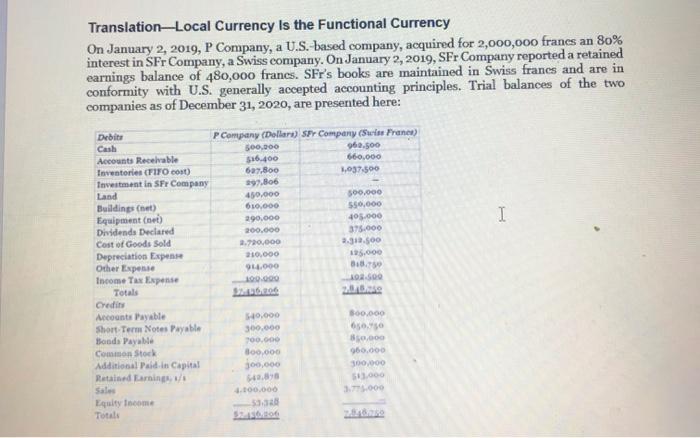

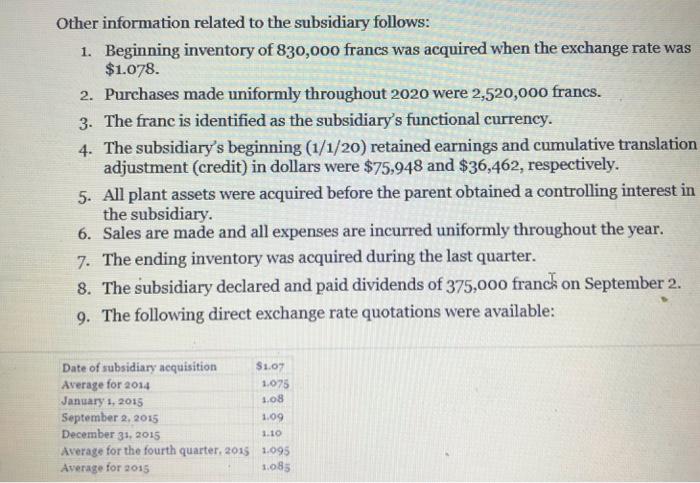

Translation Local Currency Is the Functional Currency On January 2, 2019, P Company, a U.S. based company, acquired for 2,000,000 francs an 80% interest in SFr Company, a Swiss company. On January 2, 2019, SFr Company reported a retained earnings balance of 480,000 francs. SFI's books are maintained in Swiss francs and are in conformity with U.S. generally accepted accounting principles. Trial balances of the two companies as of December 31, 2020, are presented here: Debite Cash Accounts Receivable Inventories (FIFO cost) Investment in SFr Company Land Buildings (net) Equipment (e) Dividends Declared Cost of Goods Sold Depreciation Expense Other Expense Income Tax Expense Totals Credit Accounts Payable Short Term Notes Payable Bands Payable Common Stock Additional Paid in Capital Retained Earnings / Sale Equity Income Total P Company (Dollars) SPY Company (Swiss France) 500.000 96.500 $16.400 660.000 62.800 1,037.500 39.806 450.000 500.000 550.000 290.000 405.000 200.000 375.000 2.720.000 2.318.500 210.000 125.000 914.000 0.8.75 100.000 10250 I 50.000 300.000 0.00 300,000 300,000 142.38 4.100.000 300.000 650.750 10.000 960.000 300.000 Other information related to the subsidiary follows: 1. Beginning inventory of 830,000 francs was acquired when the exchange rate was $1.078. 2. Purchases made uniformly throughout 2020 were 2,520,000 francs. 3. The franc is identified as the subsidiary's functional currency. 4. The subsidiary's beginning (1/1/20) retained earnings and cumulative translation adjustment (credit) in dollars were $75,948 and $36,462, respectively. 5. All plant assets were acquired before the parent obtained a controlling interest in the subsidiary. 6. Sales are made and all expenses are incurred uniformly throughout the year. 7. The ending inventory was acquired during the last quarter. 8. The subsidiary declared and paid dividends of 375,000 franck on September 2. 9. The following direct exchange rate quotations were available: $1.07 Date of subsidiary acquisition Average for 2014 1.075 January 1, 2015 1.08 September 2, 2015 1.09 December 31, 2015 Average for the fourth quarter. 2015 1.095 Average for 2015 1.085 1.10 Required: 1. Prepare a translated balance sheet and combined statement of income and retained earnings for the subsidiary. 2. Prepare a schedule to verify the translation adjustment. 3. Compute the following ratios based on the franc and the U.S. dollar financial statements: 1. Current ratio. 2. Debt to equity. 3. Gross profit percentage. 4. Net income to sales