Answered step by step

Verified Expert Solution

Question

1 Approved Answer

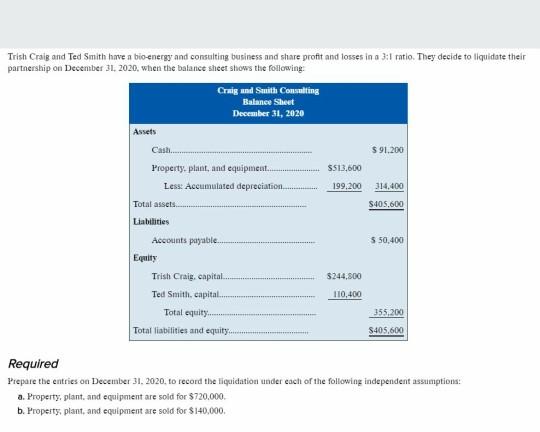

Trish Craig and Ted Smith have a bioenergy and consulting business and share profit and losses in a 3:1 ratio. They decide to liquidate their

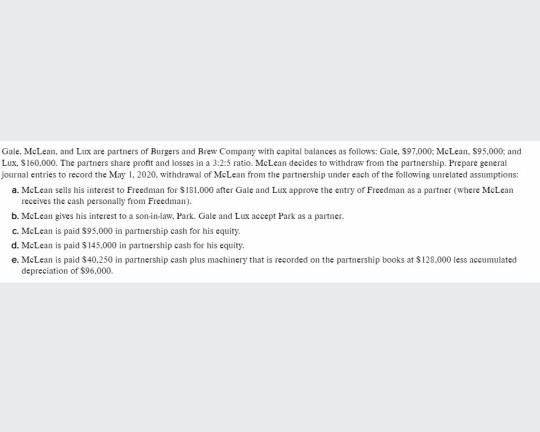

Trish Craig and Ted Smith have a bioenergy and consulting business and share profit and losses in a 3:1 ratio. They decide to liquidate their partnership on December 31, 2020, when the balance sheet shows the following Craig and Smith Consulting Balance Sheet December 31, 2020 $ 91,200 S$13.600 Assets Cashi.. Property, plant, and equipment. Less: Accumulated depreciation Total assets Liabilities 199,200 314.400 $405.600 550,400 $244.800 Accounts payable Equity Trish Craig, capital Ted Smith, capital Total equity....... Total liabilities and equity... 110,400 355,200 S405.600 Required Prepare the entries on December 31, 2020. to record the liquidation under each of the following independent assumptions: a. Property, plant, and equipment are sold for $720.000 b. Property, plant, and equipment are sold for $140.000. Gale. McLean, and Lux are partners of Burgers and Brew Company with capital balances as follows: Gale, 597.000. McLean. 595,000, and Lux, S160,000. The partners share pront and losses in a 3:2.5 ratio. McLean decides to withdraw from the partnership. Prepare general Journal entries to record the May 1, 2020, withdrawal of McLean from the partnership under each of the following unrelated assumptions: a. McLean seils his interest to Freedman for $181,000 after Gale and Lux approve the entry of Freedman as a partner (where McLean receives the cash personally from Freedman). b. McLean gives his interest to a son in law, Park Gale and Lux accept Park as a partner. c. McLean is paid $95,000 in partnership cash for his equity. d. McLean is paid $145.000 in partnership cash for his equity. e. McLean is paid $40.250 in partnership cash plus machinery that is recorded on the partnership books at $128.000 less accumulated depreciation of $96,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started