Answered step by step

Verified Expert Solution

Question

1 Approved Answer

> Transfer Pricing Algodones Inc. has a number of divisions, including a Mattress Division and a Furniture Division. The Furniture Division owns and operates

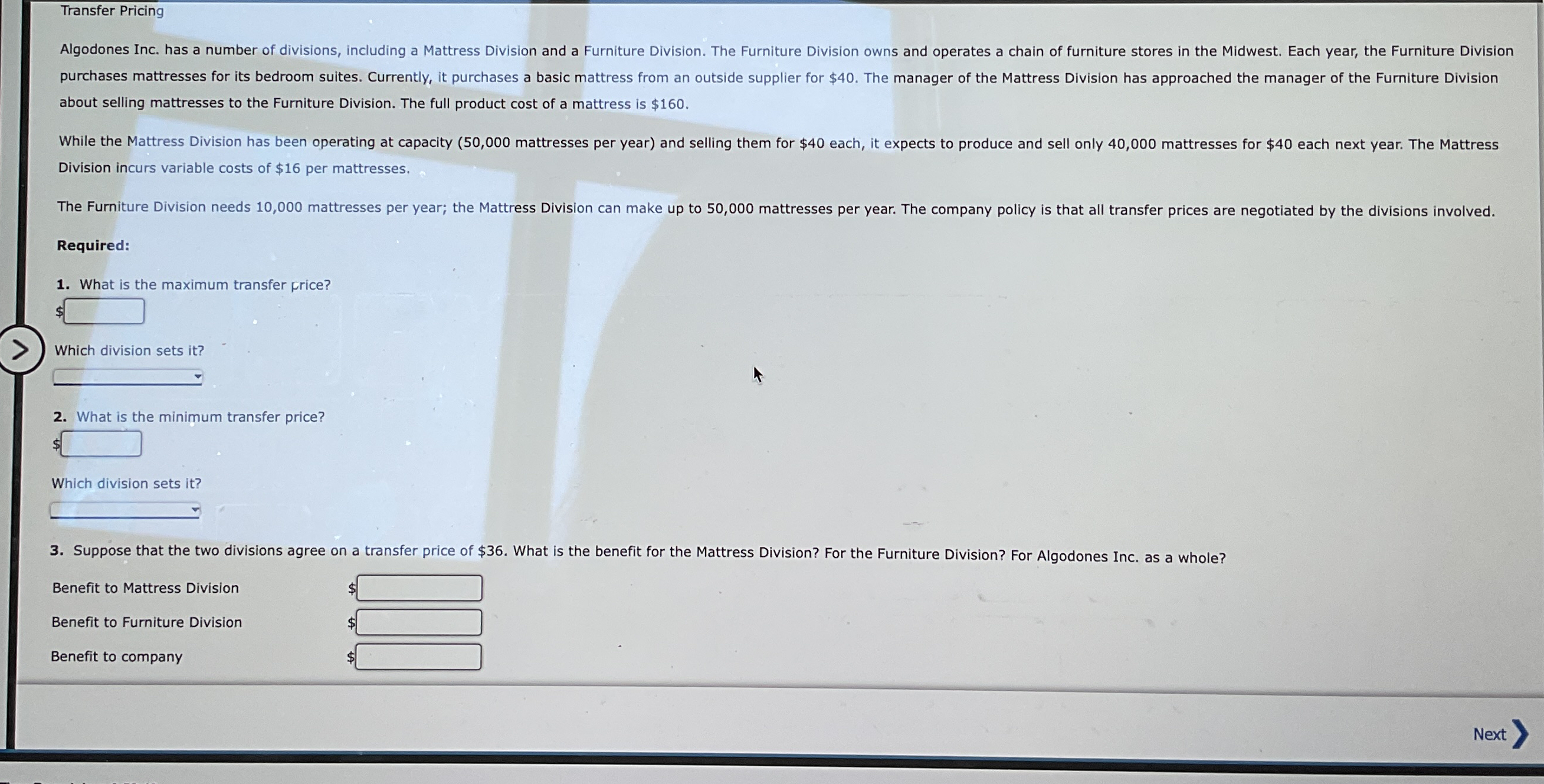

> Transfer Pricing Algodones Inc. has a number of divisions, including a Mattress Division and a Furniture Division. The Furniture Division owns and operates a chain of furniture stores in the Midwest. Each year, the Furniture Division purchases mattresses for its bedroom suites. Currently, it purchases a basic mattress from an outside supplier for $40. The manager of the Mattress Division has approached the manager of the Furniture Division about selling mattresses to the Furniture Division. The full product cost of a mattress is $160. While the Mattress Division has been operating at capacity (50,000 mattresses per year) and selling them for $40 each, it expects to produce and sell only 40,000 mattresses for $40 each next year. The Mattress Division incurs variable costs of $16 per mattresses. The Furniture Division needs 10,000 mattresses per year; the Mattress Division can make up to 50,000 mattresses per year. The company policy is that all transfer prices are negotiated by the divisions involved. Required: 1. What is the maximum transfer price? $ Which division sets it? 2. What is the minimum transfer price? Which division sets it? 3. Suppose that the two divisions agree on a transfer price of $36. What is the benefit for the Mattress Division? For the Furniture Division? For Algodones Inc. as a whole? Benefit to Mattress Division Benefit to Furniture Division Benefit to company Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Maximum Transfer Price and Setting Division The maximum transfer price is typically set at the mar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started