Answered step by step

Verified Expert Solution

Question

1 Approved Answer

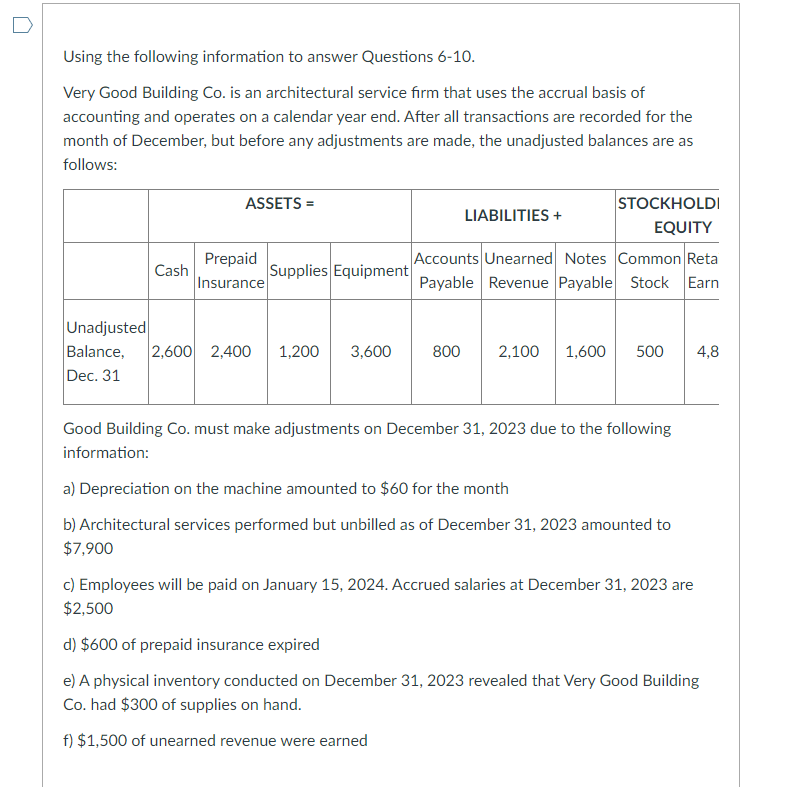

Using the following information to answer Questions 6-10. Very Good Building Co. is an architectural service firm that uses the accrual basis of accounting

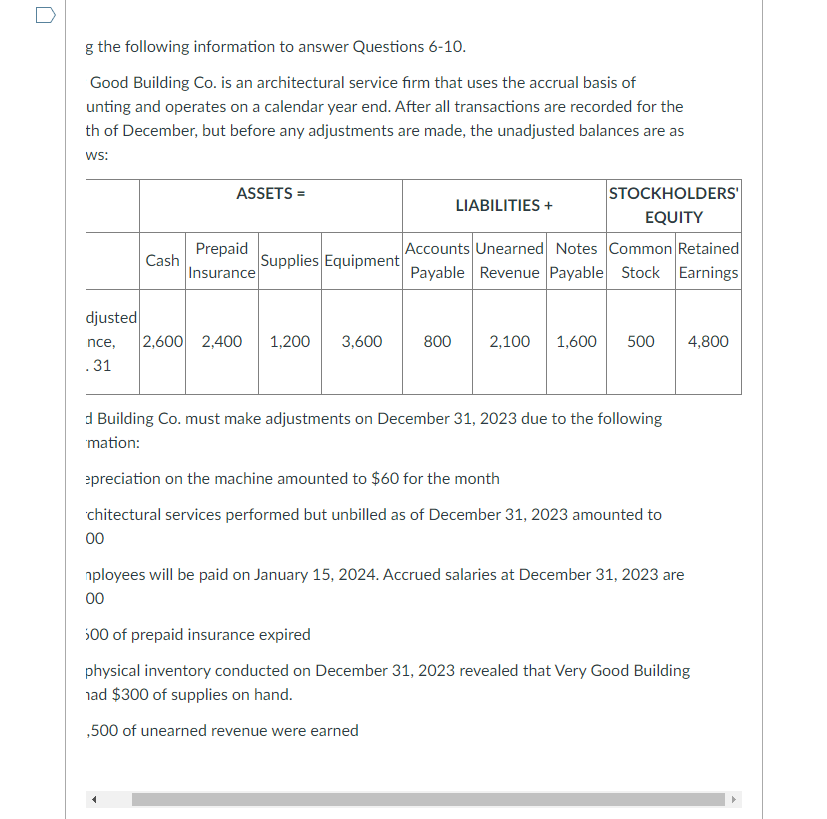

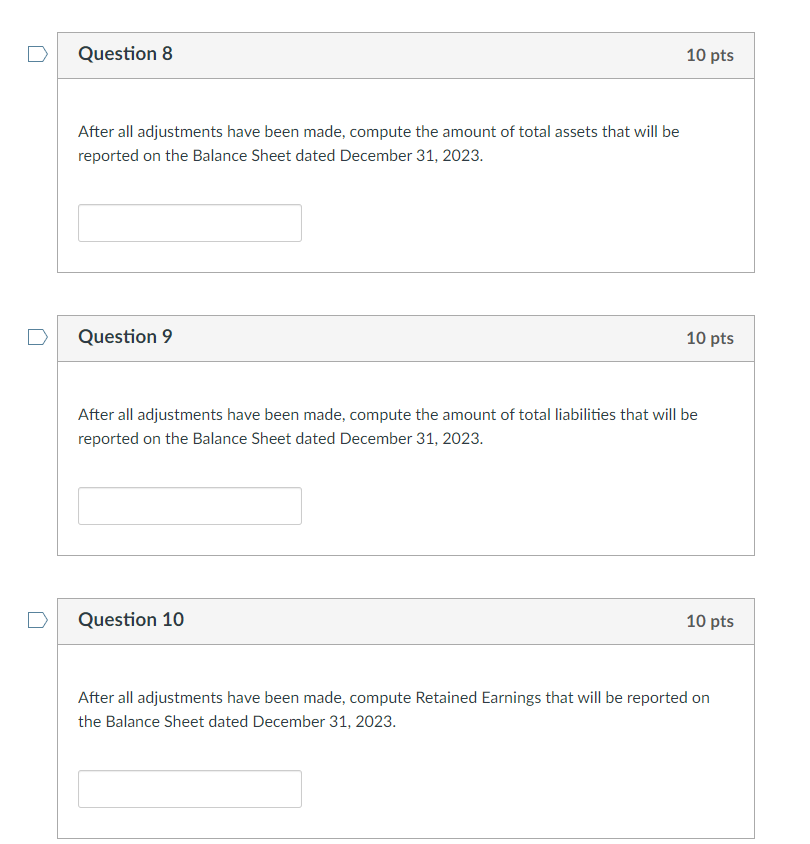

Using the following information to answer Questions 6-10. Very Good Building Co. is an architectural service firm that uses the accrual basis of accounting and operates on a calendar year end. After all transactions are recorded for the month of December, but before any adjustments are made, the unadjusted balances are as follows: Unadjusted ASSETS = STOCKHOLDI LIABILITIES + EQUITY Cash Prepaid Insurance Supplies Equipment Accounts Unearned Notes Common Reta Payable Revenue Payable Stock Earn Balance, 2,600 2,400 1,200 3,600 Dec. 31 800 2,100 1,600 500 4,8 Good Building Co. must make adjustments on December 31, 2023 due to the following information: a) Depreciation on the machine amounted to $60 for the month b) Architectural services performed but unbilled as of December 31, 2023 amounted to $7,900 c) Employees will be paid on January 15, 2024. Accrued salaries at December 31, 2023 are $2,500 d) $600 of prepaid insurance expired e) A physical inventory conducted on December 31, 2023 revealed that Very Good Building Co. had $300 of supplies on hand. f) $1,500 of unearned revenue were earned g the following information to answer Questions 6-10. Good Building Co. is an architectural service firm that uses the accrual basis of unting and operates on a calendar year end. After all transactions are recorded for the th of December, but before any adjustments are made, the unadjusted balances are as WS: ASSETS = LIABILITIES + STOCKHOLDERS EQUITY Cash Prepaid Insurance Supplies Equipment Accounts Unearned Notes Common Retained Payable Revenue Payable Stock Earnings djusted nce, 2,600 2,400 1,200 3,600 .31 800 2,100 1,600 500 4,800 d Building Co. must make adjustments on December 31, 2023 due to the following mation: epreciation on the machine amounted to $60 for the month chitectural services performed but unbilled as of December 31, 2023 amounted to 00 nployees will be paid on January 15, 2024. Accrued salaries at December 31, 2023 are 00 500 of prepaid insurance expired physical inventory conducted on December 31, 2023 revealed that Very Good Building had $300 of supplies on hand. ,500 of unearned revenue were earned Question 8 After all adjustments have been made, compute the amount of total assets that will be reported on the Balance Sheet dated December 31, 2023. Question 9 10 pts 10 pts After all adjustments have been made, compute the amount of total liabilities that will be reported on the Balance Sheet dated December 31, 2023. Question 10 10 pts After all adjustments have been made, compute Retained Earnings that will be reported on the Balance Sheet dated December 31, 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started