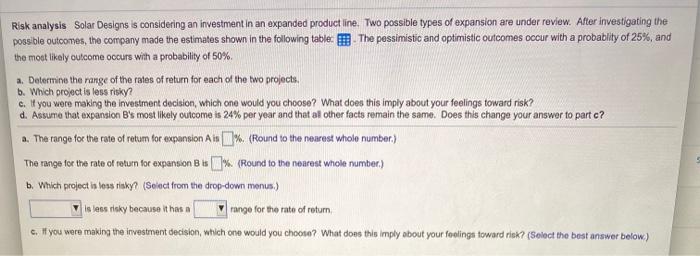

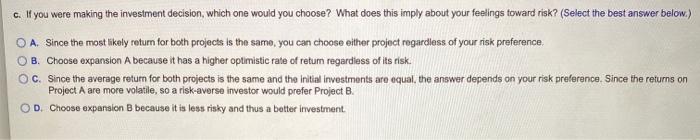

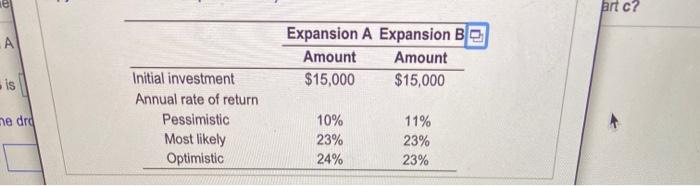

Risk analysis Solar Designs is considering an investment in an expanded product line. Two possible types of expansion are under review. After investigating the possible outcomes, the company made the estimates shown in the following table. The pessimistic and optimistic outcomes occur with a probablity of 25%, and the most likely outcome occurs with a probability of 50% a. Determine the range of the rates of return for each of the two projects. b. Which project is less risky? c. If you were making the investment decision, which one would you choose? What does this imply about your feelings toward risk? d. Assume that expansion B's most likely outcome is 24% per year and that all other facts remain the same. Does this change your answer to part c? a. The range for the rate of retum for expansion Air 1% (Round to the nearest whole number.) The range for the rate of return for expansions 1% (Round to the nearest whole number.) b. Which project is less risky? (Select from the drop-down menus.) Is less risky because it has a range for the rate of rotur c. #you were making the investment decision, which one would you choose? What does this imply about your feelings toward risk? (Select the best answer below) c. If you were making the investment decision, which one would you choose? What does this imply about your feelings toward risk? (Select the best answer below.) A. Since the most likely return for both projects is the same, you can choose either project regardless of your risk preference O B. Choose expansion A because it has a higher optimistic rate of retum regardless of its risk. OC. Since the average return for both projects is the same and the initial investments are equal, the answer depends on your risk preference. Since the returns on Project A are more volatile, so a risk-averse investor would prefer Project B. D. Choose expansion because it is less risky and thus a better investment OD. Choose expansion B because it is less risky and thus a better investment d. Assume that expansion B's most likely outcome is 24% per year and that all other facts remain the same. Does this change your answer to part c? (Select the best answer below.) A. No B. Yes OC. Not enough information to answer. art c? A A Expansion A Expansion B & Amount Amount $15,000 $15,000 is he drd Initial investment Annual rate of return Pessimistic Most likely Optimistic 10% 23% 24% 11% 23% 23%