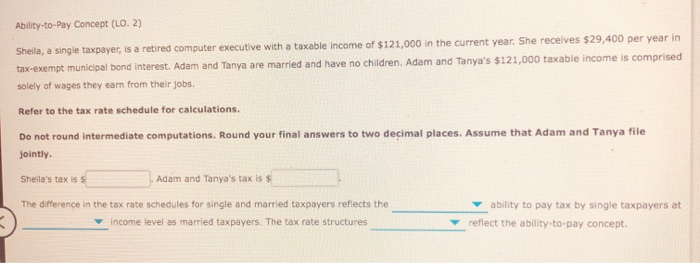

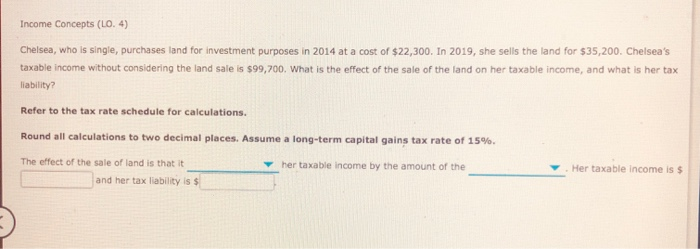

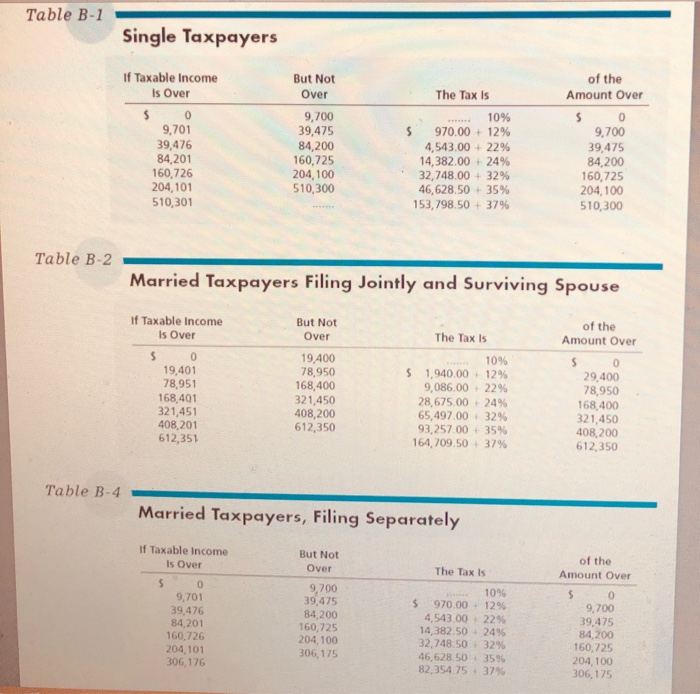

Ability-to-Pay Concept (LO. 2) Sheila, a single taxpayer, is a retired computer executive with a taxable income of $121,000 in the current year. She receives $29,400 per year in tax-exempt municipal bond interest. Adam and Tanya are married and have no children. Adam and Tanya's $121,000 taxable income is comprised solely of wages they earn from their jobs. Refer to the tax rate schedule for calculations. Do not round intermediate computations. Round your final answers to two decimal places. Assume that Adam and Tanya file jointly. Sheila's tax iss Adam and Tanya's tax is $ The difference in the tax rate schedules for single and married taxpayers reflects the income level as married taxpayers. The tax rate structures ability to pay tax by single taxpayers at reflect the ability-to-pay concept. Income Concepts (LO. 4) Chelsea, who is single, purchases land for investment purposes in 2014 at a cost of $22,300. In 2019, she sells the land for $35,200. Chelsea's taxable income without considering the land sale is $99,700. What is the effect of the sale of the land on her taxable income, and what is her tax liability Refer to the tax rate schedule for calculations. Round all calculations to two decimal places. Assume a long-term capital gains tax rate of 15%. her taxable income by the amount of the The effect of the sale of land is that it and her tax liability is $ . Her taxable income is $ Table B-1 Single Taxpayers If Taxable income Is Over 9,701 39,476 84,201 160,726 204,101 510,301 But Not Over 9,700 39,475 84,200 160,725 204,100 510,300 The Tax is ...... 10% 970.00 + 12% 4,543.00 + 22% 14,382.00 +24% 32,748.00 + 32% 46,628.50 + 35% 153,798,50 + 37% of the Amount Over 0 9,700 39,475 84,200 160,725 204,100 510,300 Table B-2 Married Taxpayers Filing Jointly and Surviving Spouse if Taxable income Is Over But Not Over of the Amount Over 19,401 78,951 168,401 321,451 408,201 612,351 19,400 78,950 168,400 321,450 408,200 612,350 The Tax Is 10% $ 1.940.00 +12% 9,086.00.22% 28,675.00 +24% 65,497.00 32% 93,257.00 35% 164,709.50 37% 29,400 78.950 168,400 321,450 408,200 612,350 Table B-4 Married Taxpayers, Filing Separately But Not Over The Tax is of the Amount Over If Taxable income Is Over 50 9,701 39,476 84,201 160.726 204,101 306 176 9,700 39,475 84,200 160,725 204,100 306,175 109 $ 970.00 1296 4,543.00 2296 14,382.50 2496 32.748.50 32% 46.628.50 35% 82.354.75 +3796 9,700 39,475 84,200 160,725 204,100 306,175