Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TranscribedText: Sullivan, Inc., sells tire rims. Its sales budget and inventory, purchases, and cost of goods sold budget for the nine months ended September 30,

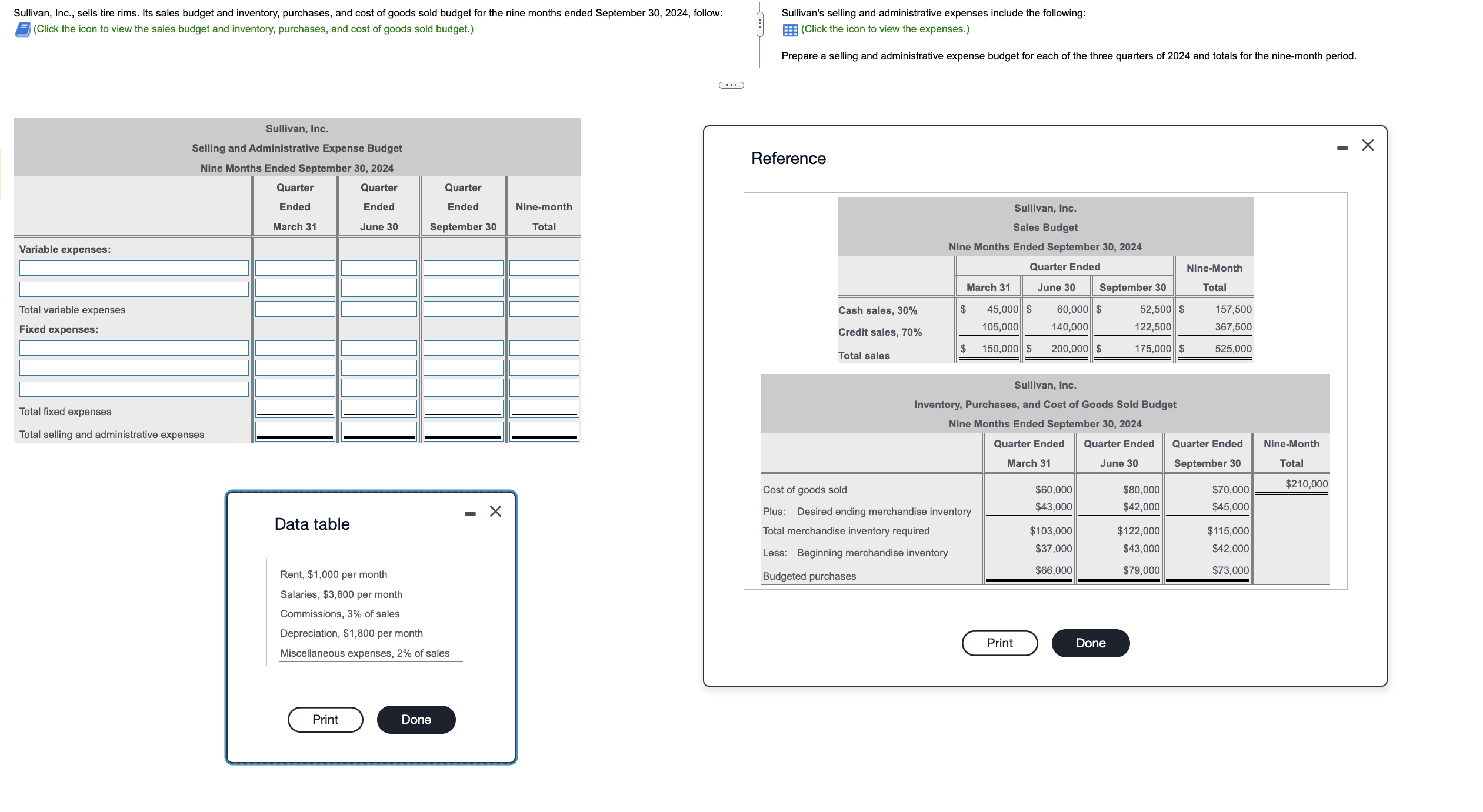

Sullivan, Inc., sells tire rims. Its sales budget and inventory, purchases, and cost of goods sold budget for the nine months ended September 30, 2024, follow: (Click the icon to view the sales budget and inventory, purchases, and cost of goods sold budget.) Variable expenses: Total variable expenses Fixed expenses: Total fixed expenses Total selling and administrative expenses Sullivan, Inc. Selling and Administrative Expense Budget Nine Months Ended September 30, 2024 Quarter Quarter Ended Ended Quarter Ended March 31 June 30 September 30 Nine-month Total Data table Rent, $1,000 per month Salaries, $3,800 per month Commissions, 3% of sales Depreciation, $1,800 per month Miscellaneous expenses, 2% of sales Print Done Sullivan's selling and administrative expenses include the following: (Click the icon to view the expenses.) Prepare a selling and administrative expense budget for each of the three quarters of 2024 and totals for the nine-month period. Reference Sullivan, Inc. Sales Budget Nine Months Ended September 30, 2024 Quarter Ended Nine-Month March 31 June 30 September 30 Total Cash sales, 30% $ 45,000 $ 105,000 60,000||$ 140,000 Credit sales, 70% $ 150,000 $ 200,000 $ 52,500 $ 122,500 175,000||$ 157,500 367,500 525,000 Total sales Sullivan, Inc. Inventory, Purchases, and Cost of Goods Sold Budget Nine Months Ended September 30, 2024 Quarter Ended March 31 Quarter Ended June 30 Quarter Ended September 30 Nine-Month Total $210,000 Cost of goods sold $60,000 $80,000 $70,000 Plus: Desired ending merchandise inventory Total merchandise inventory required $43,000 $42,000 $45,000 $103,000 $122,000 $115,000 $37,000 $43,000 $42,000 Less: Beginning merchandise inventory Budgeted purchases $66,000 $79,000 $73,000 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the selling and administrative expense budget for each of the three quarters of 2024 and totals for the ninemonth period we can use the pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started