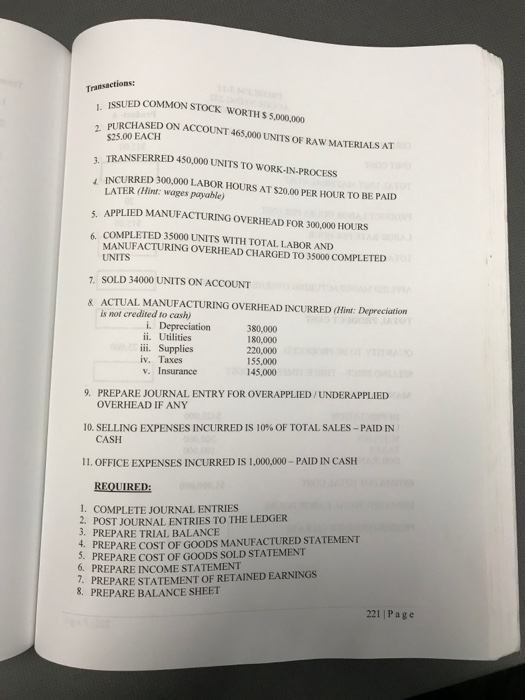

Transactions: ISSUED COMMON STOCK WORTH S 5,00,.00 PURCHASED ON ACCOUNT 465,000 UNITS OF RAW MATERIALS AT 2. $25.00 EACH 3, TRANSFERRED 450,000 UNITS TO WORK-IN-PROCESS 4 INCURRED 300,000 LABOR HOURS AT s20.00 PER HOUR TO BE PAID LATER (Hint: wages payable) PLIED MANUFACTURING OVERHEAD FOR 300,000 HOURS COMPLETED 35000 UNITS WITH TOTAL LABOR ANID MANUFACTURING OVERHEAD CHARGED TO 35000 COMPLETED UNITS 6. 7 SOLD 34000 UNITS ON ACCOUNT & ACTUAL MANUFACTURING OVERHEAD INCURRED (Hint: Depreciation is not credited to cash) 380,000 180,000 220,000 155,000 145,000 ii. Utilities ii. Supplies iv. Taxes v. Insurance 9. PREPARE JOURNAL ENTRY FOR OVERAPPLIED/UNDERAPPLIED OVERHEAD IF ANY 10. SELLING EXPENSES INCURRED IS 100% OF TOTAL SALES-PAID IN CASH 11, OFFICE EXPENSES INCURRED Is i,000,00-PAID IN CASH REQUIRED 1. COMPLETE JOURNAL ENTRIES 2. POST JOURNAL ENTRIES TO THE LEDGER 3. PREPARE TRIAL BALANCE 4. PREPARE COST OF GOODS MANUFACTURED STATEMENT . PREPARE COST OF GOODS SOLD STATEMENT 6. PREPARE INCOME STATEMENT PREPARE STATEMENT OF RETAINED EARNINGS 8. PREPARE BALANCE SHEET 221 |Page Transactions: ISSUED COMMON STOCK WORTH S 5,00,.00 PURCHASED ON ACCOUNT 465,000 UNITS OF RAW MATERIALS AT 2. $25.00 EACH 3, TRANSFERRED 450,000 UNITS TO WORK-IN-PROCESS 4 INCURRED 300,000 LABOR HOURS AT s20.00 PER HOUR TO BE PAID LATER (Hint: wages payable) PLIED MANUFACTURING OVERHEAD FOR 300,000 HOURS COMPLETED 35000 UNITS WITH TOTAL LABOR ANID MANUFACTURING OVERHEAD CHARGED TO 35000 COMPLETED UNITS 6. 7 SOLD 34000 UNITS ON ACCOUNT & ACTUAL MANUFACTURING OVERHEAD INCURRED (Hint: Depreciation is not credited to cash) 380,000 180,000 220,000 155,000 145,000 ii. Utilities ii. Supplies iv. Taxes v. Insurance 9. PREPARE JOURNAL ENTRY FOR OVERAPPLIED/UNDERAPPLIED OVERHEAD IF ANY 10. SELLING EXPENSES INCURRED IS 100% OF TOTAL SALES-PAID IN CASH 11, OFFICE EXPENSES INCURRED Is i,000,00-PAID IN CASH REQUIRED 1. COMPLETE JOURNAL ENTRIES 2. POST JOURNAL ENTRIES TO THE LEDGER 3. PREPARE TRIAL BALANCE 4. PREPARE COST OF GOODS MANUFACTURED STATEMENT . PREPARE COST OF GOODS SOLD STATEMENT 6. PREPARE INCOME STATEMENT PREPARE STATEMENT OF RETAINED EARNINGS 8. PREPARE BALANCE SHEET 221 |Page