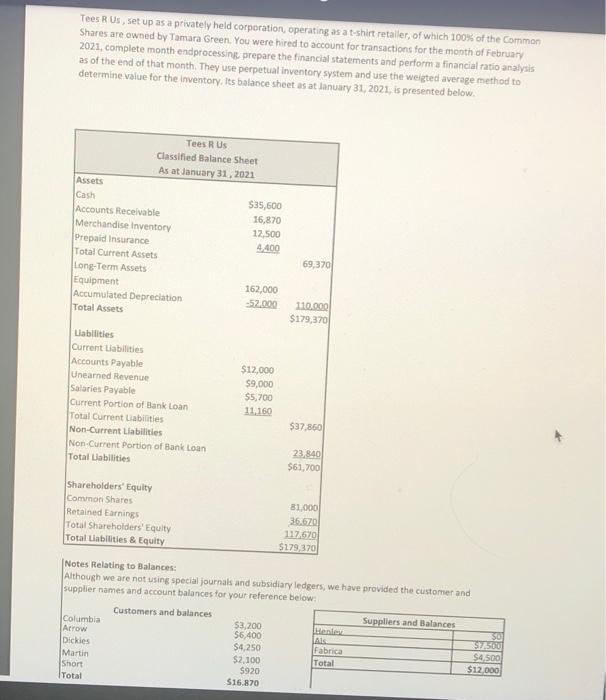

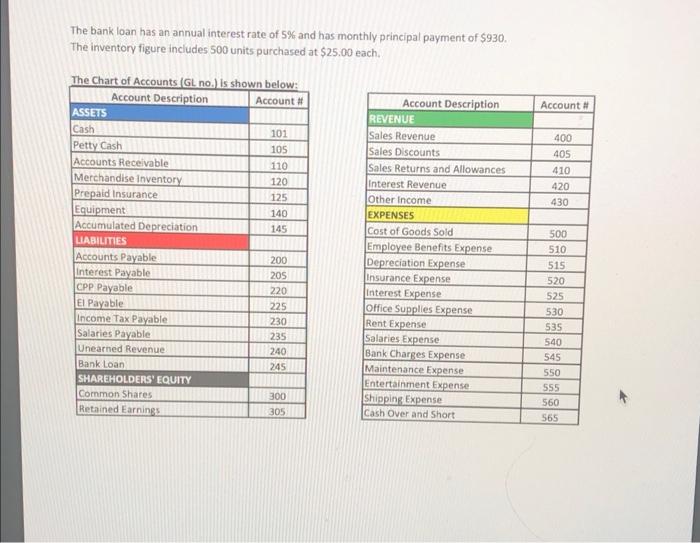

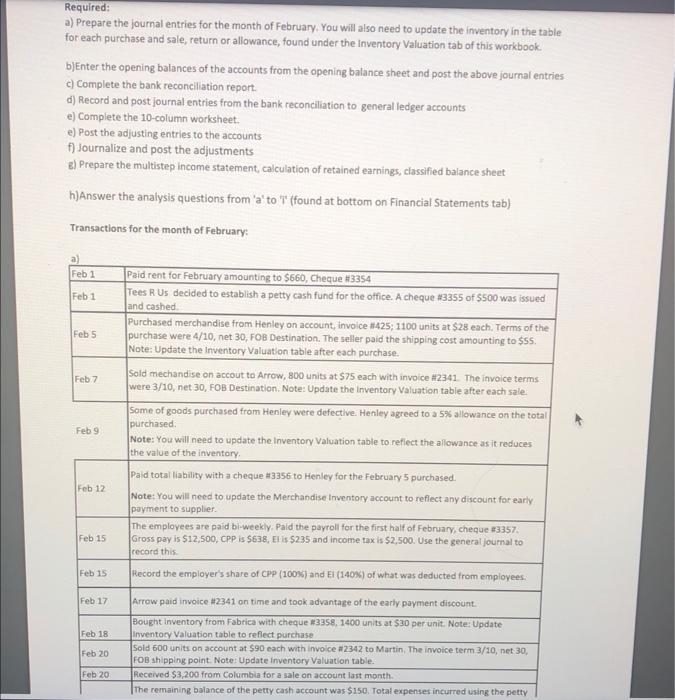

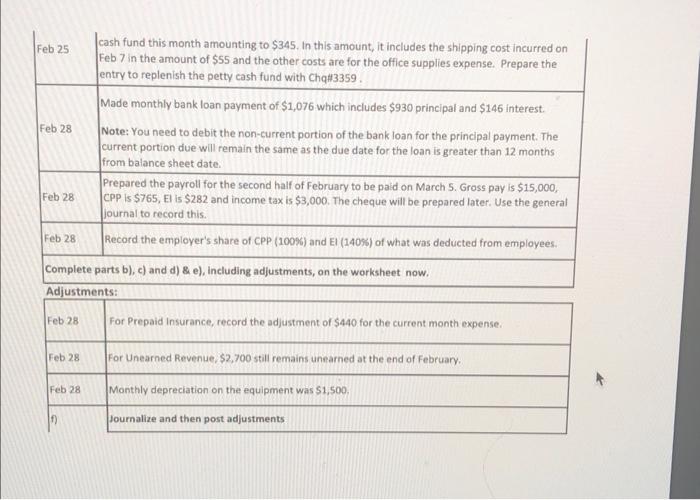

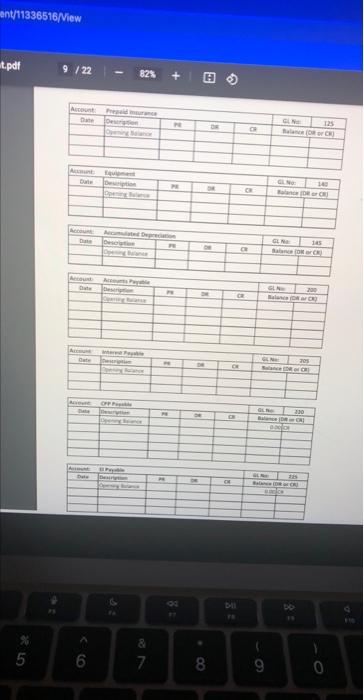

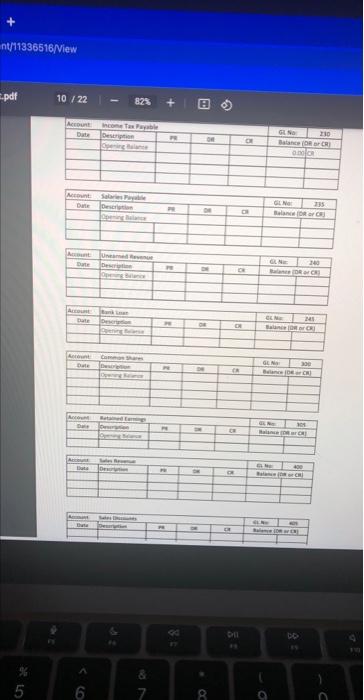

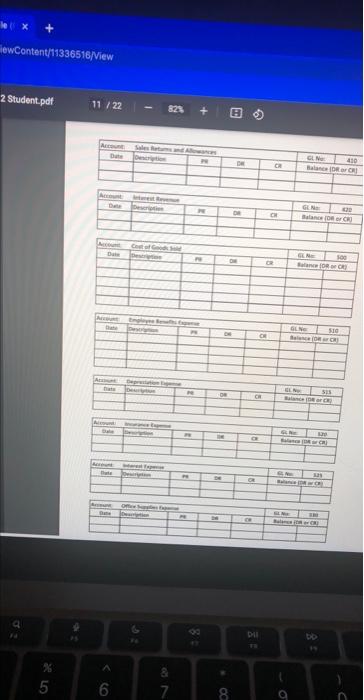

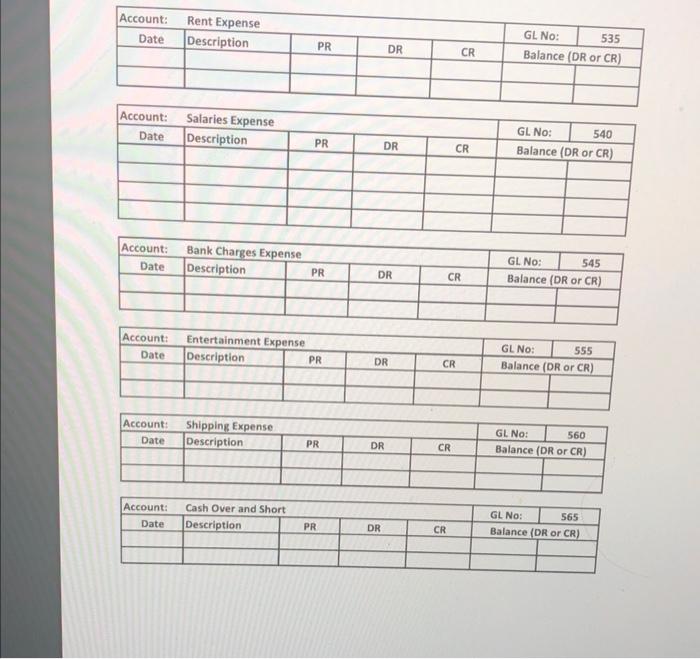

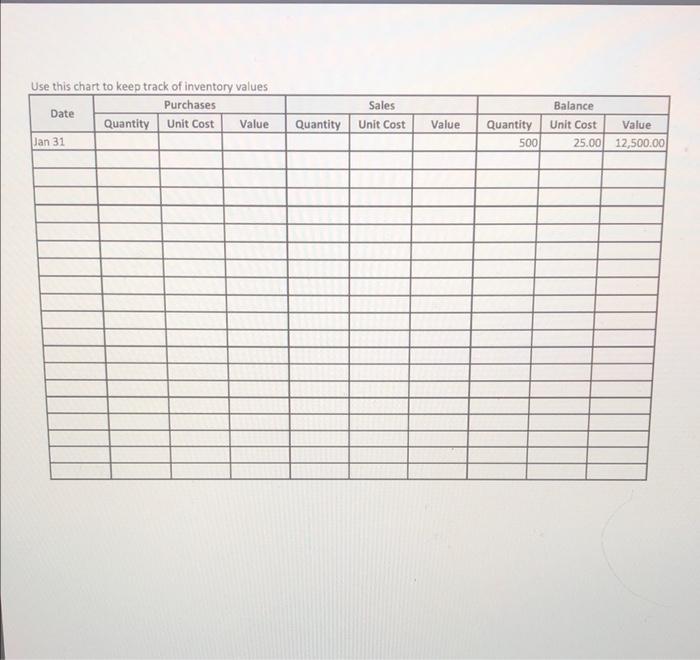

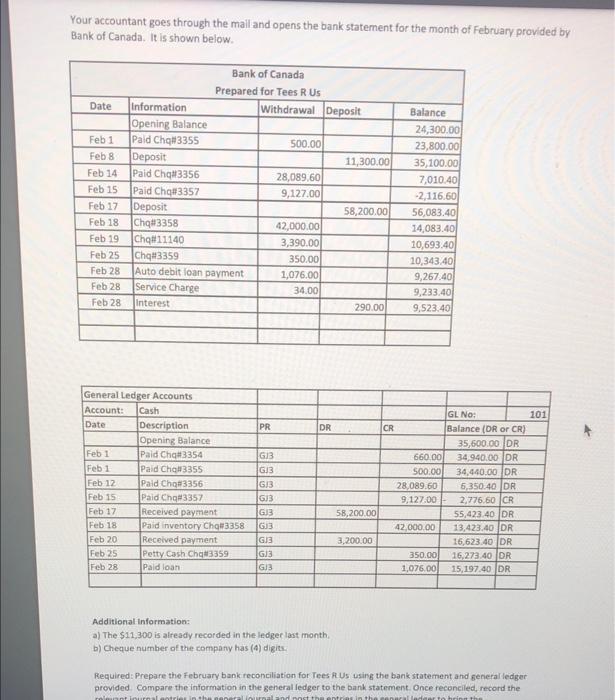

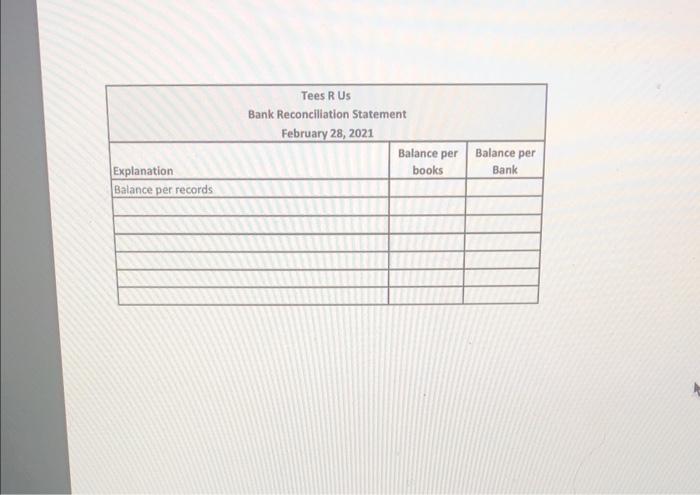

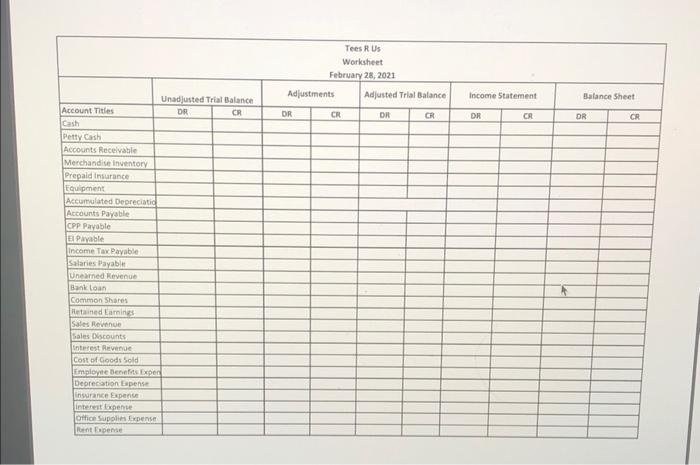

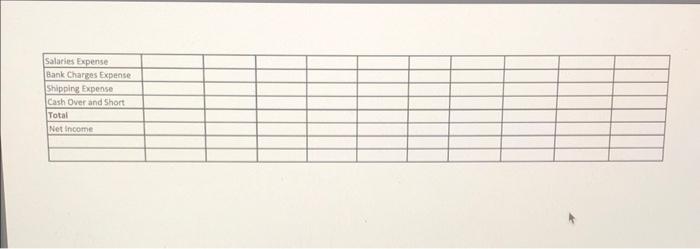

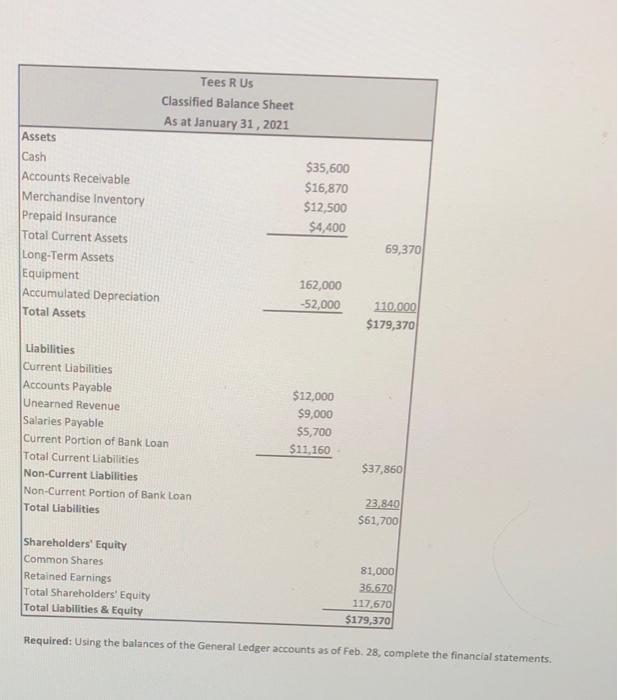

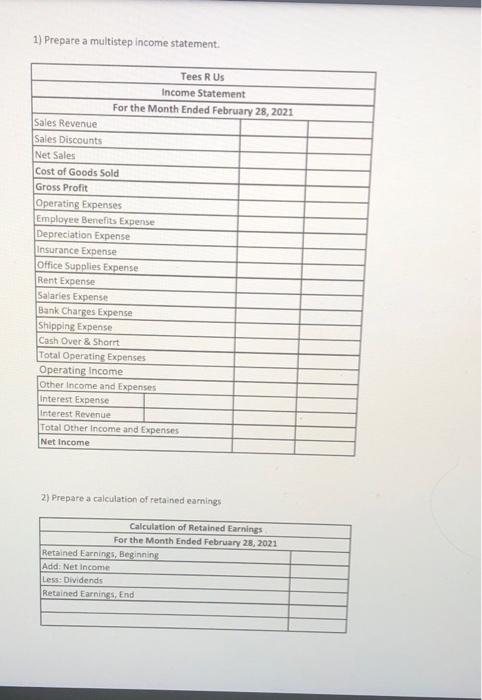

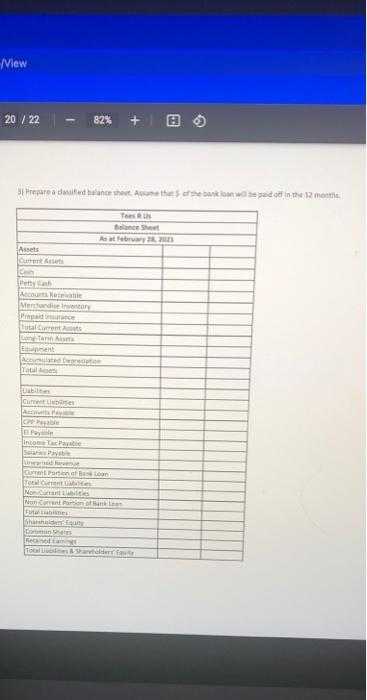

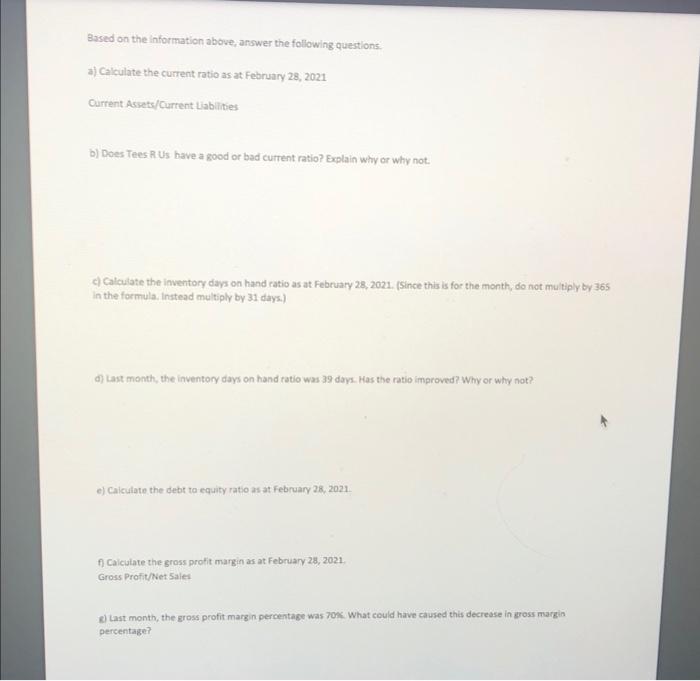

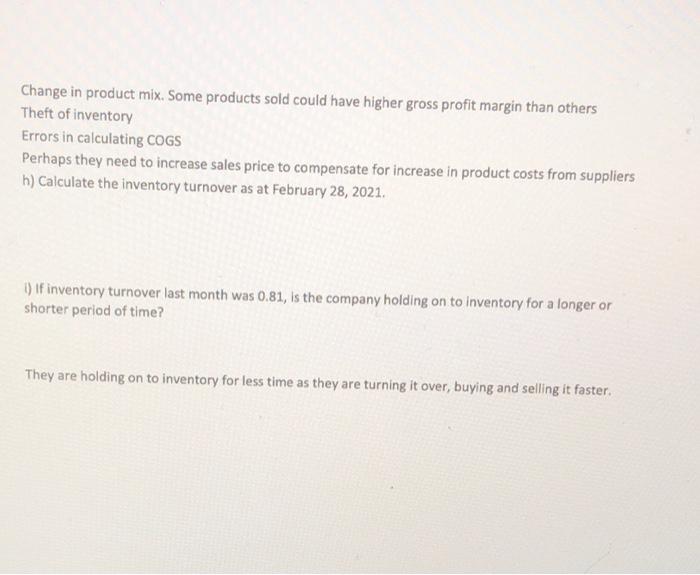

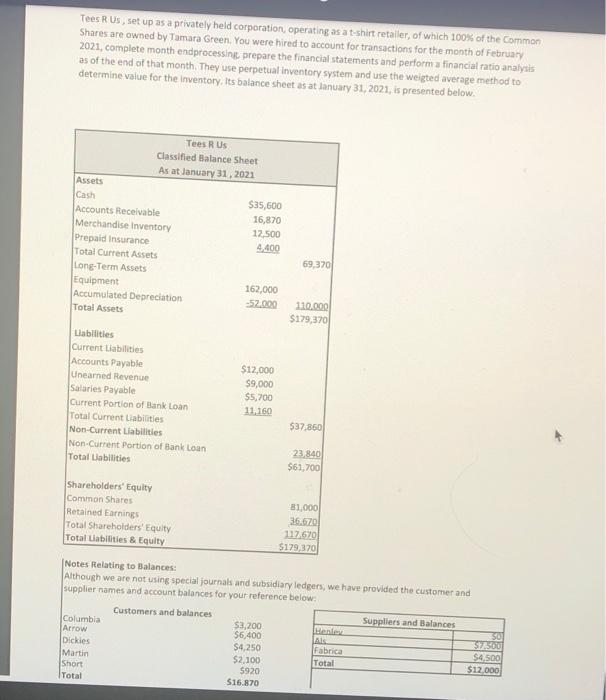

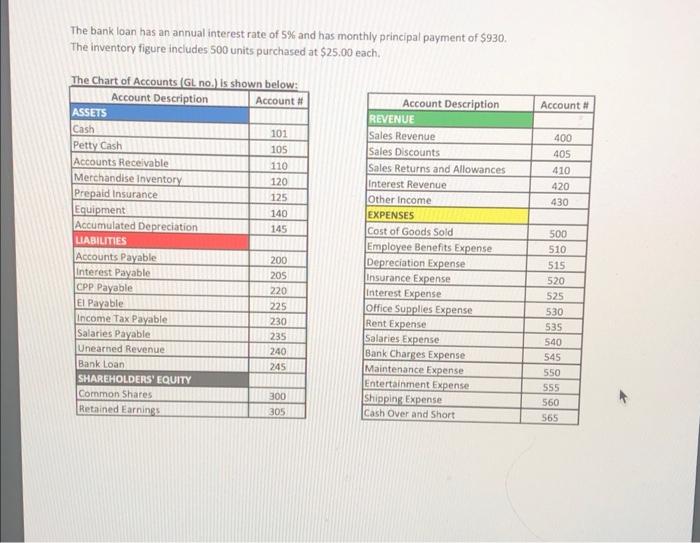

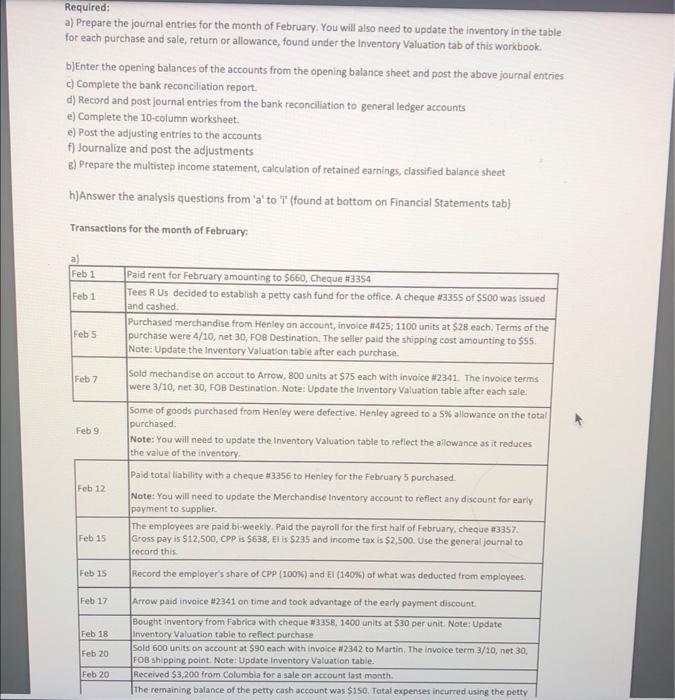

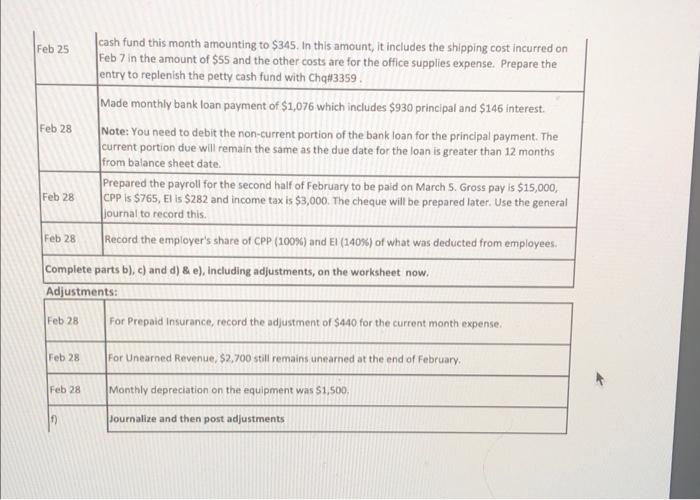

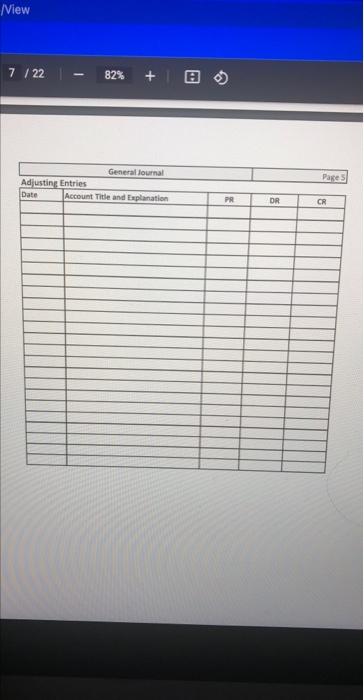

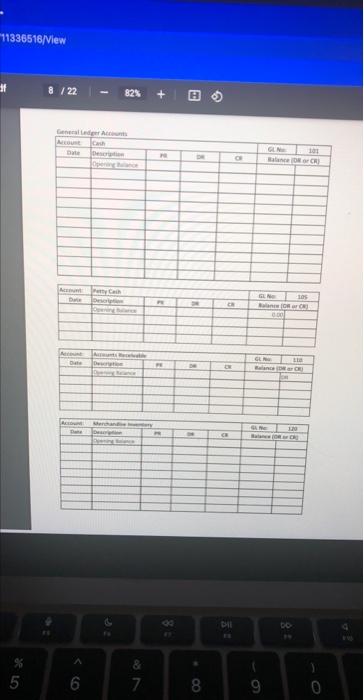

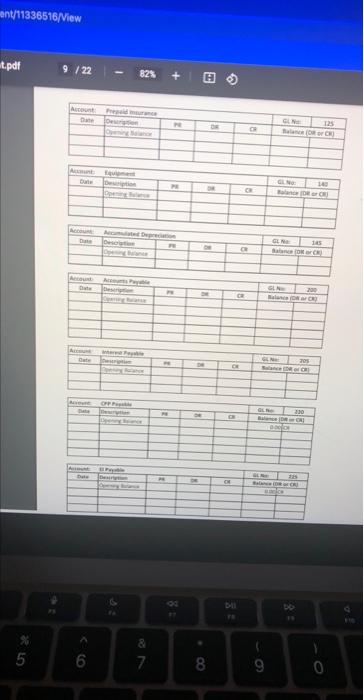

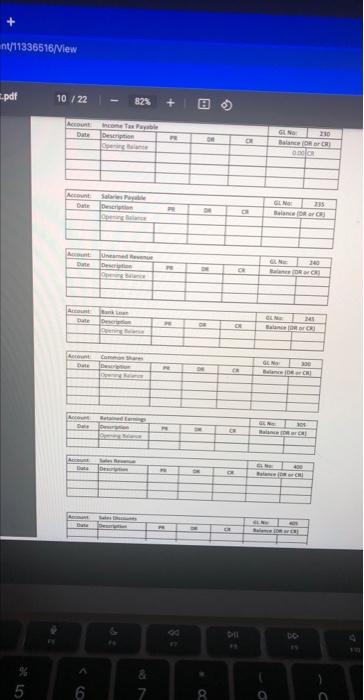

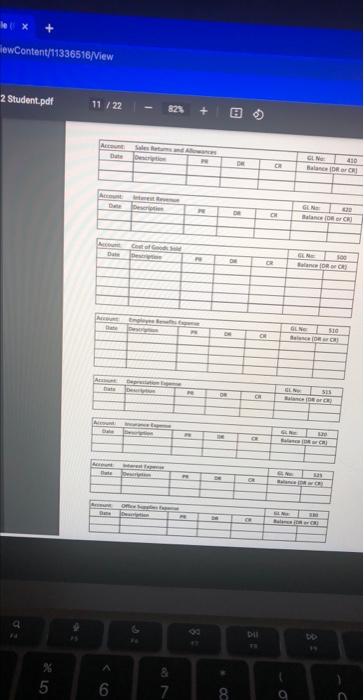

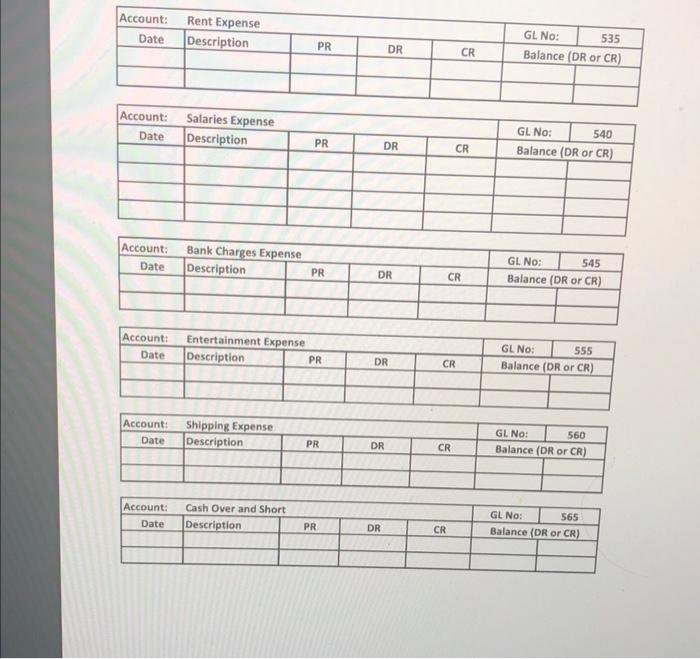

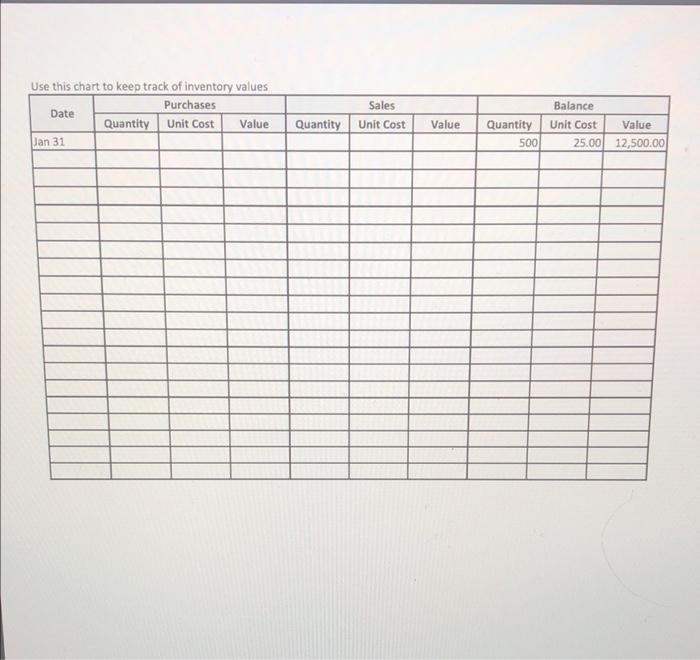

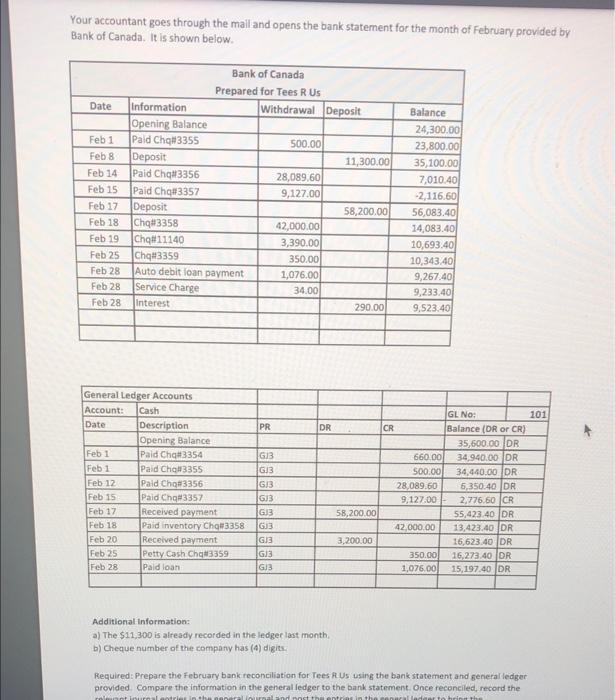

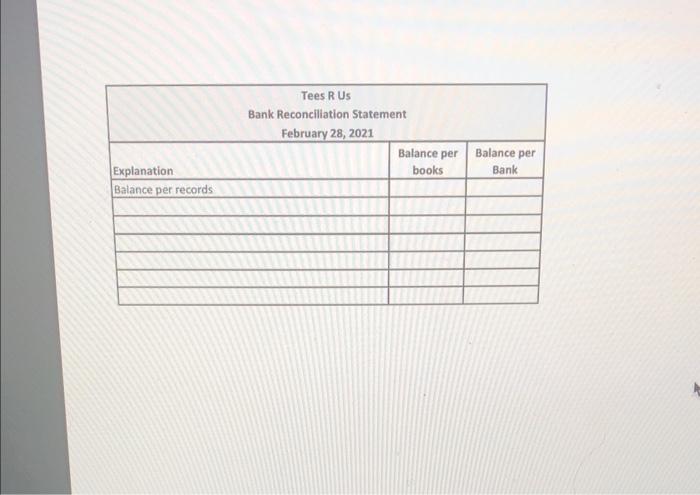

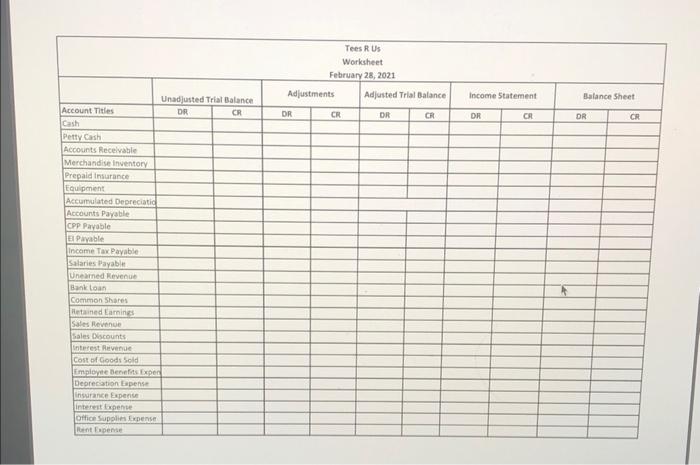

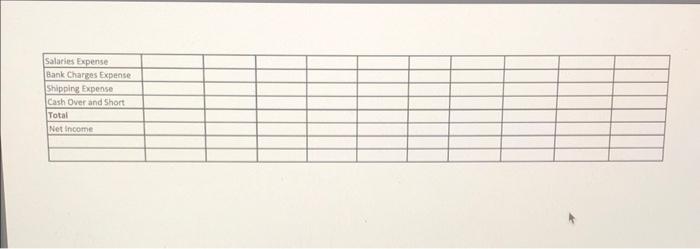

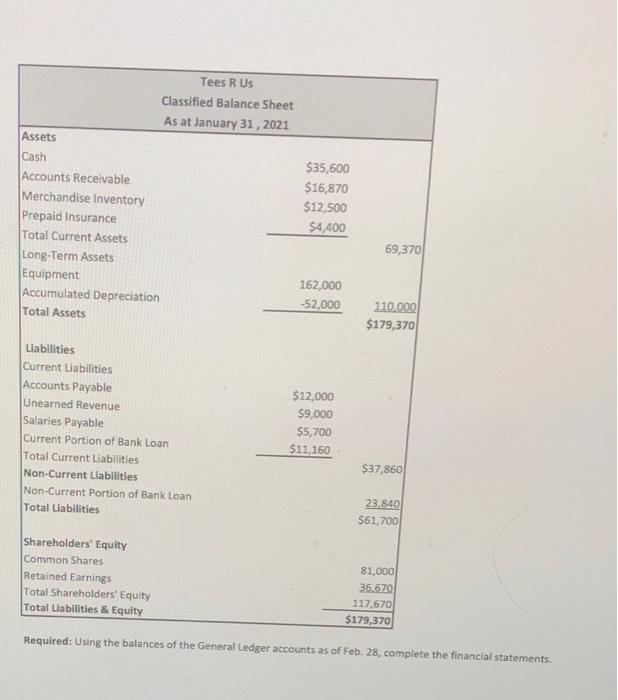

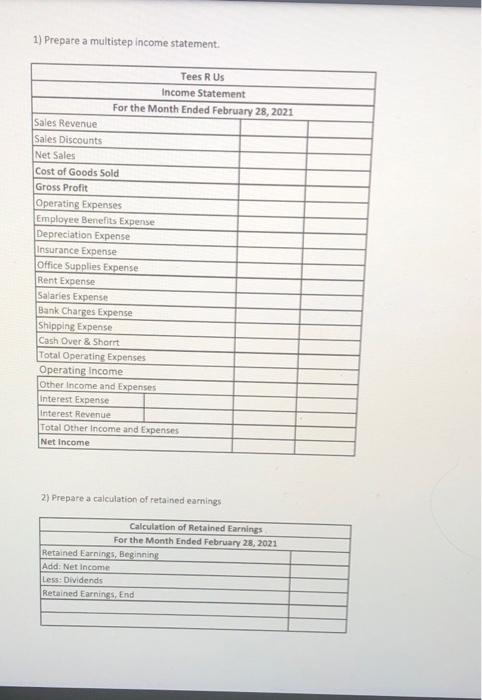

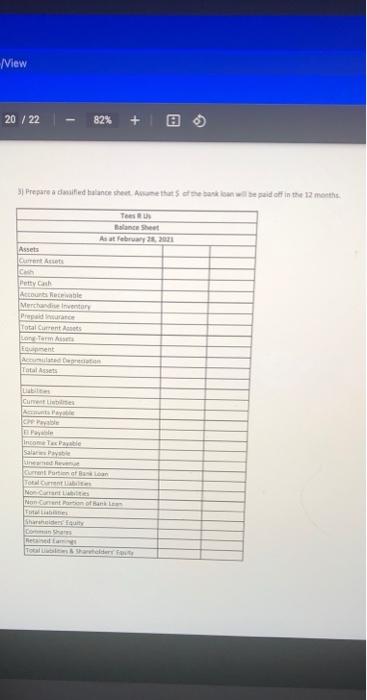

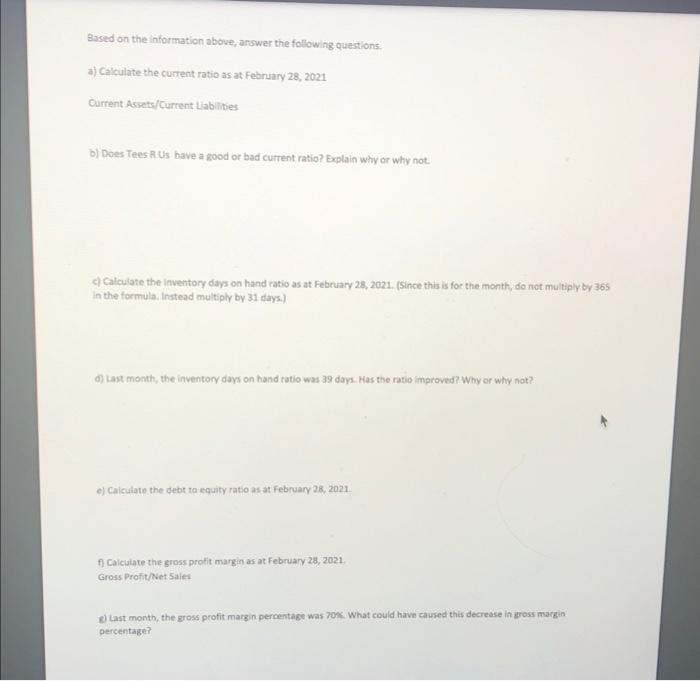

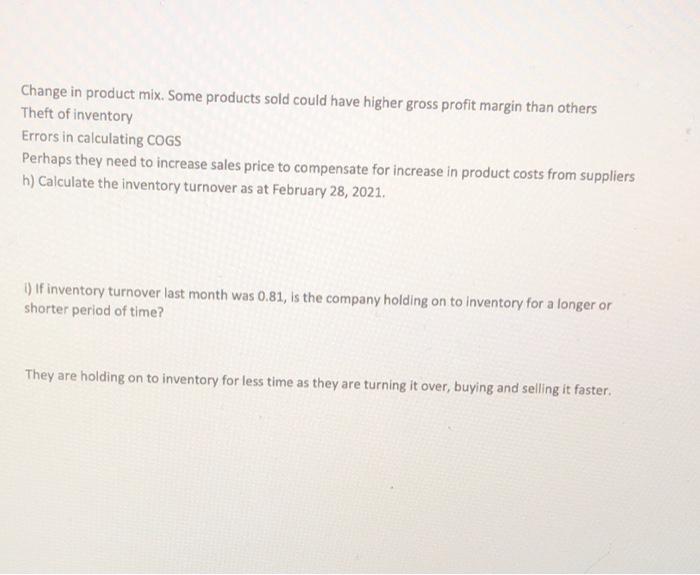

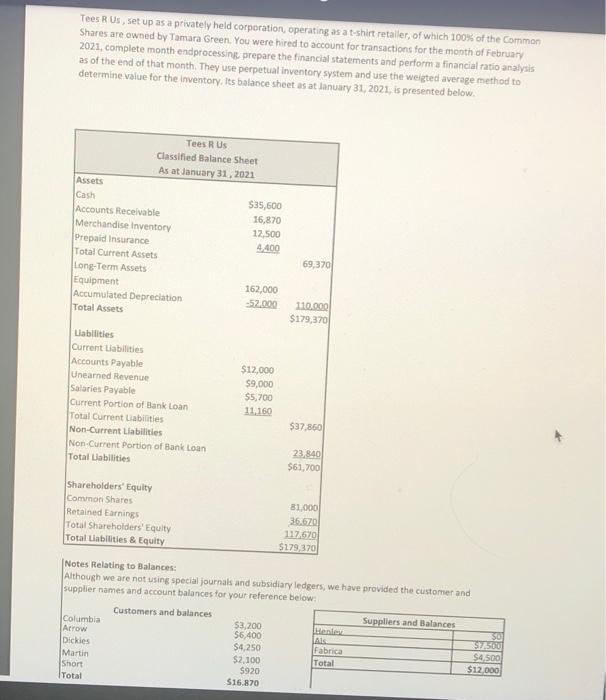

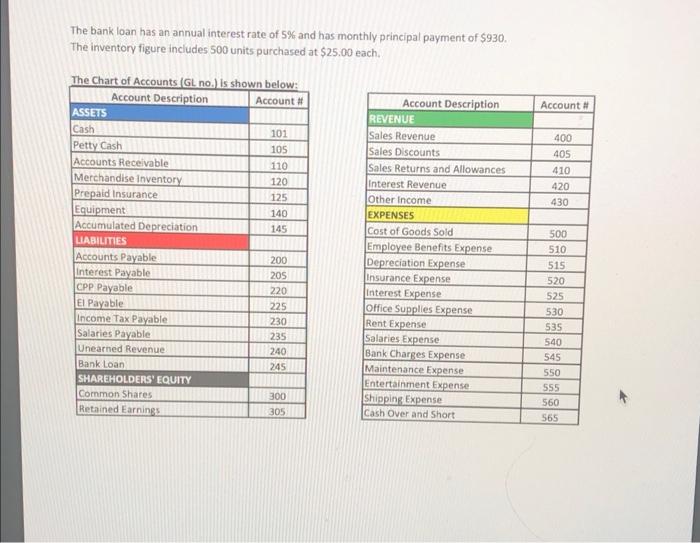

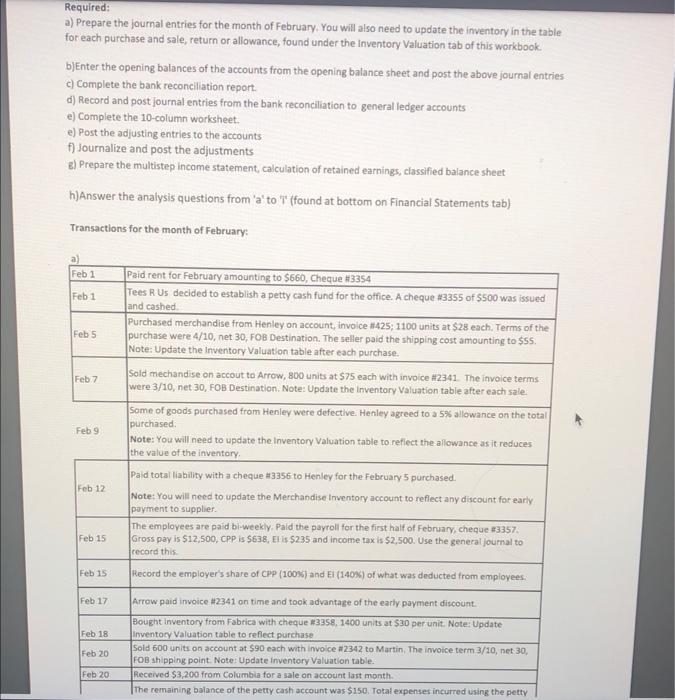

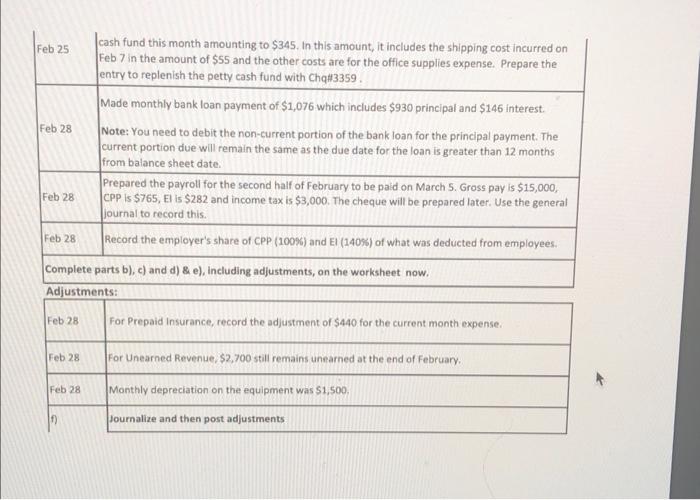

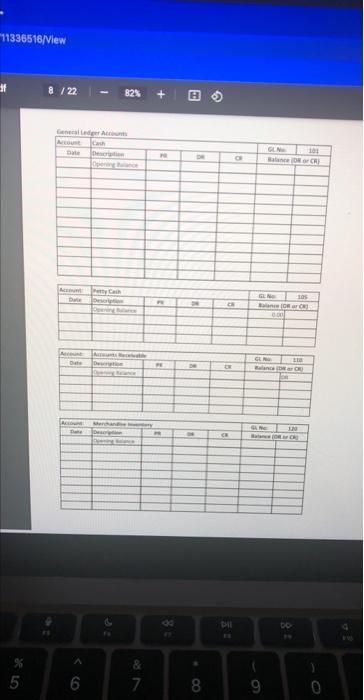

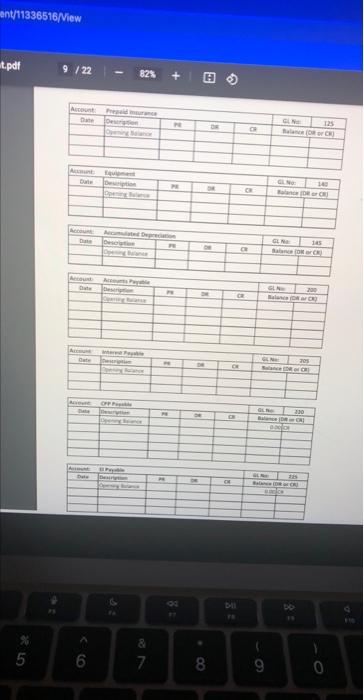

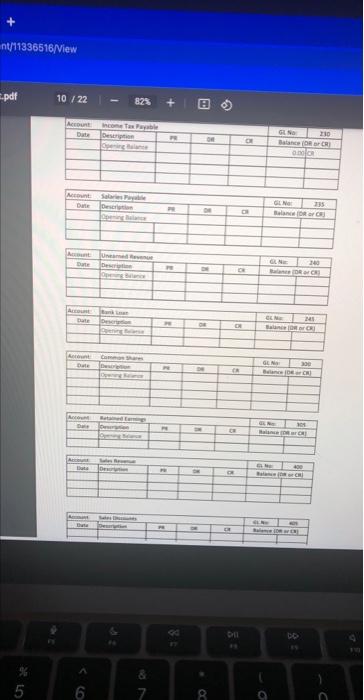

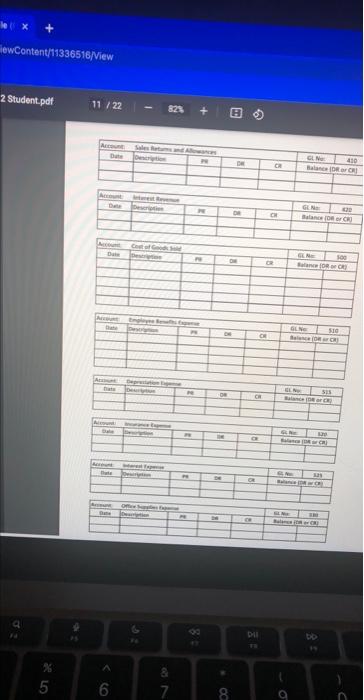

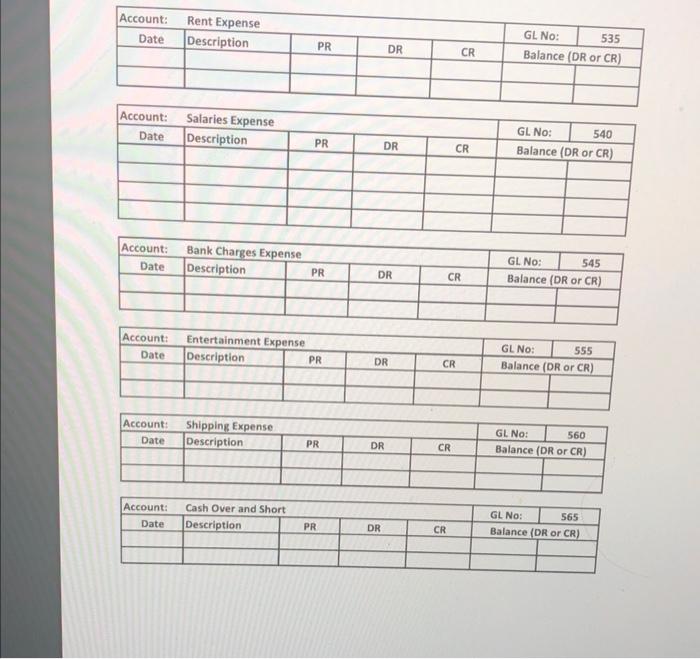

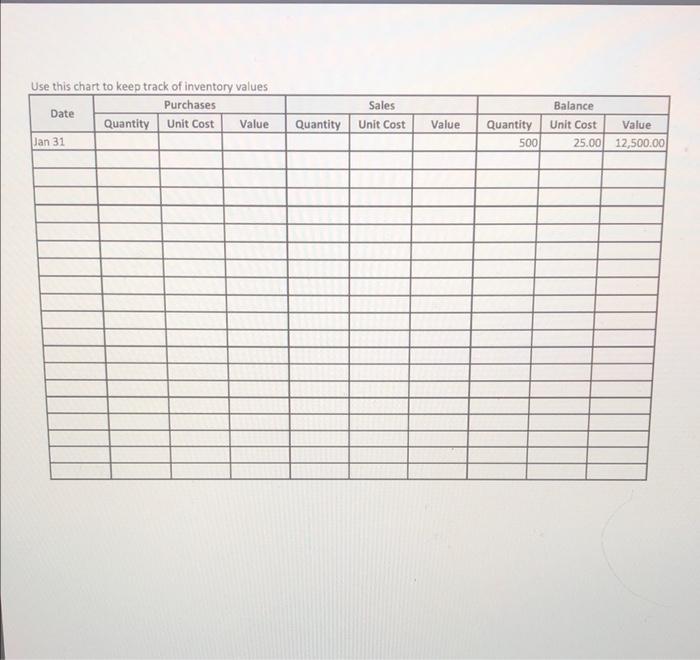

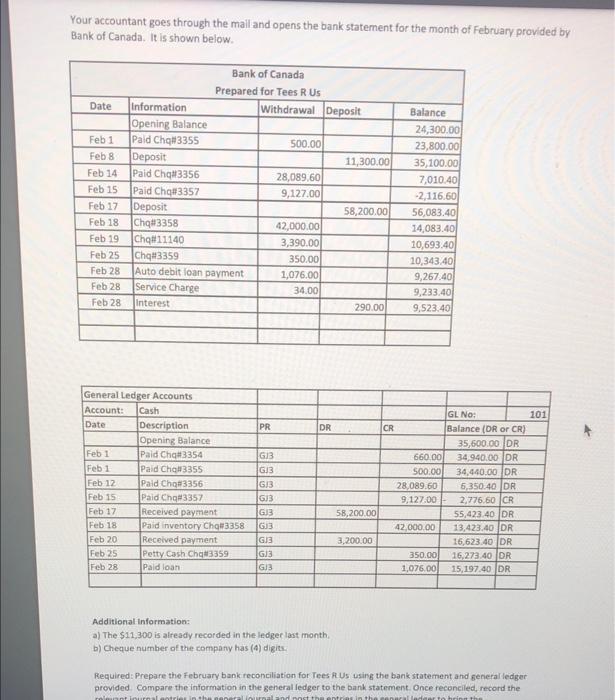

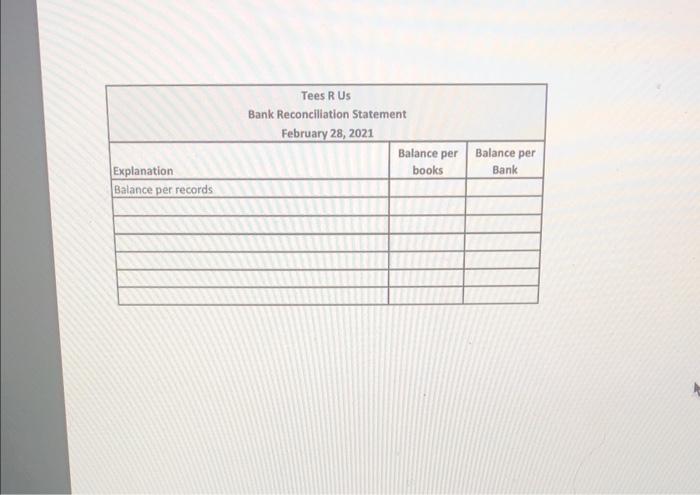

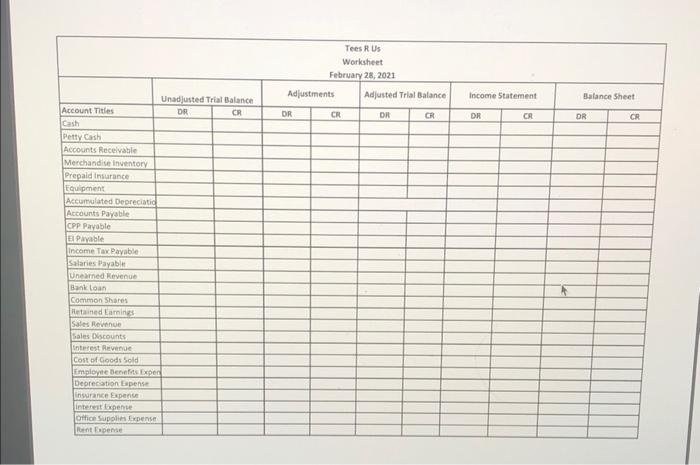

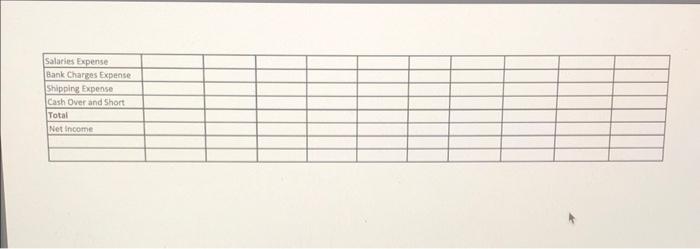

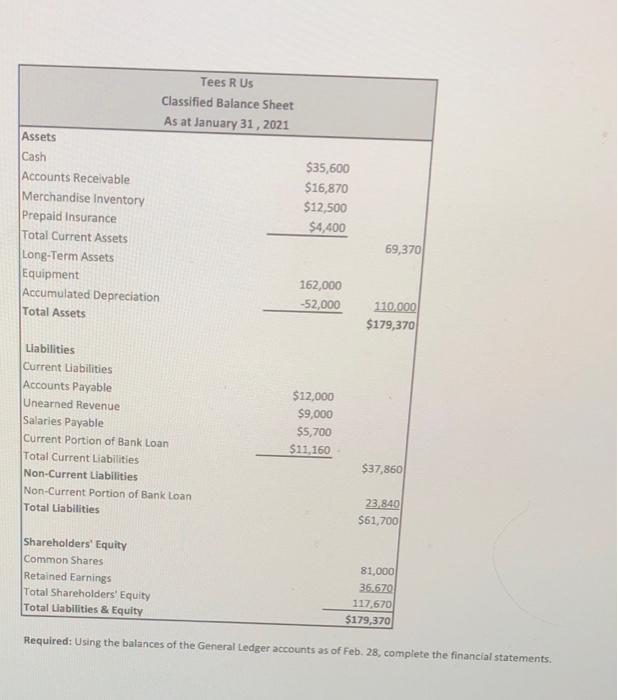

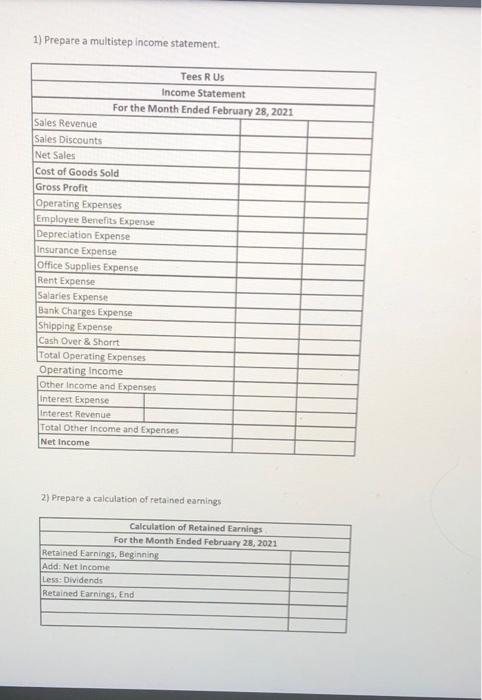

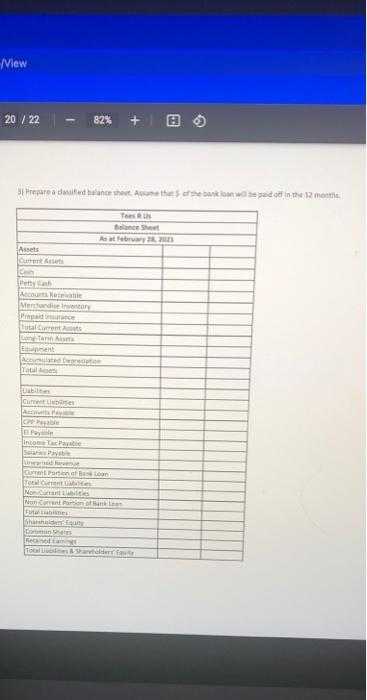

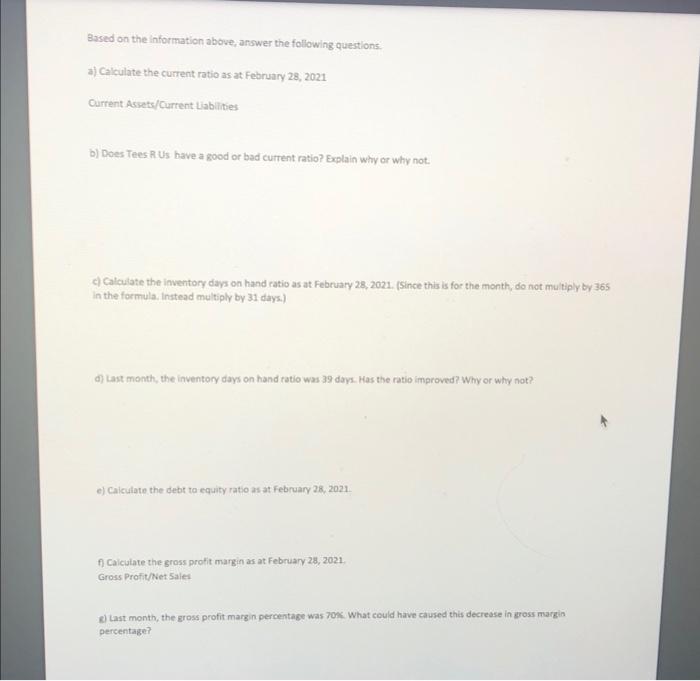

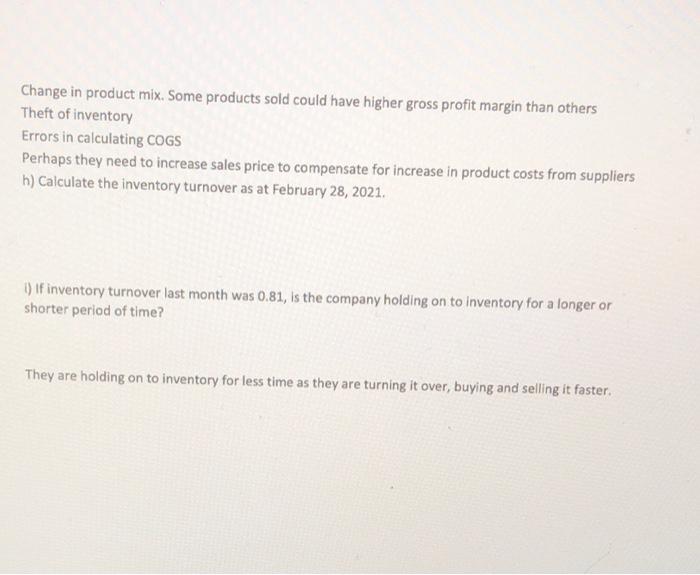

Tees R Us, set up as a privately held corporation, operating as a t-shirt retailer, of which 100 sis of the Common Shares are owned by Tamara Green. You were hired to account for transactions for the month of february 2021, complete month endprocessing, prepare the financial statements and perform a financial fatio anafysis as of the end of that month, They use perpetual inventory system and use- the weigted average method to determine.value for the inventory. Its balance sheet as at lanuary 31 , 2021, is presented below. Notes Relating to balances: Although we are not using special journals and subsidiary ledgers, we have provided the customer and. supplier names and account balances tor your reference below: The bank loan has an annual interest rate of 5% and has monthly principal payment of $930 . The inventory figure includes $00 units purchased at $25.00 each. Required: a) Prepare the journal entries for the month of February. You will also need to update the inventory in the table for each purchase and sale, return or allowance, found under the Inventory Valuation tab of this workbook. b) Enter the opening balances of the accounts from the opening balance sheet and post the above journal entries c) Complete the bank reconciliation report. d) Record and post journal entries from the bank reconciliation to general ledger accounts e) Complete the 10 -column worksheet. e) Post the adjusting entries to the accounts f) Journalize and post the adjustments B) Prepare the multistep income statement, calculation of retained earnings, classified balance sheet h)Answer the analysis questions from 'a' to T' (found at bottom on Financial Statements tab) Transactions for the month of February: Adjustments: \begin{tabular}{|l|l|} \hline Feb 28 & For Prepaid insurance, record the adjustment of $440 for the current month expense. \\ \hline Feb 28 & For Unearned Revenue, $2 , 700 still remains unearned at the end of february. \\ \hline Feb 28 & Monthly depreciation on the equipment was $1 , 500 , , \\ \hline f) & Journalize and then post adjustments \\ \cline { 2 } \end{tabular} n1336513Niew Niew 7122 + 82% + 6 11336518 View Ceneral Ledrer Arris onta ant/1336516Niew nth1336516/View ewContent/1336516/ View \begin{tabular}{|c|l|l|l|l|l|c|c|} \hline Account: & \multicolumn{3}{|l|}{ Rent Expense } & GL No: & 535 \\ \hline Date & Description & PR & DR & CR & \multicolumn{3}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Account: Salaries Expense } & PR & DR & CR & Balance (DR or CR) \\ \hline Date & Description & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|l|} \hline Account: & \multicolumn{3}{|l|}{ Bank Charges Expense } & GL. No: & 545 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|l|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|l|} \hline Account: & Entertainment Expense & PR & GL No: & 555 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|l|} \hline Account: & \multicolumn{2}{|l|}{ Shipping Expense } & GL No: & 560 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|l|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|c|} \hline Account: & \multicolumn{2}{|l|}{ Cash Over and Short } & GL No: & 565 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} tlep thic chart to koantrark nf invantoru valiac Your accountant goes through the malland opens the bank statement for the month of February provided by Bank of Canada. It is shown below. Additional information: a) The $11 , 300 is already recorded in the ledger last month. b) Cheque number of the company has (4) digits. Required: Prepare the february bankireconciliation for Tees A Us using the bank statement and general ledger provided. Compare the information in the general fedger to the bank statement. Once reconciled, record the \begin{tabular}{|l|l|l|} \hline \multicolumn{3}{|c|}{\begin{tabular}{l} Tees R Us \\ \multicolumn{3}{|c|}{ Bank Reconciliation Statement } \\ February 28, 2021 \end{tabular}} \\ \hline Explanation & Balance per books & Balance per Bank \\ \hline Balance per records & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & \\ \hline \end{tabular} Kequired: Using the balances of the General Ledger accounts as of Feb. 28, complete the financial statements. 1) Prepare a multistep income statement. 2) Prepare a calculation of retained earnings Niew. 3) Prepare a damified halance thest. Aswnethirs draesaric ioan wh te paid off in the 12 months. Based on the information above, answer the following questions. a) Calculate the current ratio as at February 28, 2021 Current Acsets/Current Liablities b) Does Tees R Us bave a good or bad current ratio? Explain why or why not. c) Caloulate the inventory days on hand ratio as at February 28,2021 . (Since this is for the month, do not multipy by 365 in the formula. Instead multiply by 31 days.) d) Last month, the inventory days on hand ratio was 39 days. Has the ratio improved? Why or why not? e) Caiculate the debt to equity ratio as at february 28 , 2021. f) Caicutate the gross profit margin as at February 28, 2021 . Gross Profit/Net 5 a l e 1 6) Last month, the gross profit margin percentage was 70 . What could have caused this decrease in gross margin percentage? Change in product mix. Some products sold could have higher gross profit margin than others Theft of inventory Errors in calculating COGS Perhaps they need to increase sales price to compensate for increase in product costs from suppliers h) Calculate the inventory turnover as at February 28 , 2021. i) If inventory turnover last month was 0.81 , is the company holding on to inventory for a longer or shorter period of time? They are holding on to inventory for less time as they are turning it over, buying and selling it faster