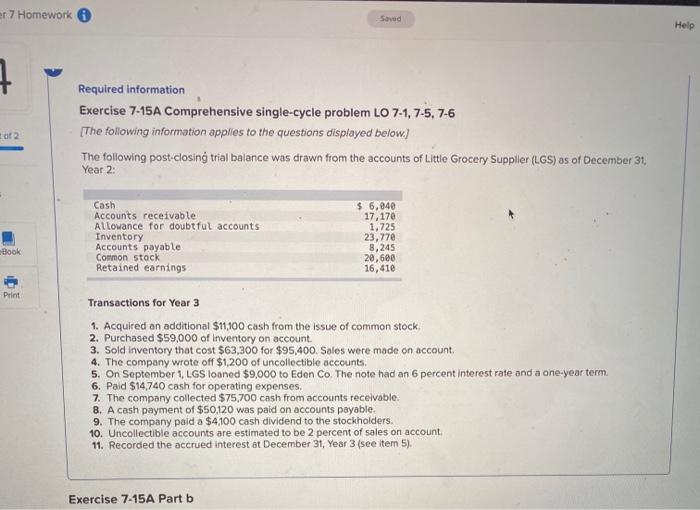

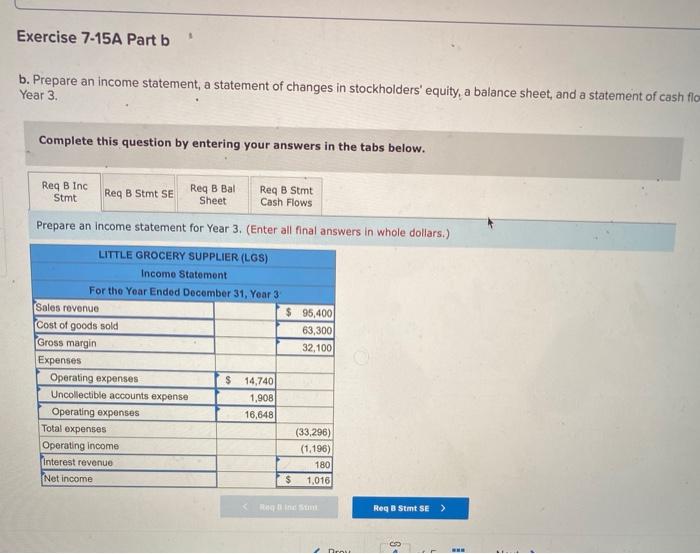

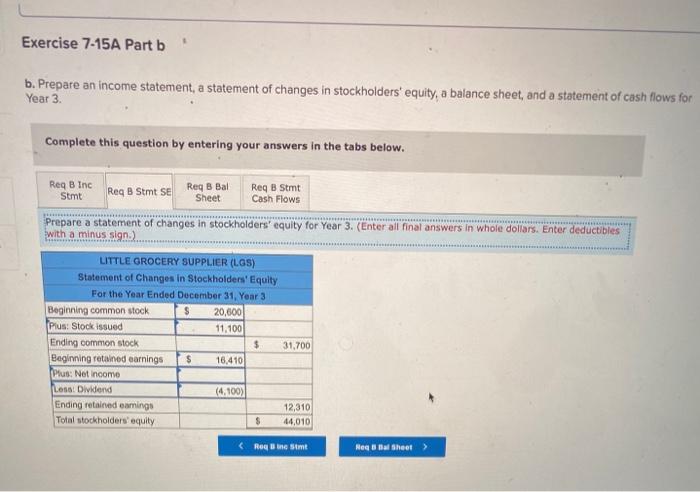

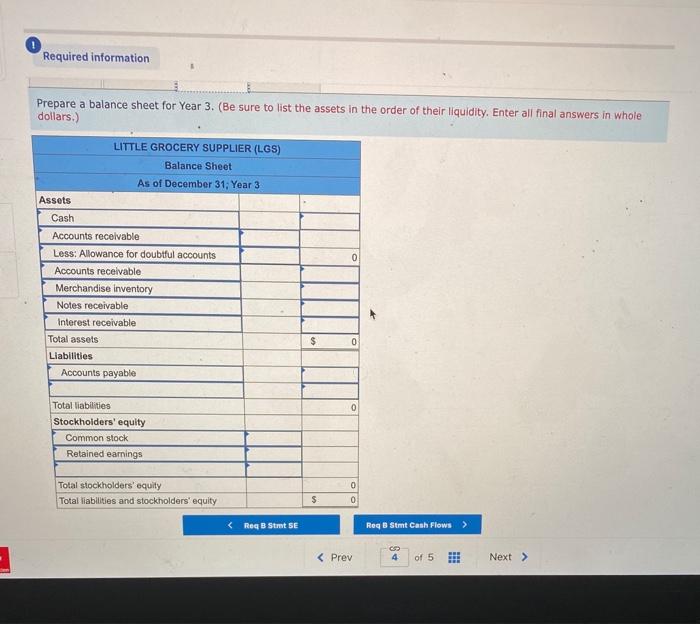

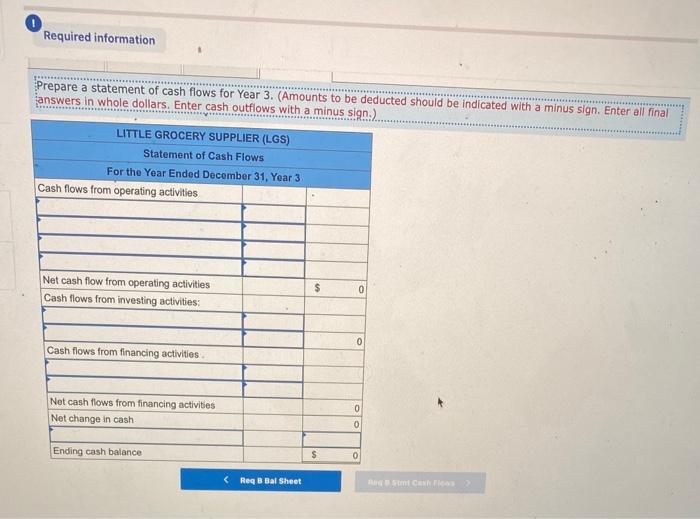

r 7 Homework 6 Help 7 Required information Exercise 7-15A Comprehensive single-cycle problem LO 7-4, 7-5, 7-6 The following information applies to the questions displayed below.) The following post-closing trial balance was drawn from the accounts of Little Grocery Suppller (LGS) as of December 31 Year 2: of 2 Cash Accounts receivable Allowance for doubtful accounts Inventory Accounts payable Common stock Retained earnings $ 6,040 17,170 1,725 23,770 8,245 20,600 16,410 Book Print Transactions for Year 3 1. Acquired an additional $11,100 cash from the issue of common stock 2. Purchased $59,000 of Inventory on account 3. Sold inventory that cost $63,300 for $95,400. Sales were made on account. 4. The company wrote off $1,200 of uncollectible accounts, 5. On September 1, LGS loaned $9,000 to Eden Co. The note had an 6 percent interest rate and a one-year term 6. Paid $14,740 cash for operating expenses. 7. The company collected $75,700 cash from accounts recevable. 8. A cash payment of $50,120 was paid on accounts payable. 9. The company paid a $4,100 cash dividend to the stockholders 10. Uncollectible accounts are estimated to be 2 percent of sales on account 11. Recorded the accrued interest at December 31, Year 3 (see item 5). Exercise 7-15A Part b Exercise 7-15A Part b . b. Prepare an income statement, a statement of changes in stockholders' equity, a balance sheet, and a statement of cash flow Year 3. Complete this question by entering your answers in the tabs below. Req B Inc Req B Bal Req B Stmt Reg B Stmt SE Stmt Sheet Cash Flows Prepare an income statement for Year 3. (Enter all final answers in whole dollars.) LITTLE GROCERY SUPPLIER (LGS) Income Statement For the Year Ended December 31, Year 3 Sales revenue $ 95,400 Cost of goods sold 63,300 (Gross margin 32,100 Expenses Operating expenses $ 14,740 Uncollectible accounts expense 1,908 Operating expenses 16,648 Total expenses (33,296) Operating income (1.196) Interest revenue 180 Net income $ 1,016 Req B Stmt SE > Exercise 7-15A Part b b. Prepare an income statement, a statement of changes in stockholders' equity, a balance sheet, and a statement of cash flows for Year 3. Complete this question by entering your answers in the tabs below. Req B Inc Stmt Reg B Stmt SE Reg B Bal Sheet Req B Stmt Cash Flows Prepare a statement of changes in stockholders' equity for Year 3. (Enter all final answers in whole dollars. Enter deductibles with a minus sign.) LITTLE GROCERY SUPPLIER (LGS) Statement of Changes in Stockholders' Equity For the Year Ended December 31, Year 3 Beginning common stock $ 20,600 Plus: Stock issued 11.100 Ending common stock $ 31,700 Beginning retained earnings $ 16,410 Plus: Net Income Loss Dividend (4.100) Ending retained earings 12,310 Total stockholders' equity $ 44,010 Regine simt Heg a Bal Sheet > Required information Prepare a balance sheet for Year 3. (Be sure to list the assets in the order of their liquidity. Enter all final answers in whole dollars.) LITTLE GROCERY SUPPLIER (LGS) Balance Sheet As of December 31, Year 3 Assets 0 Cash Accounts receivable Less: Allowance for doubtful accounts Accounts receivable Merchandise inventory Notes receivable Interest receivable Total assets Liabilities Accounts payable $ 0 0 Total liabilities Stockholders' equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 0 0 $ 4 Required information Prepare a statement of cash flows for Year 3. (Amounts to be deducted should be indicated with a minus sign. Enter all final answers in whole dollars. Enter cash outflows with a minus sign.). LITTLE GROCERY SUPPLIER (LGS) Statement of Cash Flows For the Year Ended December 31, Year 3 Cash flows from operating activities Net cash flow from operating activities Cash flows from investing activities: $ 0 0 Cash flows from financing activities Net cash flows from financing activities Net change in cash 0 0 Ending cash balance $ 0