Answered step by step

Verified Expert Solution

Question

1 Approved Answer

translation: R and S stock returns have the following probability distributions: a. Calculate the expected return on each share b. Calculate the standard deviation of

translation:

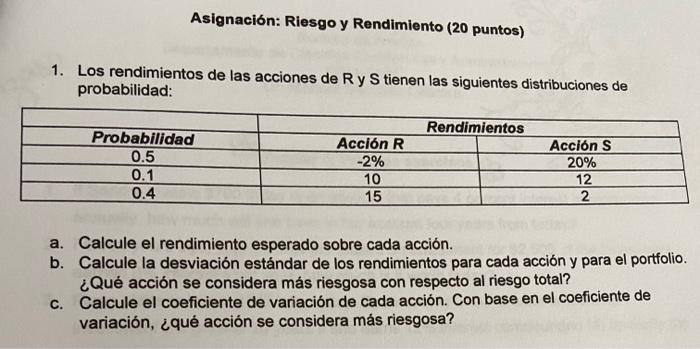

Asignacin: Riesgo y Rendimiento (20 puntos) 1. Los rendimientos de las acciones de R y S tienen las siguientes distribuciones de probabilidad: Rendimientos Probabilidad 0.5 0.1 0.4 Accin R -2% 10 15 Accin S 20% 12 2 a. Calcule el rendimiento esperado sobre cada accin. b. Calcule la desviacin estndar de los rendimientos para cada accin y para el portfolio. Qu accin se considera ms riesgosa con respecto al riesgo total? c. Calcule el coeficiente de variacin de cada accin. Con base en el coeficiente de variacin, qu accin se considera ms riesgosa R and S stock returns have the following probability distributions:

a. Calculate the expected return on each share

b. Calculate the standard deviation of the returns for each stock and for the portfolio. What action is considered more risky with respect to the total risk?

c. Find the coefficient of variation for each action. Based on the coefficient of variation, which action is considered riskier?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started