Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Translation and Remeasurement of Subsidiary Trial Balance Costsave Corporation, a U.S. company, acquired Denner, a discount supermarket chain in Switzerland, on January 1, 2024. Denner

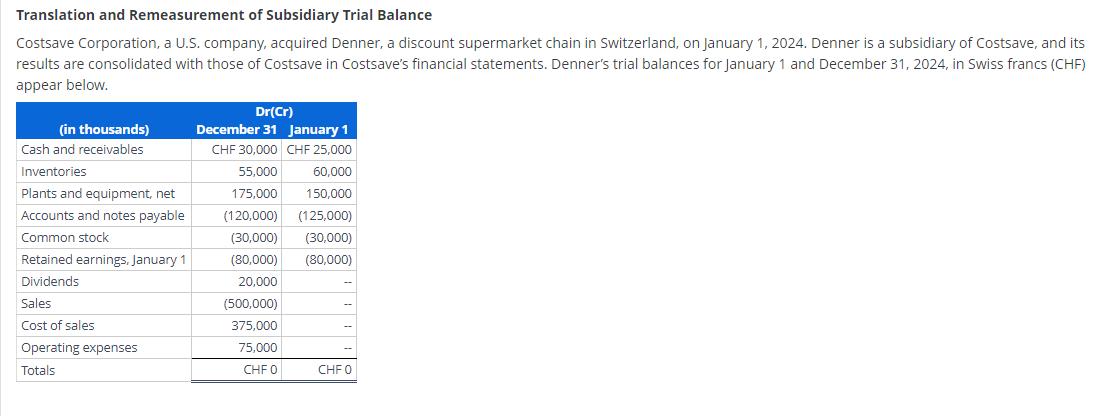

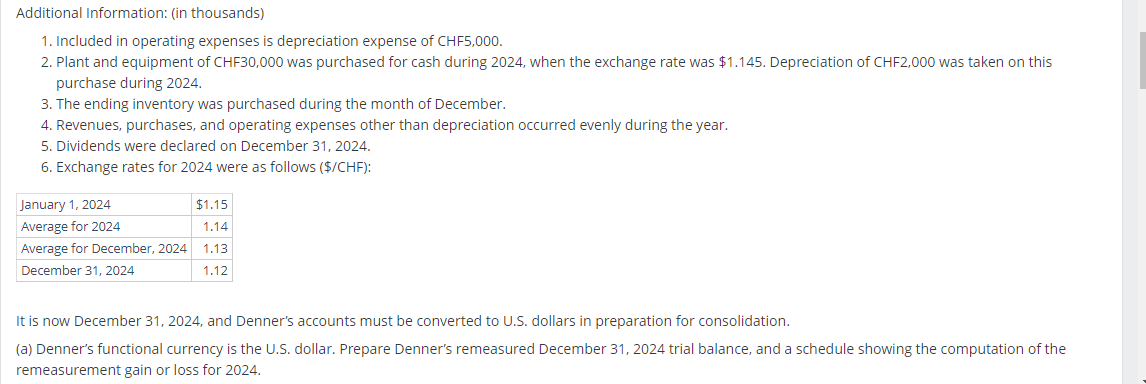

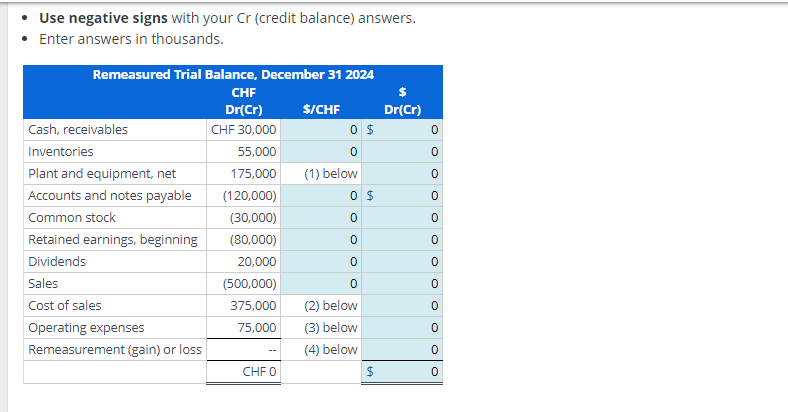

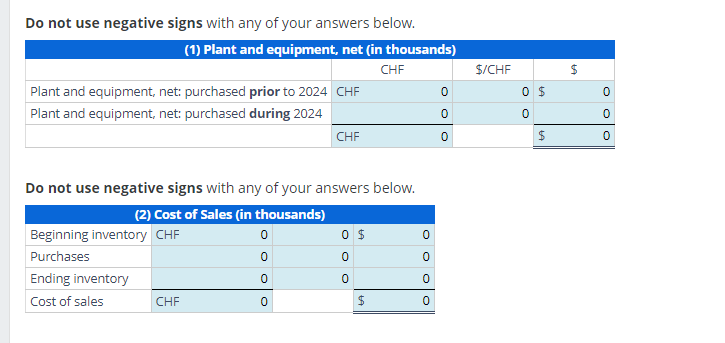

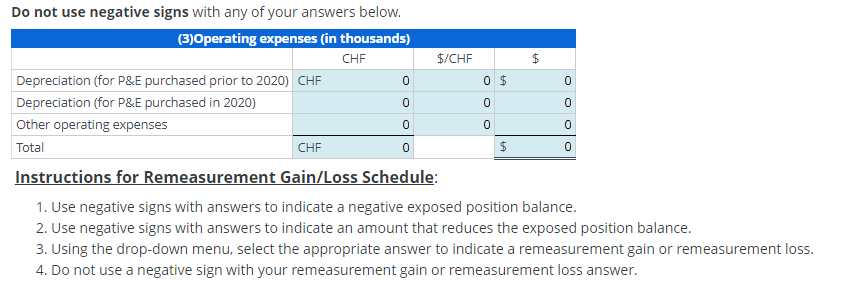

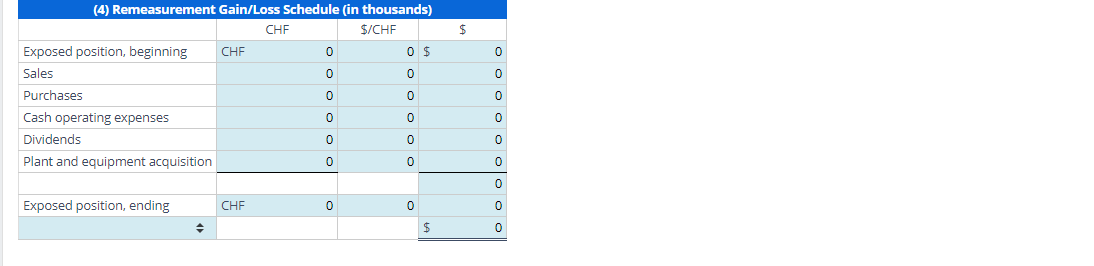

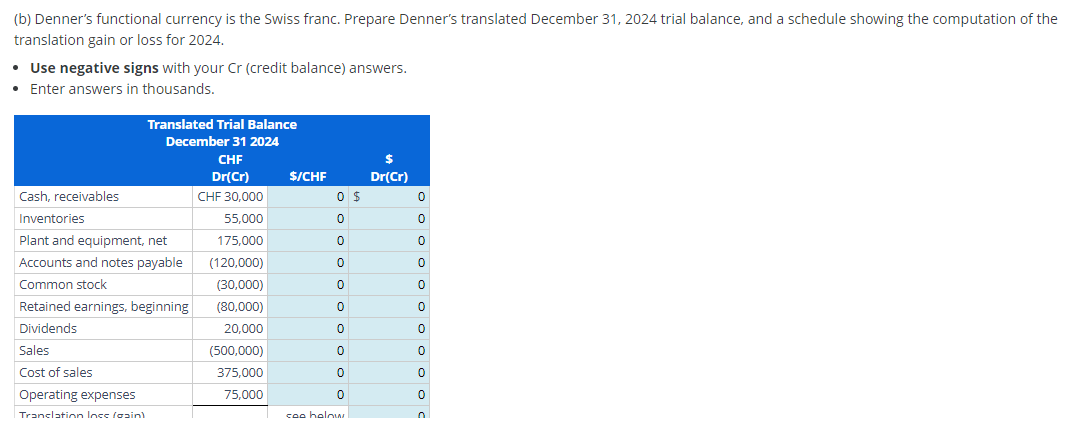

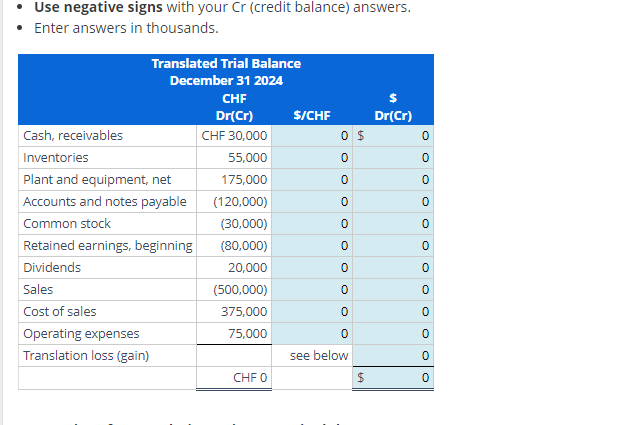

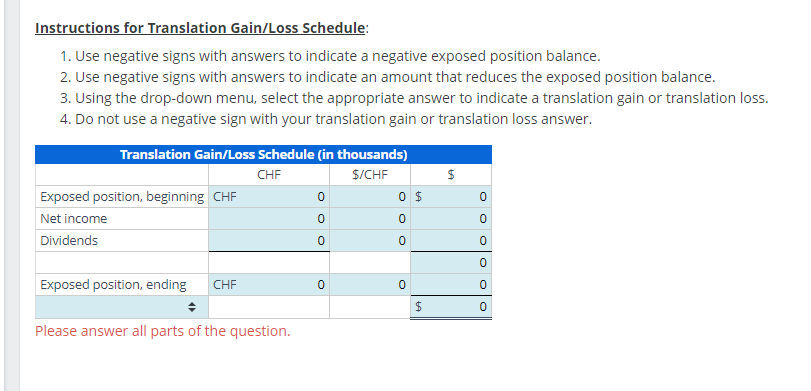

Translation and Remeasurement of Subsidiary Trial Balance Costsave Corporation, a U.S. company, acquired Denner, a discount supermarket chain in Switzerland, on January 1, 2024. Denner is a subsidiary of Costsave, and its results are consolidated with those of Costsave in Costsave's financial statements. Denner's trial balances for January 1 and December 31, 2024, in Swiss francs (CHF) appear below. Additional Information: (in thousands) 1. Included in operating expenses is depreciation expense of CHF5,000. 2. Plant and equipment of CHF30,000 was purchased for cash during 2024, when the exchange rate was $1.145. Depreciation of CHF2,000 was taken on this purchase during 2024. 3. The ending inventory was purchased during the month of December. 4. Revenues, purchases, and operating expenses other than depreciation occurred evenly during the year. 5. Dividends were declared on December 31, 2024. 6. Exchange rates for 2024 were as follows (\$/CHF): It is now December 31,2024, and Denner's accounts must be converted to U.S. dollars in preparation for consolidation. (a) Denner's functional currency is the U.S. dollar. Prepare Denner's remeasured December 31, 2024 trial balance, and a schedule showing the computation of the remeasurement gain or loss for 2024. - Use negative signs with your Cr (credit balance) answers. - Enter answers in thousands. Do not use negative signs with any of your answers below. Do not use negative signs with any of your answers below. Do not use negative signs with any of your answers below. Instructions for Remeasurement Gain/Loss Schedule: 1. Use negative signs with answers to indicate a negative exposed position balance. 2. Use negative signs with answers to indicate an amount that reduces the exposed position balance. 3. Using the drop-down menu, select the appropriate answer to indicate a remeasurement gain or remeasurement loss. 4. Do not use a negative sign with your remeasurement gain or remeasurement loss answer. (b) Denner's functional currency is the Swiss franc. Prepare Denner's translated December 31, 2024 trial balance, and a schedule showing the computation of the translation gain or loss for 2024. - Use negative signs with your Cr (credit balance) answers. - Enter answers in thousands. - Use negative signs with your Cr (credit balance) answers. - Enter answers in thousands. Instructions for Translation Gain/Loss Schedule: 1. Use negative signs with answers to indicate a negative exposed position balance. 2. Use negative signs with answers to indicate an amount that reduces the exposed position balance. 3. Using the drop-down menu, select the appropriate answer to indicate a translation gain or translation loss. 4. Do not use a negative sign with your translation gain or translation loss answer. Please answer all parts of the question. Translation and Remeasurement of Subsidiary Trial Balance Costsave Corporation, a U.S. company, acquired Denner, a discount supermarket chain in Switzerland, on January 1, 2024. Denner is a subsidiary of Costsave, and its results are consolidated with those of Costsave in Costsave's financial statements. Denner's trial balances for January 1 and December 31, 2024, in Swiss francs (CHF) appear below. Additional Information: (in thousands) 1. Included in operating expenses is depreciation expense of CHF5,000. 2. Plant and equipment of CHF30,000 was purchased for cash during 2024, when the exchange rate was $1.145. Depreciation of CHF2,000 was taken on this purchase during 2024. 3. The ending inventory was purchased during the month of December. 4. Revenues, purchases, and operating expenses other than depreciation occurred evenly during the year. 5. Dividends were declared on December 31, 2024. 6. Exchange rates for 2024 were as follows (\$/CHF): It is now December 31,2024, and Denner's accounts must be converted to U.S. dollars in preparation for consolidation. (a) Denner's functional currency is the U.S. dollar. Prepare Denner's remeasured December 31, 2024 trial balance, and a schedule showing the computation of the remeasurement gain or loss for 2024. - Use negative signs with your Cr (credit balance) answers. - Enter answers in thousands. Do not use negative signs with any of your answers below. Do not use negative signs with any of your answers below. Do not use negative signs with any of your answers below. Instructions for Remeasurement Gain/Loss Schedule: 1. Use negative signs with answers to indicate a negative exposed position balance. 2. Use negative signs with answers to indicate an amount that reduces the exposed position balance. 3. Using the drop-down menu, select the appropriate answer to indicate a remeasurement gain or remeasurement loss. 4. Do not use a negative sign with your remeasurement gain or remeasurement loss answer. (b) Denner's functional currency is the Swiss franc. Prepare Denner's translated December 31, 2024 trial balance, and a schedule showing the computation of the translation gain or loss for 2024. - Use negative signs with your Cr (credit balance) answers. - Enter answers in thousands. - Use negative signs with your Cr (credit balance) answers. - Enter answers in thousands. Instructions for Translation Gain/Loss Schedule: 1. Use negative signs with answers to indicate a negative exposed position balance. 2. Use negative signs with answers to indicate an amount that reduces the exposed position balance. 3. Using the drop-down menu, select the appropriate answer to indicate a translation gain or translation loss. 4. Do not use a negative sign with your translation gain or translation loss answer. Please answer all parts of the

Translation and Remeasurement of Subsidiary Trial Balance Costsave Corporation, a U.S. company, acquired Denner, a discount supermarket chain in Switzerland, on January 1, 2024. Denner is a subsidiary of Costsave, and its results are consolidated with those of Costsave in Costsave's financial statements. Denner's trial balances for January 1 and December 31, 2024, in Swiss francs (CHF) appear below. Additional Information: (in thousands) 1. Included in operating expenses is depreciation expense of CHF5,000. 2. Plant and equipment of CHF30,000 was purchased for cash during 2024, when the exchange rate was $1.145. Depreciation of CHF2,000 was taken on this purchase during 2024. 3. The ending inventory was purchased during the month of December. 4. Revenues, purchases, and operating expenses other than depreciation occurred evenly during the year. 5. Dividends were declared on December 31, 2024. 6. Exchange rates for 2024 were as follows (\$/CHF): It is now December 31,2024, and Denner's accounts must be converted to U.S. dollars in preparation for consolidation. (a) Denner's functional currency is the U.S. dollar. Prepare Denner's remeasured December 31, 2024 trial balance, and a schedule showing the computation of the remeasurement gain or loss for 2024. - Use negative signs with your Cr (credit balance) answers. - Enter answers in thousands. Do not use negative signs with any of your answers below. Do not use negative signs with any of your answers below. Do not use negative signs with any of your answers below. Instructions for Remeasurement Gain/Loss Schedule: 1. Use negative signs with answers to indicate a negative exposed position balance. 2. Use negative signs with answers to indicate an amount that reduces the exposed position balance. 3. Using the drop-down menu, select the appropriate answer to indicate a remeasurement gain or remeasurement loss. 4. Do not use a negative sign with your remeasurement gain or remeasurement loss answer. (b) Denner's functional currency is the Swiss franc. Prepare Denner's translated December 31, 2024 trial balance, and a schedule showing the computation of the translation gain or loss for 2024. - Use negative signs with your Cr (credit balance) answers. - Enter answers in thousands. - Use negative signs with your Cr (credit balance) answers. - Enter answers in thousands. Instructions for Translation Gain/Loss Schedule: 1. Use negative signs with answers to indicate a negative exposed position balance. 2. Use negative signs with answers to indicate an amount that reduces the exposed position balance. 3. Using the drop-down menu, select the appropriate answer to indicate a translation gain or translation loss. 4. Do not use a negative sign with your translation gain or translation loss answer. Please answer all parts of the question. Translation and Remeasurement of Subsidiary Trial Balance Costsave Corporation, a U.S. company, acquired Denner, a discount supermarket chain in Switzerland, on January 1, 2024. Denner is a subsidiary of Costsave, and its results are consolidated with those of Costsave in Costsave's financial statements. Denner's trial balances for January 1 and December 31, 2024, in Swiss francs (CHF) appear below. Additional Information: (in thousands) 1. Included in operating expenses is depreciation expense of CHF5,000. 2. Plant and equipment of CHF30,000 was purchased for cash during 2024, when the exchange rate was $1.145. Depreciation of CHF2,000 was taken on this purchase during 2024. 3. The ending inventory was purchased during the month of December. 4. Revenues, purchases, and operating expenses other than depreciation occurred evenly during the year. 5. Dividends were declared on December 31, 2024. 6. Exchange rates for 2024 were as follows (\$/CHF): It is now December 31,2024, and Denner's accounts must be converted to U.S. dollars in preparation for consolidation. (a) Denner's functional currency is the U.S. dollar. Prepare Denner's remeasured December 31, 2024 trial balance, and a schedule showing the computation of the remeasurement gain or loss for 2024. - Use negative signs with your Cr (credit balance) answers. - Enter answers in thousands. Do not use negative signs with any of your answers below. Do not use negative signs with any of your answers below. Do not use negative signs with any of your answers below. Instructions for Remeasurement Gain/Loss Schedule: 1. Use negative signs with answers to indicate a negative exposed position balance. 2. Use negative signs with answers to indicate an amount that reduces the exposed position balance. 3. Using the drop-down menu, select the appropriate answer to indicate a remeasurement gain or remeasurement loss. 4. Do not use a negative sign with your remeasurement gain or remeasurement loss answer. (b) Denner's functional currency is the Swiss franc. Prepare Denner's translated December 31, 2024 trial balance, and a schedule showing the computation of the translation gain or loss for 2024. - Use negative signs with your Cr (credit balance) answers. - Enter answers in thousands. - Use negative signs with your Cr (credit balance) answers. - Enter answers in thousands. Instructions for Translation Gain/Loss Schedule: 1. Use negative signs with answers to indicate a negative exposed position balance. 2. Use negative signs with answers to indicate an amount that reduces the exposed position balance. 3. Using the drop-down menu, select the appropriate answer to indicate a translation gain or translation loss. 4. Do not use a negative sign with your translation gain or translation loss answer. Please answer all parts of the Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started