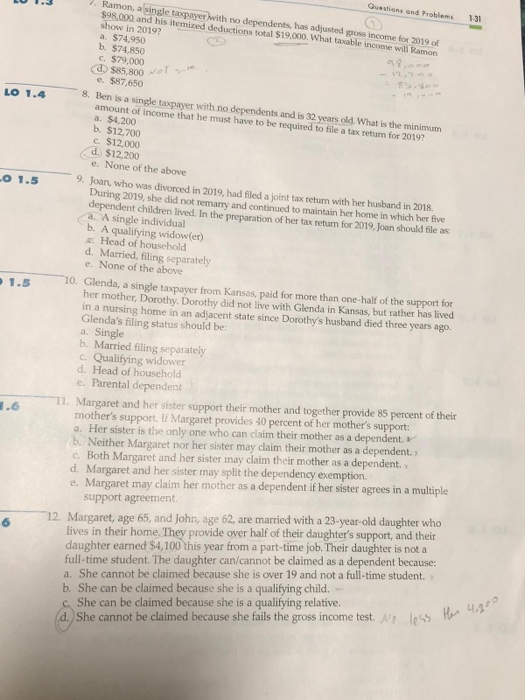

Questions and Problems V. Ramon, a single taxpayer with no dependents, has adjusted gross income for 2019 of $98.000 and his itemized deductions total $19.000. What taxable income will Ramon show in 2019? a. $74,950 b. $74,850 c. $79,000 (d) $85 ano LO 1.4 c. $87,650 8. Ben is a single taxpayer with no dependents and is 32 years old. What is the minimum amount of income that he must have to be required to file a tax return for 20192 a. $4,200 b. $12,700 C. $12,000 d. $12.200 c. None of the above 9. Joan, who was divorced in 2019, had filed a joint tax retum with her husband in 2018 During 2019, she did not remarry and continued to maintain her home in which her five dependent children lived. In the preparation of her tax return for 2019, Joan should file as a. A single individual b. A qualifying widow(er) Head of household d. Married, filing separately e. None of the above 10. Glenda, a single taxpayer from Kansas, paid for more than one-half of the support for her mother, Dorothy. Dorothy did not live with Glenda in Kansas, but rather has lived in a nursing home in an adjacent state since Dorothy's husband died three years ago. Glenda's filing status should be: a. Single b. Married filing separately c. Qualifying widower d. Head of household e. Parental dependent 1. Margaret and her sister support their mother and together provide 85 percent of their mother's support. If Margaret provides 40 percent of her mother's support: a. Her sister is the only one who can claim their mother as a dependent b. Neither Margaret nor her sister may claim their mother as a dependent. C. Both Margaret and her sister may claim their mother as a dependent d. Margaret and her sister may split the dependency exemption. e. Margaret may claim her mother as a dependent if her sister agrees in a multiple support agreement, 12. Margaret, age 65, and John, age 62, are married with a 23-year-old daughter who lives in their home. They provide over half of their daughter's support, and their daughter eamed $4,100 this year from a part-time job. Their daughter is not a full-time student. The daughter can/cannot be claimed as a dependent because: a. She cannot be claimed because she is over 19 and not a full-time student. b. She can be claimed because she is a qualifying child. She can be claimed because she is a qualifying relative. d. She cannot be claimed because she fails the gross income test. No 155 Ham less than 4,200