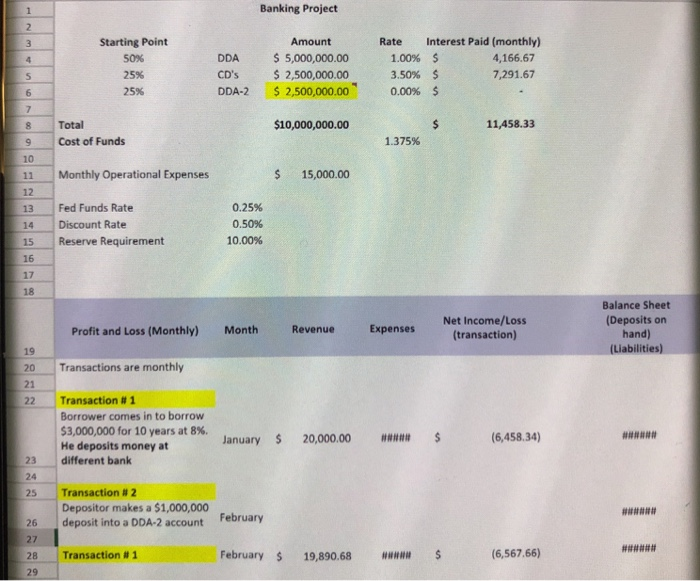

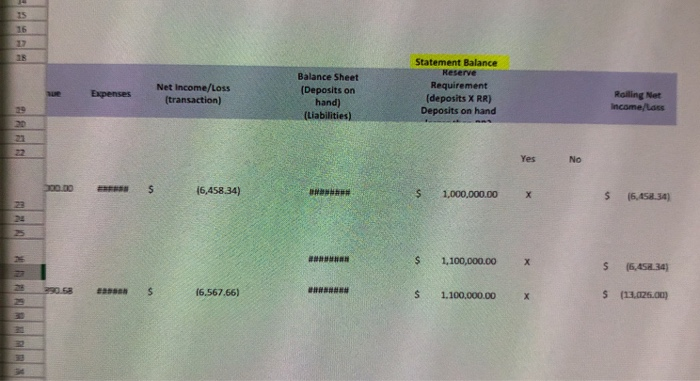

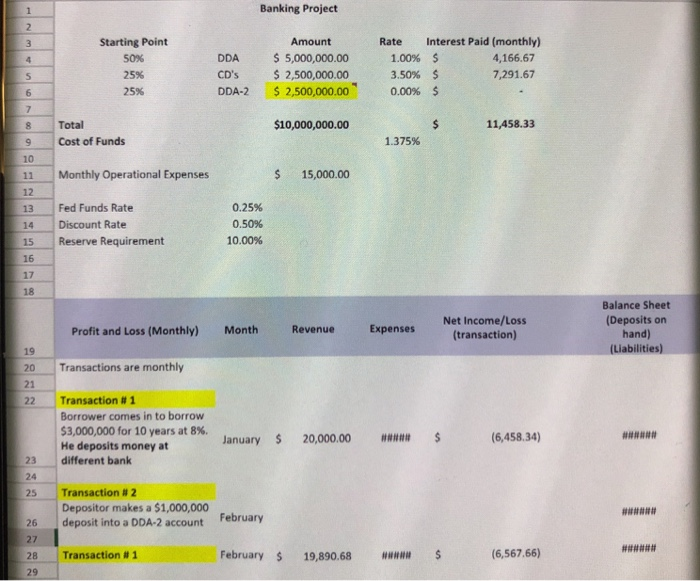

Transactions for tonight Transaction 3: Borrower takes out a 1MM loan at 9% for 4 years. He deposits money at a different bank. Remember you must process this transaction and all other transactions that would be in March. 1 Banking Project 2 3 4 Starting point 50% 25% 25% Amount $ 5,000,000.00 $ 2,500,000.00 $ 2,500,000.00 DDA CD's DDA-2 Rate Interest Paid (monthly) 1.00% $ 4,166.67 3.50% $ 7,291.67 0.00% $ 5 6 7 8 9 $10,000,000.00 $ 11,458.33 Total Cost of Funds 1.375% 10 11 Monthly Operational Expenses $ 15,000.00 12 13 14 Fed Funds Rate Discount Rate Reserve Requirement 0.25% 0.50% 10.00% 15 16 17 18 Profit and Loss (Monthly) Month Revenue Expenses Net Income/Loss (transaction) Balance Sheet (Deposits on hand) (Liabilities) 19 Transactions are monthly 20 21 22 Transaction #1 Borrower comes in to borrow $3,000,000 for 10 years at 8%. He deposits money at different bank January 5 20,000.00 ### (6,458.34) 23 24 25 Transaction #2 Depositor makes a $1,000,000 deposit into a DDA-2 account 26 February 27 28 29 Transaction # 1 February $ 19,890.68 S (6,567,66) 15 16 18 Net Income/Loss (transaction) Expenses Statement Balance Reserve Requirement (deposits X RR) Deposits on hand Balance Sheet (Deposits on hand) (Liabilities) Rolling Net Income/Lass BB Yes No 100.00 $ 16,458.34) , $ 1,000,000.00 S 16,458.34 WWW ### $ 1,100,000.00 $ (6,458 341 S 16.567.66) $ 1.100.000.00 S (12.025.00 ARM 30 Transactions for tonight Transaction 3: Borrower takes out a 1MM loan at 9% for 4 years. He deposits money at a different bank. Remember you must process this transaction and all other transactions that would be in March. 1 Banking Project 2 3 4 Starting point 50% 25% 25% Amount $ 5,000,000.00 $ 2,500,000.00 $ 2,500,000.00 DDA CD's DDA-2 Rate Interest Paid (monthly) 1.00% $ 4,166.67 3.50% $ 7,291.67 0.00% $ 5 6 7 8 9 $10,000,000.00 $ 11,458.33 Total Cost of Funds 1.375% 10 11 Monthly Operational Expenses $ 15,000.00 12 13 14 Fed Funds Rate Discount Rate Reserve Requirement 0.25% 0.50% 10.00% 15 16 17 18 Profit and Loss (Monthly) Month Revenue Expenses Net Income/Loss (transaction) Balance Sheet (Deposits on hand) (Liabilities) 19 Transactions are monthly 20 21 22 Transaction #1 Borrower comes in to borrow $3,000,000 for 10 years at 8%. He deposits money at different bank January 5 20,000.00 ### (6,458.34) 23 24 25 Transaction #2 Depositor makes a $1,000,000 deposit into a DDA-2 account 26 February 27 28 29 Transaction # 1 February $ 19,890.68 S (6,567,66) 15 16 18 Net Income/Loss (transaction) Expenses Statement Balance Reserve Requirement (deposits X RR) Deposits on hand Balance Sheet (Deposits on hand) (Liabilities) Rolling Net Income/Lass BB Yes No 100.00 $ 16,458.34) , $ 1,000,000.00 S 16,458.34 WWW ### $ 1,100,000.00 $ (6,458 341 S 16.567.66) $ 1.100.000.00 S (12.025.00 ARM 30