Answered step by step

Verified Expert Solution

Question

1 Approved Answer

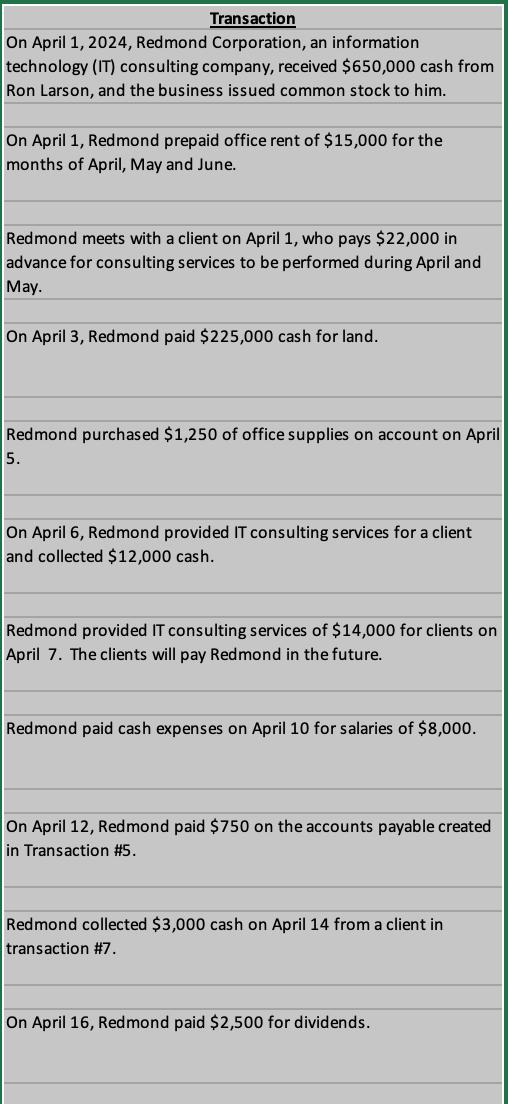

Transaction On April 1, 2024, Redmond Corporation, an information technology (IT) consulting company, received $650,000 cash from Ron Larson, and the business issued common

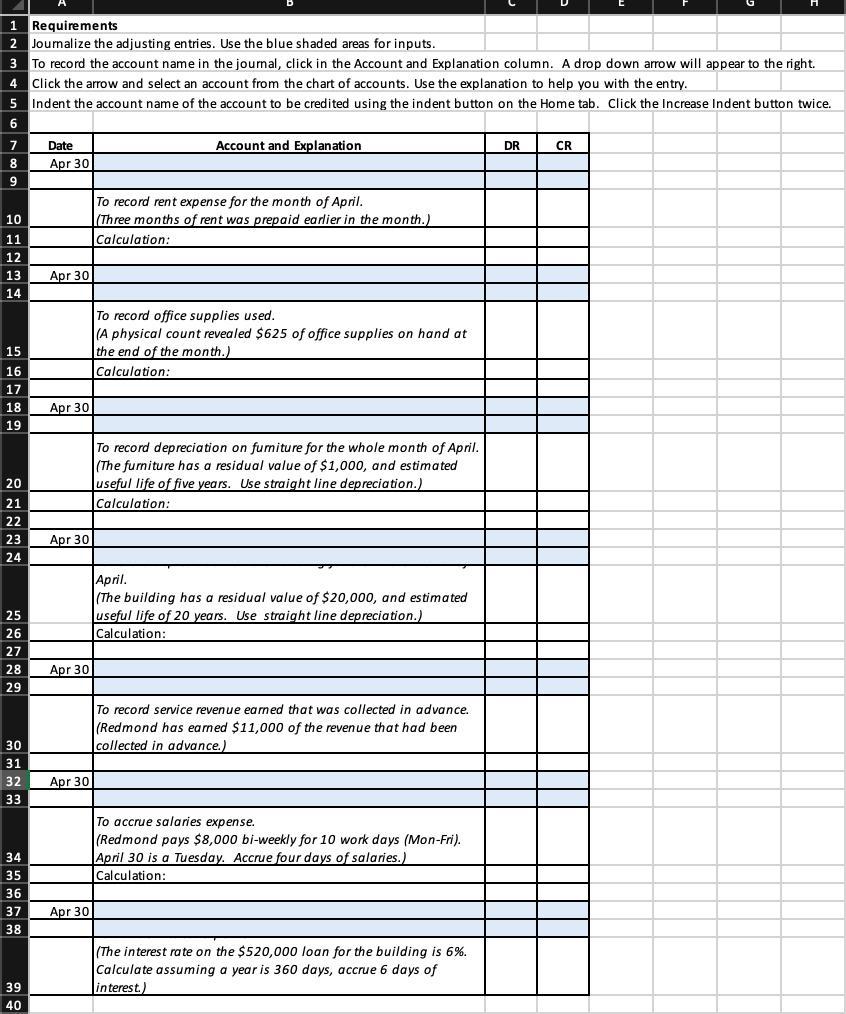

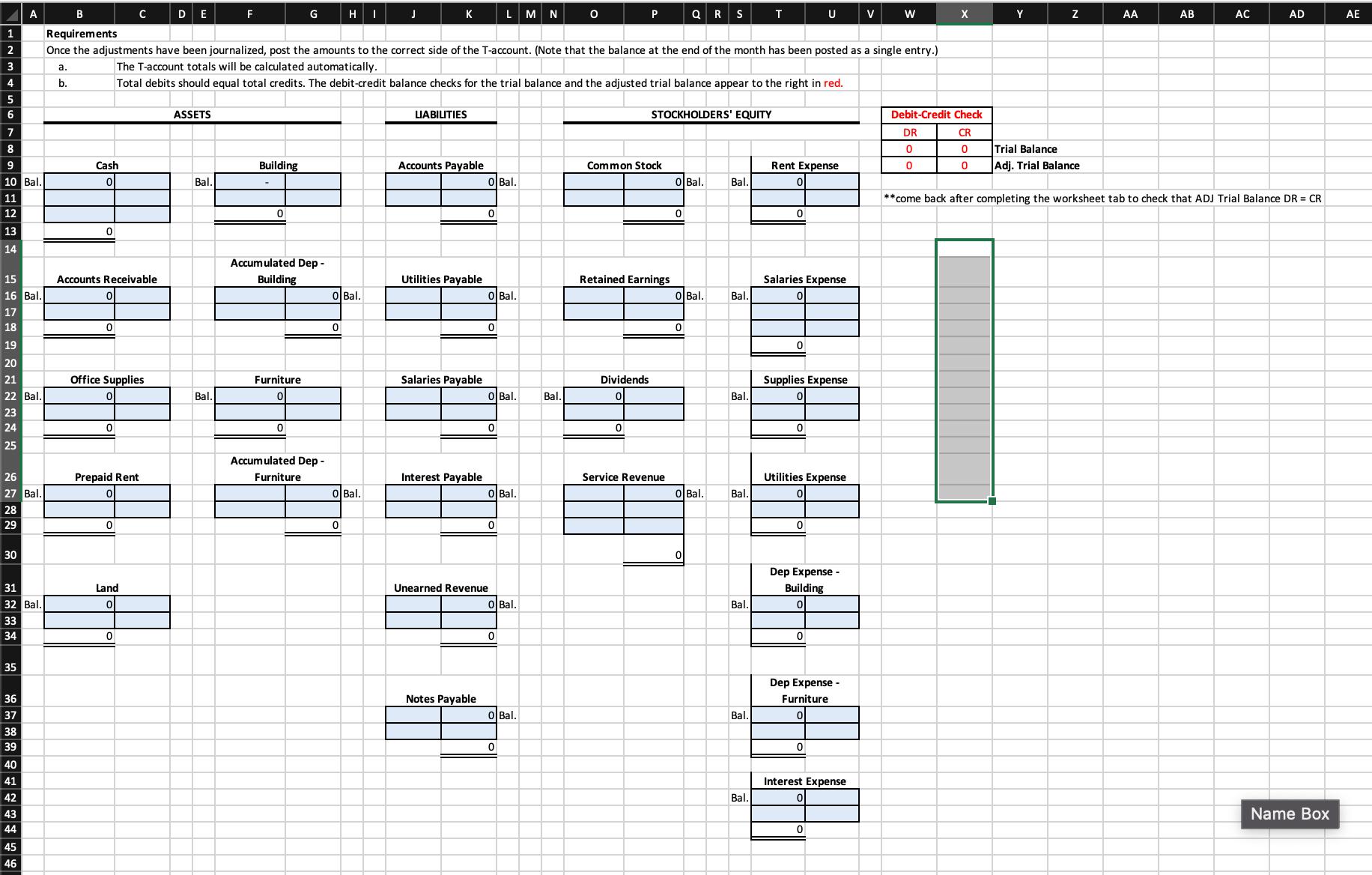

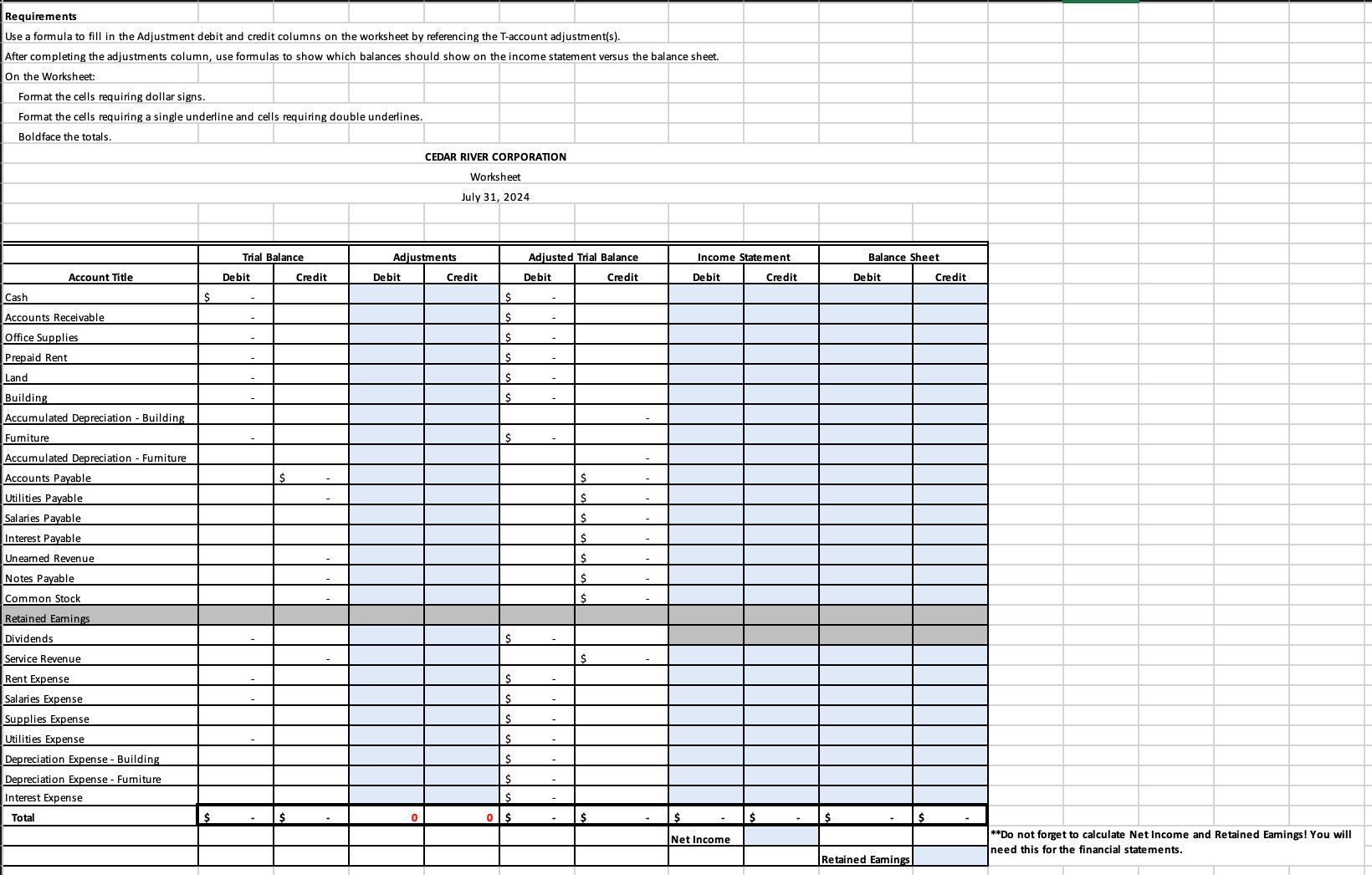

Transaction On April 1, 2024, Redmond Corporation, an information technology (IT) consulting company, received $650,000 cash from Ron Larson, and the business issued common stock to him. On April 1, Redmond prepaid office rent of $15,000 for the months of April, May and June. Redmond meets with a client on April 1, who pays $22,000 in advance for consulting services to be performed during April and May. On April 3, Redmond paid $225,000 cash for land. Redmond purchased $1,250 of office supplies on account on April 5. On April 6, Redmond provided IT consulting services for a client and collected $12,000 cash. Redmond provided IT consulting services of $14,000 for clients on April 7. The clients will pay Redmond in the future. Redmond paid cash expenses on April 10 for salaries of $8,000. On April 12, Redmond paid $750 on the accounts payable created in Transaction #5. Redmond collected $3,000 cash on April 14 from a client in transaction #7. On April 16, Redmond paid $2,500 for dividends. 1 Requirements 2 Joumalize the adjusting entries. Use the blue shaded areas for inputs. 3 To record the account name in the journal, click in the Account and Explanation column. A drop down arrow will appear to the right. 4 Click the arrow and select an account from the chart of accounts. Use the explanation to help you with the entry. 5 Indent the account name of the account to be credited using the indent button on the Home tab. Click the Increase Indent button twice. 123456789 Date Apr 30 Account and Explanation DR CR 10 11 12 13 Apr 30 14 To record rent expense for the month of April. (Three months of rent was prepaid earlier in the month.) Calculation: 15 16 17 18 19 20 21 Apr 30 To record office supplies used. (A physical count revealed $625 of office supplies on hand at the end of the month.) Calculation: To record depreciation on furniture for the whole month of April. (The furniture has a residual value of $1,000, and estimated useful life of five years. Use straight line depreciation.) Calculation: 22 23 Apr 30 24 25 26 27 28 29 Apr 30 April. (The building has a residual value of $20,000, and estimated useful life of 20 years. Use straight line depreciation.) Calculation: To record service revenue earned that was collected in advance. (Redmond has earned $11,000 of the revenue that had been collected in advance.) 30 31 32 Apr 30 33 34 35 36 37 Apr 30 38 39 40 To accrue salaries expense. (Redmond pays $8,000 bi-weekly for 10 work days (Mon-Fri). April 30 is a Tuesday. Accrue four days of salaries.) Calculation: (The interest rate on the $520,000 loan for the building is 6%. Calculate assuming a year is 360 days, accrue 6 days of interest.) A B C DE F G H | J K LMN P Q R S T U V W X Y Z AA AB AC AD AE 1 Requirements 2 3 a. Once the adjustments have been journalized, post the amounts to the correct side of the T-account. (Note that the balance at the end of the month has been posted as a single entry.) The T-account totals will be calculated automatically. 4 b. Total debits should equal total credits. The debit-credit balance checks for the trial balance and the adjusted trial balance appear to the right in red. 5 6 ASSETS LIABILITIES STOCKHOLDERS' EQUITY Debit-Credit Check DR 7 CR 0 0 Trial Balance 8 9 Cash Building Accounts Payable Common Stock 10 Bal. Bal. -> 0 Bal. O Bal. Bal. Rent Expense 0 0 0 Adj. Trial Balance 11 **come back after completing the worksheet tab to check that ADJ Trial Balance DR = CR 12 0 0 0 0 13 0 14 Accumulated Dep- 15 Accounts Receivable Building Utilities Payable Retained Earnings Salaries Expense 16 Bal. 0 O Bal. O Bal. O Bal. Bal. 0 17 18 0 0 0 0 0 19 20 21 Office Supplies Furniture 22 Bal. 0 Bal 0 Salaries Payable Dividends O Bal. Bal. 0 Bal. Supplies Expense 23 24 0 0 0 0 0 25 Accumulated Dep- 26 Prepaid Rent Furniture Interest Payable Service Revenue Utilities Expense 27 Bal. 0 O Bal. O Bal. O Bal. Bal. 0 28 29 0 0 0 0 30 31 Land 32 Bal. 0 33 34 0 35 36 37 38 39 40 41 42 43 44 45 46 Dep Expense- Unearned Revenue Building O Bal. Bal. o Notes Payable 0 Dep Expense - Furniture O Bal. Bal. 0 0 Bal. 0 Interest Expense 0 0 Name Box Requirements Use a formula to fill in the Adjustment debit and credit columns on the worksheet by referencing the T-account adjustment(s). After completing the adjustments column, use formulas to show which balances should show on the income statement versus the balance sheet. On the Worksheet: Format the cells requiring dollar signs. Format the cells requiring a single underline and cells requiring double underlines. Boldface the totals. CEDAR RIVER CORPORATION Worksheet July 31, 2024 Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Title Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit Cash $ $ Accounts Receivable $ Office Supplies S Prepaid Rent $ Land $ Building $ Accumulated Depreciation Building Furniture Accumulated Depreciation Furniture Accounts Payable Utilities Payable Salaries Payable Interest Payable Unearned Revenue Notes Payable Common Stock Retained Earnings Dividends Service Revenue Rent Expense Salaries Expense Supplies Expense Utilities Expense Depreciation Expense Building Depreciation Expense Fumiture Interest Expense Total $ $ $ $ $ $ $ $ $ $ $ $ S $ $ $ S $ 0 S Net Income $ $ Retained Earnings - **Do not forget to calculate Net Income and Retained Earings! You will need this for the financial statements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started