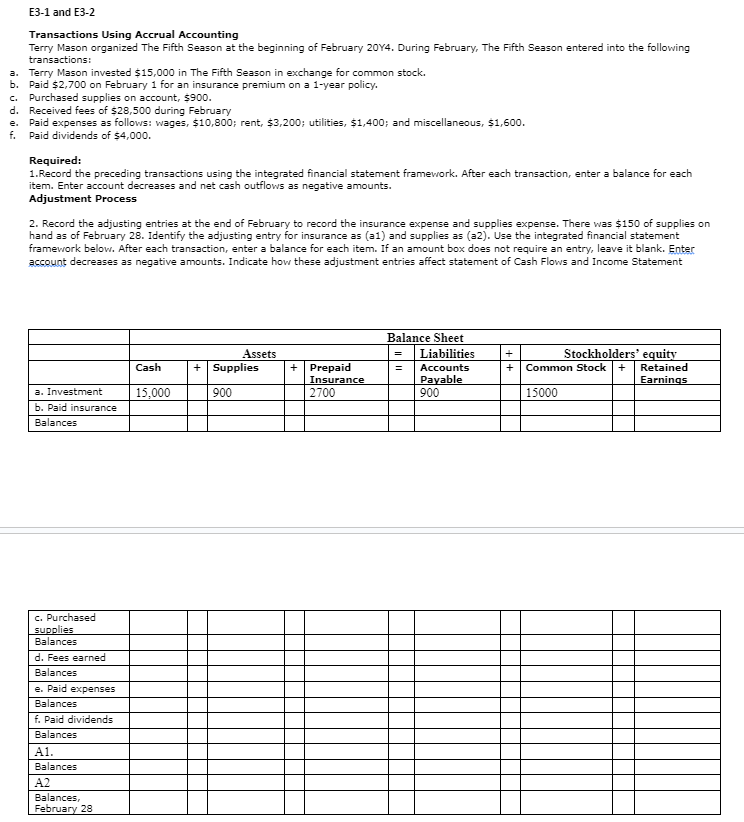

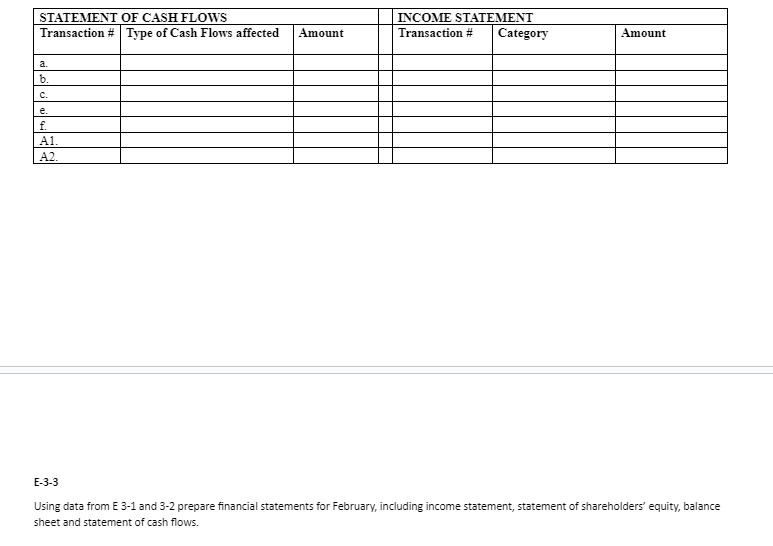

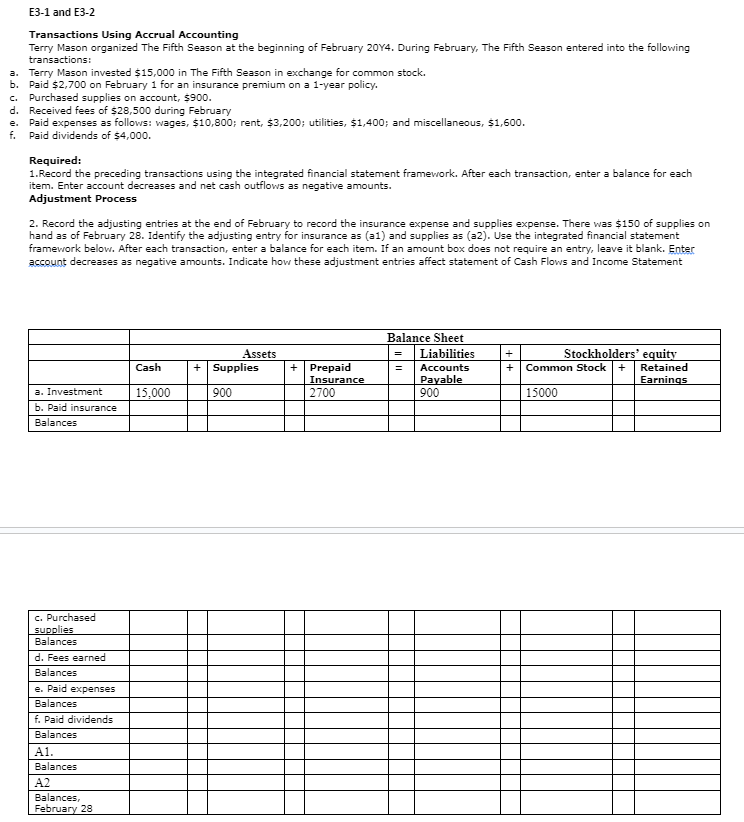

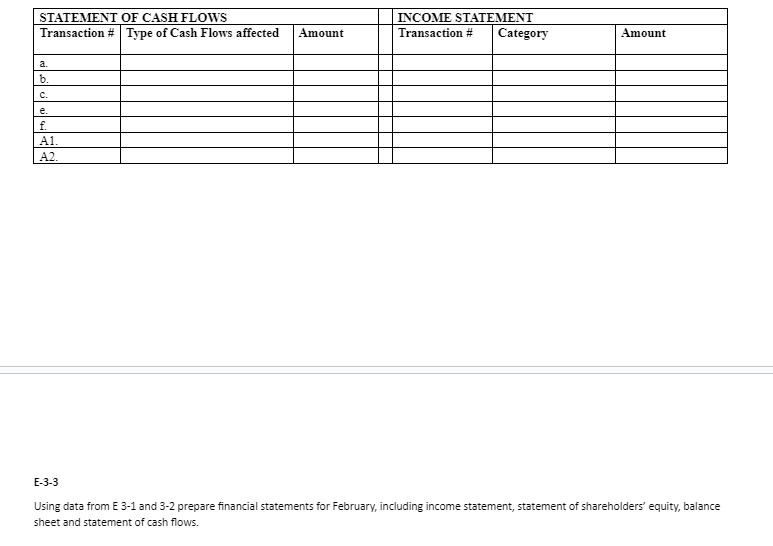

Transactions Using Accrual Accounting Terry Mason organized The Fifth Season at the beginning of February 20Y4. During February, The Fifth Season entered into the following transactions: Terry Mason invested $15,000 in The Fifth Season in exchange for common stock. Paid $2,700 on February 1 for an insurance premium on a 1 -year policy. Purchased supplies on account, 5900 . Received fees of $28,500 during February Paid expenses as follows: wages, $10,800; rent, $3,200; utilities, $1,400; and miscellaneous, $1,600. Paid dividends of $4,000. Required: 1. Record the preceding transactions using the integrated financial statement framework. After each transaction, enter a balance for each item. Enter account decreases and net cash outflows as negative amounts. Adjustment Process 2. Record the adjusting entries at the end of February to record the insurance expense and supplies expense. There was $150 of supplies on hand as of February 28. Identify the adjusting entry for insurance as (a1) and supplies as (a2). Use the integrated financial statement framework below. After each transaction, enter a balance for each item. If an amount box does not require an entry, leave it blank. Enter account decreases as negative amounts. Indicate how these adjustment entries affect statement of Cash Flows and Income Statement Using data from E 3-1 and 3-2 prepare financial statements for February, including income statement, statement of shareholders' equity, balance sheet and statement of cash flows. Transactions Using Accrual Accounting Terry Mason organized The Fifth Season at the beginning of February 20Y4. During February, The Fifth Season entered into the following transactions: Terry Mason invested $15,000 in The Fifth Season in exchange for common stock. Paid $2,700 on February 1 for an insurance premium on a 1 -year policy. Purchased supplies on account, 5900 . Received fees of $28,500 during February Paid expenses as follows: wages, $10,800; rent, $3,200; utilities, $1,400; and miscellaneous, $1,600. Paid dividends of $4,000. Required: 1. Record the preceding transactions using the integrated financial statement framework. After each transaction, enter a balance for each item. Enter account decreases and net cash outflows as negative amounts. Adjustment Process 2. Record the adjusting entries at the end of February to record the insurance expense and supplies expense. There was $150 of supplies on hand as of February 28. Identify the adjusting entry for insurance as (a1) and supplies as (a2). Use the integrated financial statement framework below. After each transaction, enter a balance for each item. If an amount box does not require an entry, leave it blank. Enter account decreases as negative amounts. Indicate how these adjustment entries affect statement of Cash Flows and Income Statement Using data from E 3-1 and 3-2 prepare financial statements for February, including income statement, statement of shareholders' equity, balance sheet and statement of cash flows