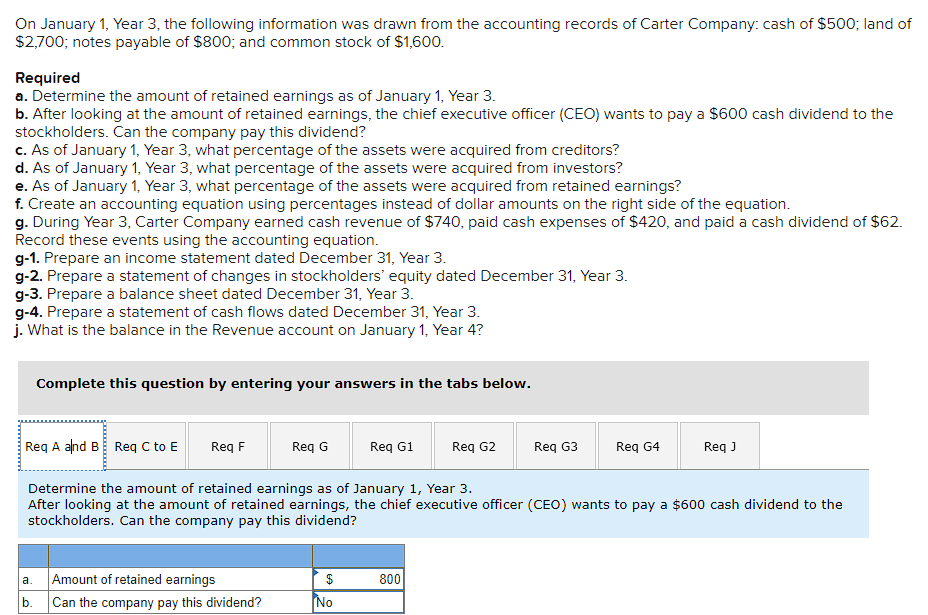

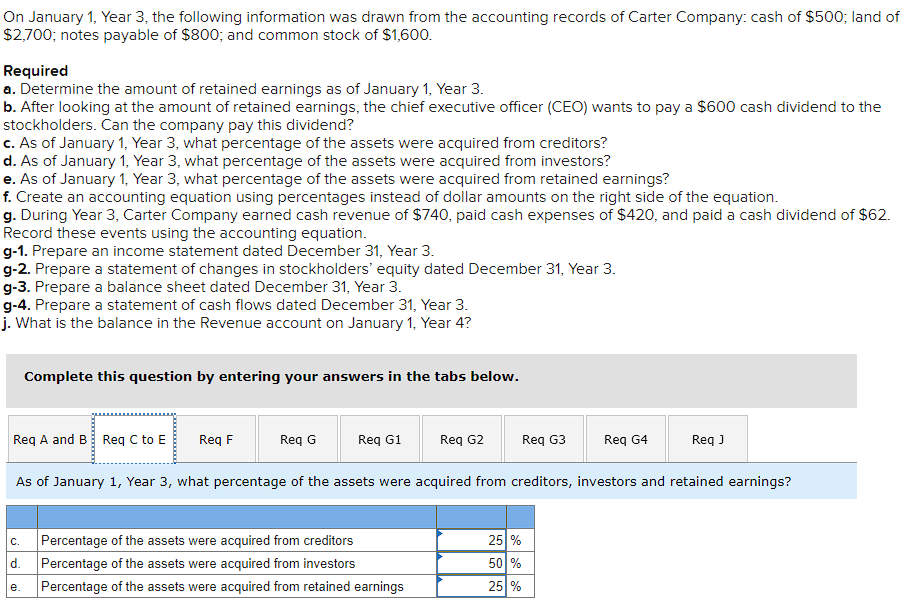

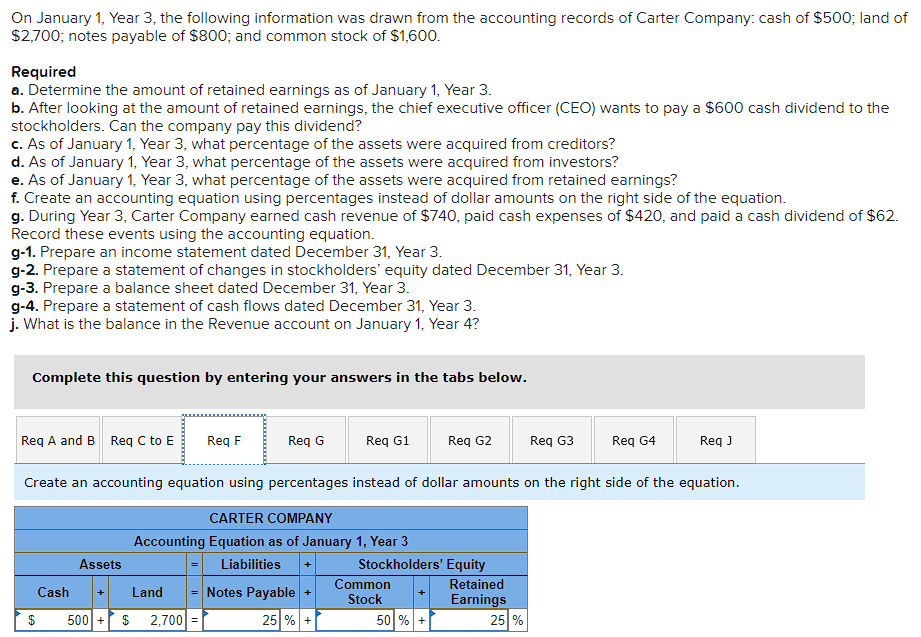

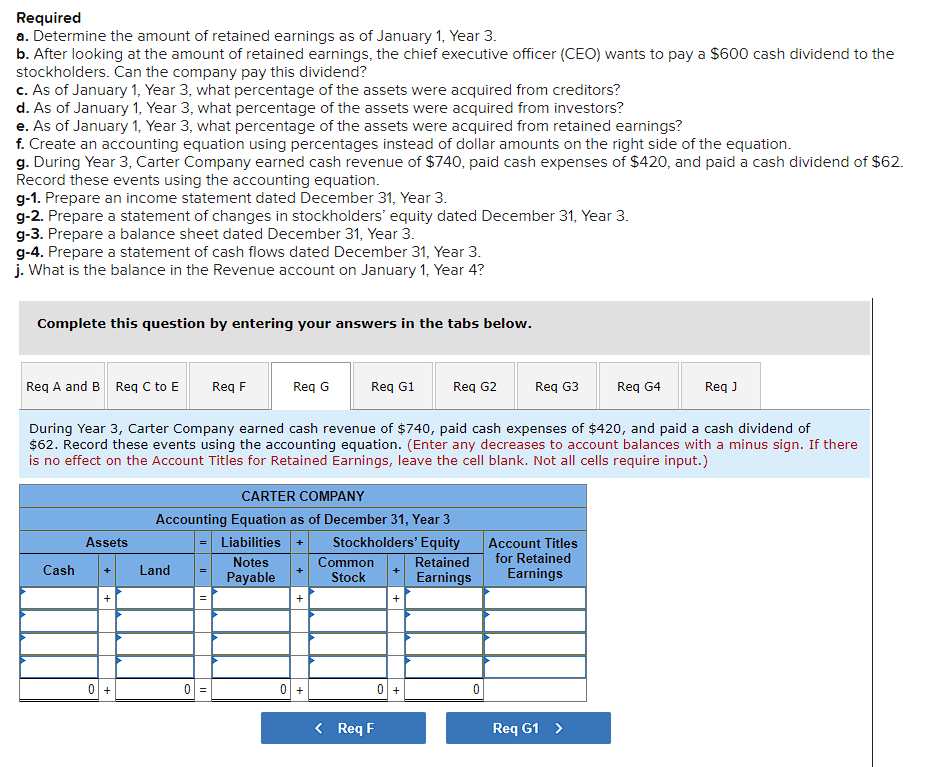

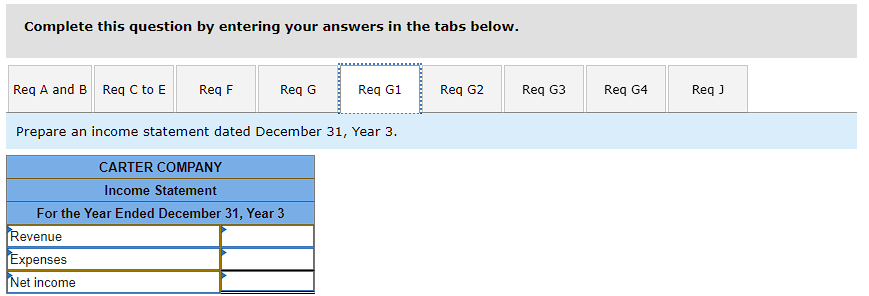

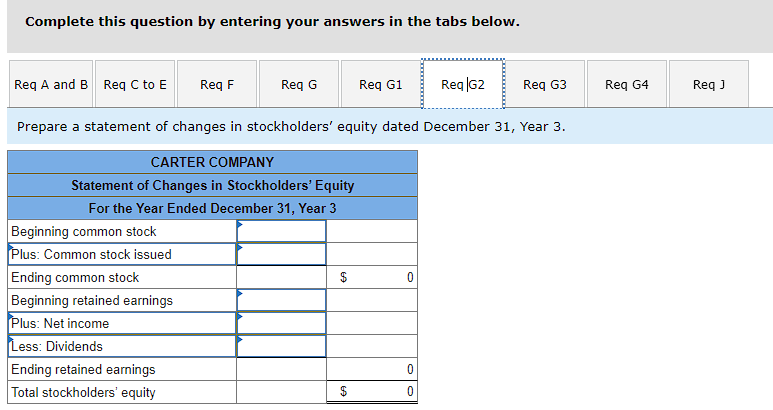

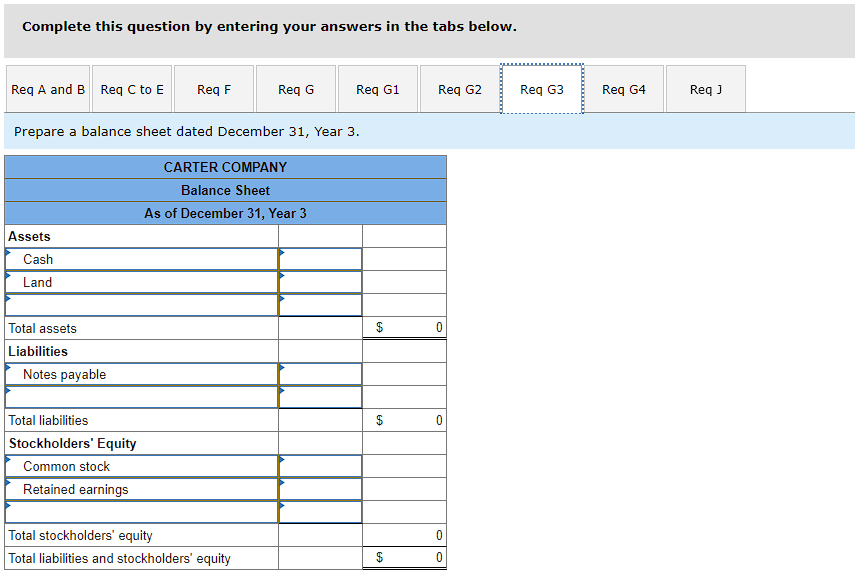

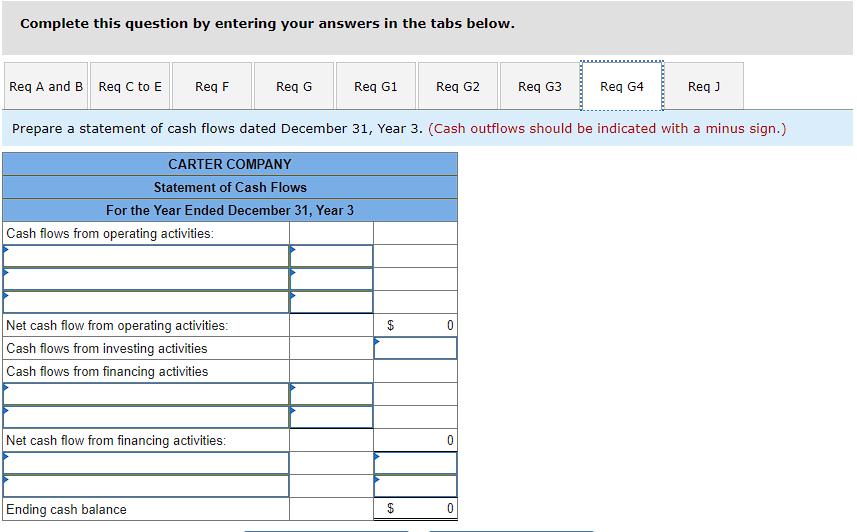

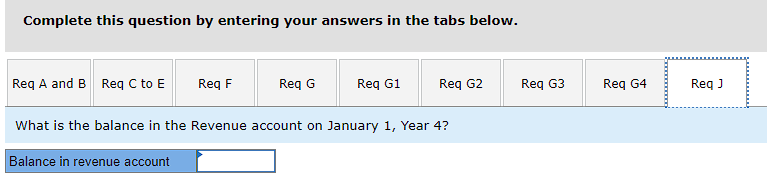

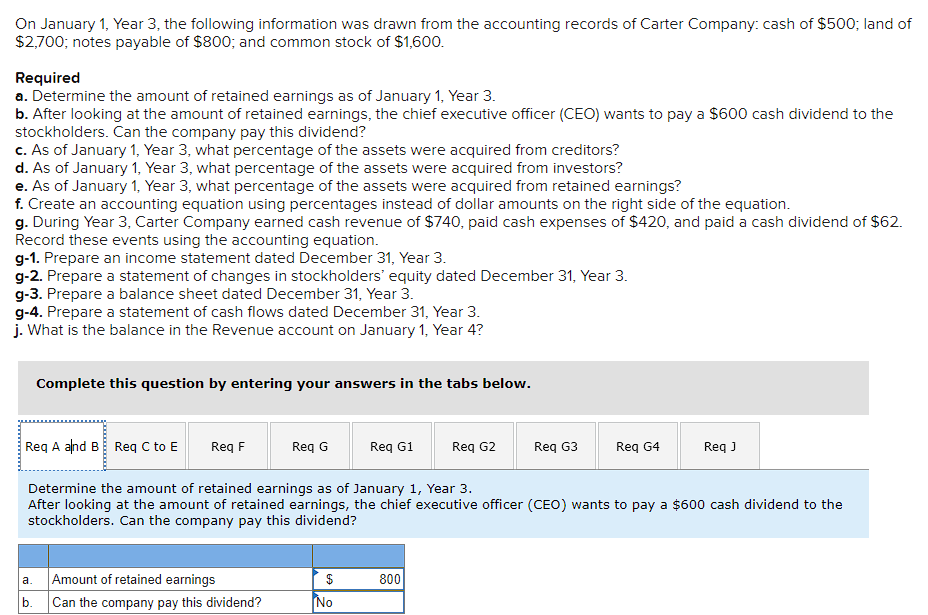

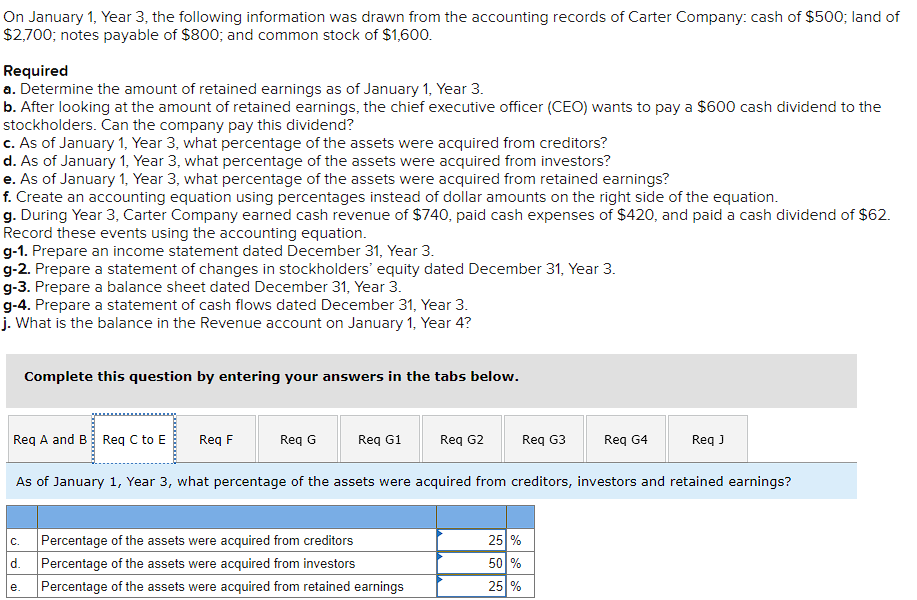

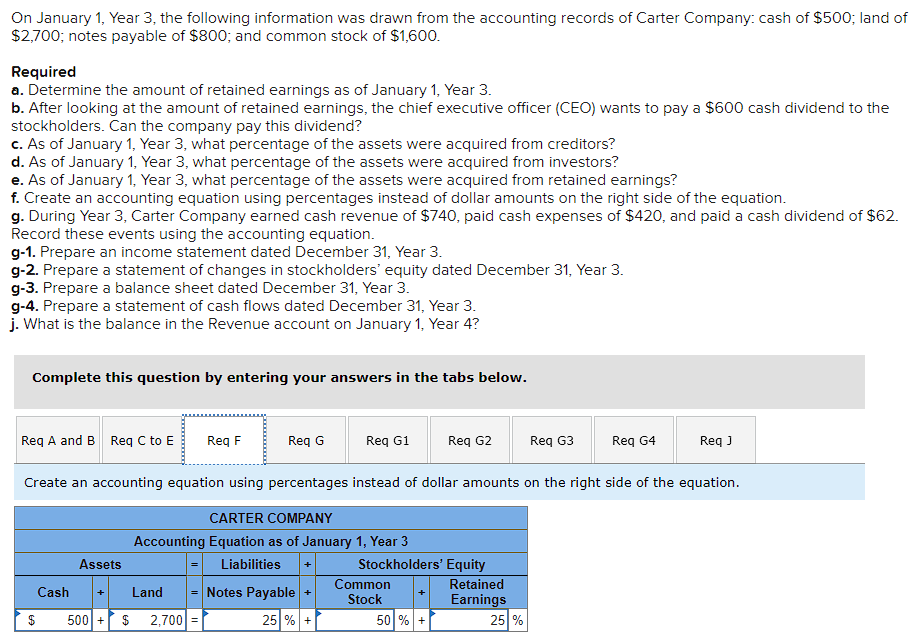

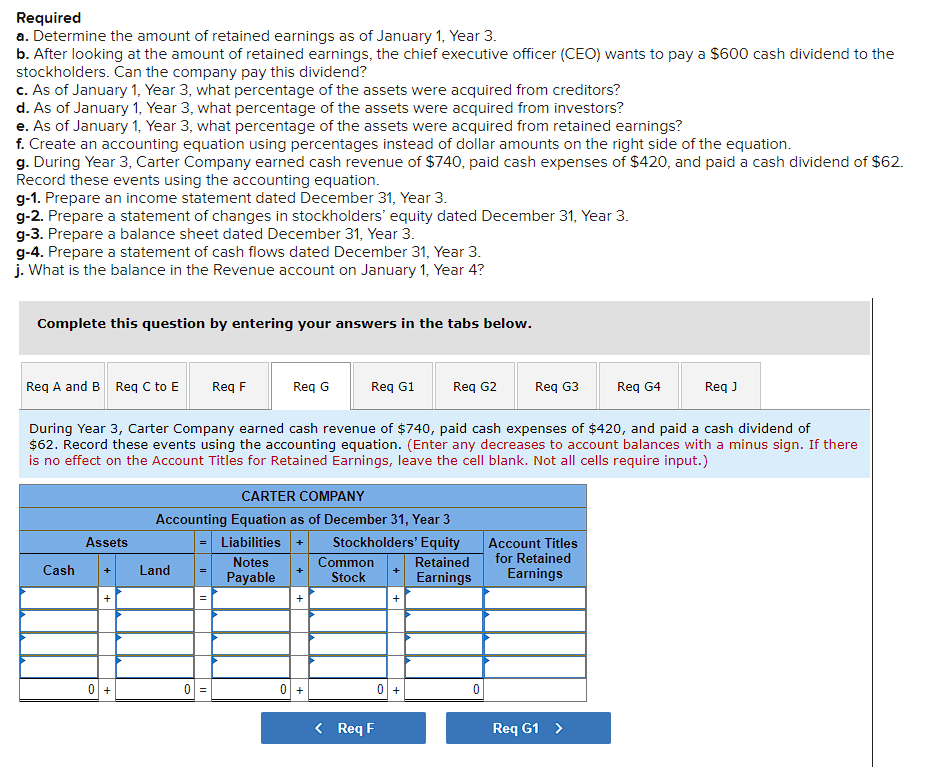

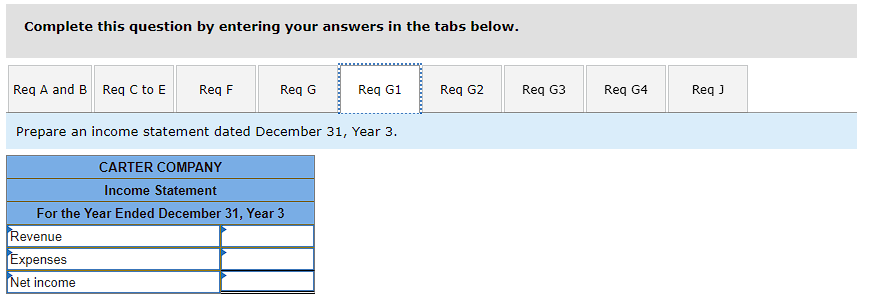

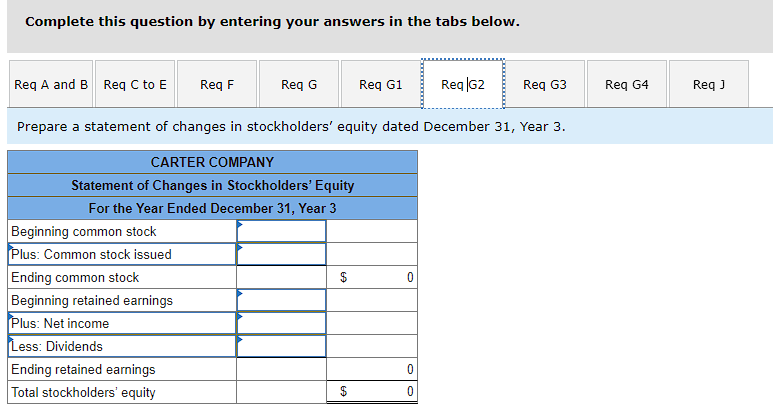

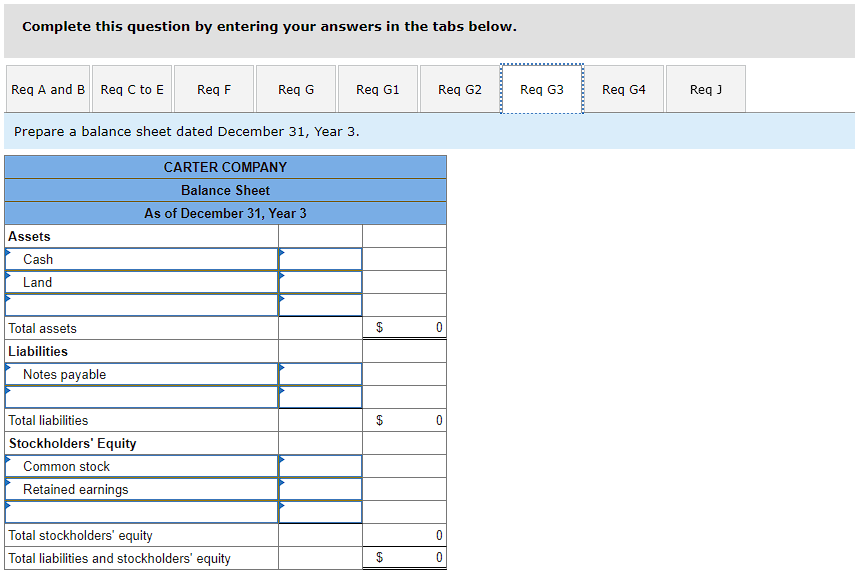

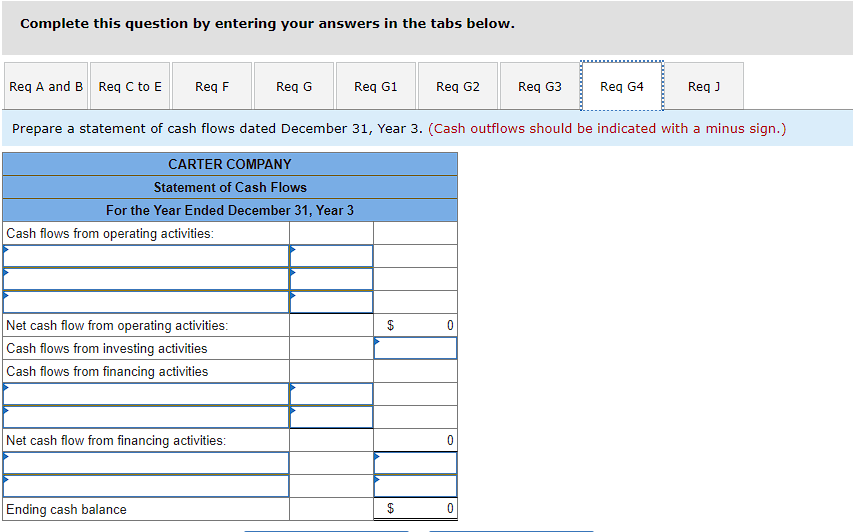

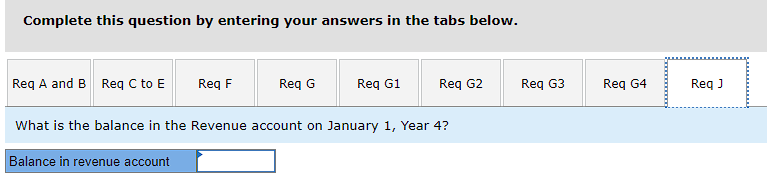

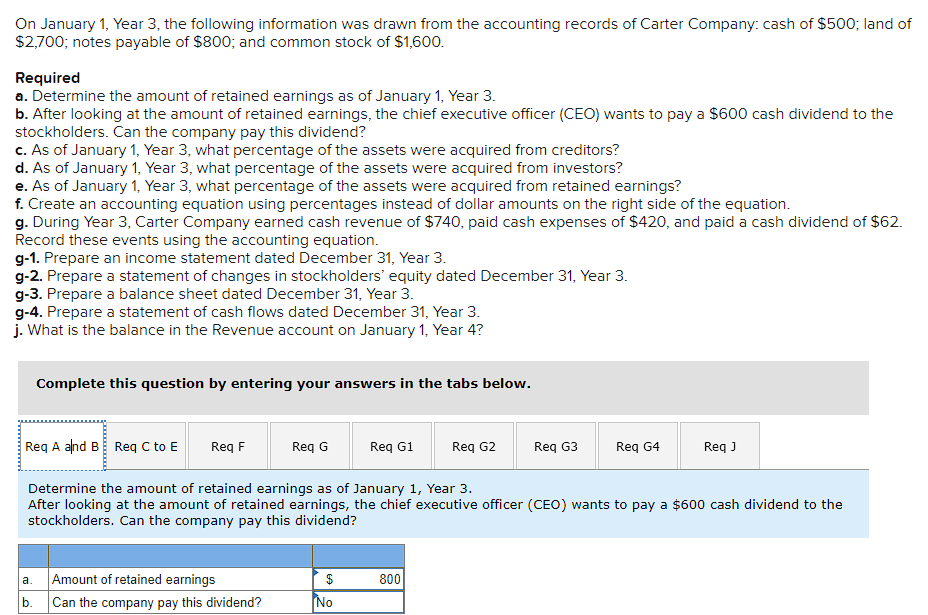

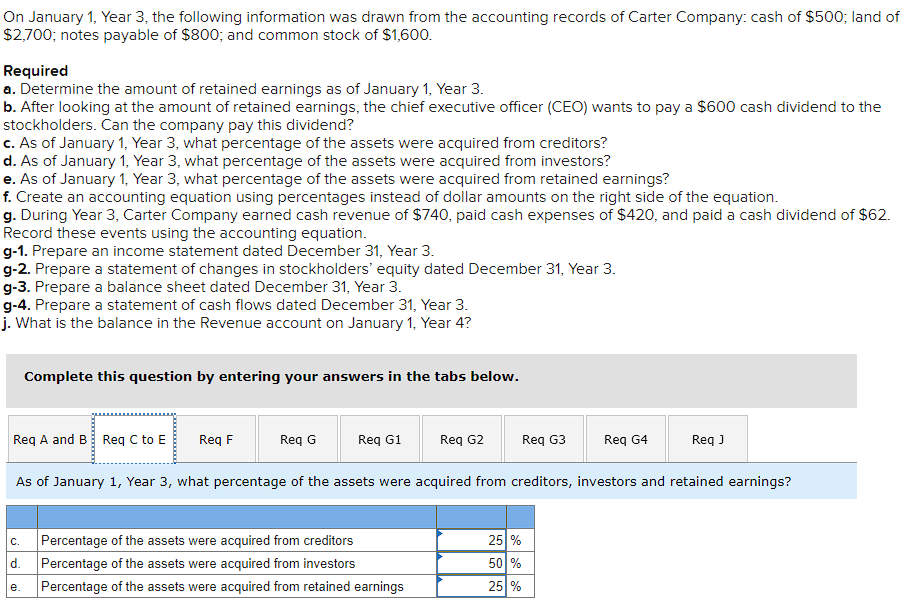

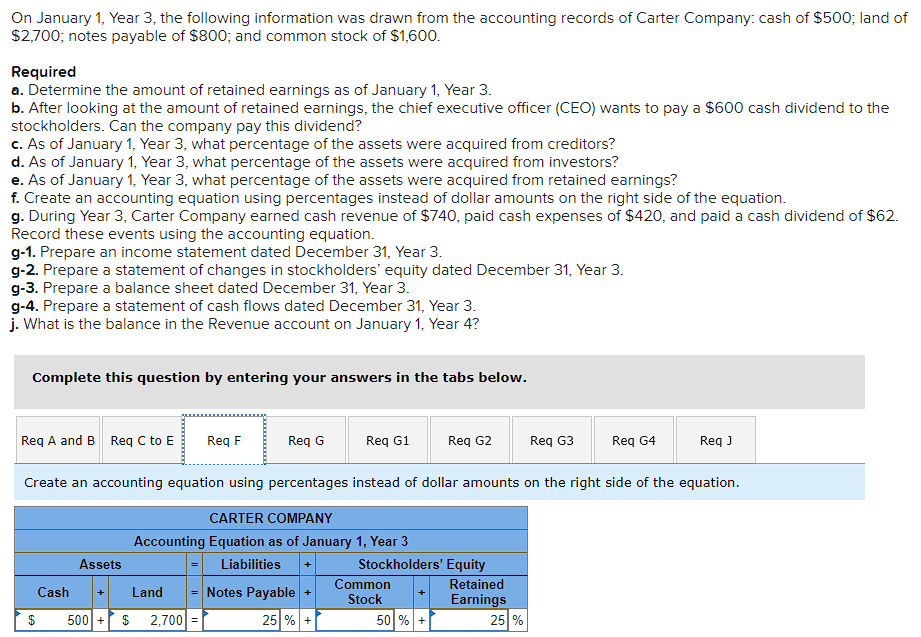

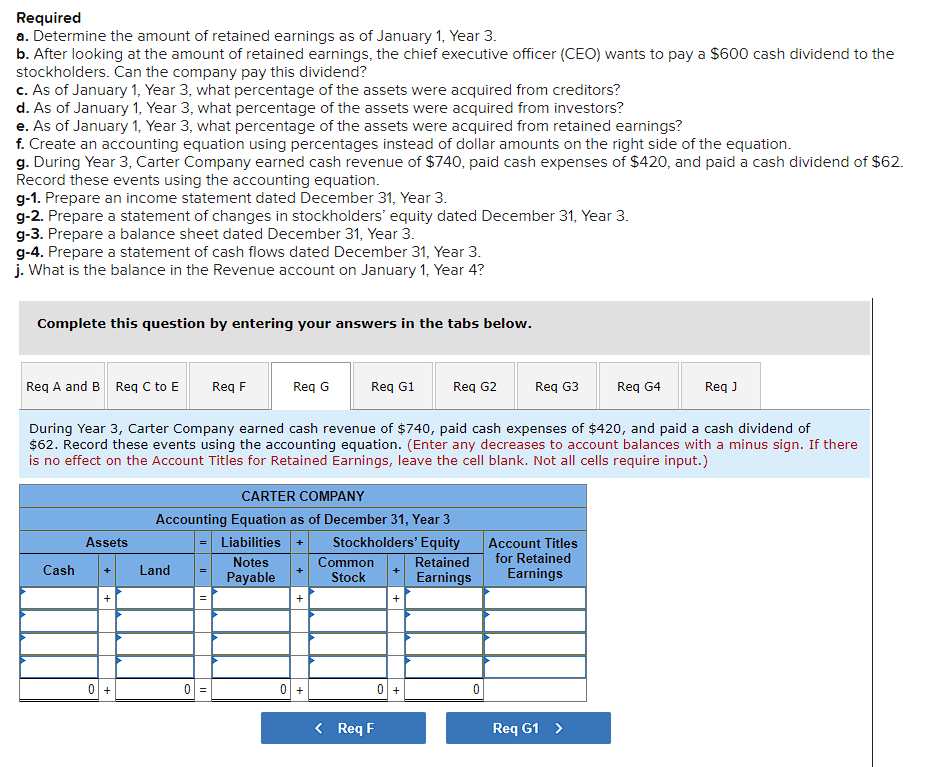

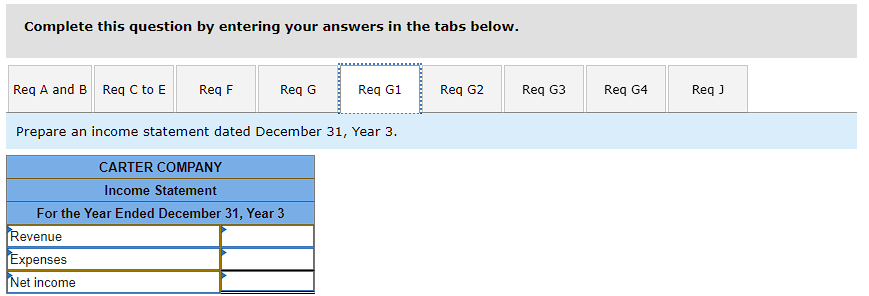

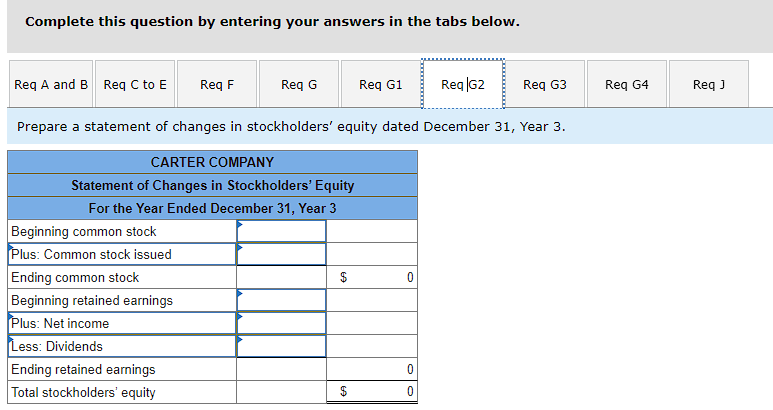

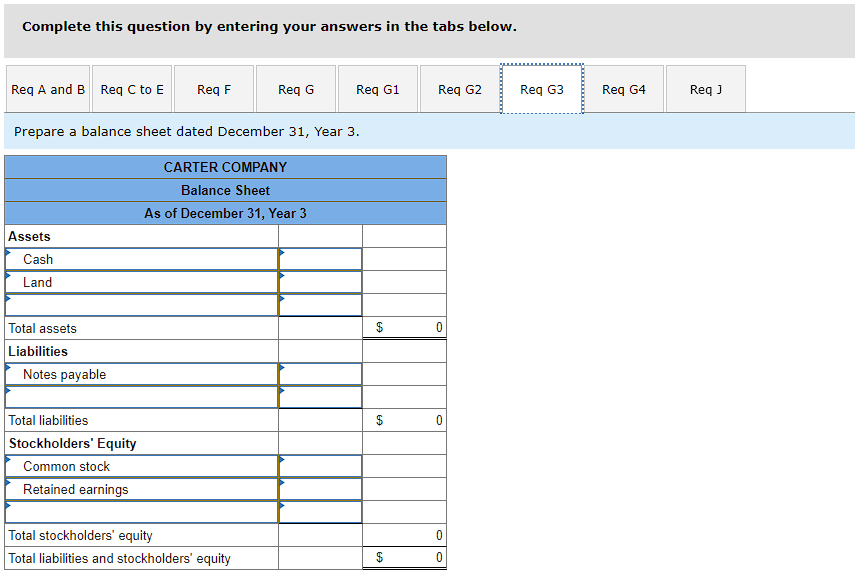

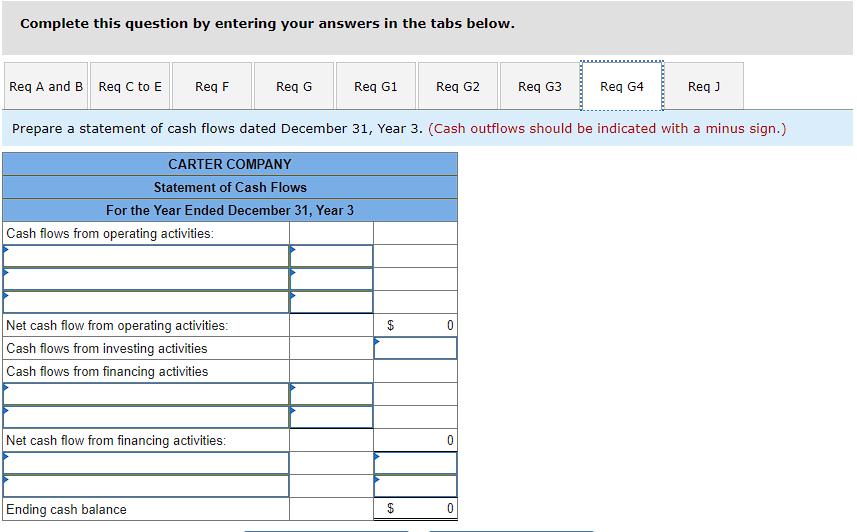

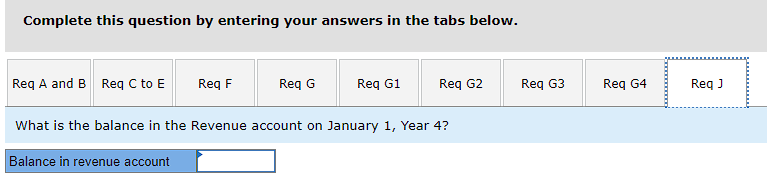

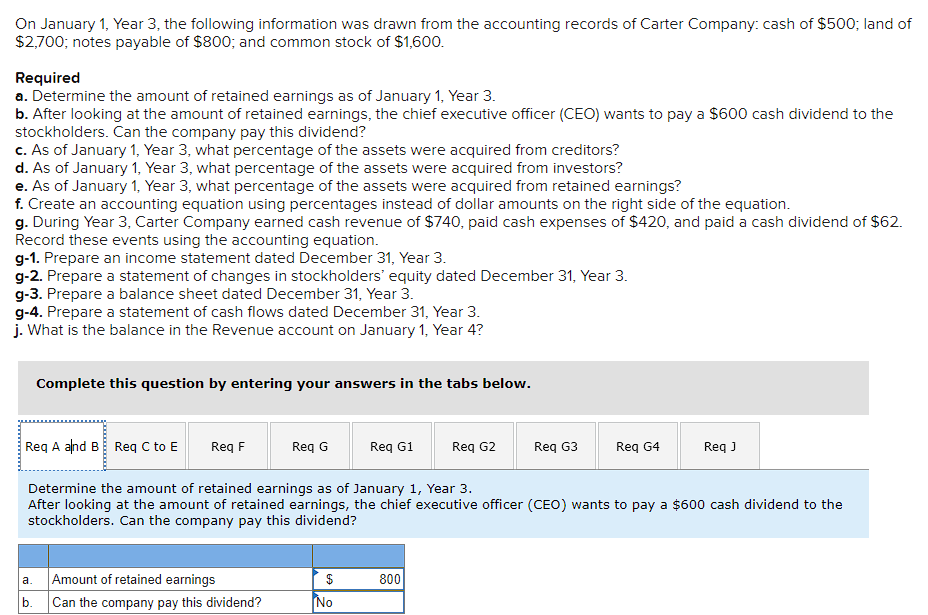

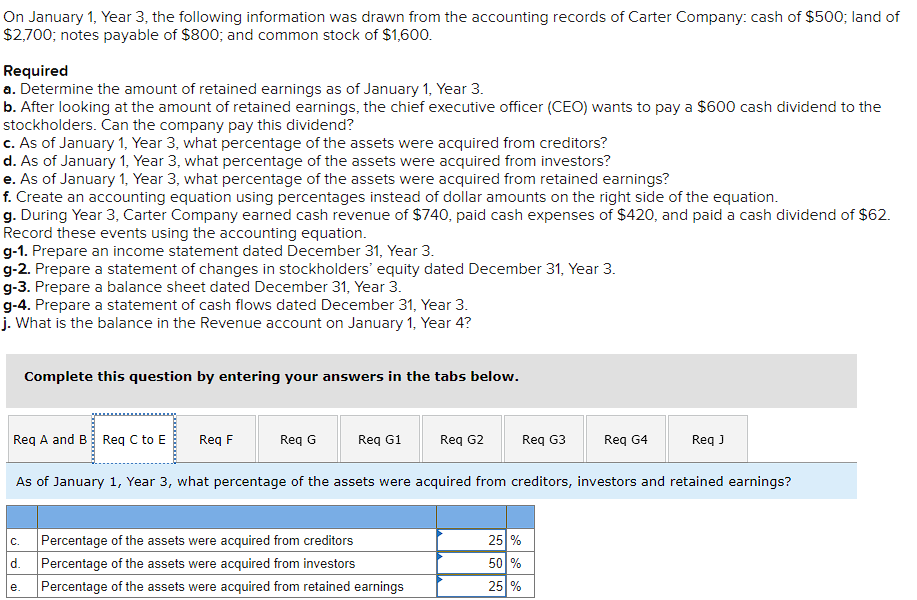

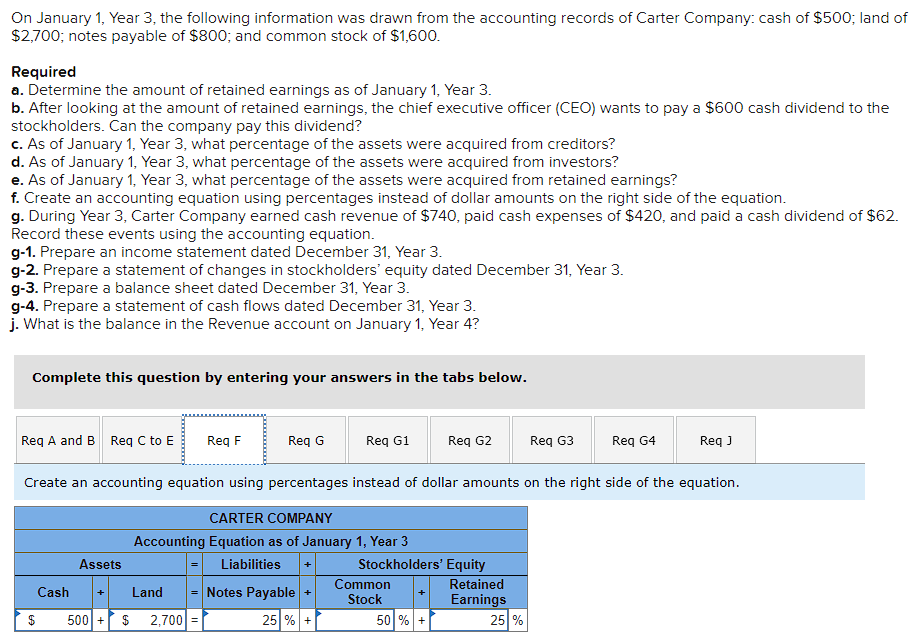

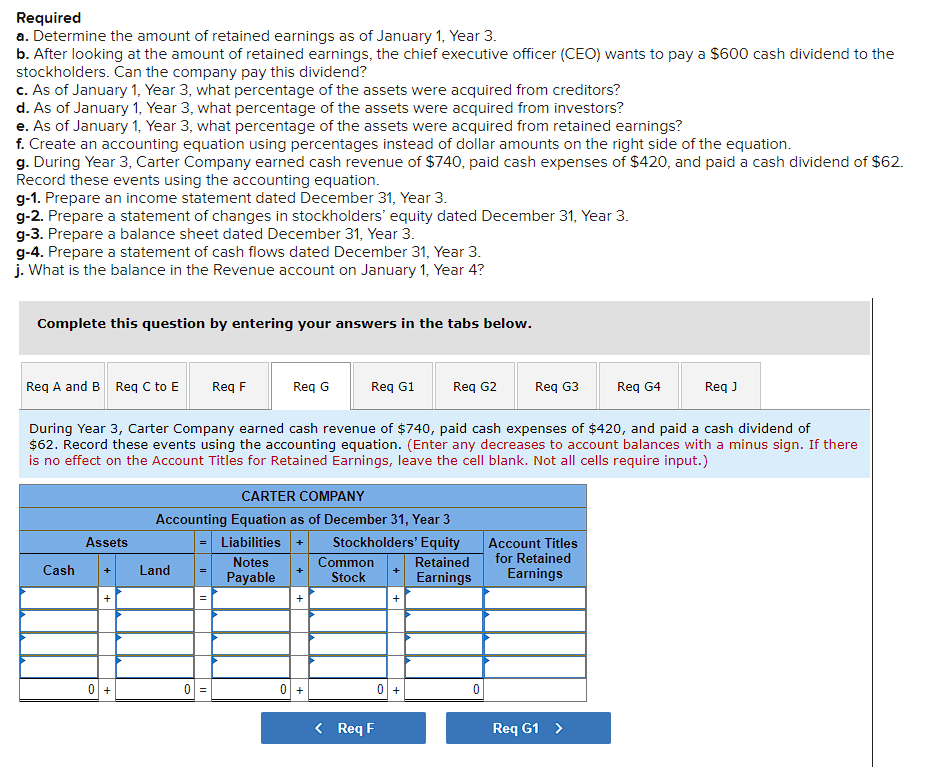

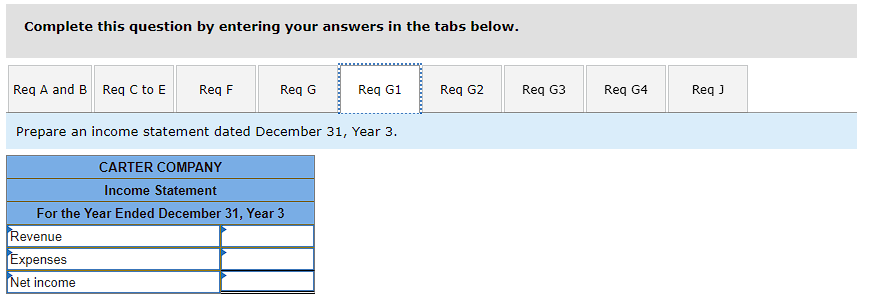

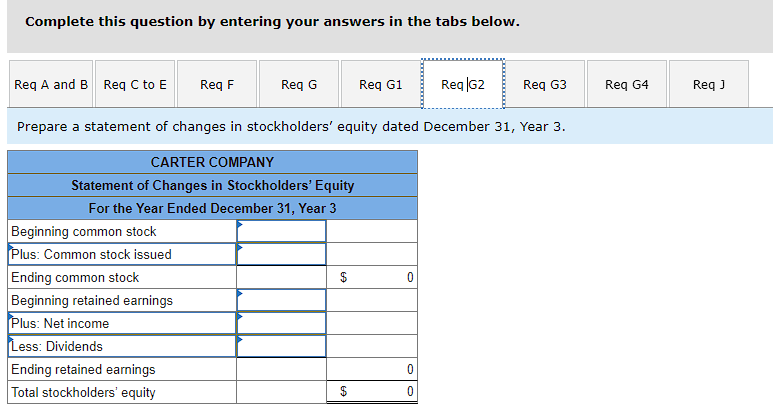

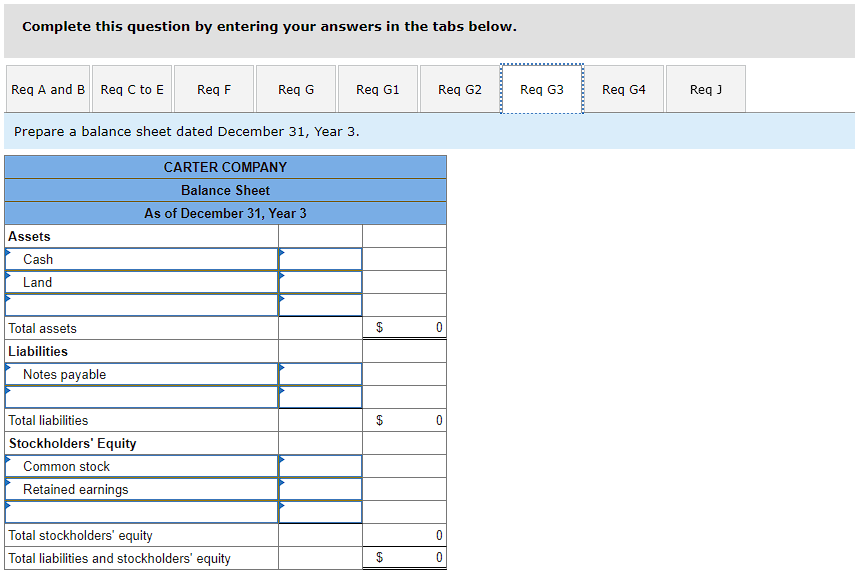

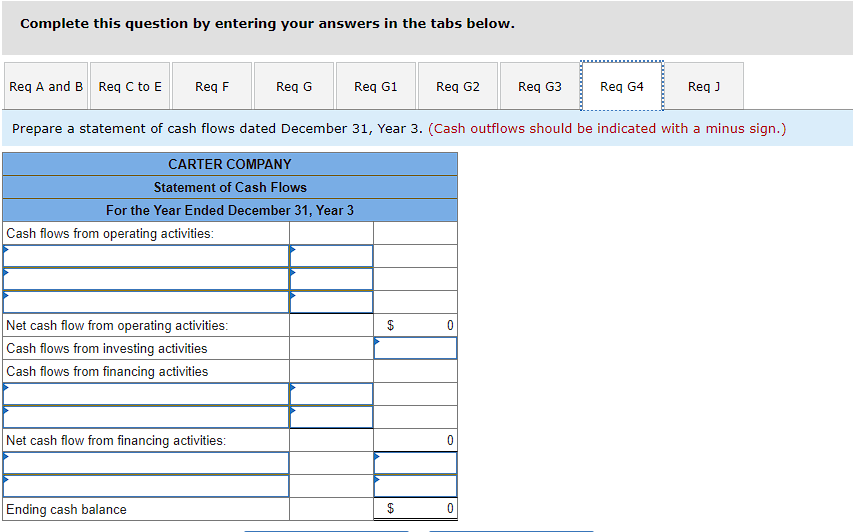

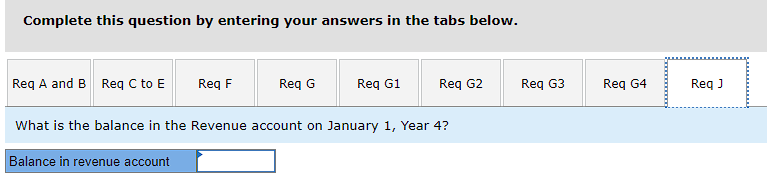

On January 1 , Year 3 , the following information was drawn from the accounting records of Carter Company: cash of $500; land of $2,700; notes payable of $800; and common stock of $1,600. Required a. Determine the amount of retained earnings as of January 1 , Year 3. b. After looking at the amount of retained earnings, the chief executive officer (CEO) wants to pay a $600 cash dividend to the stockholders. Can the company pay this dividend? c. As of January 1 , Year 3 , what percentage of the assets were acquired from creditors? d. As of January 1 , Year 3 , what percentage of the assets were acquired from investors? e. As of January 1 , Year 3 , what percentage of the assets were acquired from retained earnings? f. Create an accounting equation using percentages instead of dollar amounts on the right side of the equation. g. During Year 3, Carter Company earned cash revenue of $740, paid cash expenses of $420, and paid a cash dividend of $62. Record these events using the accounting equation. g-1. Prepare an income statement dated December 31, Year 3. g-2. Prepare a statement of changes in stockholders' equity dated December 31, Year 3. g-3. Prepare a balance sheet dated December 31, Year 3. g-4. Prepare a statement of cash flows dated December 31 , Year 3. j. What is the balance in the Revenue account on January 1 , Year 4 ? Complete this question by entering your answers in the tabs below. Determine the amount of retained earnings as of January 1s? Year 3. After looking at the amount of retained earnings, the chief executive officer (CEO) wants to pay a $600 cash dividend to the stockholders. Can the company pay this dividend? On January 1 , Year 3 , the following information was drawn from the accounting records of Carter Company: cash of $500; land of $2,700; notes payable of $800; and common stock of $1,600. Required a. Determine the amount of retained earnings as of January 1 , Year 3. b. After looking at the amount of retained earnings, the chief executive officer (CEO) wants to pay a $600 cash dividend to the stockholders. Can the company pay this dividend? c. As of January 1 , Year 3 , what percentage of the assets were acquired from creditors? d. As of January 1 , Year 3 , what percentage of the assets were acquired from investors? e. As of January 1 , Year 3 , what percentage of the assets were acquired from retained earnings? f. Create an accounting equation using percentages instead of dollar amounts on the right side of the equation. g. During Year 3, Carter Company earned cash revenue of $740, paid cash expenses of $420, and paid a cash dividend of $62. Record these events using the accounting equation. g-1. Prepare an income statement dated December 31, Year 3. g-2. Prepare a statement of changes in stockholders' equity dated December 31 , Year 3. g-3. Prepare a balance sheet dated December 31, Year 3. g-4. Prepare a statement of cash flows dated December 31 , Year 3. j. What is the balance in the Revenue account on January 1 , Year 4 ? Complete this question by entering your answers in the tabs below. On January 1 , Year 3 , the following information was drawn from the accounting records of Carter Company: cash of $500; land of $2,700; notes payable of $800; and common stock of $1,600. Required a. Determine the amount of retained earnings as of January 1 , Year 3. b. After looking at the amount of retained earnings, the chief executive officer (CEO) wants to pay a $600 cash dividend to the stockholders. Can the company pay this dividend? c. As of January 1 , Year 3 , what percentage of the assets were acquired from creditors? d. As of January 1 , Year 3 , what percentage of the assets were acquired from investors? e. As of January 1 , Year 3 , what percentage of the assets were acquired from retained earnings? f. Create an accounting equation using percentages instead of dollar amounts on the right side of the equation. g. During Year 3, Carter Company earned cash revenue of $740, paid cash expenses of $420, and paid a cash dividend of $62. Record these events using the accounting equation. g-1. Prepare an income statement dated December 31, Year 3. g-2. Prepare a statement of changes in stockholders' equity dated December 31 , Year 3. g-3. Prepare a balance sheet dated December 31, Year 3. g-4. Prepare a statement of cash flows dated December 31, Year 3. j. What is the balance in the Revenue account on January 1 , Year 4 ? Complete this question by entering your answers in the tabs below. Create an accounting equation using percentages instead of dollar amounts on the right side of the equation. Required a. Determine the amount of retained earnings as of January 1 , Year 3. b. After looking at the amount of retained earnings, the chief executive officer (CEO) wants to pay a $600 cash dividend to the stockholders. Can the company pay this dividend? c. As of January 1 , Year 3 , what percentage of the assets were acquired from creditors? d. As of January 1 , Year 3 , what percentage of the assets were acquired from investors? e. As of January 1 , Year 3 , what percentage of the assets were acquired from retained earnings? f. Create an accounting equation using percentages instead of dollar amounts on the right side of the equation. g. During Year 3, Carter Company earned cash revenue of $740, paid cash expenses of $420, and paid a cash dividend of $62. Record these events using the accounting equation. g-1. Prepare an income statement dated December 31 , Year 3. g-2. Prepare a statement of changes in stockholders' equity dated December 31 , Year 3. g-3. Prepare a balance sheet dated December 31 , Year 3. g-4. Prepare a statement of cash flows dated December 31 , Year 3. j. What is the balance in the Revenue account on January 1 , Year 4 ? Complete this question by entering your answers in the tabs below. During Year 3, Carter Company earned cash revenue of $740, paid cash expenses of $420, and paid a cash dividend of $62. Record these events using the accounting equation. (Enter any decreases to account balances with a minus sign. If there is no effect on the Account Titles for Retained Earnings, leave the cell blank. Not all cells require input.) Complete this question by entering your answers in the tabs below. Prepare an income statement dated December 31 , Year 3. Complete this question by entering your answers in the tabs below. Prepare a statement of changes in stockholders' equity dated December 31, Year 3. Complete this question by entering your answers in the tabs below. Prepare a balance sheet dated December 31 , Year 3. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. What is the balance in the Revenue account on January 1 , Year 4