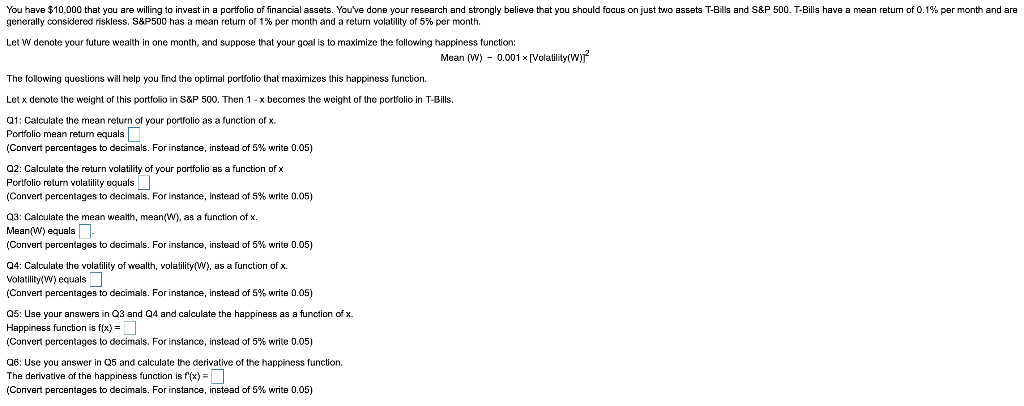

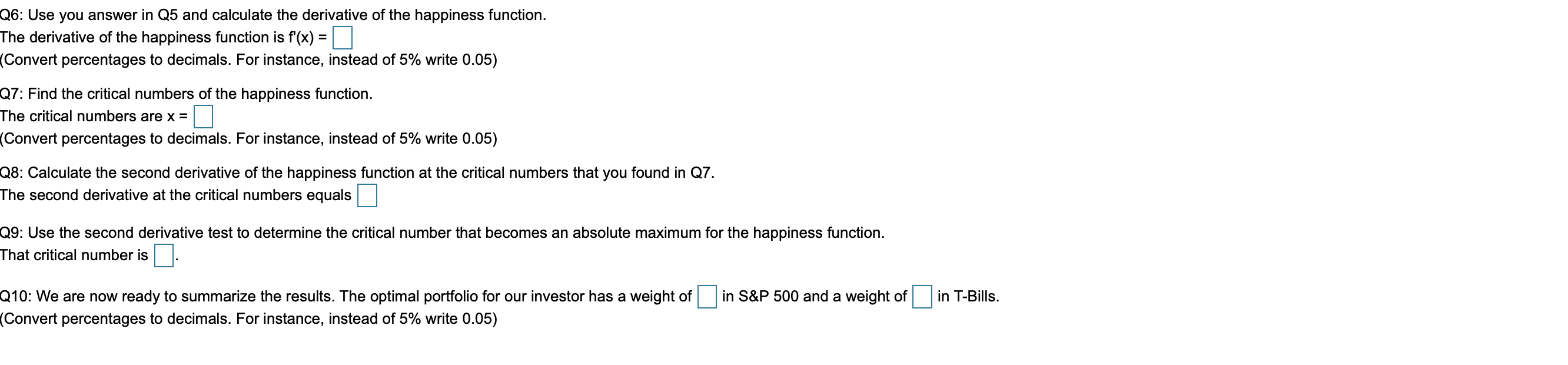

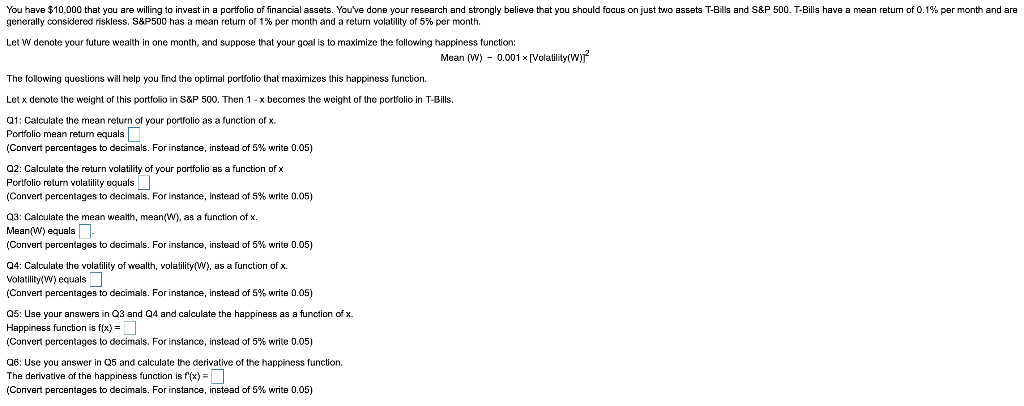

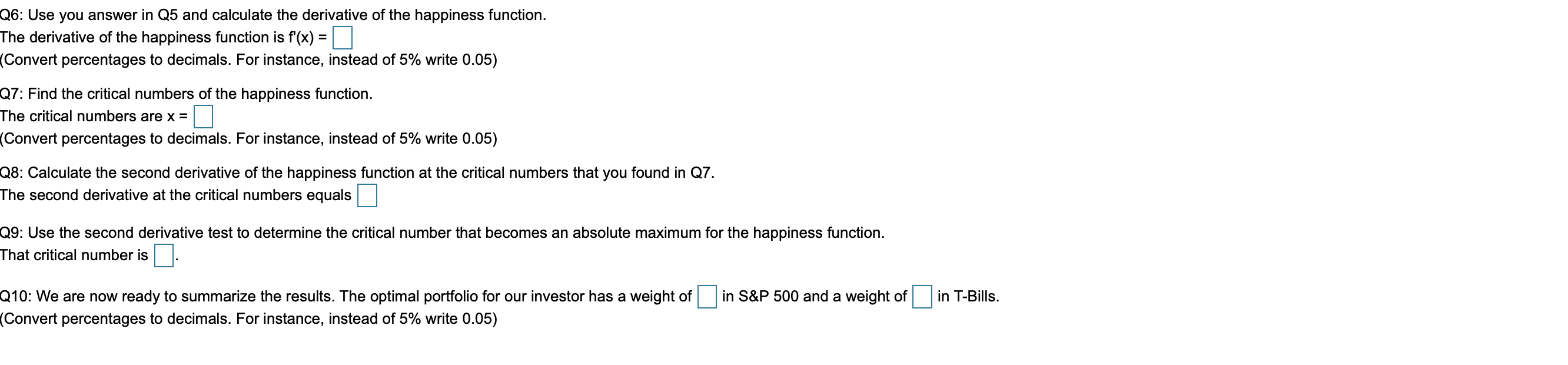

You have $10,000 that you are willing to invest in a portfolio of financial assets. You've done your research and strongly believe that you should focus on just two assets T-Bills and S&P 500. T-Bills have a mean return of 0.1% per month and are generally considered riskless. S&P500 has a mean return of 1% per month and a return volatility of 5% per month. Let W denote your future wealth in one month, and suppose that your goal is to maximize the following happiness function: Mean (W) - 0.001x [Volatility(wif The following questions will help you find the optimal portfolio that maximizes this happiness function. Let x denote the weight of this portfolio in S&P 500. Then 1 - x becomes the weight of the portfolio in T-Bills. Q1: Calculate the mean return of your portfolio as a function of x. Portfolio mean retum equals (Convert percentages to decimals. For instance, instead of 5% write 0.05) Q2: Calculate the return volatility of your portfolio as a function of Portfolio return volatility equals (Convert percentages to decimals. For instance, instead of 5% write 0.05) Q3: Calculate the mean wealth, mean/W), as a function of x. Mean(W) equals (Convert percentages to decimals. For instance, instead of 5% write 0.05) Q4: Calculate the volatility of wealth, volatility(W), as a function of x. Volatility(W) equals (Convert percentages to decimals. For instance, instead of 5% write 0.05) Q5: Use your answers in Q3 and 04 and calculate the happiness as a function of x. Happiness function is f(x) = (Convert percentages lo decimals. For instance, instead of 5% write 0.05) Q6: Use you answer in Q5 and calculate the derivative of the happiness function. The derivative of the happiness function is f'(x) = (Convert percentages to decimals. For instance, instead of 5% write 0.05) Q6: Use you answer in Q5 and calculate the derivative of the happiness function. The derivative of the happiness function is f'(x) = (Convert percentages to decimals. For instance, instead of 5% write 0.05) Q7: Find the critical numbers of the happiness function. The critical numbers are x = (Convert percentages to decimals. For instance, instead of 5% write 0.05) Q8: Calculate the second derivative of the happiness function at the critical numbers that you found in Q7. The second derivative at the critical numbers equals Q9: Use the second derivative test to determine the critical number that becomes an absolute maximum for the happiness function. That critical number is in T-Bills. Q10: We are now ready to summarize the results. The optimal portfolio for our investor has a weight of in S&P 500 and a weight of (Convert percentages to decimals. For instance, instead of 5% write 0.05) You have $10,000 that you are willing to invest in a portfolio of financial assets. You've done your research and strongly believe that you should focus on just two assets T-Bills and S&P 500. T-Bills have a mean return of 0.1% per month and are generally considered riskless. S&P500 has a mean return of 1% per month and a return volatility of 5% per month. Let W denote your future wealth in one month, and suppose that your goal is to maximize the following happiness function: Mean (W) - 0.001x [Volatility(wif The following questions will help you find the optimal portfolio that maximizes this happiness function. Let x denote the weight of this portfolio in S&P 500. Then 1 - x becomes the weight of the portfolio in T-Bills. Q1: Calculate the mean return of your portfolio as a function of x. Portfolio mean retum equals (Convert percentages to decimals. For instance, instead of 5% write 0.05) Q2: Calculate the return volatility of your portfolio as a function of Portfolio return volatility equals (Convert percentages to decimals. For instance, instead of 5% write 0.05) Q3: Calculate the mean wealth, mean/W), as a function of x. Mean(W) equals (Convert percentages to decimals. For instance, instead of 5% write 0.05) Q4: Calculate the volatility of wealth, volatility(W), as a function of x. Volatility(W) equals (Convert percentages to decimals. For instance, instead of 5% write 0.05) Q5: Use your answers in Q3 and 04 and calculate the happiness as a function of x. Happiness function is f(x) = (Convert percentages lo decimals. For instance, instead of 5% write 0.05) Q6: Use you answer in Q5 and calculate the derivative of the happiness function. The derivative of the happiness function is f'(x) = (Convert percentages to decimals. For instance, instead of 5% write 0.05) Q6: Use you answer in Q5 and calculate the derivative of the happiness function. The derivative of the happiness function is f'(x) = (Convert percentages to decimals. For instance, instead of 5% write 0.05) Q7: Find the critical numbers of the happiness function. The critical numbers are x = (Convert percentages to decimals. For instance, instead of 5% write 0.05) Q8: Calculate the second derivative of the happiness function at the critical numbers that you found in Q7. The second derivative at the critical numbers equals Q9: Use the second derivative test to determine the critical number that becomes an absolute maximum for the happiness function. That critical number is in T-Bills. Q10: We are now ready to summarize the results. The optimal portfolio for our investor has a weight of in S&P 500 and a weight of (Convert percentages to decimals. For instance, instead of 5% write 0.05)