TRANSACTIONS

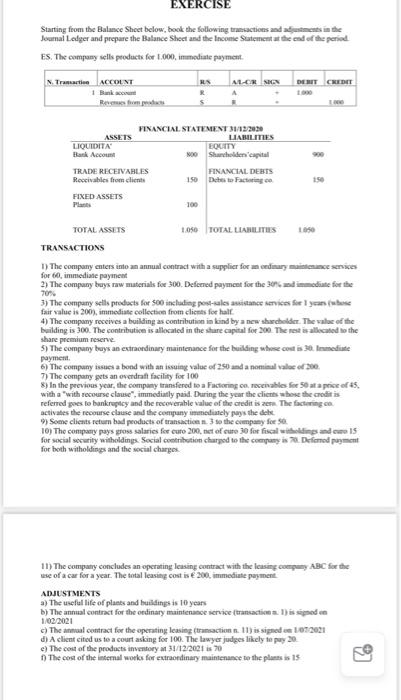

1.050 TOTAL LIABILITIES

1) The company enters into an annual contract with a supplier for an ordinary maintenance services for 60, immediate payment

2) The company buys raw materials for 300. Deferred payment for the 30% and immediate for the 70%

3) The company sells products for 500 including post-sales assistance services for 1 years (whose fair value is 200), immediate collection from clients for half.

4) The company receives a building as contribution in kind by a new shareholder. The value of the building is 300. The contribution is allocated in the share capital for 200. The rest is allocated to the share premium reserve.

5) The company buys an extraordinary maintenance for the building whose cost is 30. Immediate payment.

6) The company issues a bond with an issuing value of 250 and a nominal value of 200.

7) The company gets an overdraft facility for 100

8) In the previous year, the company transfered to a Factoring co. receivables for 50 at a price of 45, with a "with recourse clause", immediatly paid. During the year the clients whose the credit is referred goes to bankruptcy and the recoverable value of the credit is zero. The factoring co. activates the recourse clause and the company immediately pays the debt.

9) Some clients return bad products of transaction n. 3 to the company for 50.

10) The company pays gross salaries for euro 200, net of euro 30 for fiscal witholdings and euro 15 for social security witholdings. Social contribution charged to the company is 70. Deferred payment for both witholdings and the social charges.

11) The company concludes an operating leasing contract with the leasing company ABC for the use of a car for a year. The total leasing cost is 200, immediate payment.

ADJUSTMENTS

a) The useful life of plants and buildings is 10 years

b) The annual contract for the ordinary maintenance service (transaction n. 1) is signed on 1/02/2021

c) The annual contract for the operating leasing (transaction n. 11) is signed on 1/07/2021 d) A client cited us to a court asking for 100. The lawyer judges likely to pay 20.

e) The cost of the products inventory at 31/12/2021 is 70

f) The cost of the internal works for extraordinary maintenance to the plants is 15

Starting from the Balance Sheet below, book the following trantactions and acfutneats in the Joamal Ladger and prepare the Balance Shect and the Inconse Seatencent at the ead of the period. ES. The compuny sells peoducts for 1.000, inmodiate payment. TRANSACTIONS 1) The company cuters into an annual contract with a supplier for an eediary muitienasce servixes for 60 , immediane payment 2) The compuny buys raw materials foe 300 . Deferned paymeet for the 30ris and incediute for the 70ts fair value is 200 , immediate collection from clicets foe half 4) The company receives a building as contribution in kind by a new ahurcholder. The vallas of the bailding is 300 . The contributice is allocaicd in the stare capital for 200 . The rest is allecated to the share premium reserve 5) The compuny buys an extraendinary maintenance for the building whose coet is 30 . lnumediute paymera. 6) The compuny issues a bond with an issuing value of 290 and a nomiad valos of 300 . 7) The company gets an overdraft facility for 100 8) In the previous year, the company transfered to a Factoring ca. necevables fice 50 at a prise of 45 , with a "with recourse clause", immediatly paid. During the year the clients whose the crodit is refened goes to bunkreptey and the reconerable value of the credit is zen The factiring ce. activates the recourse clause and the conguny inatiediately pugs the debe. 9) Soene clicats retum bad peoducts of transactice n.3 so the cumpary foe so. 10) The compary pays gross salaries fer cure 200, net of cure 30 for fiscal witholings ad eave 15 for both witholdings and the social chargex. 11) The compatty concludes an operating leasing contract with the leasing coerpany ABC fice the wese of a car for a year. The thal leasing cost is 200, immediate payment. ADJUSTMENTS a) The useful life of plaets and builliting is 10 years b) The annual cuntrat for the endinary maintenasoe service (uransaction a. 1) is sipsod en 1/102/2021 c) The anmul contract for the operating leasing (transaction n.11 ) is signod en 1.872021 d) A clicut cited us to a court asking for 100 . The lawyer judeses likely to pwy 20 e) The con of the products inventery an 34/12/202t is 70 f) The cost of the internal woeks for extraotinary maintenasce pe the plaess is 15 Starting from the Balance Sheet below, book the following trantactions and acfutneats in the Joamal Ladger and prepare the Balance Shect and the Inconse Seatencent at the ead of the period. ES. The compuny sells peoducts for 1.000, inmodiate payment. TRANSACTIONS 1) The company cuters into an annual contract with a supplier for an eediary muitienasce servixes for 60 , immediane payment 2) The compuny buys raw materials foe 300 . Deferned paymeet for the 30ris and incediute for the 70ts fair value is 200 , immediate collection from clicets foe half 4) The company receives a building as contribution in kind by a new ahurcholder. The vallas of the bailding is 300 . The contributice is allocaicd in the stare capital for 200 . The rest is allecated to the share premium reserve 5) The compuny buys an extraendinary maintenance for the building whose coet is 30 . lnumediute paymera. 6) The compuny issues a bond with an issuing value of 290 and a nomiad valos of 300 . 7) The company gets an overdraft facility for 100 8) In the previous year, the company transfered to a Factoring ca. necevables fice 50 at a prise of 45 , with a "with recourse clause", immediatly paid. During the year the clients whose the crodit is refened goes to bunkreptey and the reconerable value of the credit is zen The factiring ce. activates the recourse clause and the conguny inatiediately pugs the debe. 9) Soene clicats retum bad peoducts of transactice n.3 so the cumpary foe so. 10) The compary pays gross salaries fer cure 200, net of cure 30 for fiscal witholings ad eave 15 for both witholdings and the social chargex. 11) The compatty concludes an operating leasing contract with the leasing coerpany ABC fice the wese of a car for a year. The thal leasing cost is 200, immediate payment. ADJUSTMENTS a) The useful life of plaets and builliting is 10 years b) The annual cuntrat for the endinary maintenasoe service (uransaction a. 1) is sipsod en 1/102/2021 c) The anmul contract for the operating leasing (transaction n.11 ) is signod en 1.872021 d) A clicut cited us to a court asking for 100 . The lawyer judeses likely to pwy 20 e) The con of the products inventery an 34/12/202t is 70 f) The cost of the internal woeks for extraotinary maintenasce pe the plaess is 15