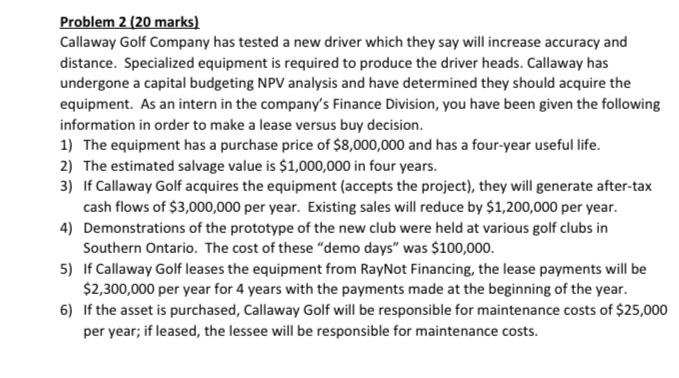

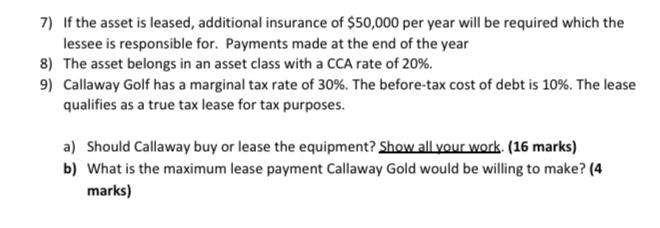

Problem 2 (20 marks) Callaway Golf Company has tested a new driver which they say will increase accuracy and distance. Specialized equipment is required to produce the driver heads. Callaway has undergone a capital budgeting NPV analysis and have determined they should acquire the equipment. As an intern in the company's Finance Division, you have been given the following information in order to make a lease versus buy decision. 1) The equipment has a purchase price of $8,000,000 and has a four-year useful life. 2) The estimated salvage value is $1,000,000 in four years. 3) If Callaway Golf acquires the equipment (accepts the project), they will generate after-tax cash flows of $3,000,000 per year. Existing sales will reduce by $1,200,000 per year. 4) Demonstrations of the prototype of the new club were held at various golf clubs in Southern Ontario. The cost of these "demo days" was $100,000. 5) If Callaway Golf leases the equipment from RayNot Financing, the lease payments will be $2,300,000 per year for 4 years with the payments made at the beginning of the year. 6) If the asset is purchased, Callaway Golf will be responsible for maintenance costs of $25,000 per year; if leased, the lessee will be responsible for maintenance costs. 7) If the asset is leased, additional insurance of $50,000 per year will be required which the lessee is responsible for. Payments made at the end of the year 8) The asset belongs in an asset class with a CCA rate of 20%. 9) Callaway Golf has a marginal tax rate of 30%. The before-tax cost of debt is 10%. The lease qualifies as a true tax lease for tax purposes. a) Should Callaway buy or lease the equipment? Show all your work. (16 marks) b) What is the maximum lease payment Callaway Gold would be willing to make? (4 marks) Problem 2 (20 marks) Callaway Golf Company has tested a new driver which they say will increase accuracy and distance. Specialized equipment is required to produce the driver heads. Callaway has undergone a capital budgeting NPV analysis and have determined they should acquire the equipment. As an intern in the company's Finance Division, you have been given the following information in order to make a lease versus buy decision. 1) The equipment has a purchase price of $8,000,000 and has a four-year useful life. 2) The estimated salvage value is $1,000,000 in four years. 3) If Callaway Golf acquires the equipment (accepts the project), they will generate after-tax cash flows of $3,000,000 per year. Existing sales will reduce by $1,200,000 per year. 4) Demonstrations of the prototype of the new club were held at various golf clubs in Southern Ontario. The cost of these "demo days" was $100,000. 5) If Callaway Golf leases the equipment from RayNot Financing, the lease payments will be $2,300,000 per year for 4 years with the payments made at the beginning of the year. 6) If the asset is purchased, Callaway Golf will be responsible for maintenance costs of $25,000 per year; if leased, the lessee will be responsible for maintenance costs. 7) If the asset is leased, additional insurance of $50,000 per year will be required which the lessee is responsible for. Payments made at the end of the year 8) The asset belongs in an asset class with a CCA rate of 20%. 9) Callaway Golf has a marginal tax rate of 30%. The before-tax cost of debt is 10%. The lease qualifies as a true tax lease for tax purposes. a) Should Callaway buy or lease the equipment? Show all your work. (16 marks) b) What is the maximum lease payment Callaway Gold would be willing to make? (4 marks)