Answered step by step

Verified Expert Solution

Question

1 Approved Answer

translation: A company considers the following investment: Year 0 1 2 3 4 5 6 Costs ($) 500 110 190 120 220 150 140 Income

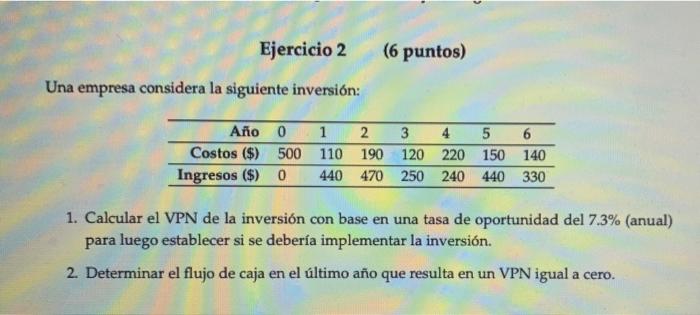

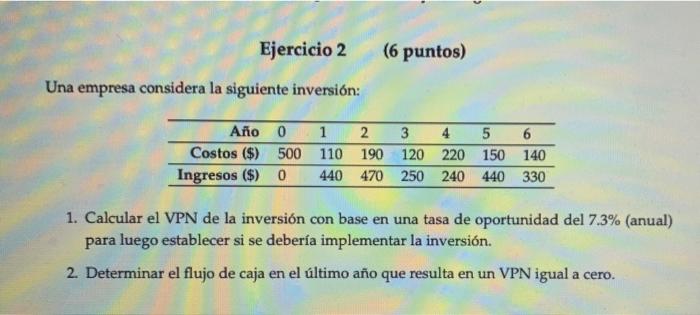

translation: A company considers the following investment:Year 0 1 2 3 4 5 6 Costs ($) 500 110 190 120 220 150 140 Income ($) 0 440 470 250 240 440 330 1. Calculate the NPV of the investment based on an opportunity rate of 7.3% (annual) to later establish whether the investment should be implemented. 2. Determine the cash flow in the last year that results in a NPV equal to zero. Ejercicio 2 (6 puntos) Una empresa considera la siguiente inversin: Ao 0 1 2 3 4 5 6 Costos ($) 500 110 190 120 220 150 140 Ingresos ($) 0 440 470 250 240 440 330 1. Calcular el VPN de la inversin con base en una tasa de oportunidad del 7.3% (anual) para luego establecer si se debera implementar la inversin. 2. Determinar el flujo de caja en el ltimo ao que resulta en un VPN igual a cero

translation: A company considers the following investment:Year 0 1 2 3 4 5 6 Costs ($) 500 110 190 120 220 150 140 Income ($) 0 440 470 250 240 440 330 1. Calculate the NPV of the investment based on an opportunity rate of 7.3% (annual) to later establish whether the investment should be implemented. 2. Determine the cash flow in the last year that results in a NPV equal to zero. Ejercicio 2 (6 puntos) Una empresa considera la siguiente inversin: Ao 0 1 2 3 4 5 6 Costos ($) 500 110 190 120 220 150 140 Ingresos ($) 0 440 470 250 240 440 330 1. Calcular el VPN de la inversin con base en una tasa de oportunidad del 7.3% (anual) para luego establecer si se debera implementar la inversin. 2. Determinar el flujo de caja en el ltimo ao que resulta en un VPN igual a cero

Year 0 1 2 3 4 5 6

Costs ($) 500 110 190 120 220 150 140

Income ($) 0 440 470 250 240 440 330

1. Calculate the NPV of the investment based on an opportunity rate of 7.3% (annual)

to later establish whether the investment should be implemented.

2. Determine the cash flow in the last year that results in a NPV equal to zero.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started