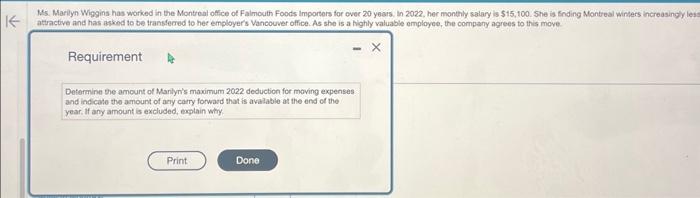

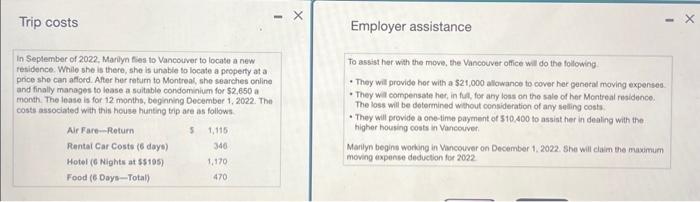

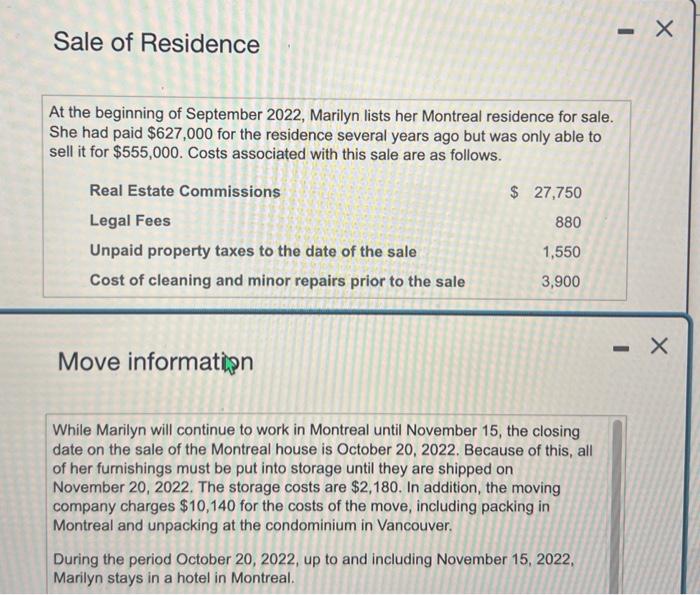

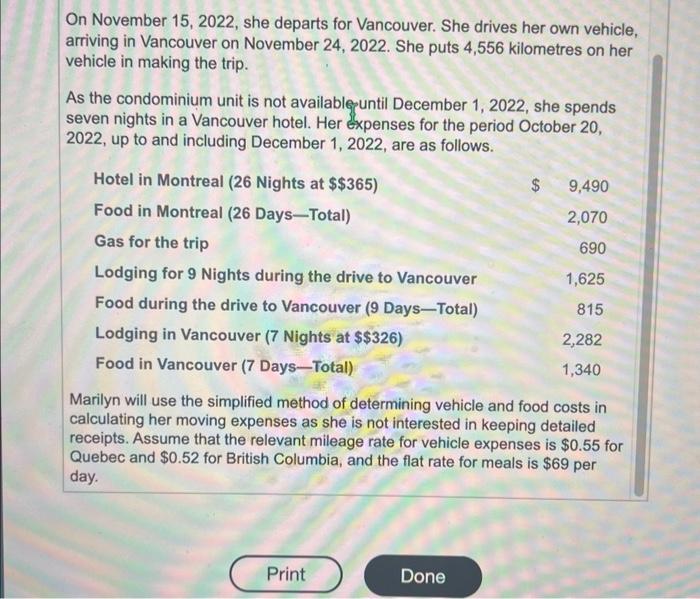

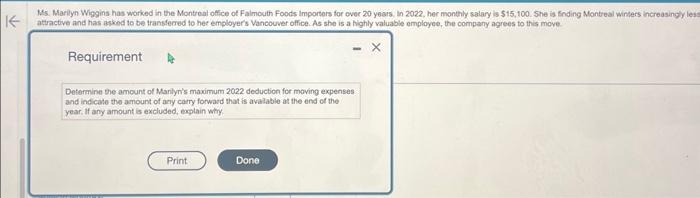

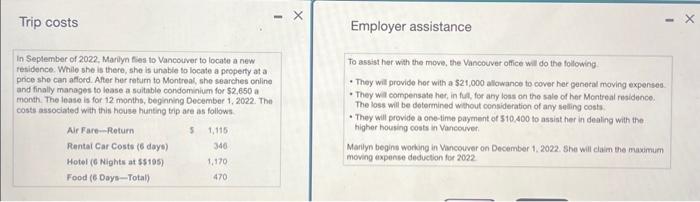

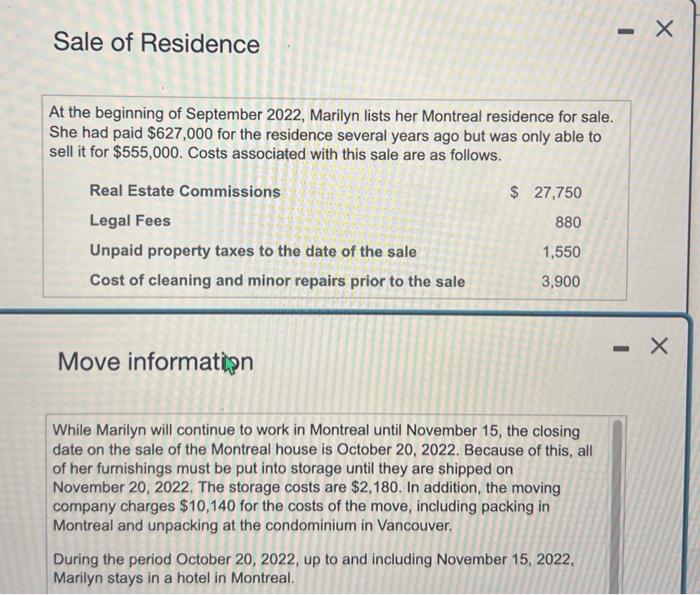

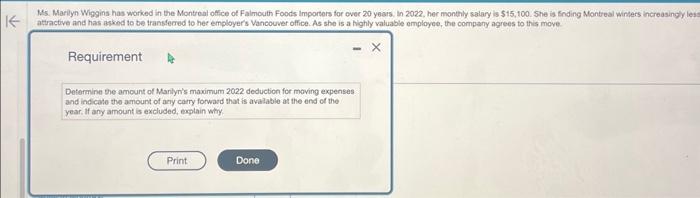

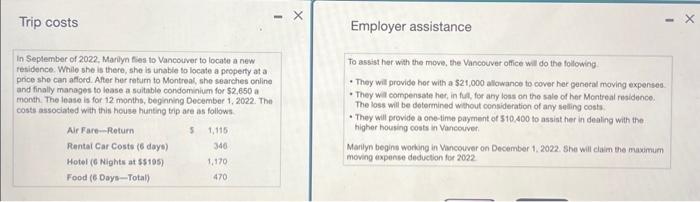

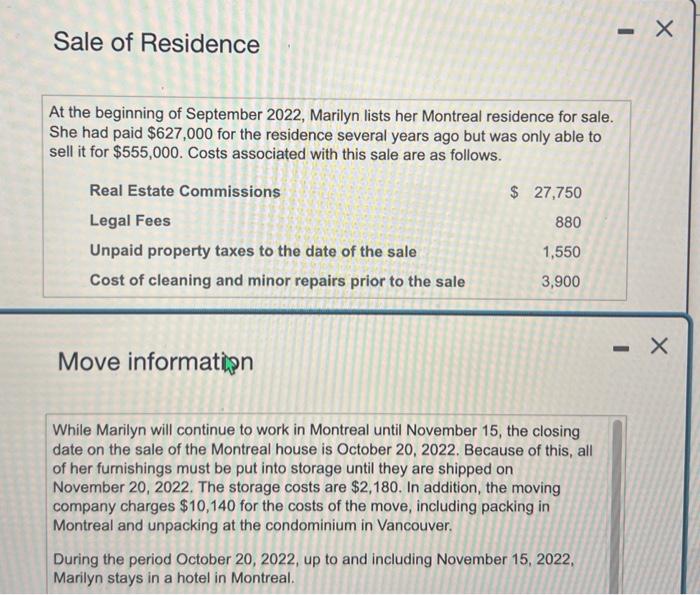

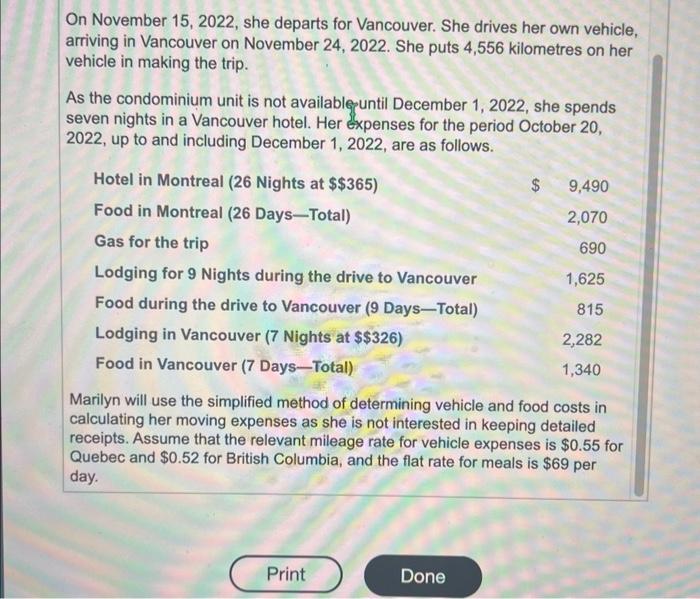

M5. Marilyn Wiggins has worked in the Montroat office of Falmouth Foods importers for over 20 years. in 2022 , her monthly salary is $15 , 100 . She is tnding Montreal wirders increasingly le3 attractive and has asked to be transfecred to her employer's Vancouver office. As she is a highly valuable employee, the company agrees to this move. Requirement Determine the amount of Manilyn's maximum 2022 deduction for moving expenses and indicate the amount of any corry forwaod that is avalable at the end of the year. If any arnount is excluded, explain wity In September of 2022, Marilyn fies to Vancouver to locate a new residence. While she is there, she is unable to locate a property at a To assist her with the move, the Vancouver ofice will do the following price she can aflord. After her ratum to Montreal, she searches online and finally manages to loase a soitable condominium for 52,650 a - They wit provide hor with a $21 , 000 allowance to cover her ganetal moving expensed. month. The lease is for 12 months, beginning December 1,2022 . Thn - They wa compensate her, in fuly, for any loss on the sale of her Montreal residence. costs associated with this house hunting trip are as follows The loss will be sotermined without consideration of any seling costs - They will provide a one-tinse payment of 510,400 to assist her in dealing with the higher housing costs in Vancouver. Marilyn begine working in Vancouver on December 1, 2022. She will claim the maxamum moving expense deduction for 2022 Sale of Residence At the beginning of September 2022, Marilyn lists her Montreal residence for sale. She had paid $627 , 000 for the residence several years ago but was only able to sell it for $555 , 000 . Costs associated with this sale are as follows. Move information While Marilyn will continue to work in Montreal until November 15 , the closing date on the sale of the Montreal house is October 20,2022. Because of this, all of her furnishings must be put into storage until they are shipped on November 20,2022 . The storage costs are $2 , 180 . In addition, the moving company charges $10 , 140 for the costs of the move, including packing in Montreal and unpacking at the condominium in Vancouver. During the period October 20,2022, up to and including November 15,2022 , Marilyn stays in a hotel in Montreal. On November 15,2022 , she departs for Vancouver. She drives her own vehicle, arriving in Vancouver on November 24,2022 . She puts 4,556 kilometres on her vehicle in making the trip. As the condominium unit is not availabl?until December 1,2022, she spends seven nights in a Vancouver hotel. Her Expenses for the period October 20 , 2022, up to and including December 1,2022 , are as follows. Marilyn will use the simplified method of determining vehicle and food costs in calculating her moving expenses as she is not interested in keeping detailed receipts. Assume that the relevant mileage rate for vehicle expenses is $0.55 for Quebec and $0.52 for British Columbia, and the flat rate for meals is $69 per day