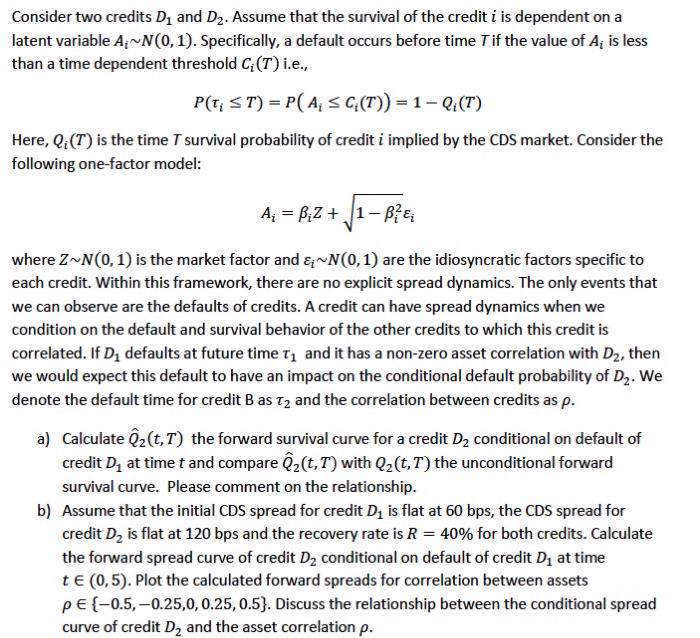

Consider two credits D, and D2. Assume that the survival of the credit i is dependent on a latent variable A;~N(0,1). Specifically, a default occurs before time Tif the value of A; is less than a time dependent threshold C(T)i.e., P(T; ST) = P(A SC (T)) = 1 - 0 (T) Here, Qi(T) is the time I survival probability of credit i implied by the CDS market. Consider the following one-factor model: A; = Biz + /1-Bei where Z~N(0,1) is the market factor and &~N(0,1) are the idiosyncratic factors specific to each credit. Within this framework, there are no explicit spread dynamics. The only events that we can observe are the defaults of credits. A credit can have spread dynamics when we condition on the default and survival behavior of the other credits to which this credit is correlated. If De defaults at future time T1 and it has a non-zero asset correlation with D2, then we would expect this default to have an impact on the conditional default probability of D2. We denote the default time for credit B as T2 and the correlation between credits as p. a) Calculate @2(t,T) the forward survival curve for a credit Da conditional on default of credit D, at time t and compare @z(t,T) with Q2(t,T) the unconditional forward survival curve. Please comment on the relationship. b) Assume that the initial CDS spread for credit D, is flat at 60 bps, the CDS spread for credit D is flat at 120 bps and the recovery rate is R = 40% for both credits. Calculate the forward spread curve of credit D2 conditional on default of credit D, at time te (0,5). Plot the calculated forward spreads for correlation between assets PE{-0.5, -0.25,0,0.25, 0.5). Discuss the relationship between the conditional spread curve of credit D, and the asset correlation p. Consider two credits D, and D2. Assume that the survival of the credit i is dependent on a latent variable A;~N(0,1). Specifically, a default occurs before time Tif the value of A; is less than a time dependent threshold C(T)i.e., P(T; ST) = P(A SC (T)) = 1 - 0 (T) Here, Qi(T) is the time I survival probability of credit i implied by the CDS market. Consider the following one-factor model: A; = Biz + /1-Bei where Z~N(0,1) is the market factor and &~N(0,1) are the idiosyncratic factors specific to each credit. Within this framework, there are no explicit spread dynamics. The only events that we can observe are the defaults of credits. A credit can have spread dynamics when we condition on the default and survival behavior of the other credits to which this credit is correlated. If De defaults at future time T1 and it has a non-zero asset correlation with D2, then we would expect this default to have an impact on the conditional default probability of D2. We denote the default time for credit B as T2 and the correlation between credits as p. a) Calculate @2(t,T) the forward survival curve for a credit Da conditional on default of credit D, at time t and compare @z(t,T) with Q2(t,T) the unconditional forward survival curve. Please comment on the relationship. b) Assume that the initial CDS spread for credit D, is flat at 60 bps, the CDS spread for credit D is flat at 120 bps and the recovery rate is R = 40% for both credits. Calculate the forward spread curve of credit D2 conditional on default of credit D, at time te (0,5). Plot the calculated forward spreads for correlation between assets PE{-0.5, -0.25,0,0.25, 0.5). Discuss the relationship between the conditional spread curve of credit D, and the asset correlation p