Answered step by step

Verified Expert Solution

Question

1 Approved Answer

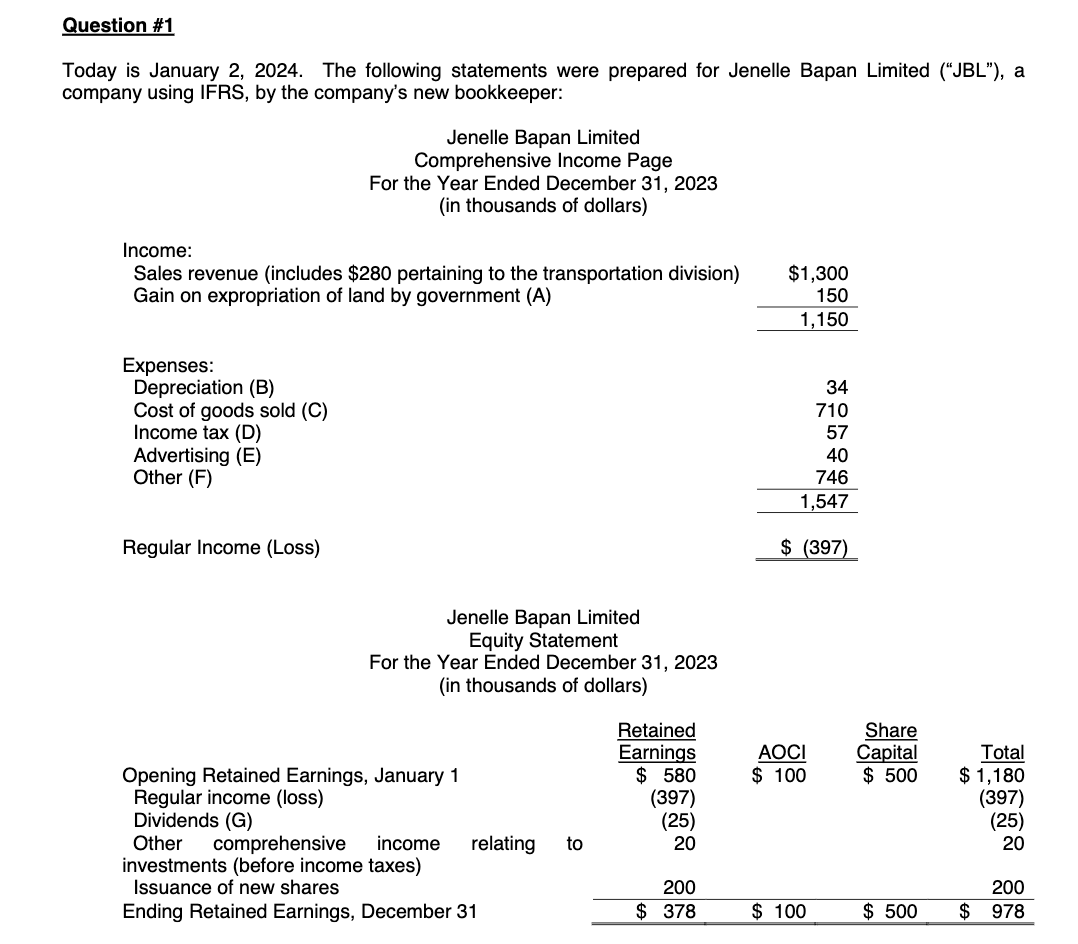

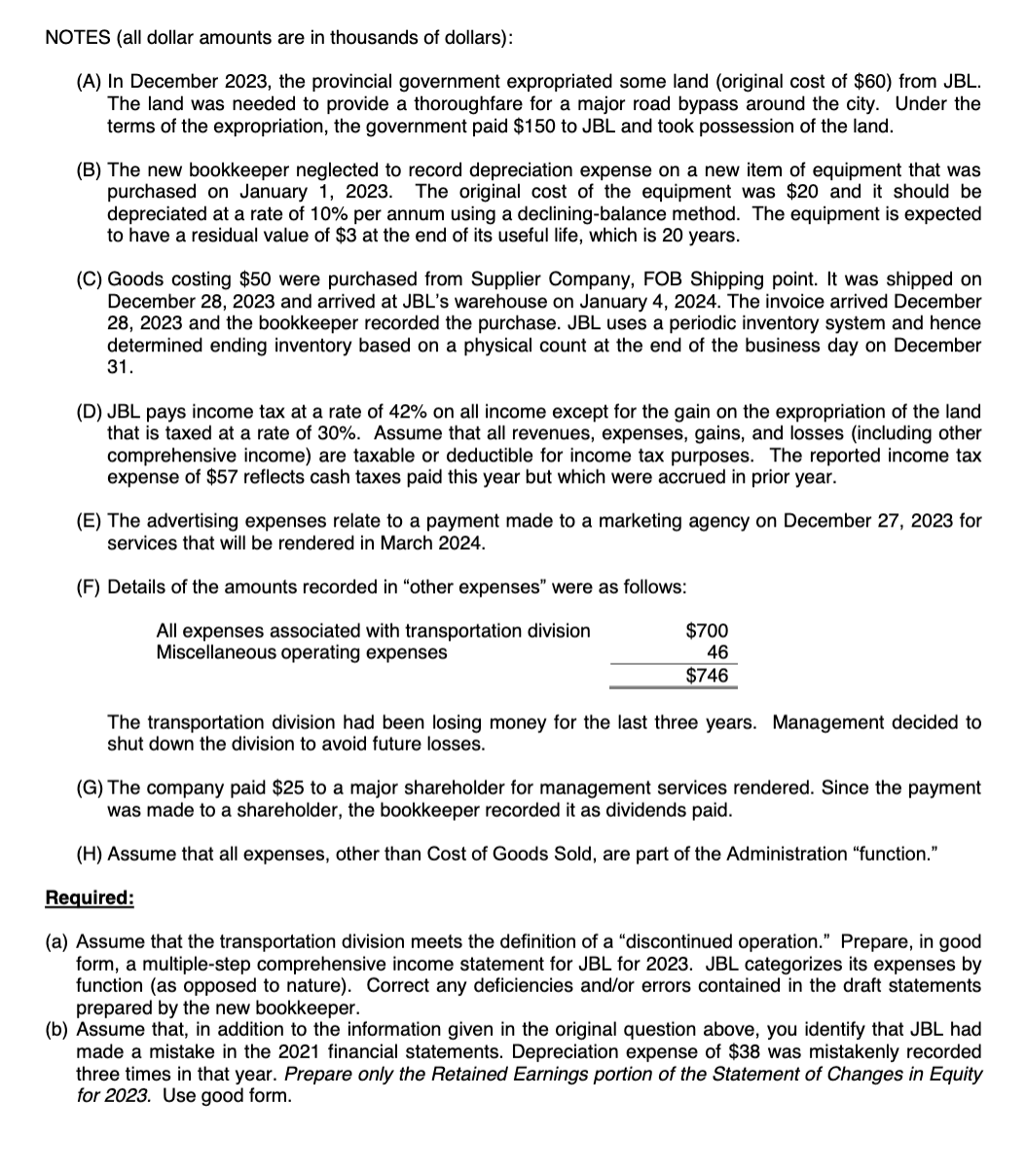

Question #1 Today is January 2, 2024. The following statements were prepared for Jenelle Bapan Limited (JBL), a company using IFRS, by the company's

Question #1 Today is January 2, 2024. The following statements were prepared for Jenelle Bapan Limited ("JBL"), a company using IFRS, by the company's new bookkeeper: Jenelle Bapan Limited Comprehensive Income Page For the Year Ended December 31, 2023 (in thousands of dollars) Income: Sales revenue (includes $280 pertaining to the transportation division) Gain on expropriation of land by government (A) $1,300 150 1,150 Expenses: Depreciation (B) Cost of goods sold (C) Income tax (D) Advertising (E) Other (F) Regular Income (Loss) Jenelle Bapan Limited Equity Statement For the Year Ended December 31, 2023 (in thousands of dollars) 34 710 57 40 746 1,547 $ (397) Opening Retained Earnings, January 1 Retained Earnings $ 580 AOCI $ 100 Regular income (loss) Dividends (G) Other comprehensive (397) (25) Share Capital $ 500 Total $ 1,180 (397) (25) income relating to 20 20 investments (before income taxes) Issuance of new shares Ending Retained Earnings, December 31 200 200 $ 378 $ 100 $ 500 $ 978 NOTES (all dollar amounts are in thousands of dollars): (A) In December 2023, the provincial government expropriated some land (original cost of $60) from JBL. The land was needed to provide a thoroughfare for a major road bypass around the city. Under the terms of the expropriation, the government paid $150 to JBL and took possession of the land. (B) The new bookkeeper neglected to record depreciation expense on a new item of equipment that was purchased on January 1, 2023. The original cost of the equipment was $20 and it should be depreciated at a rate of 10% per annum using a declining-balance method. The equipment is expected to have a residual value of $3 at the end of its useful life, which is 20 years. (C) Goods costing $50 were purchased from Supplier Company, FOB Shipping point. It was shipped on December 28, 2023 and arrived at JBL's warehouse on January 4, 2024. The invoice arrived December 28, 2023 and the bookkeeper recorded the purchase. JBL uses a periodic inventory system and hence determined ending inventory based on a physical count at the end of the business day on December 31. (D) JBL pays income tax at a rate of 42% on all income except for the gain on the expropriation of the land that is taxed at a rate of 30%. Assume that all revenues, expenses, gains, and losses (including other comprehensive income) are taxable or deductible for income tax purposes. The reported income tax expense of $57 reflects cash taxes paid this year but which were accrued in prior year. (E) The advertising expenses relate to a payment made to a marketing agency on December 27, 2023 for services that will be rendered in March 2024. (F) Details of the amounts recorded in "other expenses" were as follows: All expenses associated with transportation division Miscellaneous operating expenses $700 46 $746 The transportation division had been losing money for the last three years. Management decided to shut down the division to avoid future losses. (G) The company paid $25 to a major shareholder for management services rendered. Since the payment was made to a shareholder, the bookkeeper recorded it as dividends paid. (H) Assume that all expenses, other than Cost of Goods Sold, are part of the Administration "function." Required: (a) Assume that the transportation division meets the definition of a "discontinued operation." Prepare, in good form, a multiple-step comprehensive income statement for JBL for 2023. JBL categorizes its expenses by function (as opposed to nature). Correct any deficiencies and/or errors contained in the draft statements prepared by the new bookkeeper. (b) Assume that, in addition to the information given in the original question above, you identify that JBL had made a mistake in the 2021 financial statements. Depreciation expense of $38 was mistakenly recorded three times in that year. Prepare only the Retained Earnings portion of the Statement of Changes in Equity for 2023. Use good form.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started