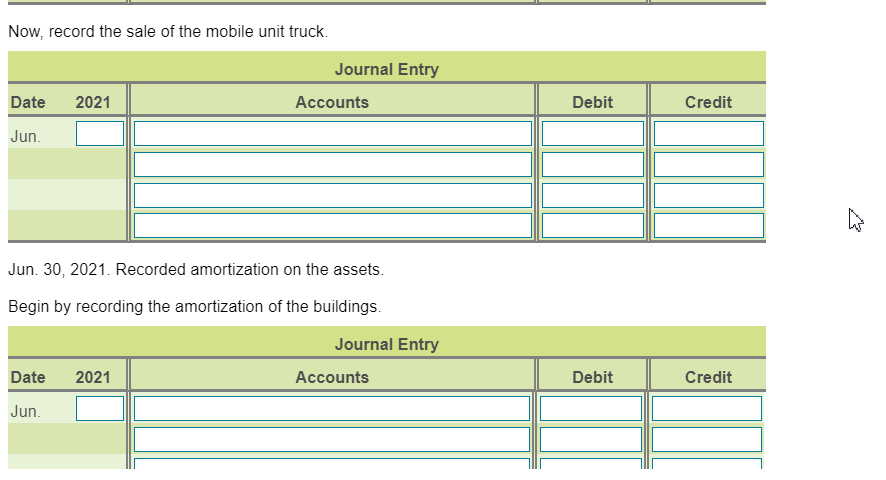

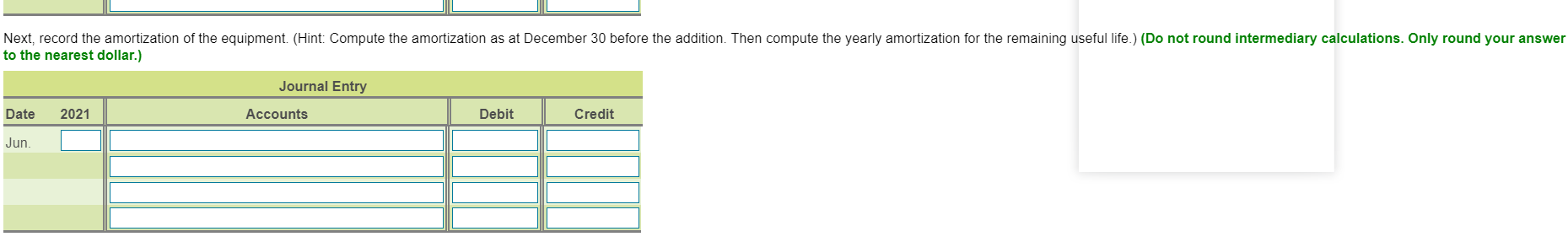

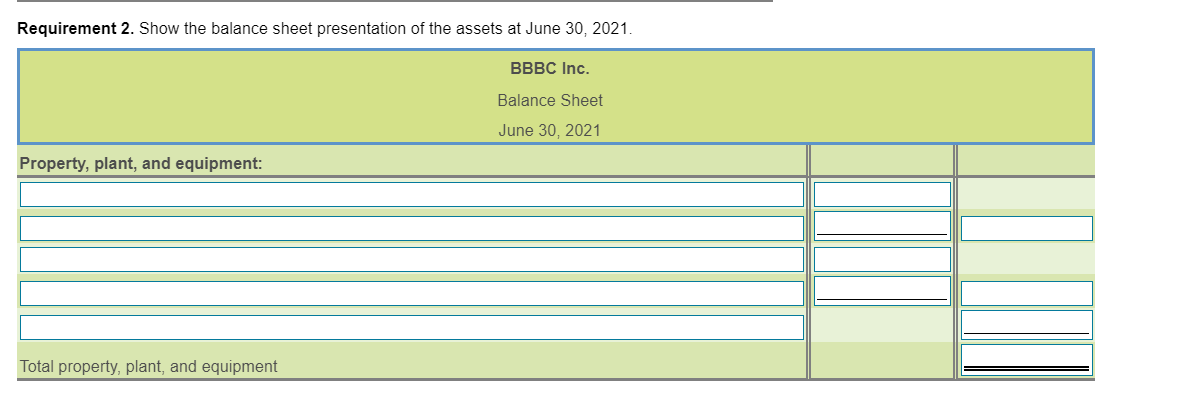

Transaction Data X BBBC Inc. owns a small television station in the interior of British Columbia. Its year end is June 30. The company completed the following transactions: (Click the icon to view the transaction data.) Required 1. Record the above transactions of BBBC Inc. Round all amounts to the nearest dollar. 2. Show the balance sheet presentation of the assets at June 30, 2021. Requirement 1. Record the above transactions of BBBC Inc. Round all amounts to the nearest dollar. Apr. 1, 2020: Paid $2,180,000 plus $105,000 in legal fees (pertaining to all assets purchased) to purchase the assets from a competitor who was going og round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2020 Accounts Debit Credit Apr. 2020 Apr. 1 Paid $2,180,000 plus $105,000 in legal fees (pertaining to all assets purchased) to purchase the following assets from a competitor who was going out of business Appraised Estimated Estimated Asset Value Useful Life Residual Value Land $ 850,000 Buildings 1,360,000 30 years $ 124,000 Equipment 1,190,000 5 years 89,000 BBBC Inc. plans to use the straight-line amortization method for the building and for the equipment. May 1 Purchased a mobile broadcast unit truck with a list price of $320,000 for $265,000 cash. It is expected that the truck will be used for seven years and driven a total of 220,000 kilometres, it is then expected to be sold for $61,000. It will be amortized using the UOP method. 3 Paid $13,000 to paint the truck with the station's colours and logo. Assume the truck has not been put into service yet. Jun. 30 Recorded amortization on the assets. The mobile unit had been driven 10,500 kilometres since it was purchased. Dec. 30 BBBC Inc. paid $31,900 to Marv's Maintenance for work done on the equipment. The job consisted of annual maintenance ($1,900) and the addition of automatic controls ($30,000) that allow the equipment to ramai rafil for another sis AAA Adina Anita Asanstad rasis..al May 1, 2020: Purchased a mobile broadcast unit truck with a list price of $320,000 for $265,000 cash. It is expected that the truck will be used for seven amortized using the UOP method. Journal Entry Date 2020 Accounts Debit Credit May Print Done Choose from any list or enter any number in the input fields and then continue to the next question. Requirement 1. Record the above transactions of BBBC Inc. Round all amounts to the nearest dollar. Apr. 1, 2020: Paid $2,180,000 plus $105,000 in legal fees (pertaining to all assets purchased) to purchase the assets from a competitor who was going out of business. (Record debits first, then credits. Exclude explanations from journal entries. Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2020 Accounts Debit Credit Apr. May 1, 2020: Purchased a mobile broadcast unit truck with a list price of $320,000 for $265,000 cash. It is expected that the truck will be used for seven years and driven a total of 220,000 kilometres, it is then expected to be sold for $61,000. It will be amortized using the UOP method. Journal Entry Date 2020 Accounts Debit Credit May May 3, 2020: Paid $13,000 to paint the truck with the station's colours and logo. Journal Entry Date 2020 Accounts Debit Credit May Jun 30, 2020: Recorded amortization on the assets. The mobile unit had been driven 10,500 kilometres since it was purchased Begin by recording the amortization expense on the buildings. (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2020 Accounts Debit Credit Jun. To Next, record the amortization of the equipment. (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2020 Accounts Debit Credit Jun. Now, record the amortization of the mobile unit. Remember that the mobile unit had been driven 10,500 kilometres since it was purchased. (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2020 Accounts Debit Credit Jun. Dec. 30, 2020: BBBC Ltd. paid $31,900 to Marv's Maintenance for work done on the equipment. The job consisted of annual maintenance ($1,900) and the addition of automatic controls ($30,000) that allow the equipment to remain useful for another six years and increase its expected residual value by $10,000 Journal Entry Date 2020 Accounts Debit Credit Dec. Jun. 1, 2021: Sold the mobile unit truck for $220,000. The truck had an odometer reading of 84,000 kilometres. Begin by recording the amortization expense for the partial year up to the sale date of June 1. (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2021 Accounts Debit Credit Jun. Now, record the sale of the mobile unit truck. Journal Entry Date 2021 Accounts Debit Credit Jun. Jun 30, 2021. Recorded amortization on the assets. Begin by recording the amortization of the buildings. Journal Entry Date 2021 Accounts Debit Credit Jun. Next, record the amortization of the equipment. (Hint: Compute the amortization as at December 30 before the addition. Then compute the yearly amortization for the remaining useful life.) (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2021 Accounts Debit Credit Jun. Requirement 2. Show the balance sheet presentation of the assets at June 30, 2021. BBBC Inc. Balance Sheet June 30, 2021 Property, plant, and equipment: Total property, plant, and equipment Transaction Data X BBBC Inc. owns a small television station in the interior of British Columbia. Its year end is June 30. The company completed the following transactions: (Click the icon to view the transaction data.) Required 1. Record the above transactions of BBBC Inc. Round all amounts to the nearest dollar. 2. Show the balance sheet presentation of the assets at June 30, 2021. Requirement 1. Record the above transactions of BBBC Inc. Round all amounts to the nearest dollar. Apr. 1, 2020: Paid $2,180,000 plus $105,000 in legal fees (pertaining to all assets purchased) to purchase the assets from a competitor who was going og round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2020 Accounts Debit Credit Apr. 2020 Apr. 1 Paid $2,180,000 plus $105,000 in legal fees (pertaining to all assets purchased) to purchase the following assets from a competitor who was going out of business Appraised Estimated Estimated Asset Value Useful Life Residual Value Land $ 850,000 Buildings 1,360,000 30 years $ 124,000 Equipment 1,190,000 5 years 89,000 BBBC Inc. plans to use the straight-line amortization method for the building and for the equipment. May 1 Purchased a mobile broadcast unit truck with a list price of $320,000 for $265,000 cash. It is expected that the truck will be used for seven years and driven a total of 220,000 kilometres, it is then expected to be sold for $61,000. It will be amortized using the UOP method. 3 Paid $13,000 to paint the truck with the station's colours and logo. Assume the truck has not been put into service yet. Jun. 30 Recorded amortization on the assets. The mobile unit had been driven 10,500 kilometres since it was purchased. Dec. 30 BBBC Inc. paid $31,900 to Marv's Maintenance for work done on the equipment. The job consisted of annual maintenance ($1,900) and the addition of automatic controls ($30,000) that allow the equipment to ramai rafil for another sis AAA Adina Anita Asanstad rasis..al May 1, 2020: Purchased a mobile broadcast unit truck with a list price of $320,000 for $265,000 cash. It is expected that the truck will be used for seven amortized using the UOP method. Journal Entry Date 2020 Accounts Debit Credit May Print Done Choose from any list or enter any number in the input fields and then continue to the next question. Requirement 1. Record the above transactions of BBBC Inc. Round all amounts to the nearest dollar. Apr. 1, 2020: Paid $2,180,000 plus $105,000 in legal fees (pertaining to all assets purchased) to purchase the assets from a competitor who was going out of business. (Record debits first, then credits. Exclude explanations from journal entries. Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2020 Accounts Debit Credit Apr. May 1, 2020: Purchased a mobile broadcast unit truck with a list price of $320,000 for $265,000 cash. It is expected that the truck will be used for seven years and driven a total of 220,000 kilometres, it is then expected to be sold for $61,000. It will be amortized using the UOP method. Journal Entry Date 2020 Accounts Debit Credit May May 3, 2020: Paid $13,000 to paint the truck with the station's colours and logo. Journal Entry Date 2020 Accounts Debit Credit May Jun 30, 2020: Recorded amortization on the assets. The mobile unit had been driven 10,500 kilometres since it was purchased Begin by recording the amortization expense on the buildings. (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2020 Accounts Debit Credit Jun. To Next, record the amortization of the equipment. (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2020 Accounts Debit Credit Jun. Now, record the amortization of the mobile unit. Remember that the mobile unit had been driven 10,500 kilometres since it was purchased. (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2020 Accounts Debit Credit Jun. Dec. 30, 2020: BBBC Ltd. paid $31,900 to Marv's Maintenance for work done on the equipment. The job consisted of annual maintenance ($1,900) and the addition of automatic controls ($30,000) that allow the equipment to remain useful for another six years and increase its expected residual value by $10,000 Journal Entry Date 2020 Accounts Debit Credit Dec. Jun. 1, 2021: Sold the mobile unit truck for $220,000. The truck had an odometer reading of 84,000 kilometres. Begin by recording the amortization expense for the partial year up to the sale date of June 1. (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2021 Accounts Debit Credit Jun. Now, record the sale of the mobile unit truck. Journal Entry Date 2021 Accounts Debit Credit Jun. Jun 30, 2021. Recorded amortization on the assets. Begin by recording the amortization of the buildings. Journal Entry Date 2021 Accounts Debit Credit Jun. Next, record the amortization of the equipment. (Hint: Compute the amortization as at December 30 before the addition. Then compute the yearly amortization for the remaining useful life.) (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Date 2021 Accounts Debit Credit Jun. Requirement 2. Show the balance sheet presentation of the assets at June 30, 2021. BBBC Inc. Balance Sheet June 30, 2021 Property, plant, and equipment: Total property, plant, and equipment