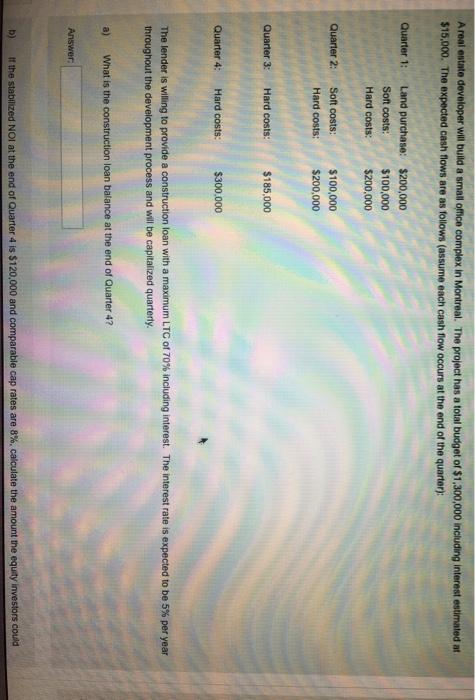

Areal estate developer will build a small office complex in Montreal. The project has a total budget of $1,300,000 including interest estimated at $15,000. The expected cash flows are as follows (assume each cash flow occurs at the end of the quarter): Quarter 1: Land purchase: $200,000 Soft costs: $100,000 Hard costs: $200,000 Quarter 2: Soft costs: Hard costs: $100,000 $200,000 Quarter 3: Hard costs: $185,000 Quarter 4: Hard costs $300.000 The lender is willing to provide a construction loan with a maximum LTC of 70% including interest. The interest rate is expected to be 5% per year throughout the development process and will be capitalized quarterly a) What is the construction loan balance at the end of Quarter 4? Answer: b) If the stabilized NOI at the end of Quarter 4 is $120,000 and comparable cap rates are 8%, calculate the amount the equity investors could What is the construction loan balance at the end of Quarter 47 Answer: b) if the stabilized NOI at the end of Quarter 4 is $120,000 and comparable cap rates are 8%, calculate the amount the equity investors could withdraw from the project if they secure a 5-year mortgage with an interest rate of 5%, an amortization period of 15 years, a maximum LTV of 75% and a minimum DSCR of 1.25. Answer: Areal estate developer will build a small office complex in Montreal. The project has a total budget of $1,300,000 including interest estimated at $15,000. The expected cash flows are as follows (assume each cash flow occurs at the end of the quarter): Quarter 1: Land purchase: $200,000 Soft costs: $100,000 Hard costs: $200,000 Quarter 2: Soft costs: Hard costs: $100,000 $200,000 Quarter 3: Hard costs: $185,000 Quarter 4: Hard costs $300.000 The lender is willing to provide a construction loan with a maximum LTC of 70% including interest. The interest rate is expected to be 5% per year throughout the development process and will be capitalized quarterly a) What is the construction loan balance at the end of Quarter 4? Answer: b) If the stabilized NOI at the end of Quarter 4 is $120,000 and comparable cap rates are 8%, calculate the amount the equity investors could What is the construction loan balance at the end of Quarter 47 Answer: b) if the stabilized NOI at the end of Quarter 4 is $120,000 and comparable cap rates are 8%, calculate the amount the equity investors could withdraw from the project if they secure a 5-year mortgage with an interest rate of 5%, an amortization period of 15 years, a maximum LTV of 75% and a minimum DSCR of 1.25