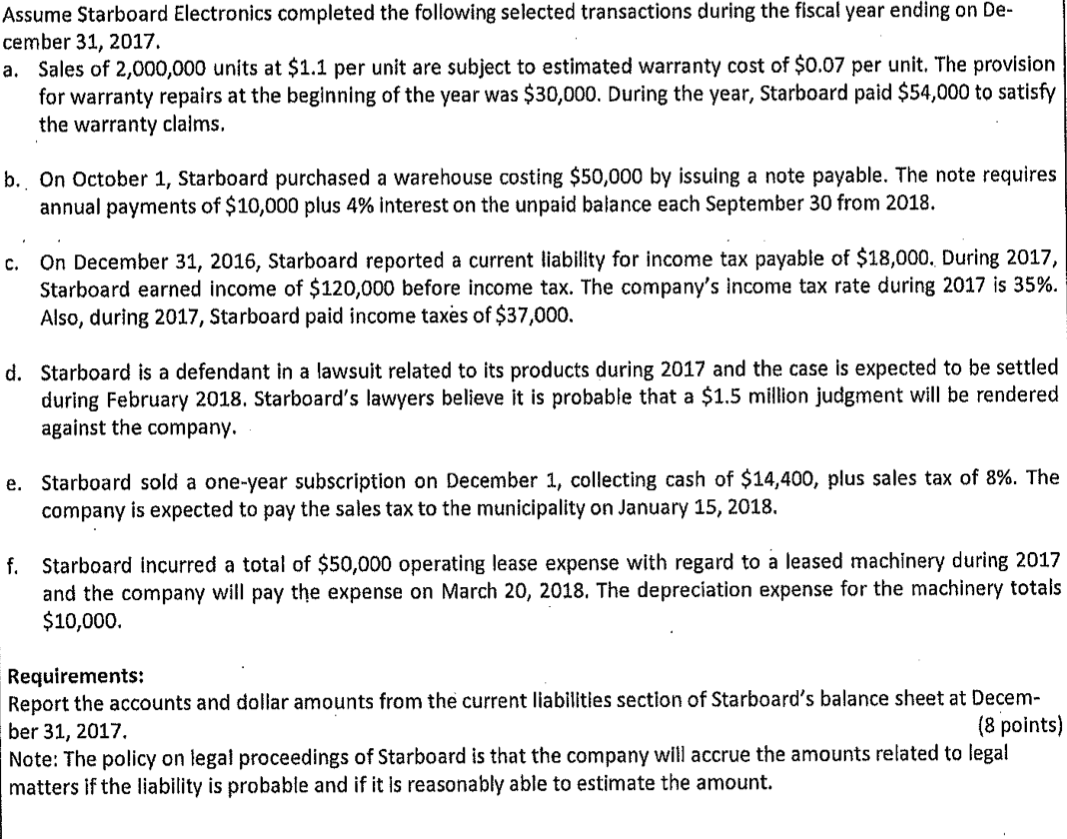

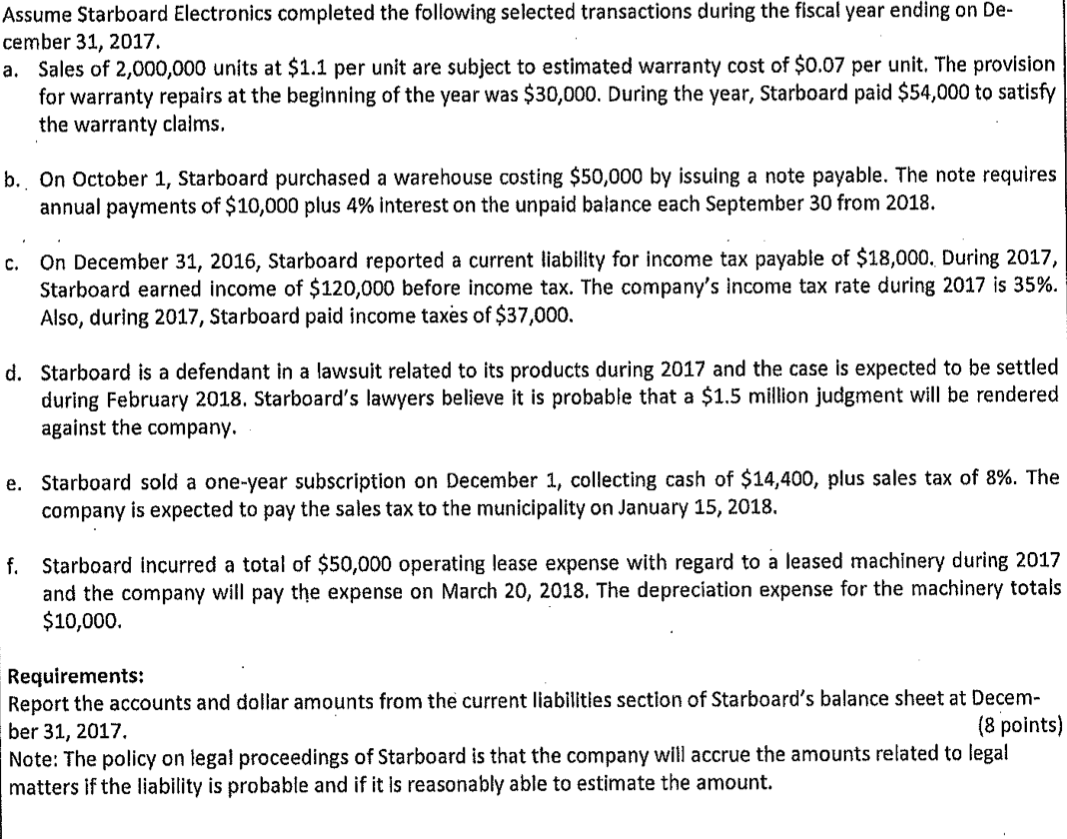

Assume Starboard Electronics completed the following selected transactions during the fiscal year ending on De- cember 31, 2017 a. Sales of 2,000,000 units at $1.1 per unit are subject to estimated warranty cost of $0.07 per unit. The provision for warranty repairs at the beginning of the year was $30,000. During the year, Starboard paid $54,000 to satisfy the warranty claims. b. On October 1, Starboard purchased a warehouse costing $50,000 by issuing a note payable. The note requires annual payments of $10,000 plus 4% interest on the unpaid balance each September 30 from 2018. C. On December 31, 2016, Starboard reported a current liability for income tax payable of $18,000. During 2017, Starboard earned income of $120,000 before income tax. The company's income tax rate during 2017 is 35%. Also, during 2017, Starboard paid income taxes of $37,000. d. Starboard is a defendant in a lawsuit related to its products during 2017 and the case is expected to be settled during February 2018. Starboard's lawyers believe it is probable that a $1.5 million judgment will be rendered against the company. e. Starboard sold a one-year subscription on December 1, collecting cash of $14,400, plus sales tax of 8%. The company is expected to pay the sales tax to the municipality on January 15, 2018. f. Starboard incurred a total of $50,000 operating lease expense with regard to a leased machinery during 2017 and the company will pay the expense on March 20, 2018. The depreciation expense for the machinery totals $10,000. Requirements: Report the accounts and dollar amounts from the current liabilities section of Starboard's balance sheet at Decem- ber 31, 2017 (8 points) Note: The policy on legal proceedings of Starboard is that the company will accrue the amounts related to legal matters if the liability is probable and if it is reasonably able to estimate the amount. Assume Starboard Electronics completed the following selected transactions during the fiscal year ending on De- cember 31, 2017 a. Sales of 2,000,000 units at $1.1 per unit are subject to estimated warranty cost of $0.07 per unit. The provision for warranty repairs at the beginning of the year was $30,000. During the year, Starboard paid $54,000 to satisfy the warranty claims. b. On October 1, Starboard purchased a warehouse costing $50,000 by issuing a note payable. The note requires annual payments of $10,000 plus 4% interest on the unpaid balance each September 30 from 2018. C. On December 31, 2016, Starboard reported a current liability for income tax payable of $18,000. During 2017, Starboard earned income of $120,000 before income tax. The company's income tax rate during 2017 is 35%. Also, during 2017, Starboard paid income taxes of $37,000. d. Starboard is a defendant in a lawsuit related to its products during 2017 and the case is expected to be settled during February 2018. Starboard's lawyers believe it is probable that a $1.5 million judgment will be rendered against the company. e. Starboard sold a one-year subscription on December 1, collecting cash of $14,400, plus sales tax of 8%. The company is expected to pay the sales tax to the municipality on January 15, 2018. f. Starboard incurred a total of $50,000 operating lease expense with regard to a leased machinery during 2017 and the company will pay the expense on March 20, 2018. The depreciation expense for the machinery totals $10,000. Requirements: Report the accounts and dollar amounts from the current liabilities section of Starboard's balance sheet at Decem- ber 31, 2017 (8 points) Note: The policy on legal proceedings of Starboard is that the company will accrue the amounts related to legal matters if the liability is probable and if it is reasonably able to estimate the amount