Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Translation and Remeasurement of Depreclable Assets Massmart, the second largest retaller in Africa, is a subsidiary of Wal-Mart Inc, a U.S. company. Massmart reports its

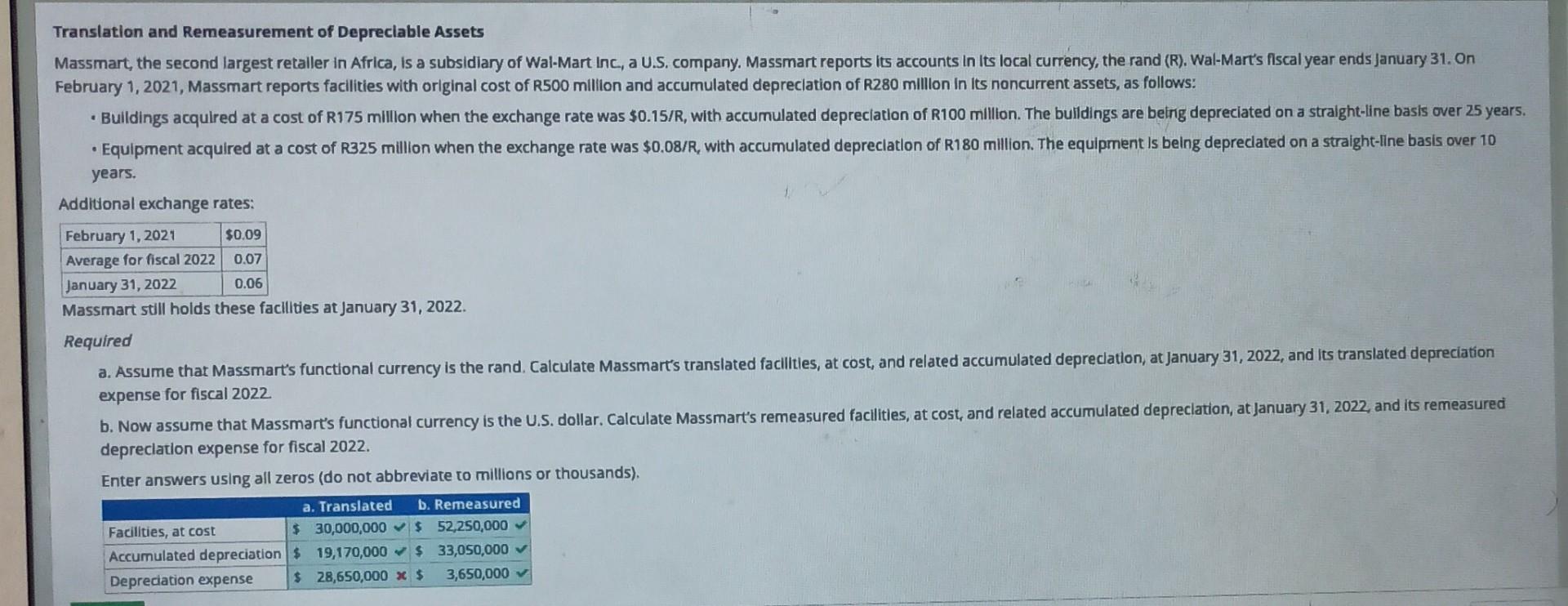

Translation and Remeasurement of Depreclable Assets Massmart, the second largest retaller in Africa, is a subsidiary of Wal-Mart Inc, a U.S. company. Massmart reports its accounts in Its local currency, the rand (R). Wal-Mart's fiscal year ends January 31 . On February 1, 2021, Massmart reports facilities with original cost of R500 million and accumulated depreclation of R280 million in its noncurrent assets, as follows: - Buildings acquired at a cost of R175 million when the exchange rate was $0.15/R, with accumulated depreciation of R100 million. The bulidings are being depreciated on a stralght-line basis over 25 years. - Equipment acquired at a cost of R325 million when the exchange rate was $0.08/R, with accumulated depreclation of R180 million. The equipment is beling depreclated on a straight-line basis over 10 years. Additional exchange rates: Massmart still holds these faclities at January 31, 2022. Required a. Assume that Massmart's functional currency is the rand. Calculate Massmart's translated facilities, at cost, and related accumulated depreclation, at January 31 , 2022, and its translated depreciation expense for fiscal 2022 b. Now assume that Massmart's functional currency is the U.S. dollar. Calculate Massmart's remeasured facilities, at cost, and related accumulated depreclation, at january 31 , 2022, and its remeasured depreclation expense for fiscal 2022. Enter answers using all zeros (do not abbreviate to millions or thousands)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started